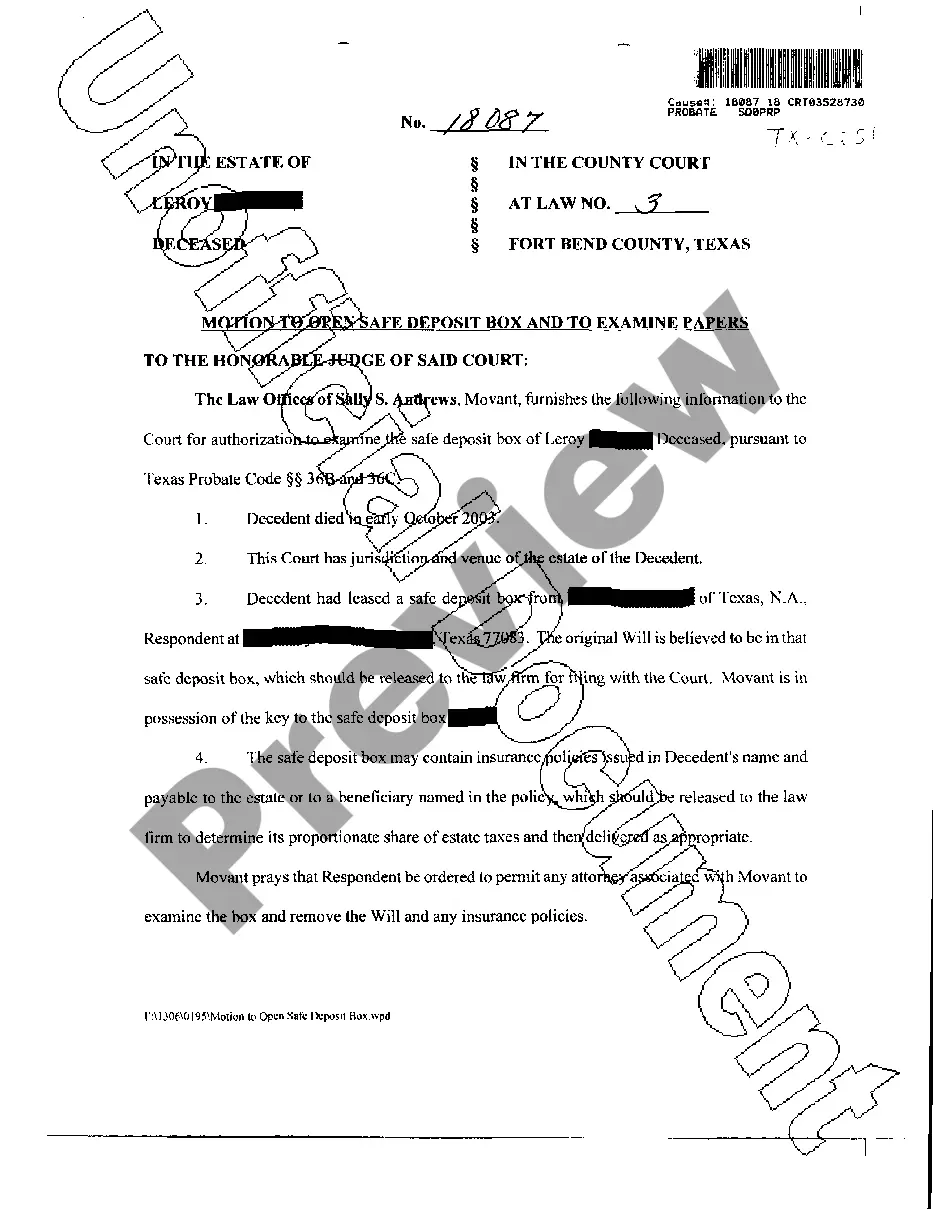

Texas Motion to Open Safe Deposit Box and Examine Papers

Description

How to fill out Texas Motion To Open Safe Deposit Box And Examine Papers?

Get access to high quality Texas Motion to Open Safe Deposit Box and Examine Papers templates online with US Legal Forms. Steer clear of hours of wasted time browsing the internet and dropped money on forms that aren’t updated. US Legal Forms provides you with a solution to exactly that. Find over 85,000 state-specific authorized and tax samples you can save and submit in clicks in the Forms library.

To get the sample, log in to your account and then click Download. The file will be saved in two places: on your device and in the My Forms folder.

For people who don’t have a subscription yet, look at our how-guide below to make getting started easier:

- Check if the Texas Motion to Open Safe Deposit Box and Examine Papers you’re looking at is appropriate for your state.

- Look at the sample using the Preview option and read its description.

- Check out the subscription page by clicking Buy Now.

- Choose the subscription plan to go on to sign up.

- Pay by card or PayPal to complete making an account.

- Pick a favored format to download the document (.pdf or .docx).

You can now open the Texas Motion to Open Safe Deposit Box and Examine Papers sample and fill it out online or print it out and get it done yourself. Consider mailing the file to your legal counsel to make certain things are filled out correctly. If you make a error, print out and fill application again (once you’ve created an account all documents you save is reusable). Create your US Legal Forms account now and get far more templates.

Form popularity

FAQ

In addition to freezing accounts, levying accounts, garnishing wages, and seizing assets, the IRS can get a court order to freeze and seize or force a sale of the contents of a safe deposit box to satisfy a tax debt or penalty.

California law provides that on the death of the box owner, the institution at which the box is located may deliver the contents to certain defined people (including, but not limited to, a relative) if: a) the institution has no reason to believe there is a dispute over the contents; b) the person to whom the

Spare Keys Think about it: You only have access to your safe deposit box during normal banking hours and only if you have the box's key with you. If you're like most people, your safe deposit box key is squirreled away somewhere inside your home2026from which you're currently locked out.

An additional method for access to a safe deposit box is for the executor or personal representative of an estate to present letters testamentary or letters of general administration issued by the court to the holder of the safe deposit box.

A: If one key is lost, bring in the remaining key and close the box. If both keys are lost, the box must be forced open by a safe deposit service company in your presence and at your expense.

Identify an interested party who can petition the court. An interested party can be the decedent's spouse, beneficiary or a named fiduciary in the Will. Identify the location of the safe deposit box. Petition the Court. Contact the Financial Institution to Review the Contents of the Box. Retrieve the Contents.

Put it in a small envelope marked as Bank Box Key or just "Key". If it is with the bank records, you will likely remember what it unlocks, and will treat it with the respect for security you give these files. Many people who have keys all over the house opt for a lockable key vault to store extra copies of keys.

Safe deposit boxes are protected by two keys: one that the bank gives you and another guard key that the bank keeps. Without these two keys available, the box cannot be opened. Losing your personal key will cost you both time and money, as the bank will have to arrange for a locksmith to drill the lock.

California Probate Code section 331(a) requires that the person seeking access to a safe deposit box be in the possession of a key. Further, this individual must provide a financial institution with the following information: Proof of the decedent's death. Reasonable proof of the person seeking access.