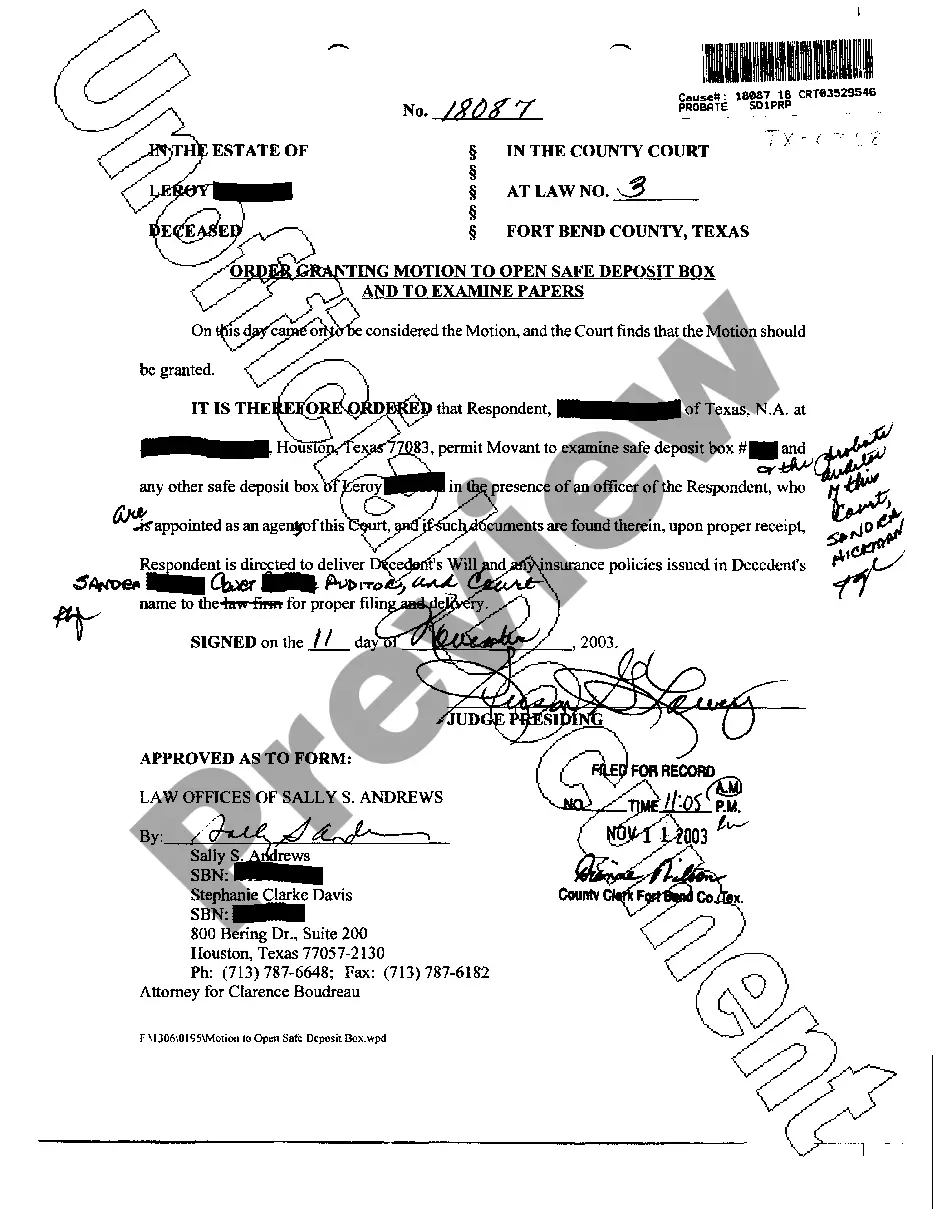

Texas Order Granting Motion to Open Safe Deposit Box

Description

How to fill out Texas Order Granting Motion To Open Safe Deposit Box?

Access to high quality Texas Order Granting Motion to Open Safe Deposit Box samples online with US Legal Forms. Steer clear of days of wasted time browsing the internet and dropped money on documents that aren’t up-to-date. US Legal Forms provides you with a solution to just that. Get around 85,000 state-specific authorized and tax forms you can download and submit in clicks in the Forms library.

To get the example, log in to your account and then click Download. The document will be saved in two places: on your device and in the My Forms folder.

For people who don’t have a subscription yet, look at our how-guide listed below to make getting started easier:

- Verify that the Texas Order Granting Motion to Open Safe Deposit Box you’re considering is appropriate for your state.

- Look at the sample using the Preview option and read its description.

- Check out the subscription page by simply clicking Buy Now.

- Choose the subscription plan to continue on to sign up.

- Pay by card or PayPal to complete creating an account.

- Pick a favored file format to save the document (.pdf or .docx).

Now you can open up the Texas Order Granting Motion to Open Safe Deposit Box example and fill it out online or print it out and do it by hand. Take into account giving the file to your legal counsel to be certain everything is completed correctly. If you make a mistake, print and complete sample again (once you’ve created an account every document you save is reusable). Make your US Legal Forms account now and get a lot more forms.

Form popularity

FAQ

Dual control: Two peopleusually a bank employee and the renterare required to open the box. In this way, no one person can ever open the box and remove the contents. Authorized signature: When the safe deposit account is opened, all persons authorized to access the box sign a signature card.

A safe deposit box is a locked storage bin, usually in a vault or secure area, that banks and credit unions rent. Typically, customers receive a key, and must check in with a bank employee, who uses a second guard key in tandem with the customer's key, to unlock the box.

If you did not pay the annual fee on the safe deposit box, it likely would have been considered dormant once there was no activitysuch as payment of the feefor three to five years. The length of time necessary to declare a box dormant is defined by state statute.

The bottom line here is that depositing valuables in a bank safe deposit box is no guarantee that the items will be kept safe. If dishonest bank employees steal your items, you may not have legal recourse to get them back.

There are other creative avenues to pursue against a debtor who may or may not have liquid funds to satisfy a judgement, including issuing a subpoena with restraining notice to the debtor's bank and seizing the contents of his or her safe deposit box.

Safety deposit boxes are located in secure buildings with alarms, video cameras, and high-security locks. In most cases, a bank employee must be with you to retrieve the box. Each box should require two keys (yours and a bank employee's), and the most secure boxes are in separate areas, away from the bank entrance.

Safe deposit boxes can provide individuals with confidence that important documents and valuable or prized possessions will be kept safe from loss, accidental destruction, and theft. However, courts do have the authority to issue an order requiring a bank to freeze, or open, a person's safe deposit box.