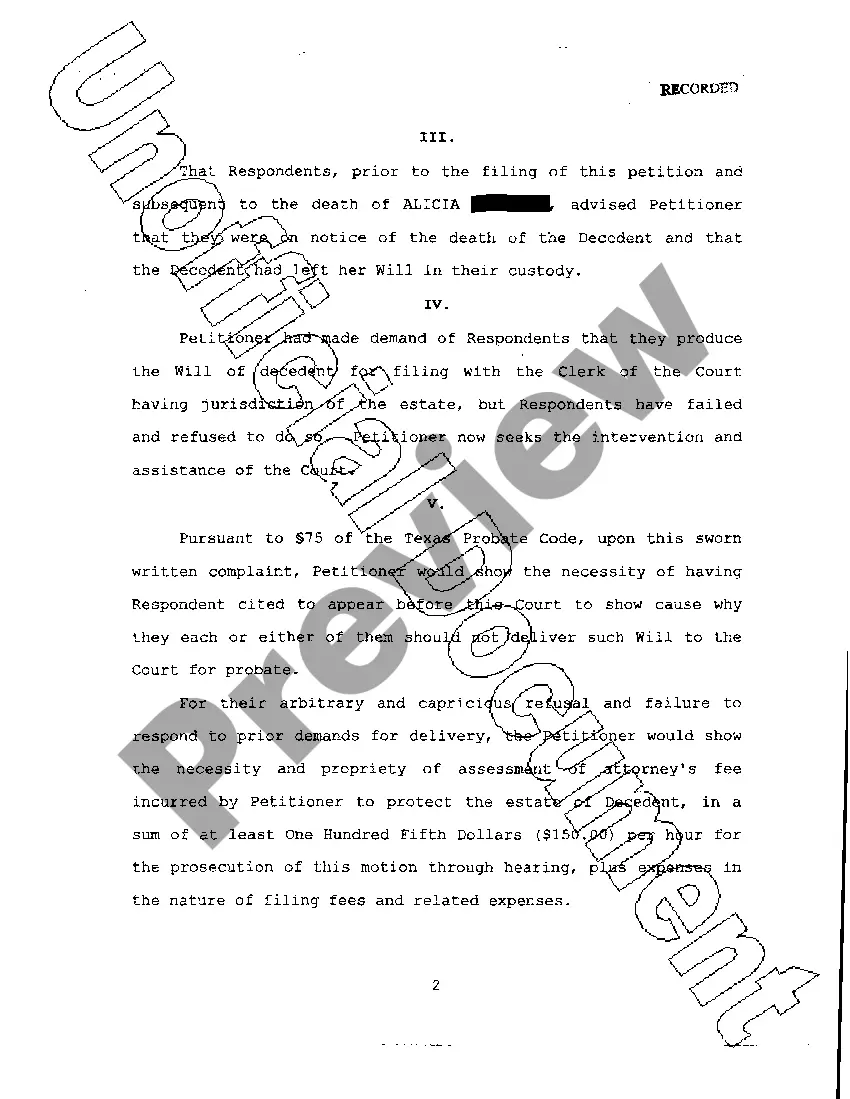

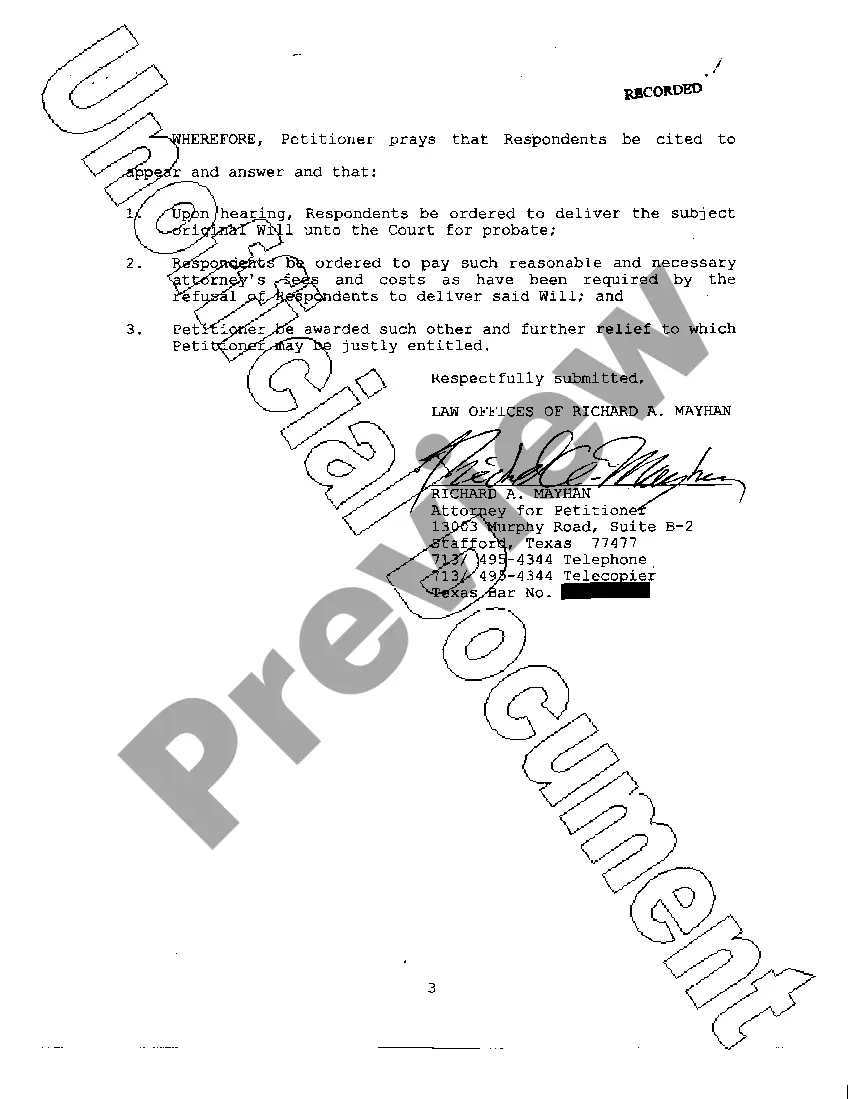

Texas Petition for Release and Delivery of Will

Description

How to fill out Texas Petition For Release And Delivery Of Will?

Access to high quality Texas Petition for Release and Delivery of Will samples online with US Legal Forms. Prevent hours of lost time looking the internet and dropped money on forms that aren’t updated. US Legal Forms offers you a solution to exactly that. Get around 85,000 state-specific legal and tax forms you can download and complete in clicks within the Forms library.

To receive the example, log in to your account and click Download. The file will be saved in two places: on the device and in the My Forms folder.

For individuals who don’t have a subscription yet, look at our how-guide listed below to make getting started easier:

- Verify that the Texas Petition for Release and Delivery of Will you’re considering is suitable for your state.

- View the sample utilizing the Preview function and read its description.

- Go to the subscription page by clicking on Buy Now button.

- Select the subscription plan to go on to register.

- Pay out by card or PayPal to complete making an account.

- Pick a favored format to save the file (.pdf or .docx).

You can now open up the Texas Petition for Release and Delivery of Will example and fill it out online or print it out and do it yourself. Take into account mailing the file to your legal counsel to be certain all things are completed properly. If you make a error, print and fill sample once again (once you’ve created an account all documents you download is reusable). Make your US Legal Forms account now and get much more forms.

Form popularity

FAQ

1) Petition the court to be the estate representative. 2) Notify heirs and creditors. 3) Change legal ownership of assets. 4) Pay Funeral Expenses, Taxes, Debts and Transfer assets to heirs.

This is also called Form 503, and you can fill it out online or manually.

For example, the court costs for filing certain applications, such as an Application for Probate of Will and for Issuance of Letters Testamentary or an Application for Appointment of Independent/Dependent Administrator and Determination of Heirship can range from approximately $300.00 to $800.00.

To get the process started, someone files the will, and a request to probate the will as a muniment of title, with the probate court. If the court decides there's no need for probate administration, it admits the will into probate as a muniment, or evidence, of title to the estate assets.

The filing fee to register an Assumed Name (DBA) for sole proprietorships and partnerships in Texas varies by county. Usually, the fee is about $15 per county. Corporations & LLCs will pay $25 to register with the Texas Secretary of State. The registration is valid for 10 years and can be renewed.

Step 1: Filing. Step 2: Posting. Step 3: Will Validation. Step 4: Cataloging Assets. Step 5: Beneficiaries Identified. Step 6 Notifying Creditors. Step 7: Resolving Disputes. Step 8: Distributing Assets.

In Texas, wills are not filed with the public records office. They're filed with the probate court when its creator, called the testator, passes away.

Without a probate attorney to guide you, the Texas probate process can be a daunting experience. To begin with, certain Courts will not allow non-lawyers to file applications to probate a will or an estate nor will they allow non-lawyers to represent an estate in Court.

The court appoints the executor who was named in the will to manage the estate. This involves not only protecting and distributing the decedent's assets, but also taking care of his or her debts and liabilities. Any estate worth less than $75,000 is not required to go through the court.