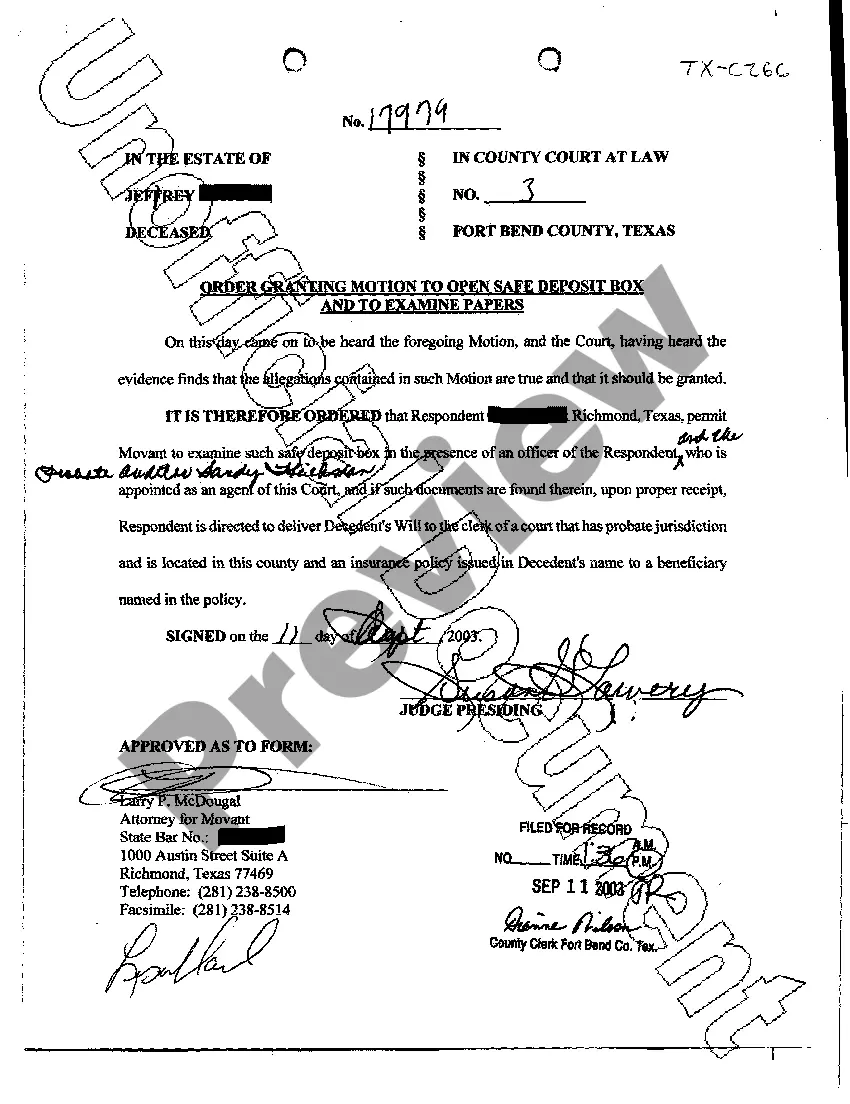

Texas Order Granting Motion to Open Safe Deposit Box and Examine Papers

Description

How to fill out Texas Order Granting Motion To Open Safe Deposit Box And Examine Papers?

Get access to quality Texas Order Granting Motion to Open Safe Deposit Box and Examine Papers templates online with US Legal Forms. Steer clear of hours of misused time browsing the internet and dropped money on files that aren’t up-to-date. US Legal Forms offers you a solution to just that. Get over 85,000 state-specific legal and tax samples you can save and complete in clicks within the Forms library.

To find the example, log in to your account and then click Download. The file is going to be stored in two places: on the device and in the My Forms folder.

For people who don’t have a subscription yet, take a look at our how-guide listed below to make getting started easier:

- Verify that the Texas Order Granting Motion to Open Safe Deposit Box and Examine Papers you’re looking at is appropriate for your state.

- Look at the sample making use of the Preview option and read its description.

- Go to the subscription page by simply clicking Buy Now.

- Select the subscription plan to go on to register.

- Pay out by credit card or PayPal to finish creating an account.

- Select a favored format to save the file (.pdf or .docx).

Now you can open the Texas Order Granting Motion to Open Safe Deposit Box and Examine Papers example and fill it out online or print it out and get it done by hand. Consider giving the papers to your legal counsel to make sure things are filled in appropriately. If you make a error, print out and complete application again (once you’ve created an account every document you download is reusable). Create your US Legal Forms account now and get access to a lot more templates.

Form popularity

FAQ

If you did not pay the annual fee on the safe deposit box, it likely would have been considered dormant once there was no activitysuch as payment of the feefor three to five years. The length of time necessary to declare a box dormant is defined by state statute.

What happens to items in a safety deposit box when a bank goes bankrupt? If you are paying for the box, The FDIC (or other agencies) will transfer that box to a different bank. Your box stays in the same branch, Its just a different bank who take it over.

The contents of a safe-deposit box is vulnerable to creditors who have judgments, the same way that a checking or savings account is vulnerable.

In addition to freezing accounts, levying accounts, garnishing wages, and seizing assets, the IRS can get a court order to freeze and seize or force a sale of the contents of a safe deposit box to satisfy a tax debt or penalty.

While creditors can seize a safe deposit box, this is usually a last resort and requires obtaining a judgement and placing a lien on your personal property. The creditor then has to locate your safe deposit box and have the approval to seize and liquidate it.

Contrary to popular wisdom, the terms of a safe deposit box agreement with a financial institution typically describe a lessor/lessee relationship. As a result, most safe deposit box agreements only govern the use of the box; they do not govern the ownership of its contents.

Authorized signature: When the safe deposit account is opened, all persons authorized to access the box sign a signature card. The bank allows only those individuals to open the box. From then on, the bank records the signature of any individual allowed to open the box.

Banks can't deny access to a safe deposit box to an authorized person. While they may keep records of who accessed the box, they don't know who is the actual owner of its contents.In any case, keep detailed records of the box's contents, the bank's contact information and the box number you rented.

Come to the bank with your safe deposit box key. You will need to sign an admission slip to get access to the Safe Deposit area of the vault. A Safe Deposit Area attendant will take you to the vault. With the bank's Guard Key and your key, open your Safe Deposit Box slot.