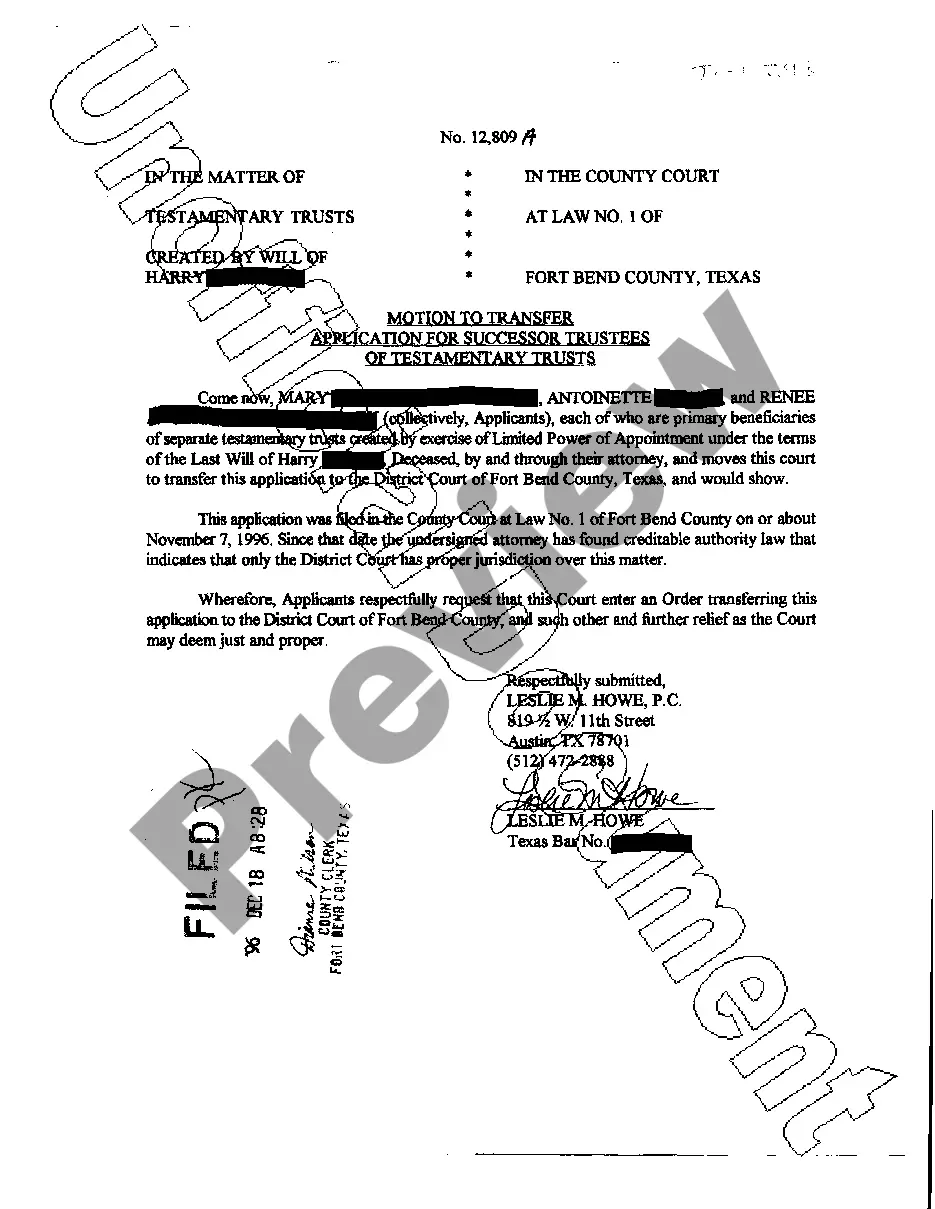

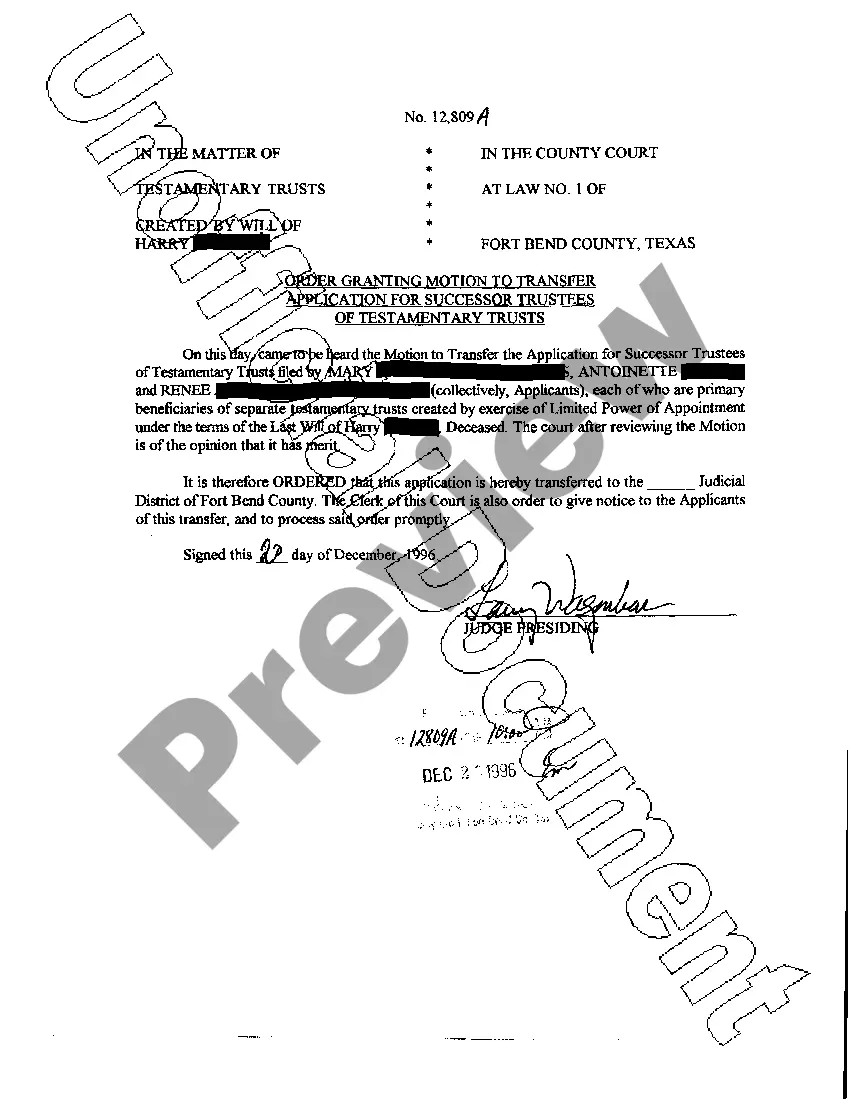

Texas Motion to Transfer Application for Successor Trustees

Description

How to fill out Texas Motion To Transfer Application For Successor Trustees?

Get access to top quality Texas Motion to Transfer Application for Successor Trustees samples online with US Legal Forms. Steer clear of hours of lost time searching the internet and dropped money on forms that aren’t up-to-date. US Legal Forms offers you a solution to just that. Get above 85,000 state-specific authorized and tax samples you can download and complete in clicks in the Forms library.

To receive the example, log in to your account and then click Download. The file will be stored in two places: on your device and in the My Forms folder.

For those who don’t have a subscription yet, look at our how-guide below to make getting started easier:

- See if the Texas Motion to Transfer Application for Successor Trustees you’re looking at is suitable for your state.

- Look at the form making use of the Preview option and read its description.

- Go to the subscription page by clicking Buy Now.

- Select the subscription plan to continue on to register.

- Pay by card or PayPal to finish making an account.

- Pick a favored format to download the file (.pdf or .docx).

You can now open the Texas Motion to Transfer Application for Successor Trustees template and fill it out online or print it out and get it done yourself. Think about sending the papers to your legal counsel to be certain things are completed properly. If you make a mistake, print out and fill sample once again (once you’ve made an account every document you download is reusable). Make your US Legal Forms account now and get access to much more templates.

Form popularity

FAQ

For a revocable living trust, that Trustee is usually the person that created the trust.The successor trustee usually takes power when the person that created the trust either becomes incapacitated or has died. The Trustee only manages the assets that are owned by the trust, not assets outside the trust.

Nolo's Living Trust does not currently allow you to name an institution as successor trustee. If you want to do so, you will need help from an attorney. Normally, your first choice as successor trustee should be a flesh-and-blood person, not the trust department of a bank or other institution.

A party who is interested in the Trust is required to file a petition requesting the change of trustee to the appropriate courts. Parties with interest include beneficiaries and co-trustees of the original trust instrument. Usually, there is a successor trustee named in the trust instrument.

Two documents are needed to transfer California real property from a trust to beneficiaries of the trust; a deed and an 'affidavit of death of trustee. ' An 'affidavit death of trustee' is a declaration, under oath, by the successor trustee.

With an irrevocable trust, you must get written consent from all involved parties to switch the trustee. That means having the trustmaker (the person who created the trust), the current trustee and all listed beneficiaries sign an amendment to remove the trustee and replace him or her with a new one.

Typically, the named successor trustee to a trust does not take over until the existing trustee stops serving, whether due to his or her resignation, removal, or death.First, the trustee can use the trust funds to fight the court case. Second, the court will first seek to advance the trust grantor's intent.

Generally, a successor trustee cannot change or amend a trust.But after their passing, a successor trustee must step in to take legal title to assets and administer the trust according to its terms.

Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries who will get the trust property. Create the trust document. Sign the document in front of a notary public.

They must act solely in their capacity as trustee, and in the interest of the beneficiaries. A successor trustee seeking to sell real property on behalf of a trust may have to sign an affidavit indicating that they have succeeded the original trustee.