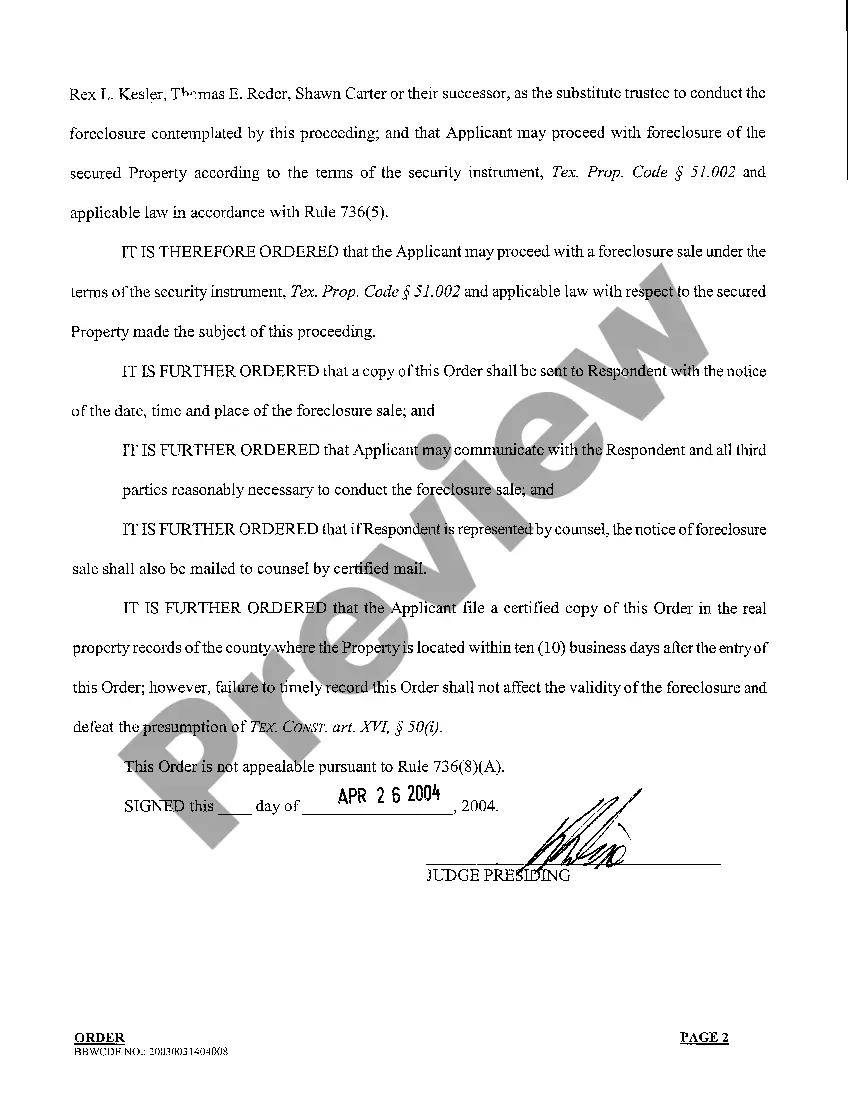

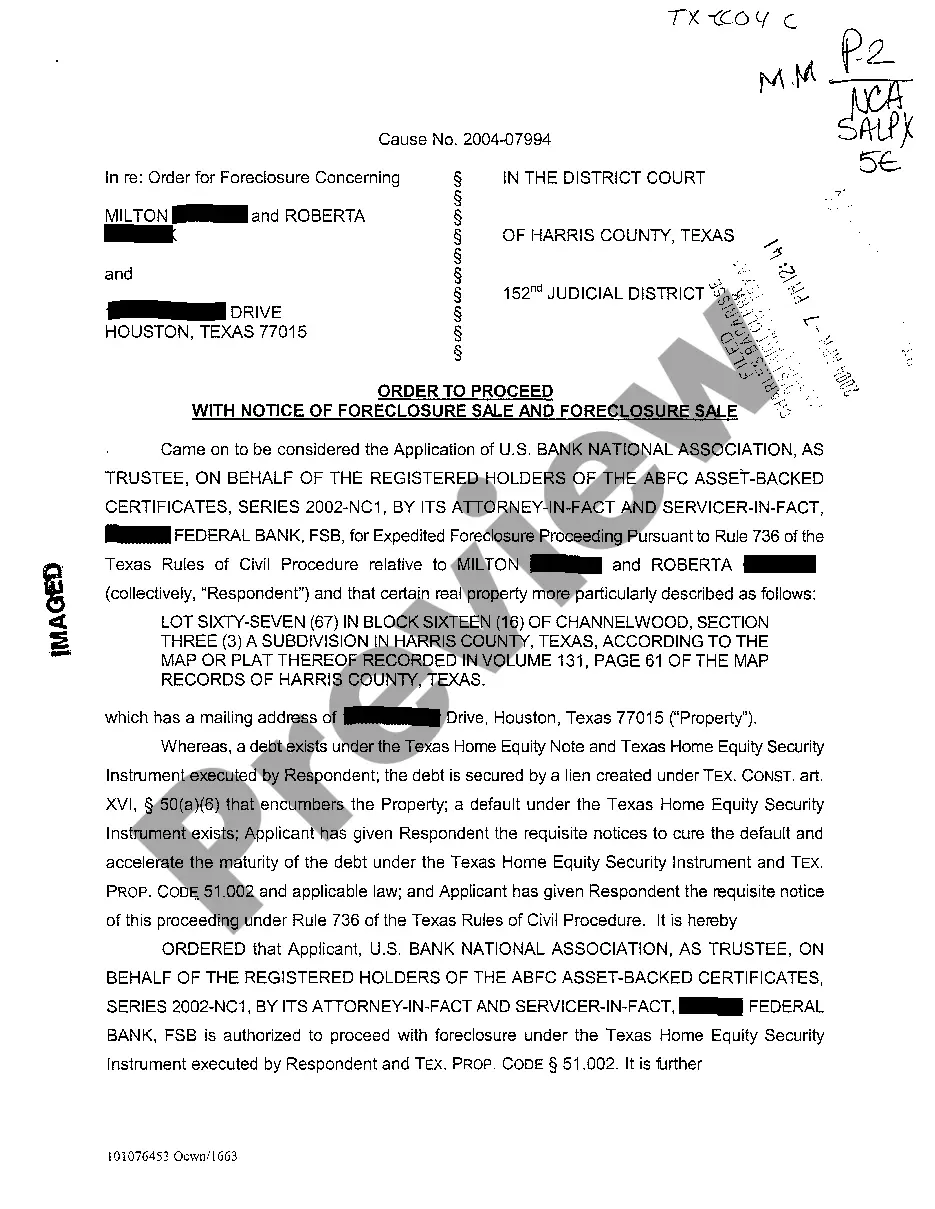

Texas Home Equity Foreclosure Order

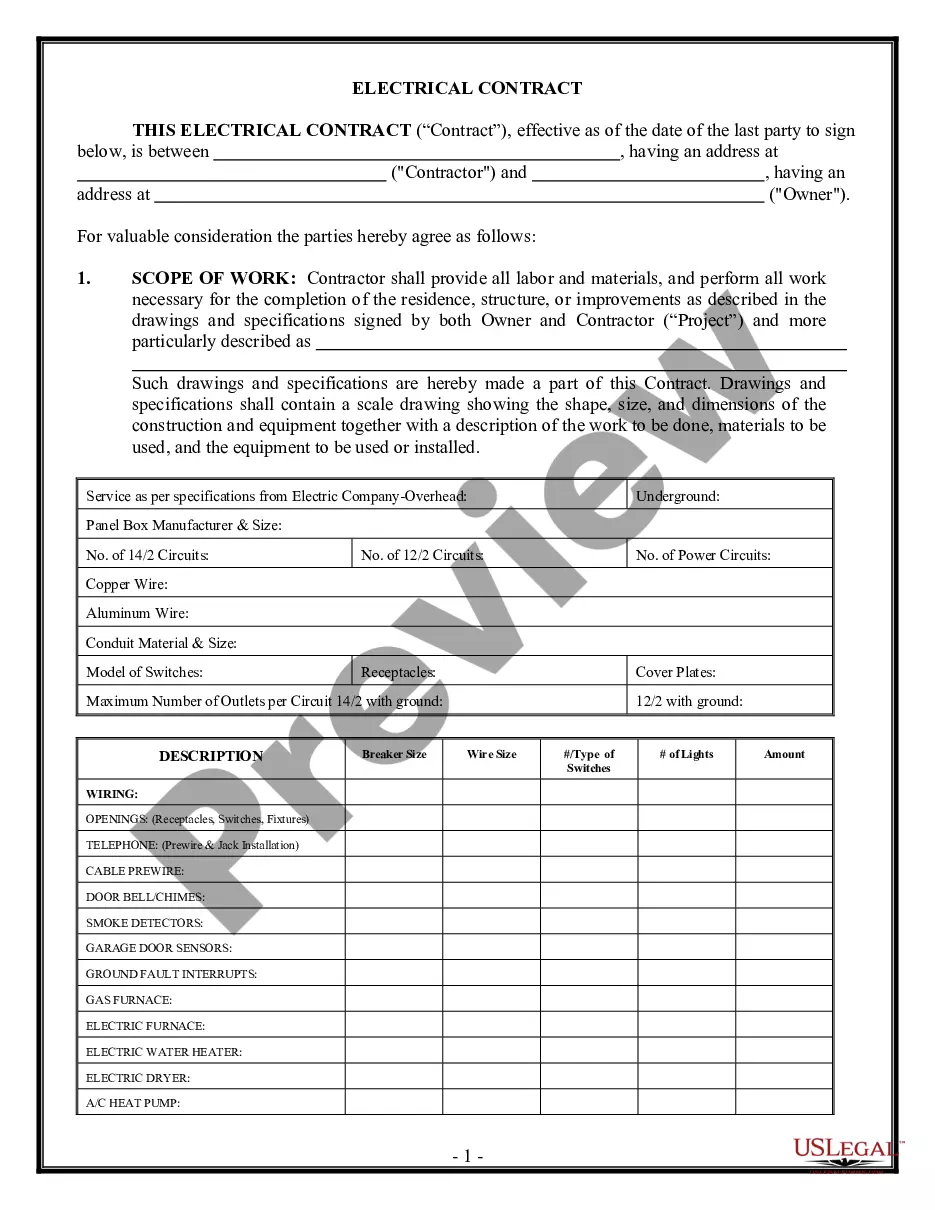

Description

How to fill out Texas Home Equity Foreclosure Order?

Access to high quality Texas Home Equity Foreclosure Order samples online with US Legal Forms. Prevent hours of lost time browsing the internet and lost money on documents that aren’t updated. US Legal Forms offers you a solution to exactly that. Find over 85,000 state-specific legal and tax forms you can save and fill out in clicks in the Forms library.

To receive the example, log in to your account and then click Download. The file will be stored in two places: on the device and in the My Forms folder.

For individuals who don’t have a subscription yet, take a look at our how-guide listed below to make getting started simpler:

- Verify that the Texas Home Equity Foreclosure Order you’re considering is appropriate for your state.

- See the form using the Preview option and read its description.

- Visit the subscription page by clicking Buy Now.

- Choose the subscription plan to continue on to register.

- Pay out by credit card or PayPal to complete creating an account.

- Choose a preferred format to save the file (.pdf or .docx).

Now you can open up the Texas Home Equity Foreclosure Order example and fill it out online or print it and do it by hand. Consider sending the papers to your legal counsel to ensure all things are filled in appropriately. If you make a error, print and complete sample once again (once you’ve created an account every document you download is reusable). Make your US Legal Forms account now and get access to a lot more templates.

Form popularity

FAQ

Foreclosure rules in Texas require that you have at least 21 days' notice in writing, beginning on the day the notice goes into the mail, before the lender sells your home at auction. The lender must also post the Notice of Sale at the door of your county courthouse and file it with the clerk of that county.

How long does it take to foreclose a property in Texas? Depending on the timing of the various required notices, it usually takes approximately 60 days to effectuate an uncontested non-judicial foreclosure.

However, you do not have to lose everything in a foreclosure. When faced with a foreclosure, there are things that you can be allowed to remove from the home. For example, you are allowed to remove personal property or anything else that's not considered part of the real estate.

In Foreclosure, Equity Remains Yours If you cannot get new financing or sell the home, the lender can sell the home at auction for whatever price they choose. If the home does not sell at auction, the lender can sell the home through a real estate agent. Remember that equity is what you own of your home's value.

Defaulting on a home equity loan or HELOC could result in foreclosure.If you have equity in your home, your lender will likely initiate foreclosure, because it has a decent chance of recovering some of its money after the first mortgage is paid off.

The process may take as little as 41 days, depending on the timing between mailing the required notices and the actual foreclosure date. All foreclosure sales in Texas occur on the first Tuesday of the month between 10 a.m. and 4 p.m. The commissioner's court designates the loca- tion.

A borrower whose first loan was foreclosed on can still be liable for the balance of a home equity loan. The equity loan is no longer secured by the property and becomes a personal debt instead.

Generally, the foreclosed borrower is entitled to the extra money; but, if any junior liens were on the home, like a second mortgage or HELOC, or if a creditor recorded a judgment lien against the property, those parties get the first crack at the funds.

Under Texas law, a lender has to use a quasi-judicial process to foreclose a home equity loan. In this process, the lender must get a court order approving the foreclosure before conducting a nonjudicial foreclosure. Also, Texas law doesn't allow deficiency judgments following the foreclosure of a home equity loan.