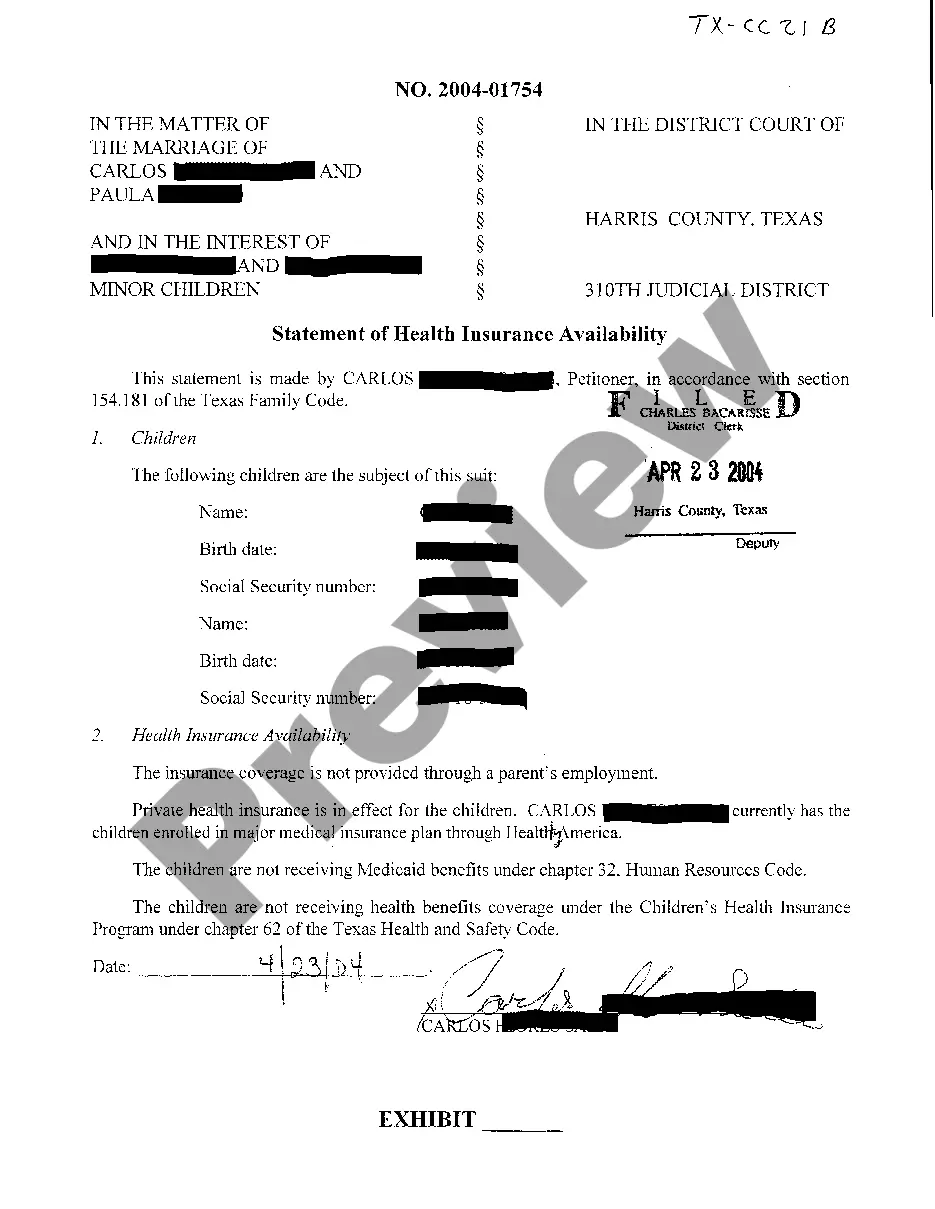

Texas Statement of Health Insurance Availability

Description

How to fill out Texas Statement Of Health Insurance Availability?

Access to high quality Texas Statement of Health Insurance Availability samples online with US Legal Forms. Prevent days of lost time seeking the internet and lost money on files that aren’t updated. US Legal Forms provides you with a solution to just that. Find around 85,000 state-specific legal and tax samples that you can save and fill out in clicks within the Forms library.

To find the sample, log in to your account and click on Download button. The file will be stored in two places: on your device and in the My Forms folder.

For those who don’t have a subscription yet, check out our how-guide listed below to make getting started easier:

- Verify that the Texas Statement of Health Insurance Availability you’re considering is suitable for your state.

- See the sample using the Preview function and browse its description.

- Visit the subscription page by clicking Buy Now.

- Choose the subscription plan to go on to register.

- Pay out by card or PayPal to complete making an account.

- Select a preferred format to download the file (.pdf or .docx).

You can now open the Texas Statement of Health Insurance Availability template and fill it out online or print it and do it yourself. Consider giving the file to your legal counsel to ensure everything is filled in appropriately. If you make a error, print out and complete sample once again (once you’ve registered an account all documents you download is reusable). Make your US Legal Forms account now and access much more templates.

Form popularity

FAQ

If you're enrolling in a non-ACA-compliant plan (like a short-term health plan), coverage can be effective as soon as the day after you enroll, but the insurer can use medical underwriting to determine your eligibility for coverage.

Proof of InsuranceYou are not required to send the IRS information forms or other proof of health care coverage when filing your tax return.Records of advance payments of the premium tax credit. Other statements indicating that you, or a member of your family, had health care coverage.

The 1095-B form provides information about your prior year health coverage.You do not need to wait for Form 1095-B to file your tax return if you already know this information. Form 1095-B is not included in your tax return.

If you are expecting to receive a Form 1095-A, you should wait to file your income tax return until you receive that form. However, it is not necessary to wait for Forms 1095-B or 1095-C in order to file.While the information on these forms may assist in preparing a return, they are not required.

Proof of Insurance You are not required to send the IRS information forms or other proof of health care coverage when filing your tax return. However, it's a good idea to keep these records on hand to verify coverage. This documentation includes: Form 1095 information forms.

Proving Health Insurance for Your Tax Returns. Individuals who have health insurance should receive one of three tax forms for the 2020 tax year: the Form 1095-A, Form 1095-C or Form 1095-B.You do not need to wait for the forms to file your taxes, and they do not have to be attached to your tax return.

If your employer doesn't offer health insurance to part-time employees. Employers aren't required to provide health insurance for part-time employees, even if they provide coverage for full-time employees. If your employer doesn't offer you insurance coverage, you can fill out an application through the Marketplace.

Dial 800-925-9126. MEDICAID Texas is a free health insurance plan for the low income as well as uninsured. The program is paid for by the state of Texas as well as federal government. It will help pay medical bills for children, families in or near poverty, the unemployed, seniors, and disabled among others.

If your employer doesn't offer you insurance coverage, you can fill out an application through the Marketplace. You'll find out if you qualify for: A health insurance plan with savings on your monthly premiums and out-of-pocket costs based on your household size and income.