Texas Employers Order To Withhold From Earnings

Description

How to fill out Texas Employers Order To Withhold From Earnings?

Get access to quality Texas Employers Order To Withhold From Earnings forms online with US Legal Forms. Prevent days of lost time seeking the internet and lost money on files that aren’t updated. US Legal Forms gives you a solution to exactly that. Get around 85,000 state-specific authorized and tax samples you can download and complete in clicks within the Forms library.

To find the example, log in to your account and click Download. The file will be saved in two places: on the device and in the My Forms folder.

For people who don’t have a subscription yet, look at our how-guide below to make getting started simpler:

- Verify that the Texas Employers Order To Withhold From Earnings you’re looking at is suitable for your state.

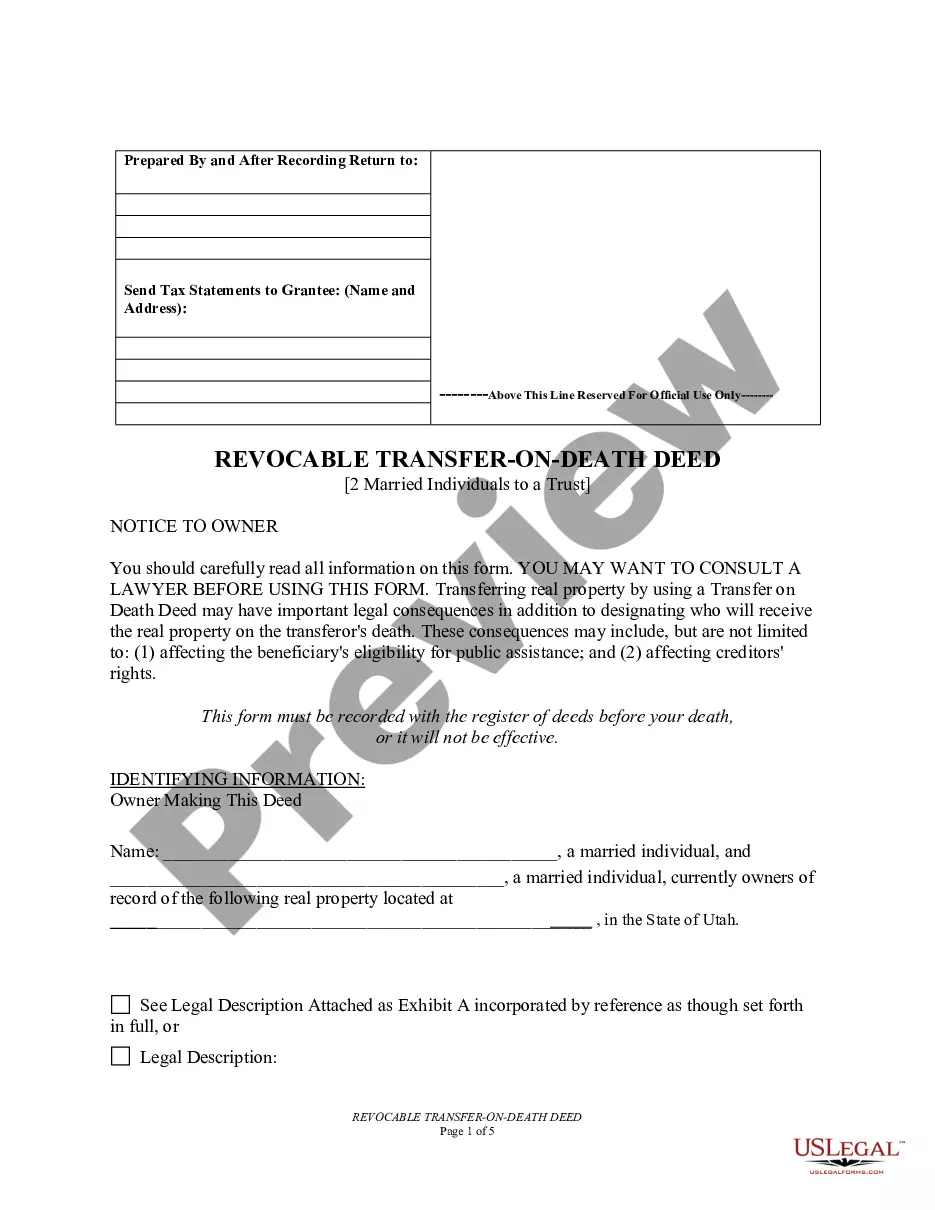

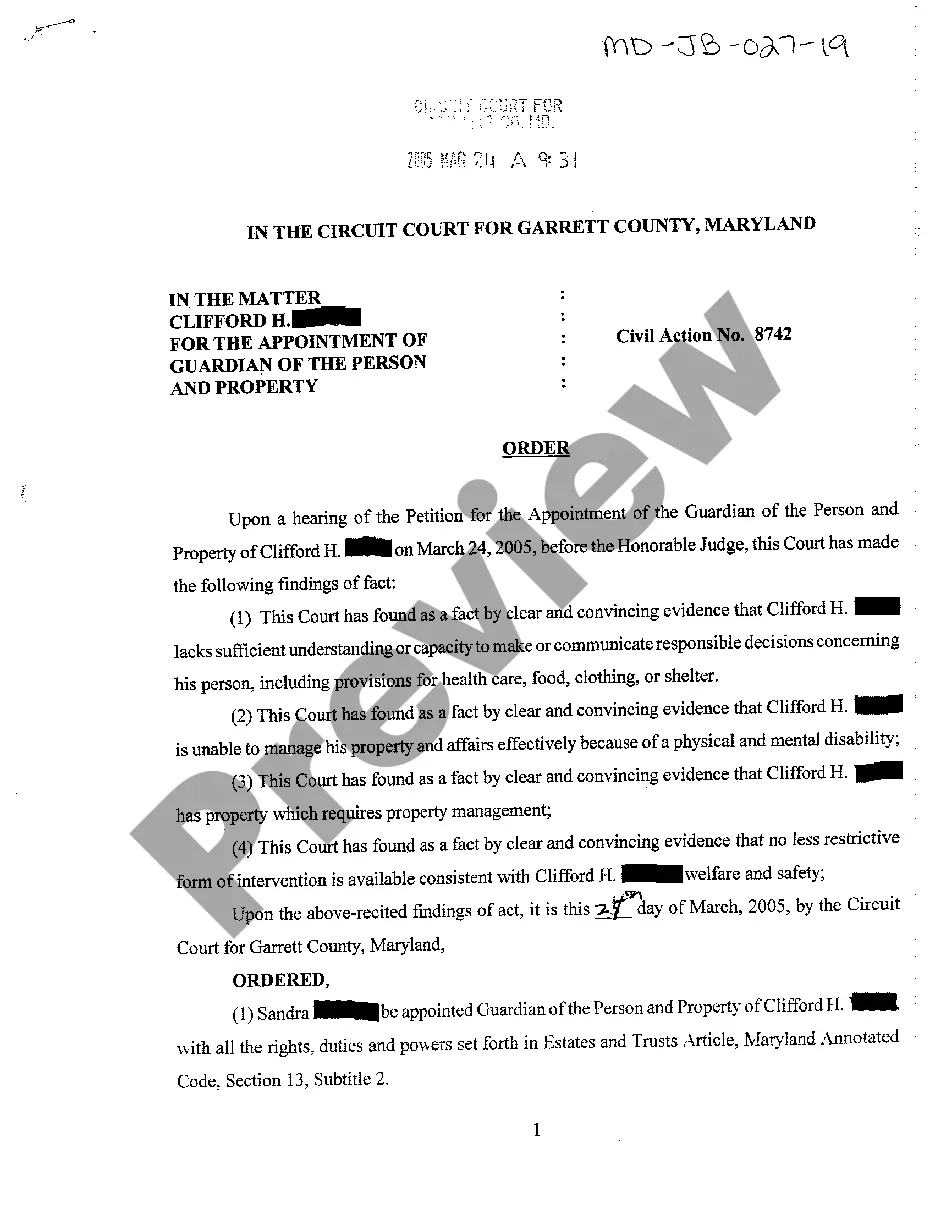

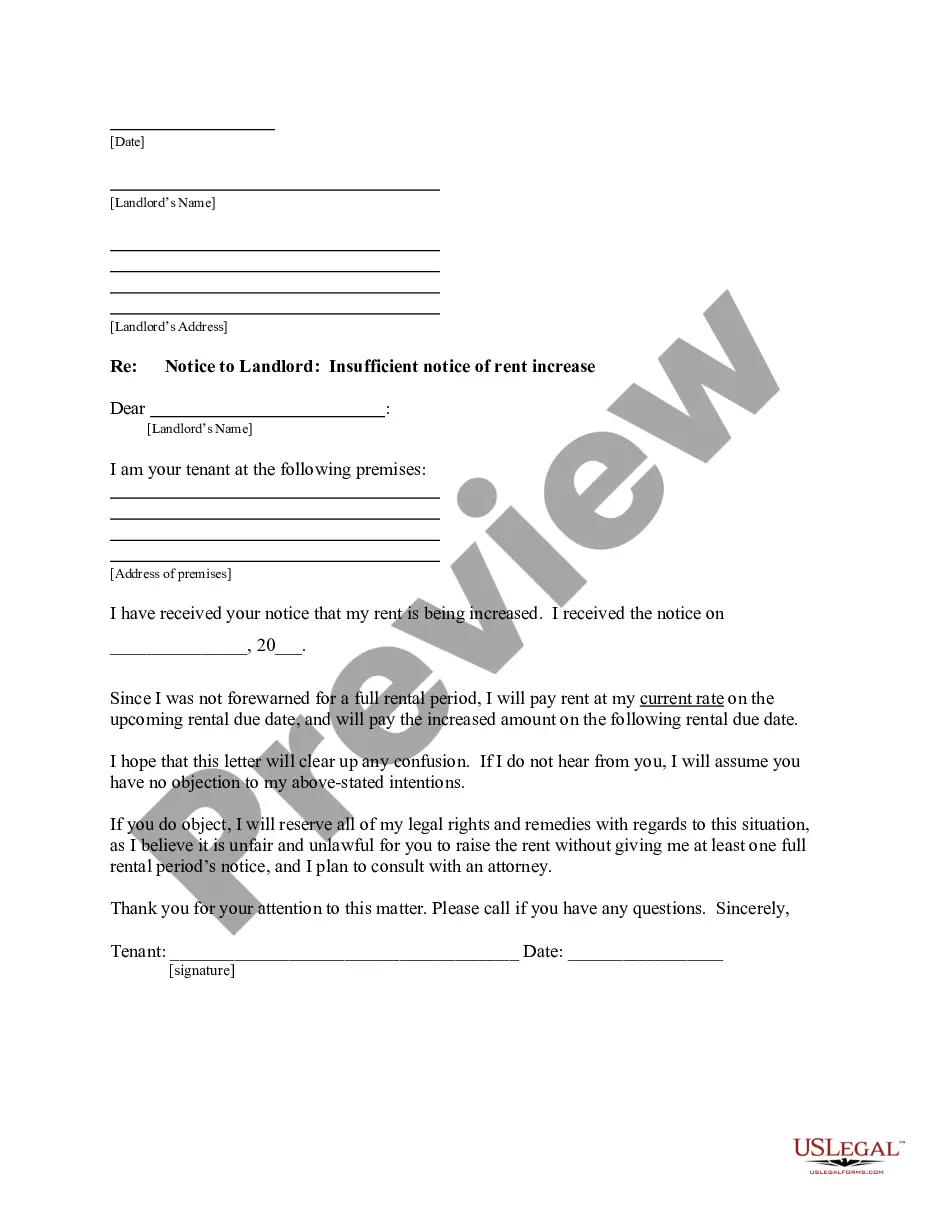

- Look at the form using the Preview option and browse its description.

- Check out the subscription page by clicking Buy Now.

- Select the subscription plan to continue on to register.

- Pay out by credit card or PayPal to complete creating an account.

- Choose a preferred file format to save the document (.pdf or .docx).

Now you can open up the Texas Employers Order To Withhold From Earnings template and fill it out online or print it and do it by hand. Think about sending the papers to your legal counsel to make sure all things are filled in properly. If you make a mistake, print out and complete sample once again (once you’ve made an account every document you save is reusable). Make your US Legal Forms account now and access much more samples.

Form popularity

FAQ

It means that the Income Withholding Order was terminated. An Income Withholding Order is often issued by the Court to withhold income from paychecks.

All parties must sign the Agreement to Stop the Income Withholding Order (and Support Order) in front of a Clerk of the Court or a Notary. If DCSS was involved in the child support case, a representative from the agency must also sign the agreement.

An income withholding order (IWO) is a document sent to employers to tell them to withhold child support from an employee's wages. The IWO can come from a state, tribal, or territorial agency; a court; an attorney; or an individual.

Withholding is the portion of an employee's wages that is not included in his or her paycheck but is instead remitted directly to the federal, state, or local tax authorities. Withholding reduces the amount of tax employees must pay when they submit their annual tax returns.

Once you receive an IWO, you should withhold child support as soon as possible. Most states require that you start withholding no later than the pay period beginning 14 days after the agency mailed the IWO. If you don't withhold child support after receiving an income withholding order, you will face penalties.

Child support withholding is a court-mandated payroll deduction. You will receive a withholding notice if you are required to make child support deductions from an employee's wages. Typically, an employee's disposable income is used to determine the limits of child support deductions.

An income withholding order (IWO) is a document sent to employers to tell them to withhold child support from an employee's wages. The IWO can come from a state, tribal, or territorial agency; a court; an attorney; or an individual.

Fill out the income withholding order, mark the appropriate boxes, mark you're terminating support, file it with the court, get the order from the judge, and then serve it on the employer by certified mail. That's the way you would terminate the support.