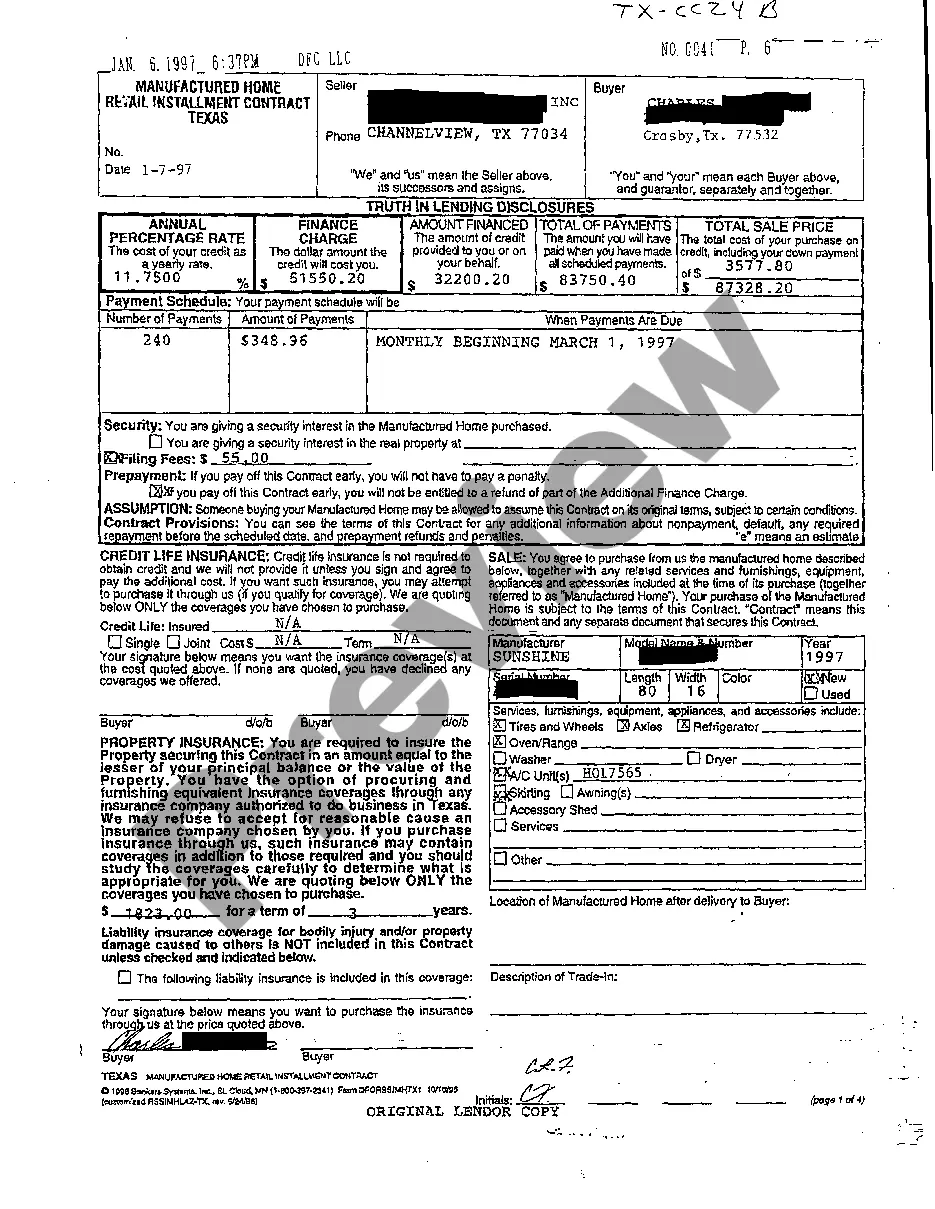

Texas Truth In Lending Disclosures

Description Truth In Lending Document

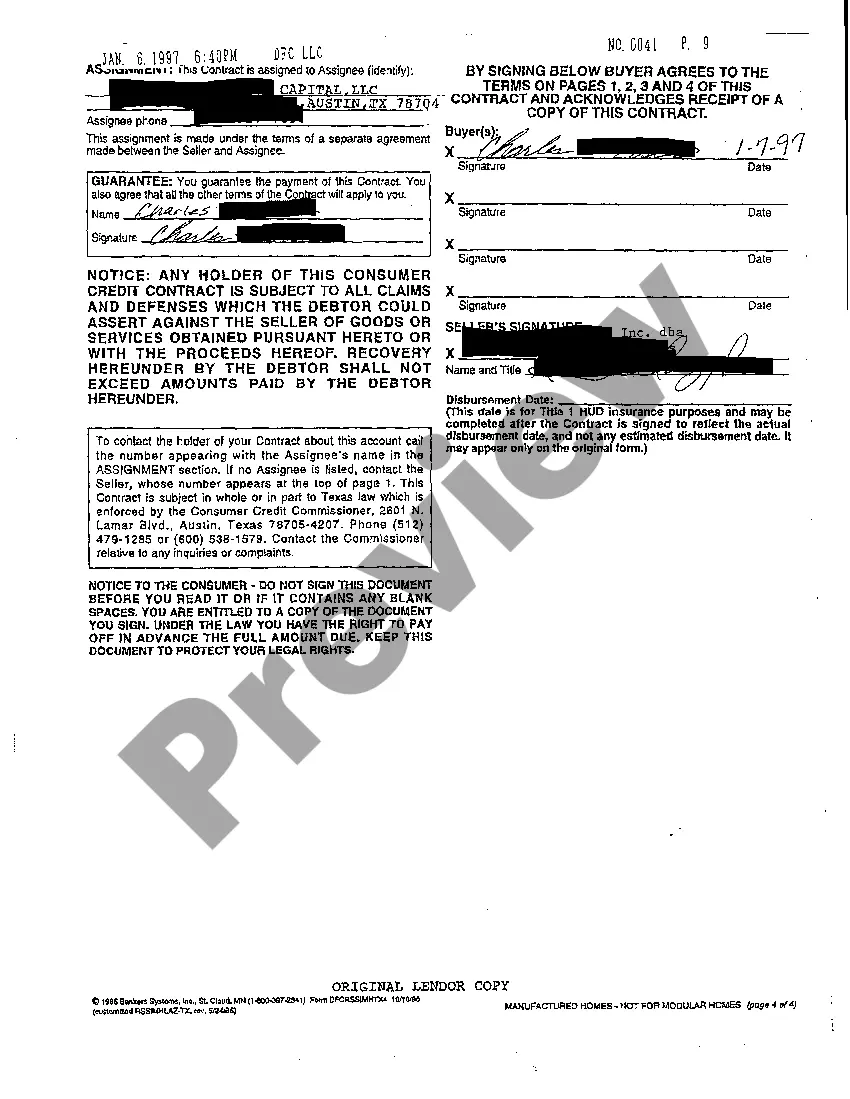

How to fill out Texas Truth In Lending Disclosures?

Access to top quality Texas Truth In Lending Disclosures templates online with US Legal Forms. Prevent hours of misused time searching the internet and dropped money on documents that aren’t updated. US Legal Forms provides you with a solution to just that. Find above 85,000 state-specific authorized and tax forms that you could save and fill out in clicks in the Forms library.

To find the example, log in to your account and click Download. The file is going to be stored in two places: on the device and in the My Forms folder.

For those who don’t have a subscription yet, look at our how-guide listed below to make getting started simpler:

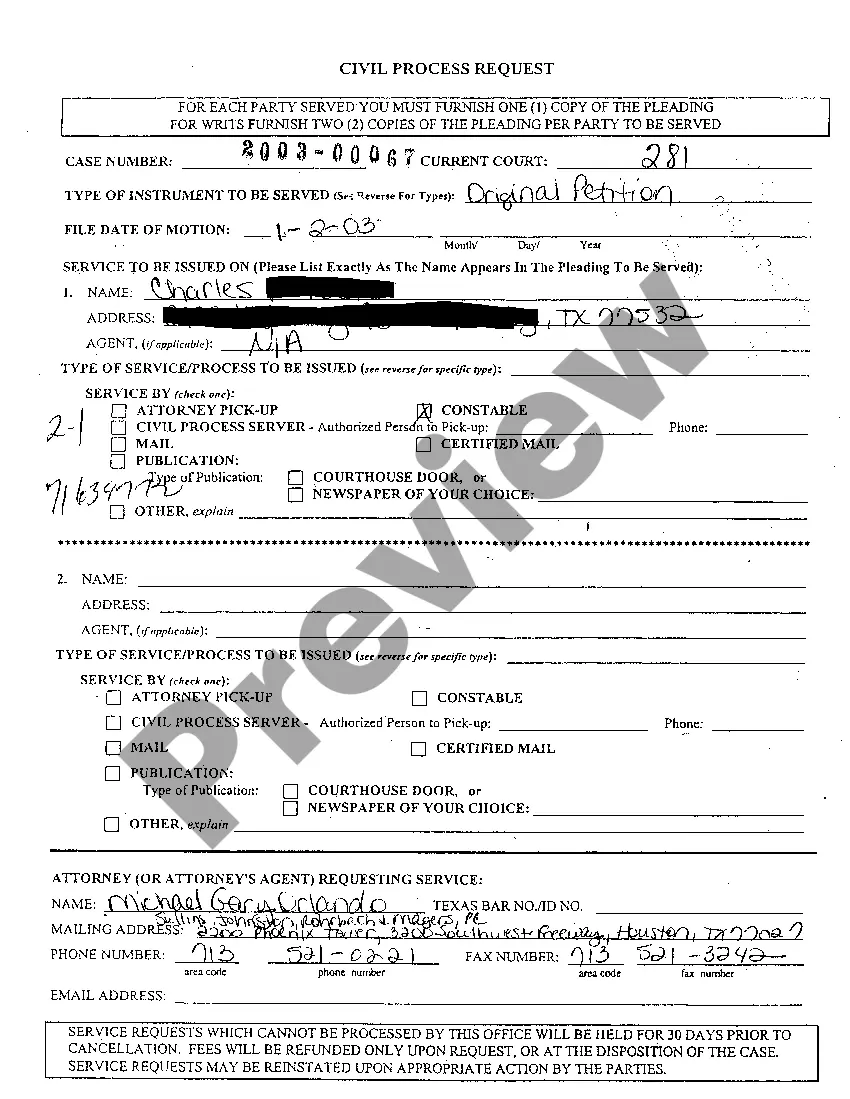

- Verify that the Texas Truth In Lending Disclosures you’re considering is suitable for your state.

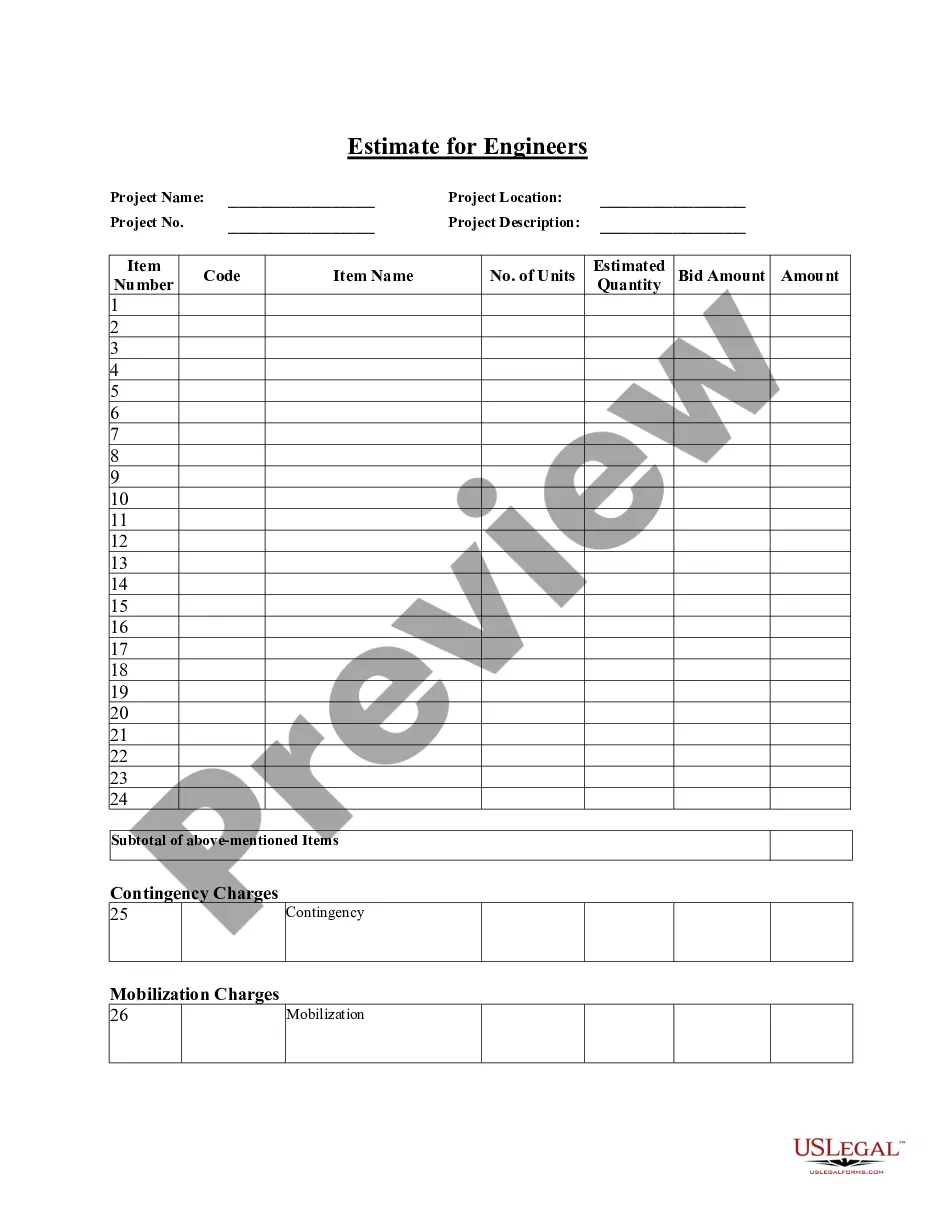

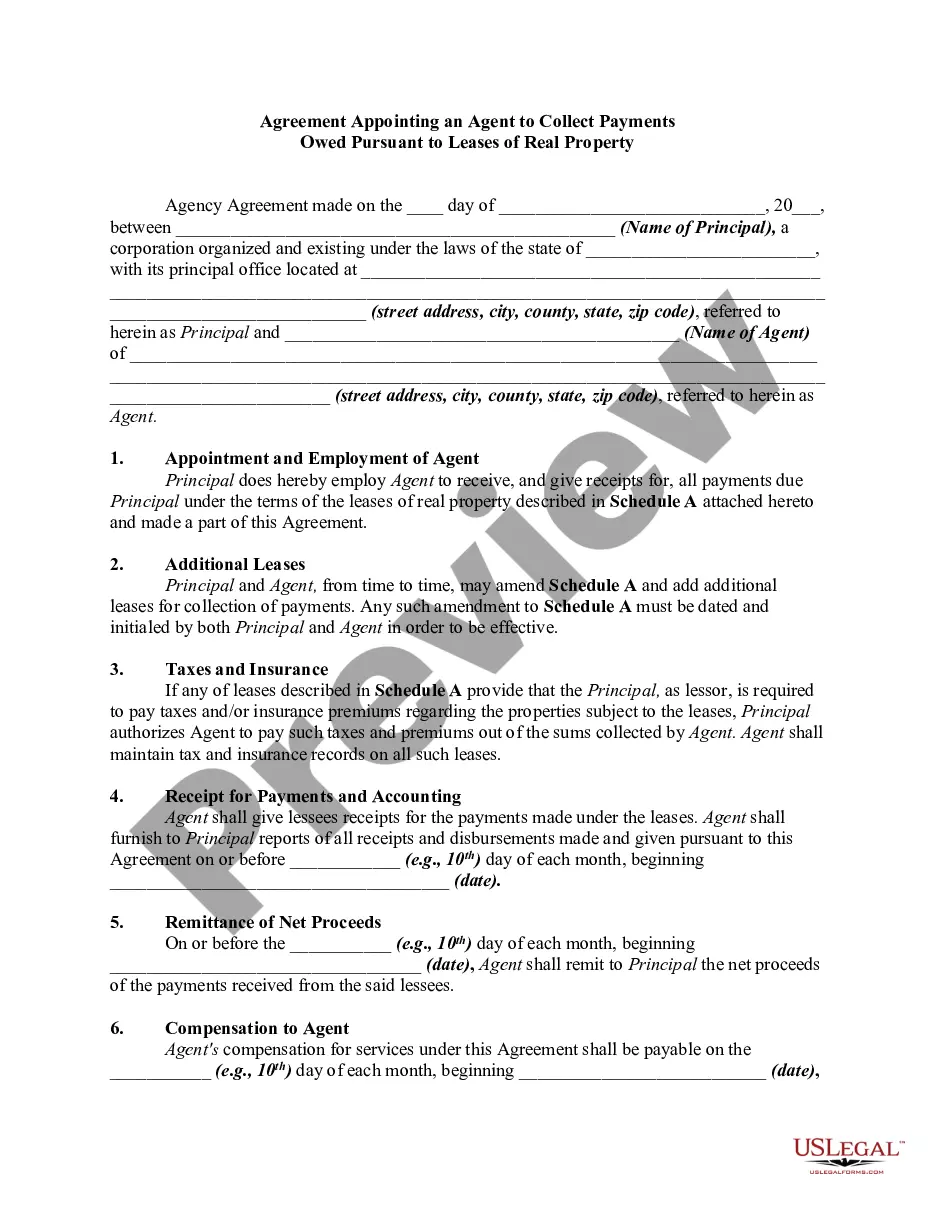

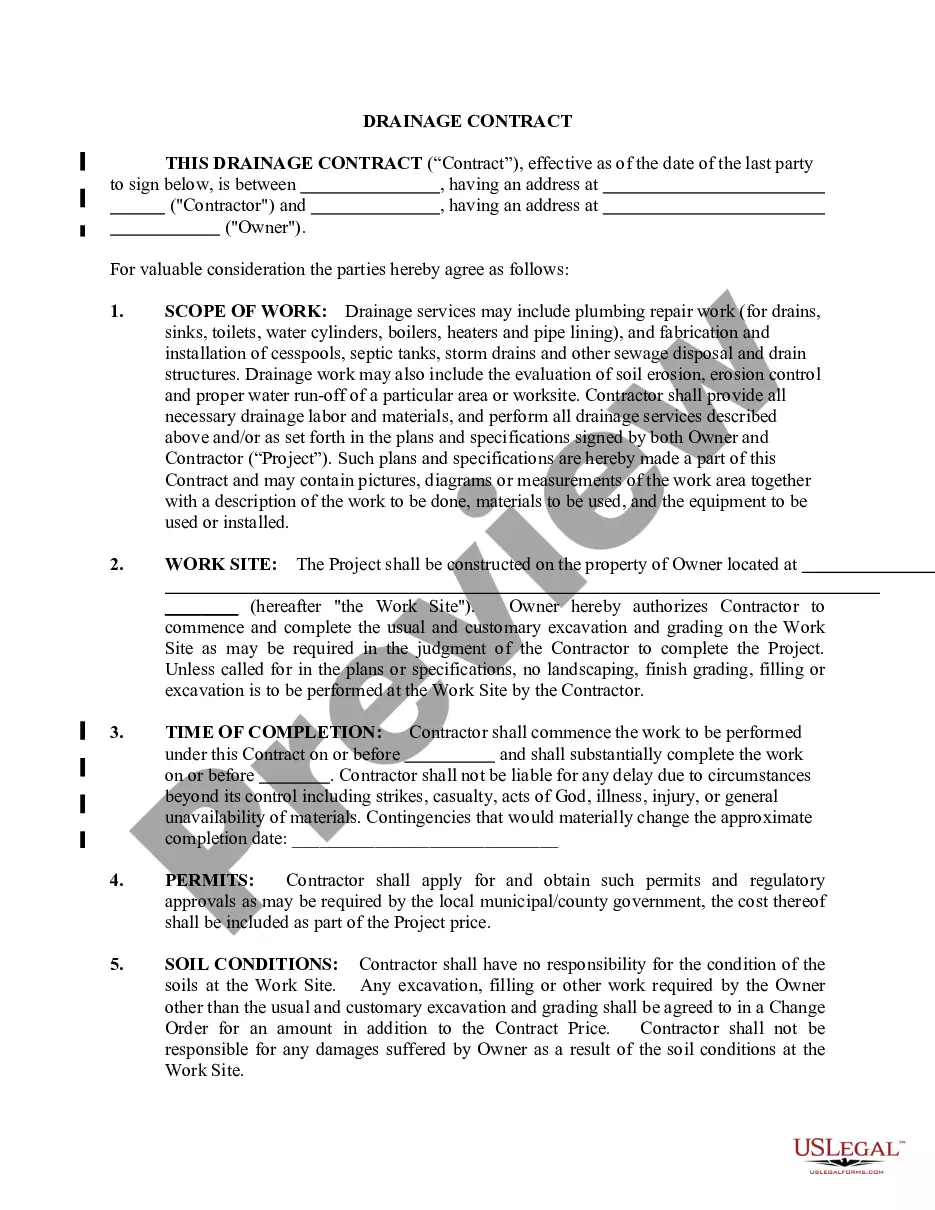

- Look at the form making use of the Preview option and browse its description.

- Check out the subscription page by clicking Buy Now.

- Choose the subscription plan to go on to sign up.

- Pay out by card or PayPal to complete making an account.

- Pick a preferred format to download the document (.pdf or .docx).

You can now open up the Texas Truth In Lending Disclosures sample and fill it out online or print it out and do it by hand. Take into account sending the file to your legal counsel to make sure things are completed appropriately. If you make a mistake, print and complete application once again (once you’ve created an account all documents you download is reusable). Make your US Legal Forms account now and access far more samples.

Form popularity

FAQ

A Truth in Lending agreement is a written disclosure or set of disclosures provided to the borrower before credit or a loan is issued. It outlines the terms and conditions of the credit, the annual percentage rate (APR), and financing details.

A Truth-in-Lending Disclosure Statement provides information about the costs of your credit.Your Truth-in-Lending form includes information about the cost of your mortgage loan, including your annual percentage rate (APR).

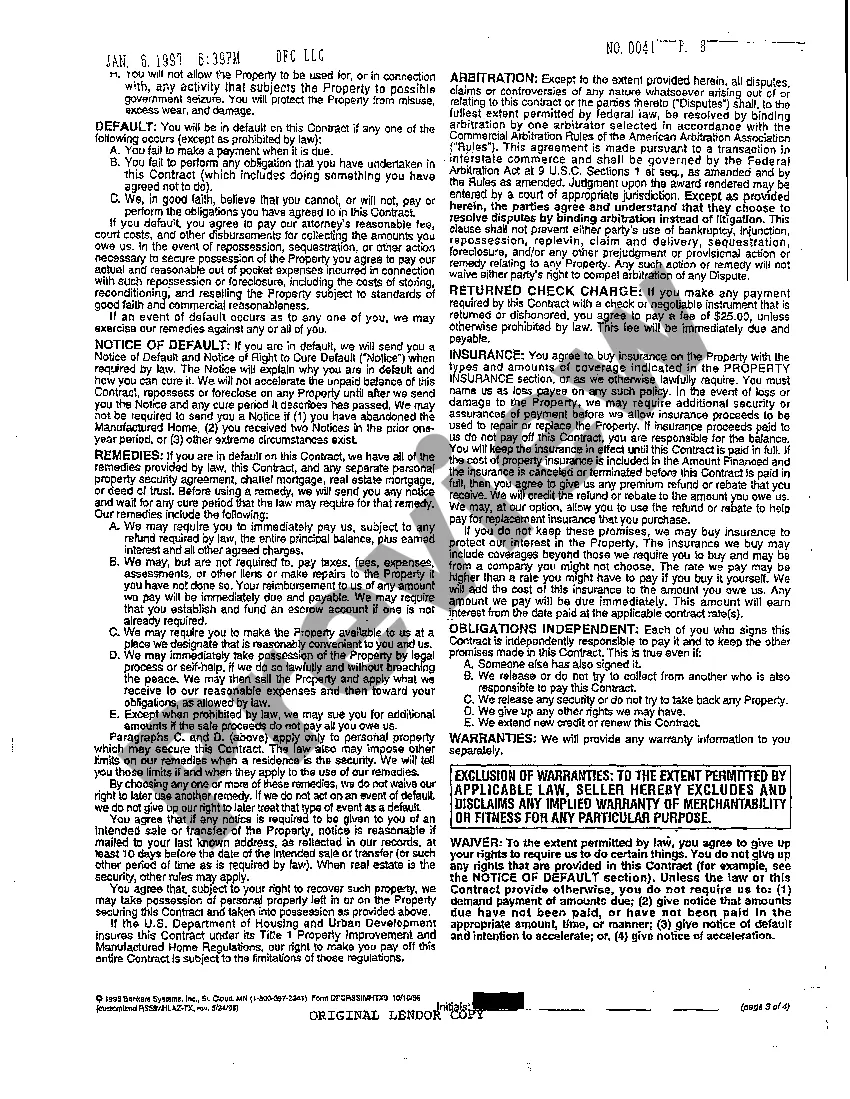

1. The Truth in Lending Act (TILA) requires lenders to disclose important information to borrowers about the cost of a loan before the borrower agrees to the loan. For example, TILA disclosures are required on all car loans and mortgages for houses.

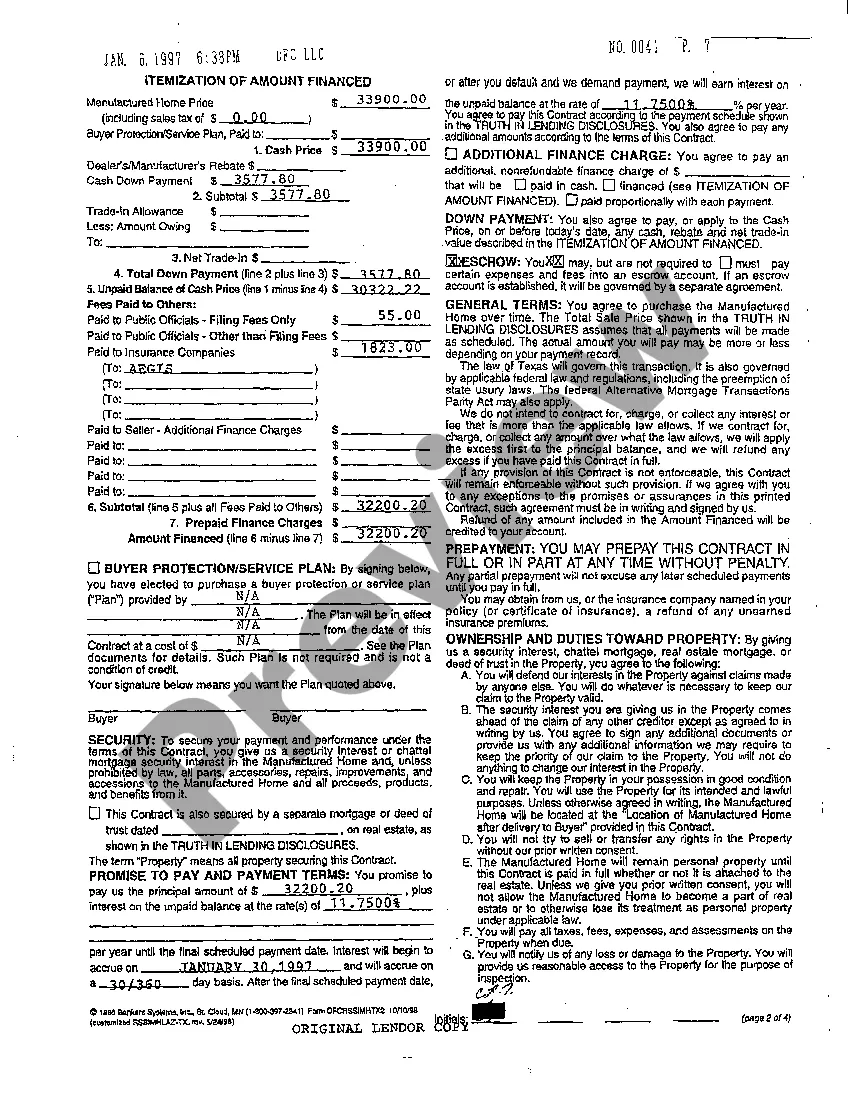

Lenders must provide a Truth in Lending (TIL) disclosure statement that includes information about the amount of your loan, the annual percentage rate (APR), finance charges (including application fees, late charges, prepayment penalties), a payment schedule and the total repayment amount over the lifetime of the loan.

The Truth in Lending Act (TILA) was signed into law in 1968 as a means to protect consumers from unfair and predatory lending practices. It requires lenders and creditors to supply borrowers with clear and visible key information about the credit extended.

Annual percentage rate. Finance charges. Payment schedule. Total amount to be financed. Total amount made in payments over the life of the loan.