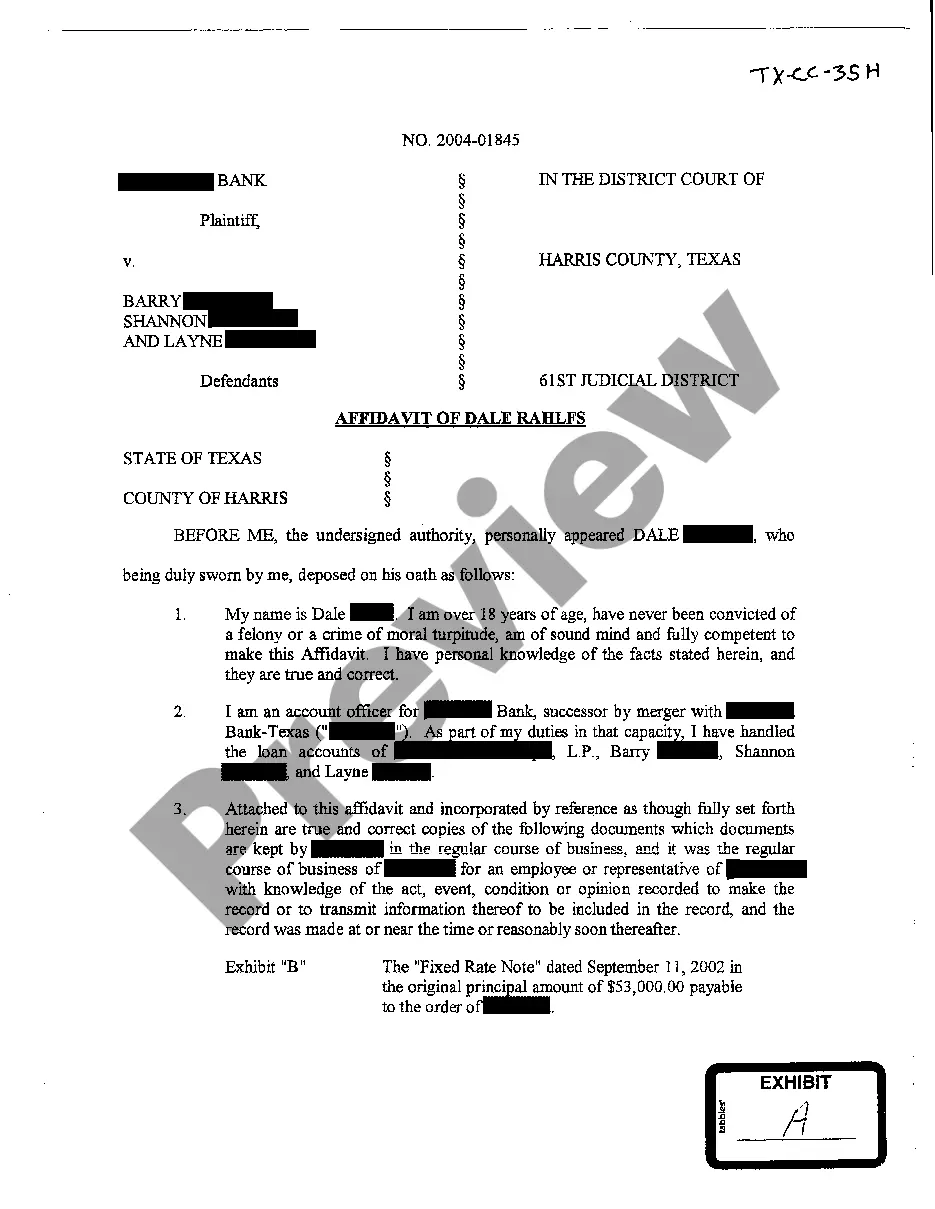

Texas Affidavit of Plaintiff detailing debt owed

Description

How to fill out Texas Affidavit Of Plaintiff Detailing Debt Owed?

Get access to quality Texas Affidavit of Plaintiff detailing debt owed samples online with US Legal Forms. Steer clear of days of misused time looking the internet and lost money on forms that aren’t updated. US Legal Forms gives you a solution to just that. Get around 85,000 state-specific legal and tax samples that you can save and fill out in clicks in the Forms library.

To get the example, log in to your account and click on Download button. The document will be saved in two places: on the device and in the My Forms folder.

For people who don’t have a subscription yet, look at our how-guide listed below to make getting started simpler:

- Check if the Texas Affidavit of Plaintiff detailing debt owed you’re looking at is suitable for your state.

- See the form utilizing the Preview function and read its description.

- Visit the subscription page by clicking on Buy Now button.

- Select the subscription plan to go on to sign up.

- Pay out by credit card or PayPal to complete making an account.

- Pick a preferred file format to download the document (.pdf or .docx).

Now you can open up the Texas Affidavit of Plaintiff detailing debt owed template and fill it out online or print it and do it by hand. Think about giving the papers to your legal counsel to make certain things are filled out correctly. If you make a error, print and complete sample again (once you’ve made an account every document you save is reusable). Make your US Legal Forms account now and get access to much more samples.

Form popularity

FAQ

When a creditor gets a judgment against a debtor, the creditor has to take steps to get the judgment paid. This is called execution.The things that are taken are sold to pay the judgment. The Texas Property Code sets out the kinds and amounts of property that can and cannot be taken to pay a judgment in Texas.

The statute of limitations on debt in Texas is four years. This section of the law, introduced in 2019, states that a payment on the debt (or any other activity) does not restart the clock on the statute of limitations.

Once you have a judgment against you, creditors can garnish your bank account in Texas. They do this with a Writ of Garnishment. They cannot garnish your wages but once you deposit your paycheck into the bank they can freeze your account with a valid judgment.

If you can't pay on a debt, a creditor (person or company you owe) might sue you to collect it. However, you can't be put in jail for failing to pay your creditors (though child support is an exception).

If the creditor or debt collector wins the lawsuit, they will obtain a judgment against you. That judgment can then be enforced in a variety of ways unless you do not have any money or assets that the creditor could claim. This is commonly called being "judgment proof."

Today, you cannot go to prison for failing to pay for a civil debt like a credit card, loan, or hospital bill. You can, however, be forced to go to jail if you don't pay your taxes or child support.

According to the CFPB, the collector would have to confirm it has in addition to the usual info account number associated with the debt, date of default, amount owed at default, and the date and amount of any payment or credit applied after default.

However, debt collectors cannot threaten to sue you if they don't intend to do so or they legally cannot.A debt collector can only threaten to take actions that are allowed by law. Texas does not allow Texas companies to garnish wages.