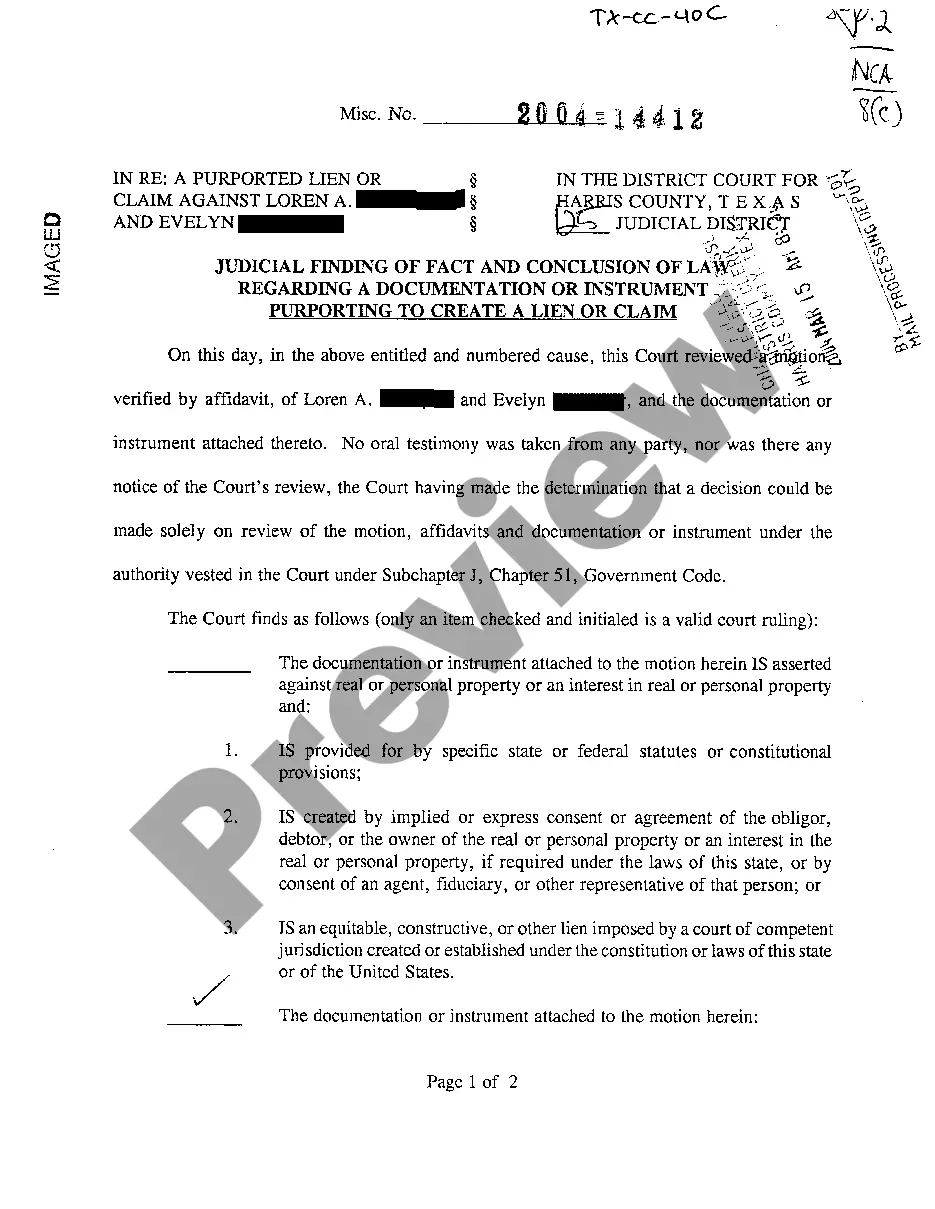

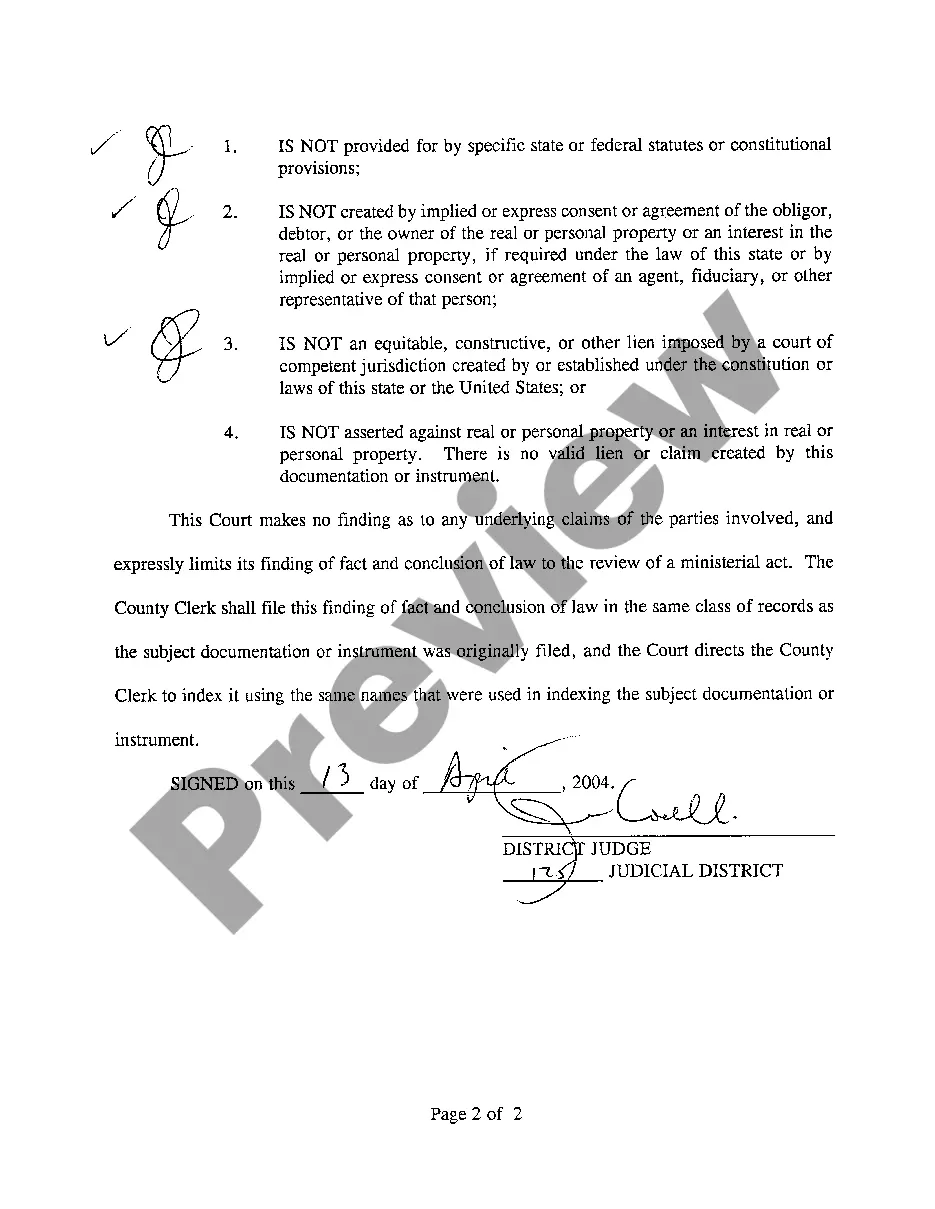

Texas Judicial Findings regarding Instrument Purporting to Create a Lien of Claim

Description

How to fill out Texas Judicial Findings Regarding Instrument Purporting To Create A Lien Of Claim?

Get access to quality Texas Judicial Findings regarding Instrument Purporting to Create a Lien of Claim samples online with US Legal Forms. Steer clear of days of lost time looking the internet and dropped money on documents that aren’t updated. US Legal Forms offers you a solution to just that. Get around 85,000 state-specific legal and tax templates you can save and submit in clicks in the Forms library.

To find the sample, log in to your account and click Download. The file is going to be stored in two places: on the device and in the My Forms folder.

For individuals who don’t have a subscription yet, look at our how-guide listed below to make getting started simpler:

- Check if the Texas Judicial Findings regarding Instrument Purporting to Create a Lien of Claim you’re considering is suitable for your state.

- See the sample using the Preview option and read its description.

- Visit the subscription page by simply clicking Buy Now.

- Choose the subscription plan to go on to sign up.

- Pay by credit card or PayPal to complete making an account.

- Select a favored format to save the document (.pdf or .docx).

You can now open the Texas Judicial Findings regarding Instrument Purporting to Create a Lien of Claim sample and fill it out online or print it and get it done yourself. Take into account sending the document to your legal counsel to make sure things are filled in properly. If you make a mistake, print and complete sample again (once you’ve created an account all documents you save is reusable). Make your US Legal Forms account now and get much more forms.

Form popularity

FAQ

Your lawyer will help you decide whether to fight the lien in court or negotiate a settlement.In some, you may be able to fend off a lien if: You prove that you've paid your construction bills fully and on time. You prove that the contractor who filed the lien has breached his contract and doesn't deserve to be paid.

If a lien is filed on your property and you believe the lien is wrongful, you, the property owner have a right to contest the lien. In some cases, you may be able to file a summary motion to remove a lien. This is a lawsuit filed in district court that will allow the almost immediate removal of the lien.

Lenders in Texas customarily use a release of lien when the loan secured by a deed of trust has been paid in full or otherwise satisfied.The release of lien is recorded in the county where the real property collateral is located.

Write your name and return address in the top three lines of the letter. Insert the complete date (month, day, year). Enter the recipient's name, title, company name and address on the next five lines. Greet the reader by writing "Dear (recipient's name):" Skip two lines. State the subject in a subject line.

About the release form This form should be filed with the recorder's office in the Texas county where the lien was originally recorded. Texas law requires claimants to file a lien release within 10 days after the lien is satisfied, or upon request from the property owner.

Pay off your debt. Fill out a release-of-lien form and have the lien holder sign it. Run out the statute of limitations. Get a court order. Make a claim with your title insurance company. Learn more:

Texas has a homestead exemption, which means creditors can still place liens on a debtor's primary real estate, but they cannot seize the property. However, having a lien on your homestead still clouds the title.

If a lien is filed on your property and you believe the lien is wrongful, you, the property owner have a right to contest the lien. In some cases, you may be able to file a summary motion to remove a lien. This is a lawsuit filed in district court that will allow the almost immediate removal of the lien.

Judgment liens in Texas expire after ten years, as do federal tax liens, and both stay attached to the property even it if changes owners. A mortgage lien remains valid on a property until the debt is paid in full. Also, many liens may be renewed before they expire.