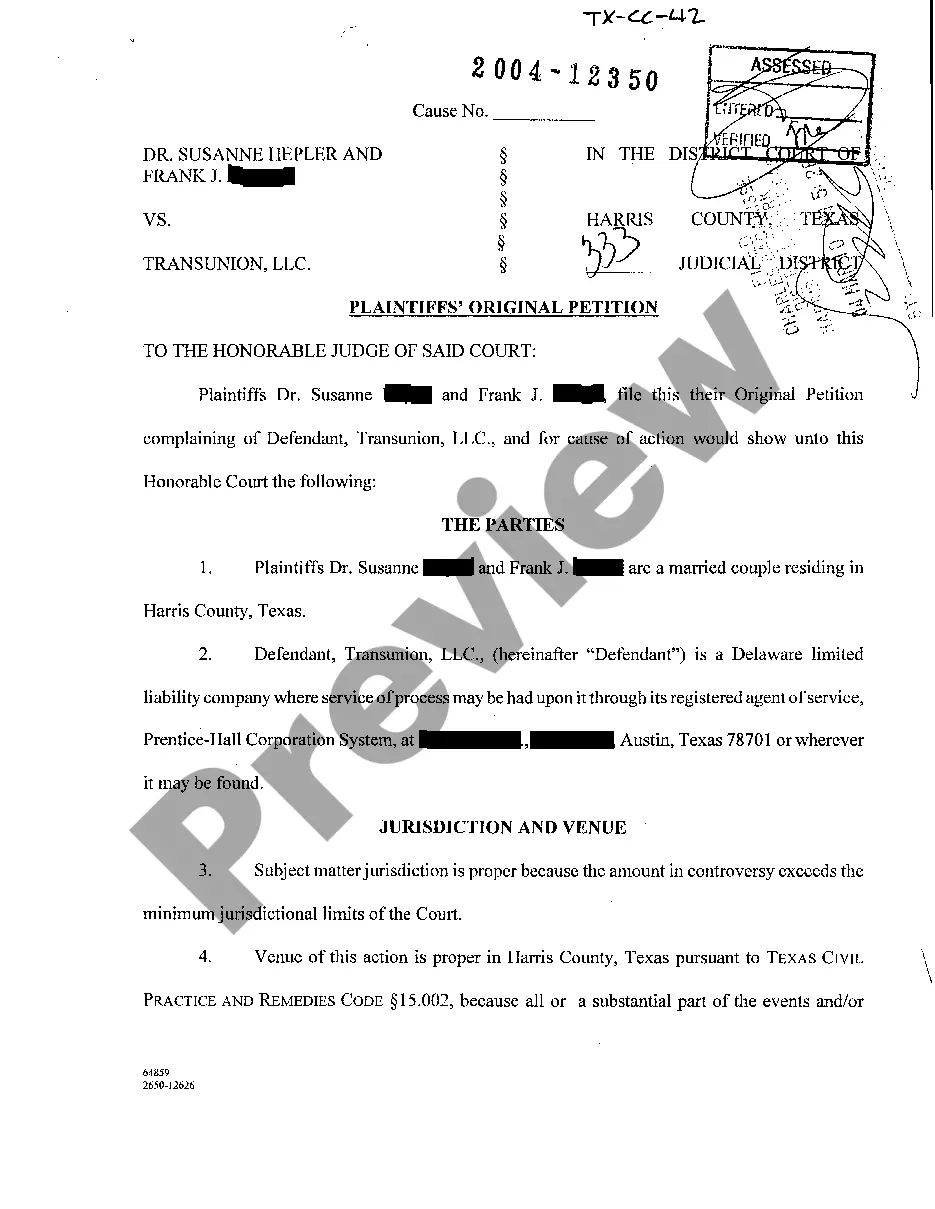

Texas Plaintiff's Original Petition regarding Fair Credit Reporting Act

Description

How to fill out Texas Plaintiff's Original Petition Regarding Fair Credit Reporting Act?

Access to high quality Texas Plaintiff's Original Petition regarding Fair Credit Reporting Act samples online with US Legal Forms. Prevent days of wasted time looking the internet and lost money on files that aren’t updated. US Legal Forms offers you a solution to just that. Find around 85,000 state-specific legal and tax templates that you can save and complete in clicks in the Forms library.

To get the sample, log in to your account and then click Download. The file will be stored in two places: on your device and in the My Forms folder.

For people who don’t have a subscription yet, have a look at our how-guide listed below to make getting started simpler:

- See if the Texas Plaintiff's Original Petition regarding Fair Credit Reporting Act you’re considering is appropriate for your state.

- See the sample making use of the Preview function and browse its description.

- Go to the subscription page by clicking on Buy Now button.

- Select the subscription plan to continue on to register.

- Pay out by credit card or PayPal to finish creating an account.

- Pick a preferred file format to save the file (.pdf or .docx).

You can now open the Texas Plaintiff's Original Petition regarding Fair Credit Reporting Act template and fill it out online or print it and get it done yourself. Think about giving the file to your legal counsel to ensure all things are completed correctly. If you make a mistake, print and complete application again (once you’ve made an account every document you download is reusable). Make your US Legal Forms account now and access more samples.

Form popularity

FAQ

The Act (Title VI of the Consumer Credit Protection Act) protects information collected by consumer reporting agencies such as credit bureaus, medical information companies and tenant screening services. Information in a consumer report cannot be provided to anyone who does not have a purpose specified in the Act.

The FCRA gives you the right to be told if information in your credit file is used against you to deny your application for credit, employment or insurance. The FCRA also gives you the right to request and access all the information a consumer reporting agency has about you (this is called "file disclosure").

A data furnisher is an entity that reports information about consumers to consumer reporting agencies (CRAs), which may include credit bureaus, tenant screening companies, check verification services, medical information services, etc.Correct, delete, or verify information within 30 or 45 days of receipt of a dispute.

Whether claiming a negligent or willful violation, a plaintiff may recover costs and reasonable attorneys' fees (15 U.S.C. ? 1681n(a)(3), 1681o(a)(2)). Actual damages can include damages for emotional distress, even if the plaintiff suffered no economic damages (see, for example, Cortez v. Trans Union, LLC, 617 F.

The FCRA and Regulation V generally require a furnisher to conduct a reasonable investigation of a dispute submitted directly to a furnisher by a consumer concerning the accuracy of any information contained in a consumer report and pertaining to an account or other relationship that the furnisher has or had with the

A furnisher is a company that provides information about a consumer, including credit history, to a credit bureau.

An information furnisher is a company that provides information to consumer reporting agencies. Information furnisher is governed under the Fair Credit Reporting Act(FCRA). Examples of information furnisher are, state or municipal courts reporting a judgment of some kind, past and present employers and bonders.

Examples of furnishers include banks, thrifts, credit unions, savings and loan institutions, mortgage lenders, credit card issuers, collection agencies, retail installment lenders, and auto finance lenders--basically anyone that reports information to the CRAs.

If a violation does occur, consumers may be entitled to the following damages: Actual damages. There is no limit to this amount, as long as you can prove the loss.