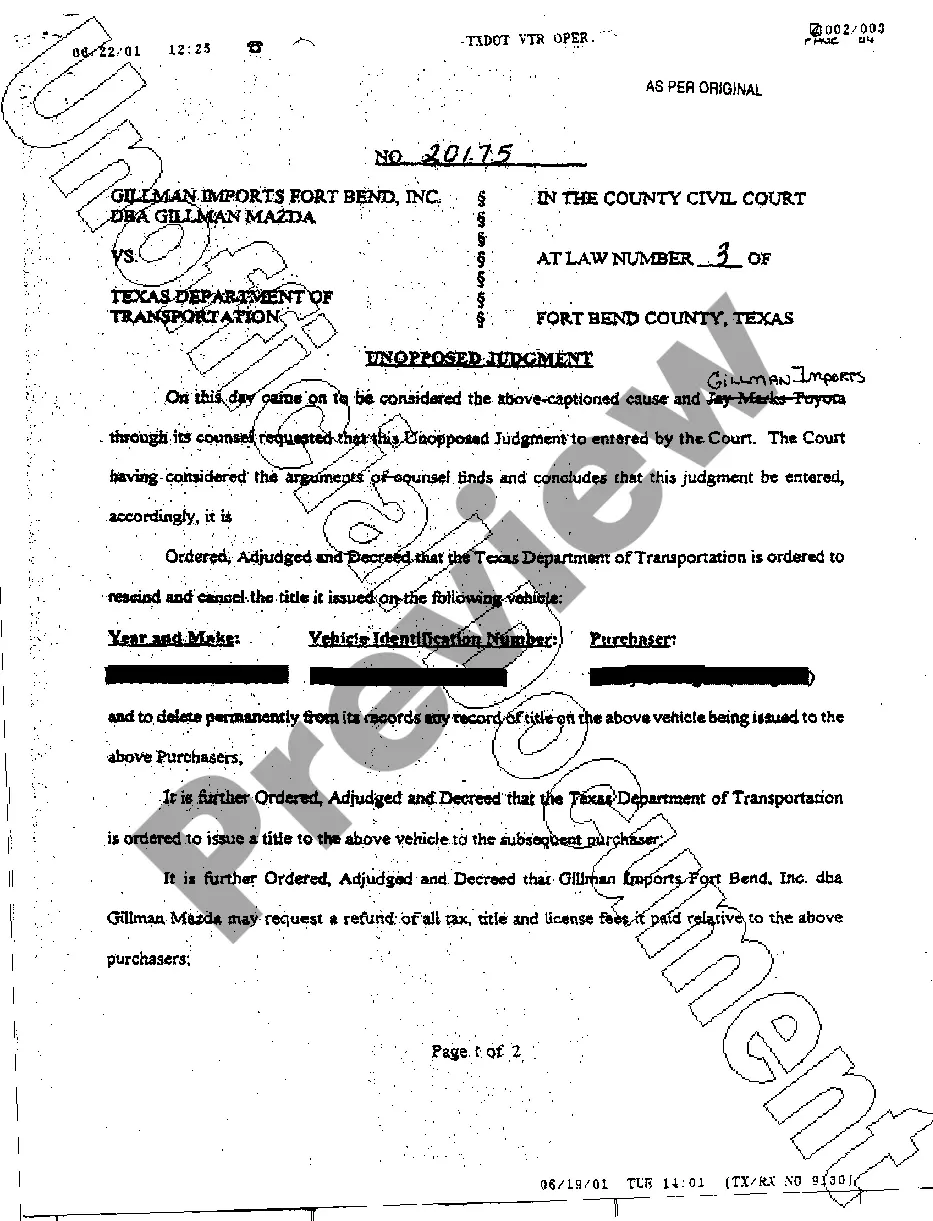

Texas Agreed Final Judgment

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

Key Concepts & Definitions

A02 Agreed Final Judgment: Refers to a legal document that indicates the resolution agreed upon by all parties in a legal dispute, which is then approved and finalized by a Judge. This document often includes terms about real estate, small business, or landlord-tenant relations in areas like San Antonio.

Legal Forms: Essential documents used in various legal proceedings including civil litigation and agreements.

Power of Attorney: A legal form granting one party the authority to act on behalf of another in private affairs, business, or some other legal matter.

Step-by-Step Guide to Filing an Agreed Final Judgment

- Gather all necessary documents and proof related to the legal proceedings to support the agreed judgment.

- Engage with all parties involved to negotiate terms of the agreement ensuring clear understanding and consensus.

- Once mutual terms are agreed, draft the agreed final judgment document incorporating terms for real estate, landlord-tenant agreements, or small business considerations if applicable.

- Review the agreement with legal counsel to ensure compliance with local San Antonio laws and wider federal regulations.

- Submit the agreed final judgment for approval to the court, followed by both parties signing off in the presence of their attorneys.

- Wait for the final approval from a judge which concludes the process.

Risk Analysis in Agreed Final Judgments

- Legal Risks: Inaccuracies or omissions in the agreed final judgment can result in legal consequences or prolonged litigation.

- Compliance Risks: Failing to adhere to local and federal laws, especially concerning real estate and business, might lead to severe penalties.

- Financial Risks: Improperly structured agreements could lead to financial losses for either party, particularly in small business settlements.

How to fill out Texas Agreed Final Judgment?

Get access to top quality Texas Agreed Final Judgment forms online with US Legal Forms. Steer clear of days of lost time searching the internet and dropped money on documents that aren’t up-to-date. US Legal Forms provides you with a solution to exactly that. Get over 85,000 state-specific authorized and tax forms you can download and complete in clicks in the Forms library.

To find the sample, log in to your account and then click Download. The file is going to be stored in two places: on the device and in the My Forms folder.

For individuals who don’t have a subscription yet, have a look at our how-guide listed below to make getting started simpler:

- See if the Texas Agreed Final Judgment you’re considering is appropriate for your state.

- Look at the form utilizing the Preview option and read its description.

- Check out the subscription page by simply clicking Buy Now.

- Select the subscription plan to keep on to sign up.

- Pay by card or PayPal to finish making an account.

- Select a preferred format to download the document (.pdf or .docx).

You can now open up the Texas Agreed Final Judgment template and fill it out online or print it and do it by hand. Consider sending the file to your legal counsel to make certain all things are completed appropriately. If you make a error, print and complete sample once again (once you’ve created an account every document you download is reusable). Create your US Legal Forms account now and get access to much more forms.

Form popularity

FAQ

An agreed judgment is a judgment which is typically entered after a memorandum of understanding, which is a written agreement shared with counsel who then incorporate it into an agreed order signed by a magistrate, the parties, and their attorneys, if applicable.

Whenever a civil lawsuit is filed, the plaintiff wins the case by obtaining a judgment against the Defendant. A judgment is the final determination by a court of proper jurisdiction of who wins the case.An agreed judgment, like a regular judgment, resolves the lawsuit.

Do Judgments Expire in Texas? Judgments issued in Texas with a non-government creditor are generally valid for ten years but they can be renewed for longer. If a judgment is not renewed, it will become dormant. You can attempt to revive a dormant judgment in order to continue to try and collect the debt.

A creditor may agree to settle the judgment for less than you owe. This typically happens when the creditor thinks you might file bankruptcy and wipe out the debt that way. Settling can be a win-win. The creditor gets at least partial payment for the debt although it usually will require it as a lump sum.

An agreed judgment is a judgment which is typically entered after a memorandum of understanding, which is a written agreement shared with counsel who then incorporate it into an agreed order signed by a magistrate, the parties, and their attorneys, if applicable.

The last decision from a court that resolves all issues in dispute and settles the parties' rights with respect to those issues. A final judgment leaves nothing except decisions on how to enforce the judgment, whether to award costs, and whether to file an appeal.

What Happens After a Judgment Is Entered Against You? The court enters a judgment against you if your creditor wins their claim or you fail to show up to court. You should receive a notice of the judgment entry in the mail. The judgment creditor can then use that court judgment to try to collect money from you.

Find the judgment creditor. Create a hardship letter. Negotiate. Write a Release of Judgment (RoJ) Transfer Money and Get Release of Judgment (RoJ) Signed. File Release of judgment (RoJ) in the correct county.

An Agreed Judgment is usually a settlement agreement for an extended payment plan. Payment plans are usually 12 to 36 months. Sometimes an agreed judgment is the only option if the creditor has produced enough evidence to likely win at trial and the consumer can only do a settlement with a long term payment plan.