This Closing Statement is for a real estate transaction where the transaction is a cash sale or provides for owner financing. This settlement statement is verified and signed by both the seller and the buyer.

Texas Closing Statement

Description Texas Closing

How to fill out Real Estate Closing Statement Template?

Access to top quality Texas Closing Statement forms online with US Legal Forms. Avoid days of wasted time looking the internet and dropped money on documents that aren’t up-to-date. US Legal Forms provides you with a solution to exactly that. Find above 85,000 state-specific legal and tax templates that you can download and complete in clicks within the Forms library.

To find the sample, log in to your account and click on Download button. The document is going to be saved in two places: on your device and in the My Forms folder.

For those who don’t have a subscription yet, have a look at our how-guide below to make getting started simpler:

- Find out if the Texas Closing Statement you’re looking at is suitable for your state.

- Look at the form utilizing the Preview function and browse its description.

- Go to the subscription page by clicking Buy Now.

- Choose the subscription plan to keep on to register.

- Pay by credit card or PayPal to complete creating an account.

- Pick a favored format to save the file (.pdf or .docx).

You can now open up the Texas Closing Statement sample and fill it out online or print it out and get it done by hand. Consider mailing the file to your legal counsel to make certain things are completed appropriately. If you make a error, print and complete sample again (once you’ve created an account every document you download is reusable). Make your US Legal Forms account now and get access to a lot more forms.

Closing Settlement Form Statement Form popularity

Texas Closing Document Other Form Names

Texas Statement Online FAQ

Total closing costs to purchase a $300,000 home could cost anywhere from approximately $6,000 to $12,000 or even more. The funds can't typically be borrowed because that would raise the buyer's loan ratios to a point where they might no longer qualify.

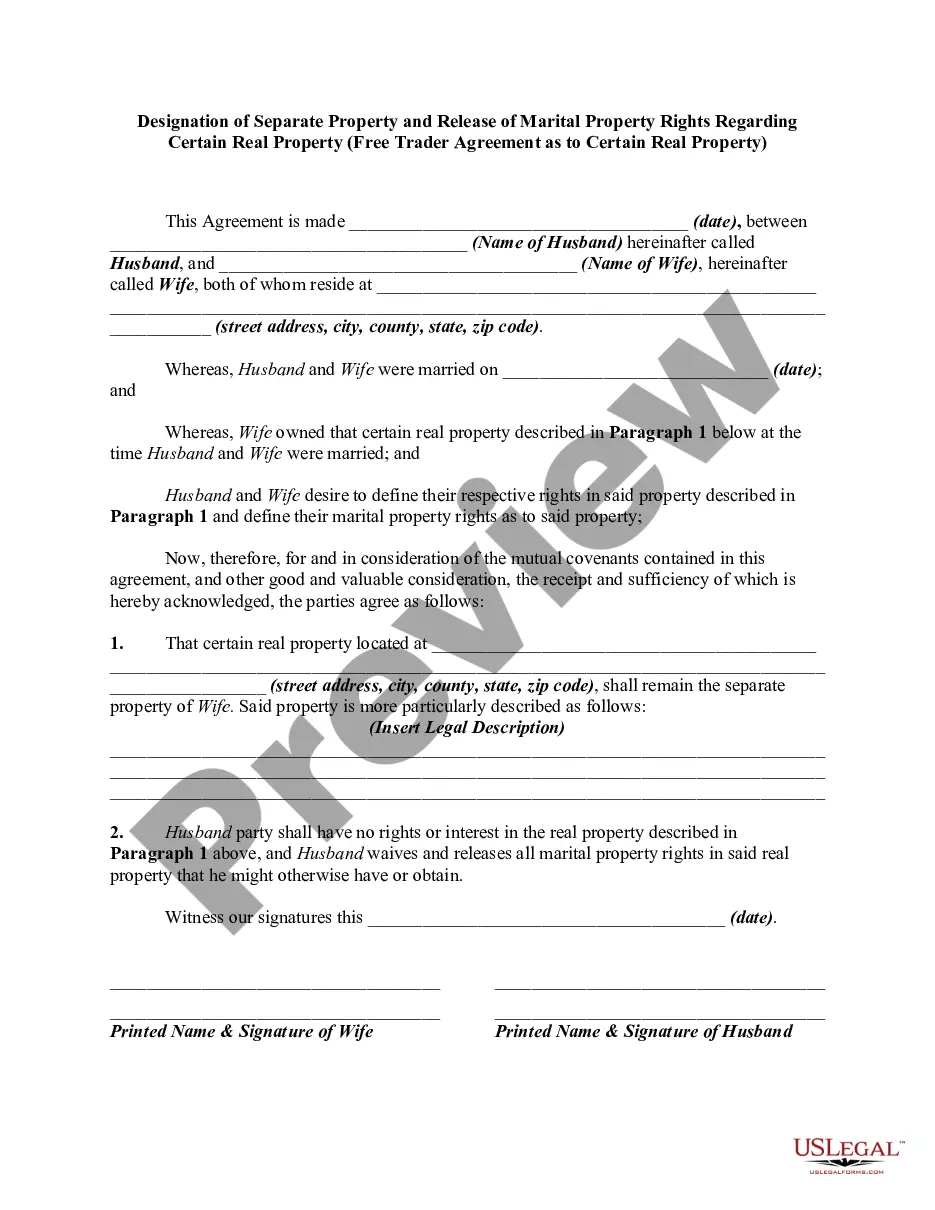

Are Sellers & Buyers at closing together? No. Texas is what's called an escrow state, which means that a trusted third party, like your title company, holds both the money and the signed deed and makes all the necessary arrangements for the transfer.

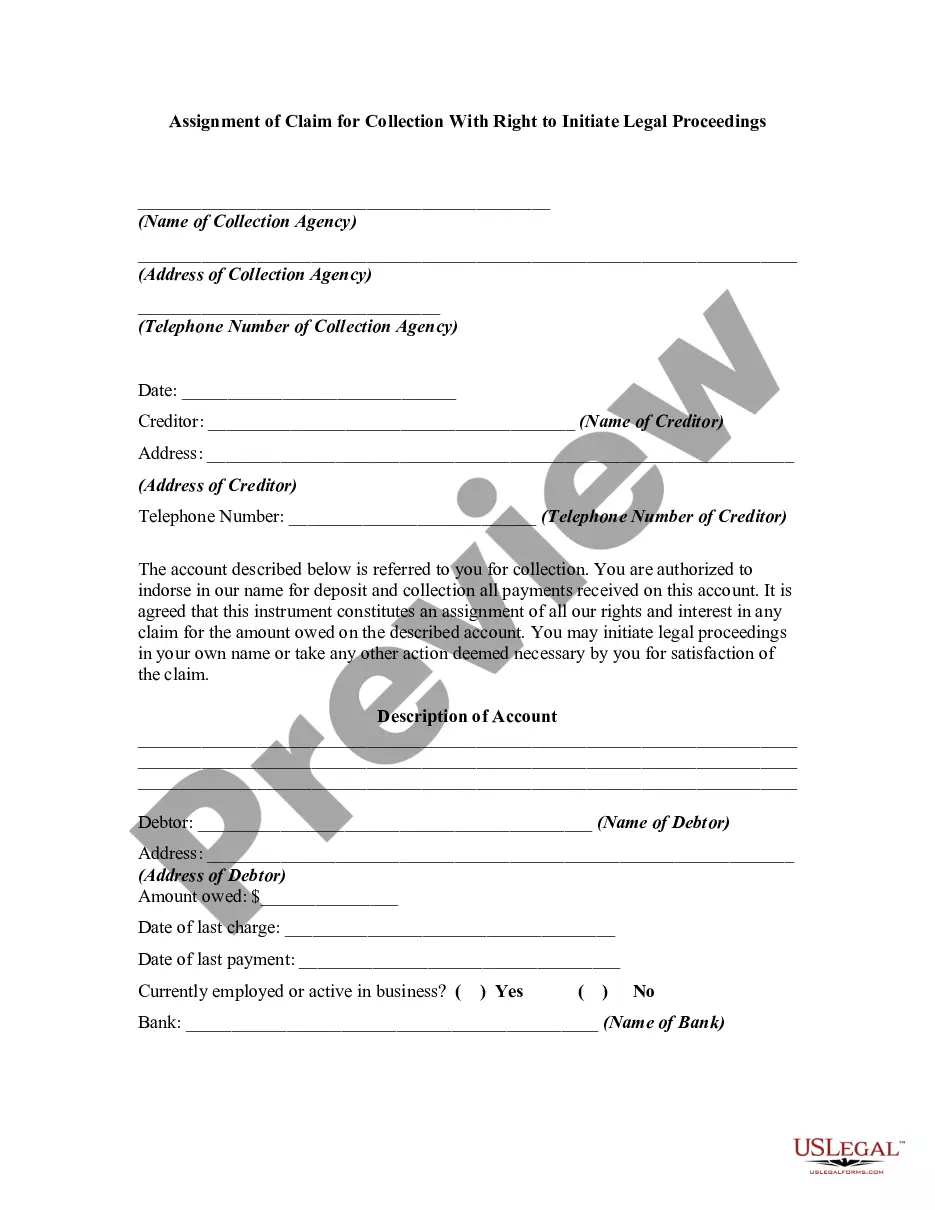

A settlement statement is also known as a HUD-1 form or a closing statement. Until 2015, when the rules changed, this form was provided twice. First, within three business days of applying for a mortgage loan, the borrower receives one in the mail with the person's estimated closing costs.

Closing arguments are the opportunity for each party to remind jurors about key evidence presented and to persuade them to adopt an interpretation favorable to their position.

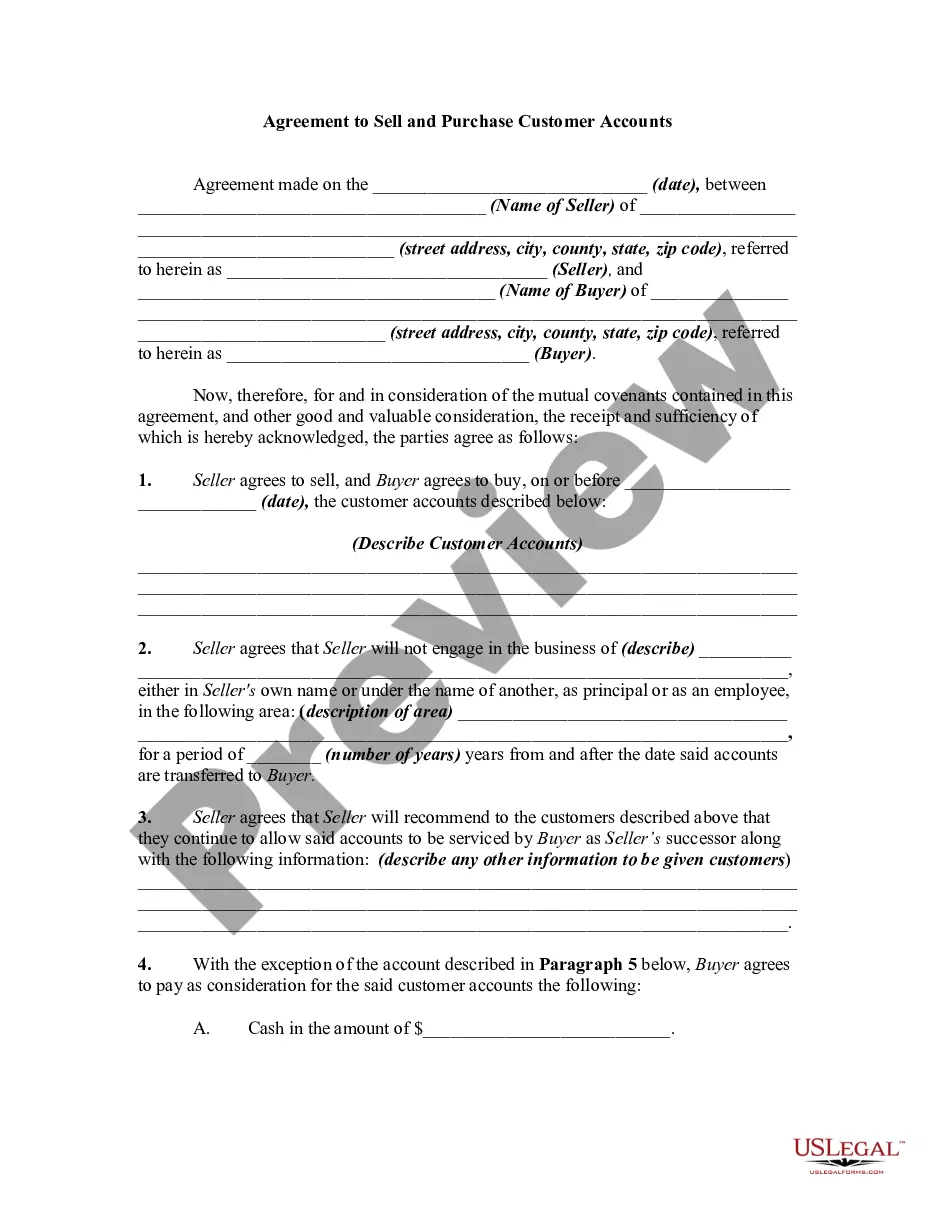

A closing agent prepares the closing statement, which is settlement sheet. It's a comprehensive list of every expense that the buyer and seller must pay to complete the real estate transaction. Fees listed on this sheet include commissions, mortgage insurance, and property tax deposits.

What is the seller's closing statement, aka settlement statement? The seller's closing statement is an itemized list of fees and credits that shows your net profits as the seller, and summarizes the finances of the entire transaction.

The deed and mortgage documents are filed with the county recorder and these become public record. 3feff You can always obtain copies of these from the recorder's office or from a title company. Most documents are digitized in some form, especially those related to the transaction.

How much are closing costs in Texas? Though all the taxes, fees, lender charges and insurance add up, generally neither party pays 100% of all the closing costs. Instead, the seller will typically pay between 5% to 10% of the sales price and the buyer will pay between 3% to 4% in closing costs.

A closing statement, also called a HUD1 or settlement sheet, is a legal form your closing or settlement agent uses to itemize all of the costs you and the seller will have to pay at closing to complete a real estate transaction.