Texas Certificate of Conversion Of A Corporation Converting To A Limited Partnership is a document filed with the Secretary of State of Texas. It is used to convert an existing Texas Corporation into a Texas Limited Partnership. This Certificate of Conversion must include the name of the converting Corporation, the date of the conversion, and the name of the new Limited Partnership. Additionally, the Certificate must include signatures of the Corporation’s directors and the Limited Partnership’s general partners. There are two types of Texas Certificate of Conversion Of A Corporation Converting To A Limited Partnership: Certificate of Conversion of a Texas Corporation with Members to a Texas Limited Partnership, and Certificate of Conversion of a Texas Corporation without Members to a Texas Limited Partnership.

Texas Certificate of Conversion Of A Corporation Converting To A Limited Partnership

Description

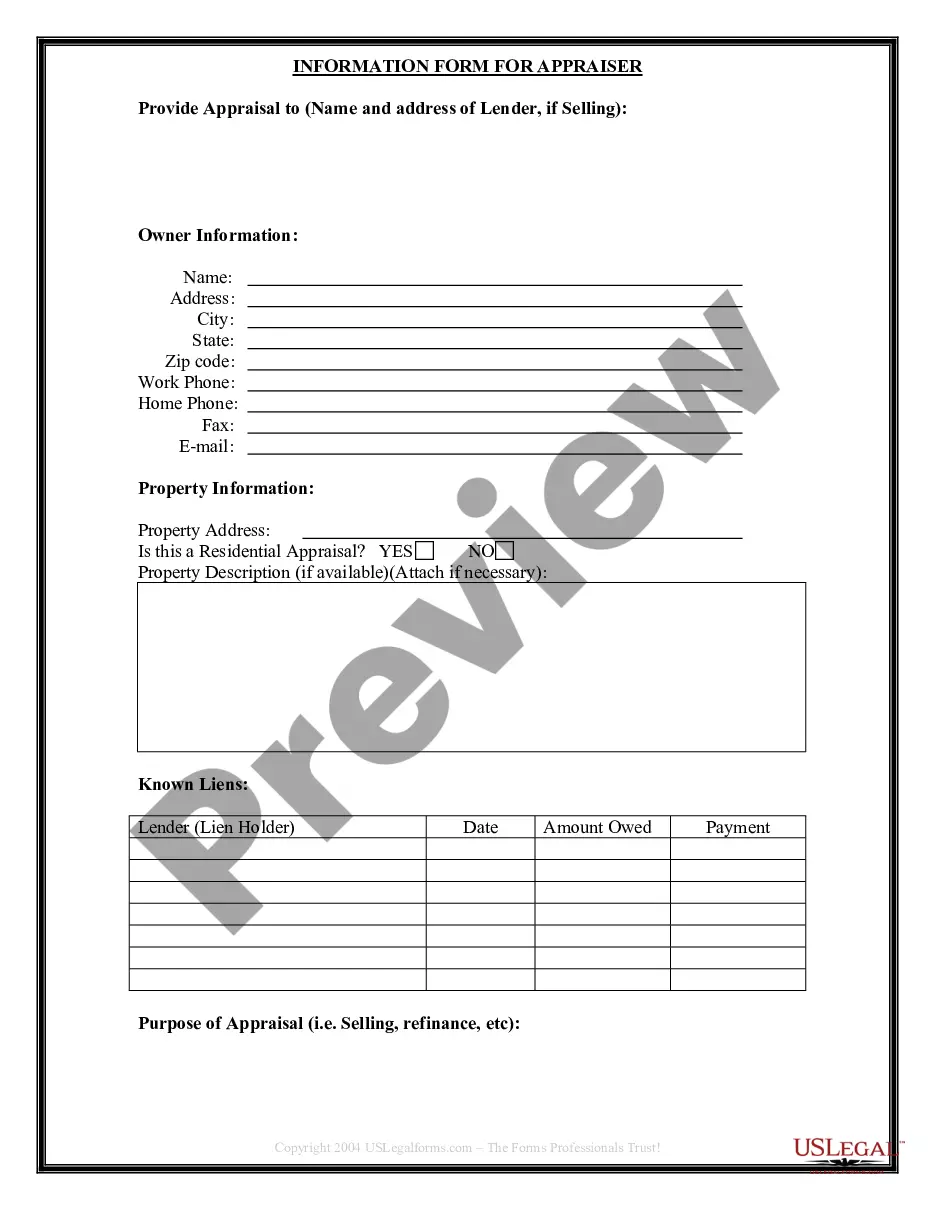

How to fill out Texas Certificate Of Conversion Of A Corporation Converting To A Limited Partnership?

US Legal Forms is the most simple and affordable way to locate appropriate formal templates. It’s the most extensive web-based library of business and individual legal documentation drafted and checked by lawyers. Here, you can find printable and fillable templates that comply with national and local regulations - just like your Texas Certificate of Conversion Of A Corporation Converting To A Limited Partnership.

Getting your template takes only a few simple steps. Users that already have an account with a valid subscription only need to log in to the website and download the document on their device. Afterwards, they can find it in their profile in the My Forms tab.

And here’s how you can obtain a professionally drafted Texas Certificate of Conversion Of A Corporation Converting To A Limited Partnership if you are using US Legal Forms for the first time:

- Read the form description or preview the document to make sure you’ve found the one corresponding to your demands, or find another one utilizing the search tab above.

- Click Buy now when you’re sure of its compatibility with all the requirements, and judge the subscription plan you like most.

- Register for an account with our service, log in, and pay for your subscription using PayPal or you credit card.

- Choose the preferred file format for your Texas Certificate of Conversion Of A Corporation Converting To A Limited Partnership and download it on your device with the appropriate button.

Once you save a template, you can reaccess it whenever you want - simply find it in your profile, re-download it for printing and manual completion or import it to an online editor to fill it out and sign more proficiently.

Benefit from US Legal Forms, your trustworthy assistant in obtaining the required formal paperwork. Try it out!

Form popularity

FAQ

A corporation may convert into a limited liability company by adopting a plan of conversion in ance with section 10.101 of the Texas Business Organizations Code (BOC) and filing a certificate of conversion with the secretary of state in ance with sections 10.154 and 10.155 of the BOC.

In California, you can use a relatively new, simplified procedure that allows you to convert your business from a corporation to an LLC largely by filing a single document with the Secretary of State.

First, you must fully dissolve the corporation. Then, you form a new LLC, and all assets are transferred to the new company before the transition is complete. You need to know the positives of converting a corporation to an LLC and the cost of changing from a corporation to know if it makes sense for your business.

Texas allows conversions from out-of-state (foreign) and domestic entities. This procedure, technically known as ?statutory conversion,? will automatically convert your current business and the business's assets and liability to the new entity.

A corporation may convert into a limited liability company by adopting a plan of conversion in ance with section 10.101 of the Texas Business Organizations Code (BOC) and filing a certificate of conversion with the secretary of state in ance with sections 10.154 and 10.155 of the BOC.

To form a limited partnership, the partners must enter into a partnership agreement and file a certificate of formation with the secretary of state. In a limited partnership, there will be one or more general partners and one or more limited partners.

One common reason for changing a corporation to an LLC is to avoid double taxation. A corporation faces double taxation because the income it earns is taxed first within its hands, and then a second time in the hands of its shareholders.