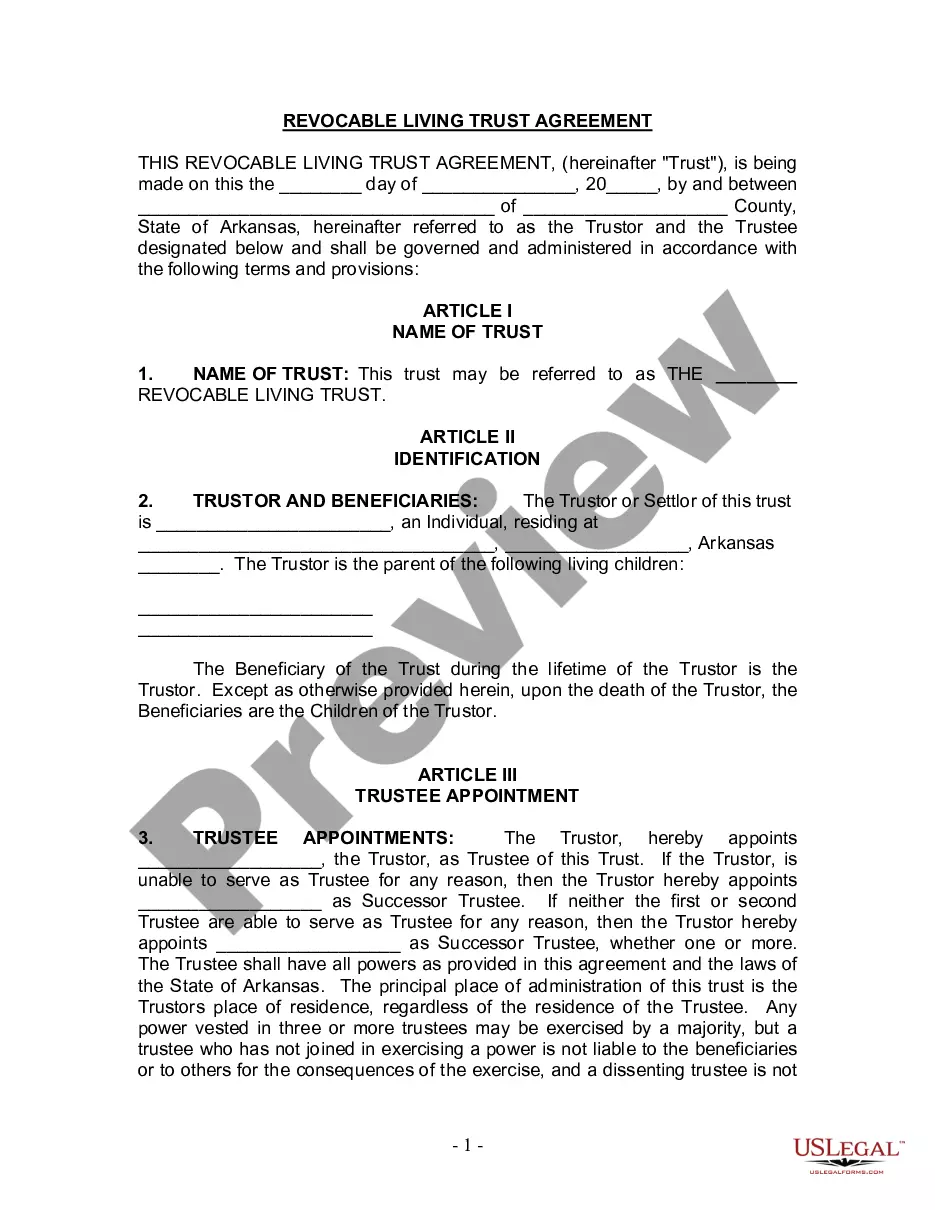

This form is a living trust form prepared for your state. It is for an individual who is either single, divorced or widowed with one or more children. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Texas Living Trust for Individual Who is Single, Divorced or Widow or Widower with Children

Description Trust Single Widow

How to fill out Texas Trust Document?

Get access to quality Texas Living Trust for Individual Who is Single, Divorced or Widow or Widower with Children samples online with US Legal Forms. Prevent hours of wasted time browsing the internet and lost money on forms that aren’t updated. US Legal Forms gives you a solution to just that. Get above 85,000 state-specific authorized and tax forms you can save and submit in clicks within the Forms library.

To receive the sample, log in to your account and then click Download. The document will be saved in two places: on the device and in the My Forms folder.

For people who don’t have a subscription yet, check out our how-guide below to make getting started simpler:

- Find out if the Texas Living Trust for Individual Who is Single, Divorced or Widow or Widower with Children you’re looking at is appropriate for your state.

- View the form using the Preview option and browse its description.

- Go to the subscription page by clicking Buy Now.

- Choose the subscription plan to continue on to sign up.

- Pay by card or PayPal to finish creating an account.

- Select a preferred file format to download the document (.pdf or .docx).

Now you can open the Texas Living Trust for Individual Who is Single, Divorced or Widow or Widower with Children example and fill it out online or print it and do it yourself. Consider sending the document to your legal counsel to be certain all things are filled in correctly. If you make a mistake, print and fill sample again (once you’ve registered an account all documents you download is reusable). Make your US Legal Forms account now and access more forms.

Tx Trust Form Form popularity

Trust Individual Widower Other Form Names

Texas Trust Template FAQ

No, you don't need a lawyer to set up a trust, but it might be a good idea to seek legal advice to ensure the trust is set up correctly and that you have considered all long-term financial and estate planning aspects of the trust.Some living trusts are revocable, which means the trust can be changed at any time.

The first step is determining which type of trust you'll need. Next, you'll want to take stock of your assets and property. You'll also need to choose a trustee. Make the trust document. Sign the trust document in front of a notary. Put the property you want inside the trust.

Although a typical will package costs $1,000 to $1,200, and a trust can run $2,500, a legal insurance plan like Texas Legal can save Texans hundreds or even thousands on their estate planning costs.

Although a typical will package costs $1,000 to $1,200, and a trust can run $2,500, a legal insurance plan like Texas Legal can save Texans hundreds or even thousands on their estate planning costs.

A living trust in Texas allows you to use your assets during your lifetime and securely transfer them to your beneficiaries after your death. A revocable living trust (also called an inter vivos trust) offers a variety of benefits as an estate planning tool.

Paperwork. Setting up a living trust isn't difficult or expensive, but it requires some paperwork. Record Keeping. After a revocable living trust is created, little day-to-day record keeping is required. Transfer Taxes. Difficulty Refinancing Trust Property. No Cutoff of Creditors' Claims.

When a person owns real property in another state, having a living trust will avoid the necessity for two probate proceedings, one in each state, which makes a living trust more desirable than a Will. Also, a living trust provides a significant lifetime advantage if a person becomes incapacitated.