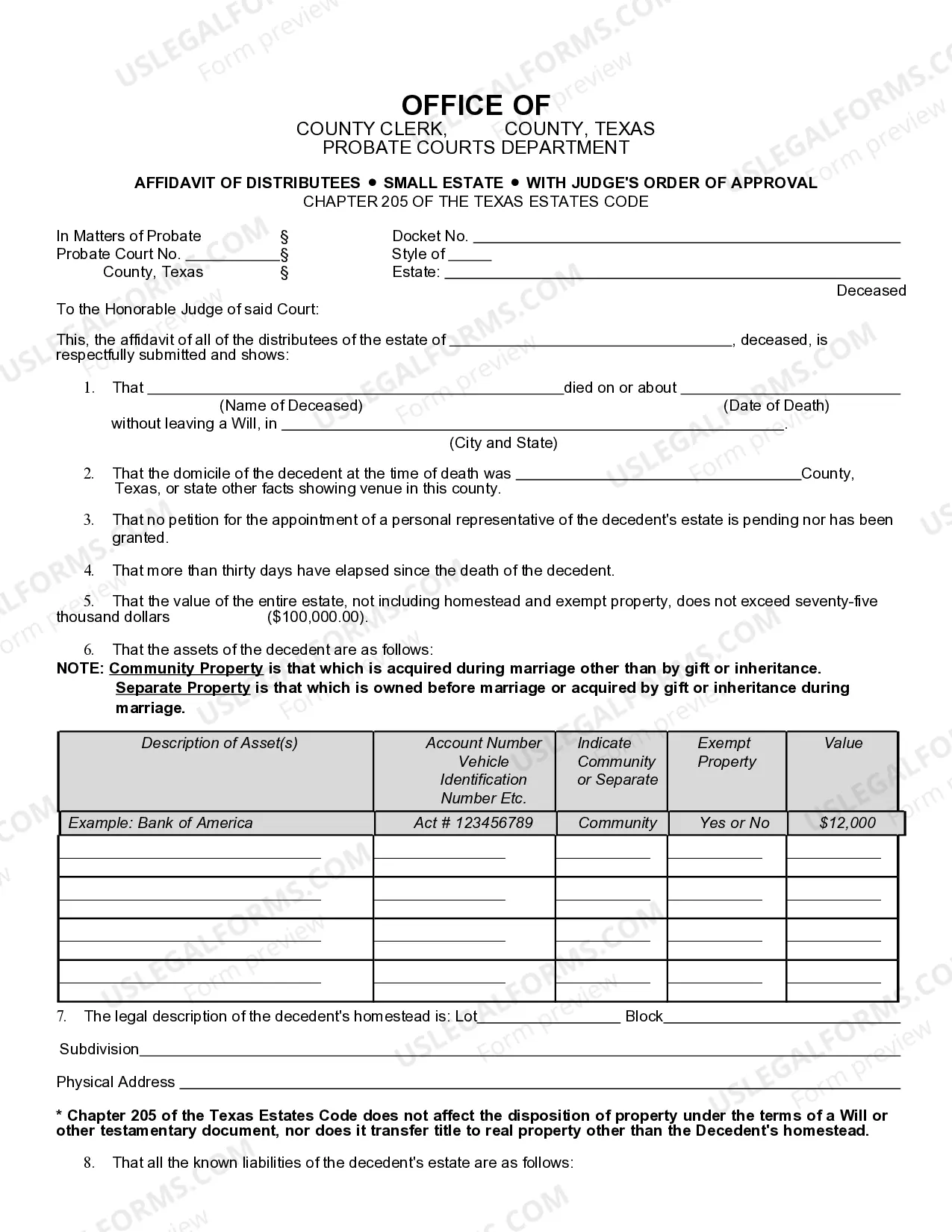

Texas Small Estate Affidavit for Estates

State:

Texas

Control #:

TX-ET10

Format:

Word;

Rich Text

Instant download

Description

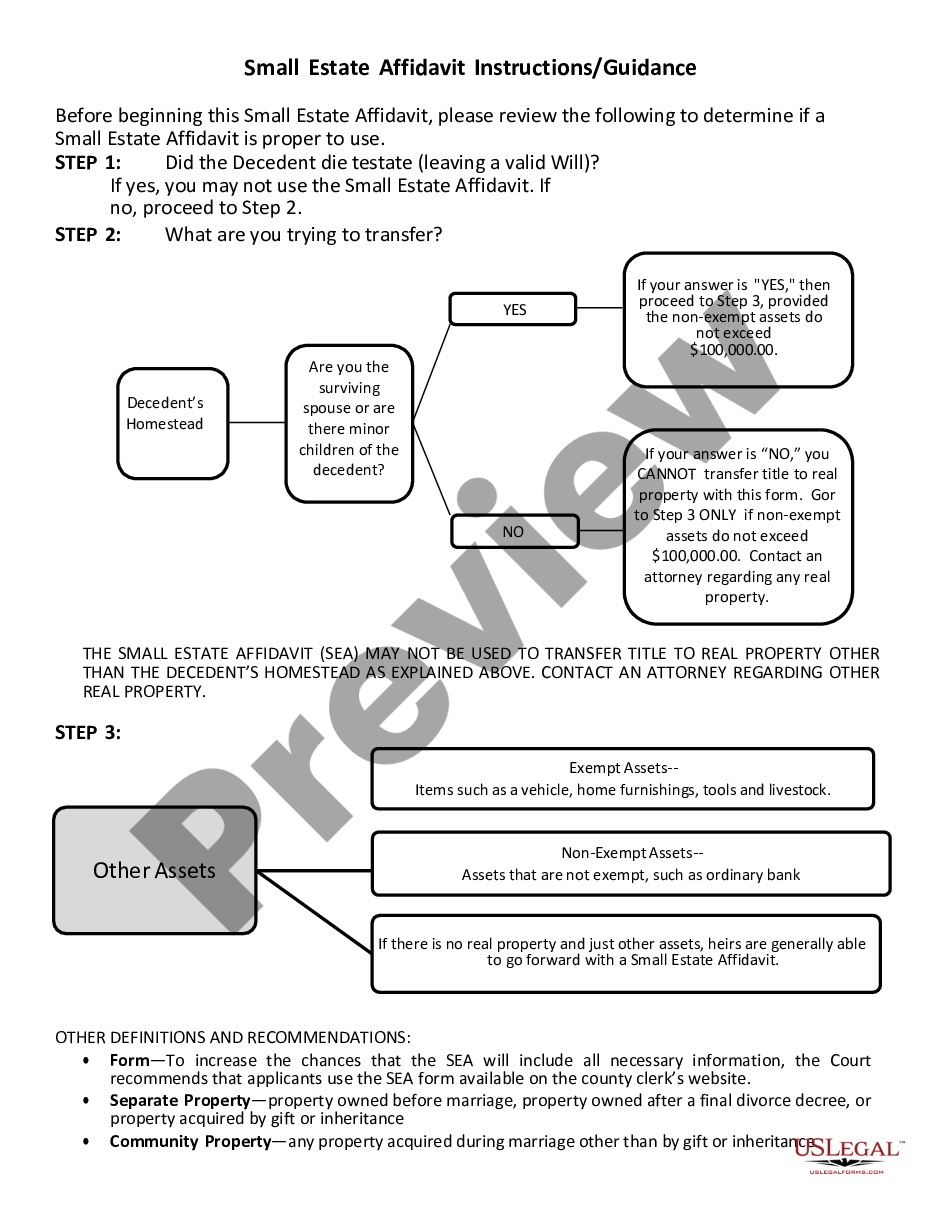

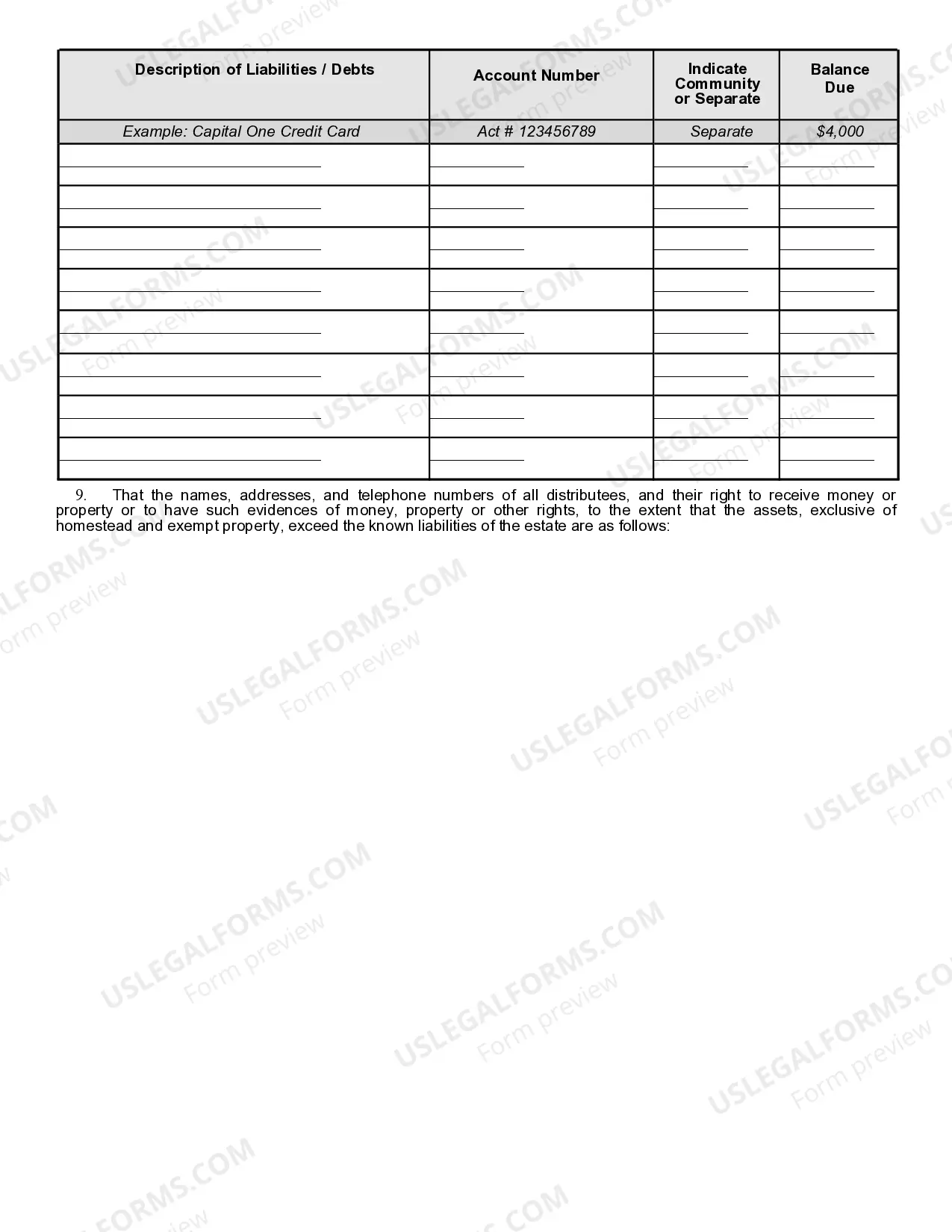

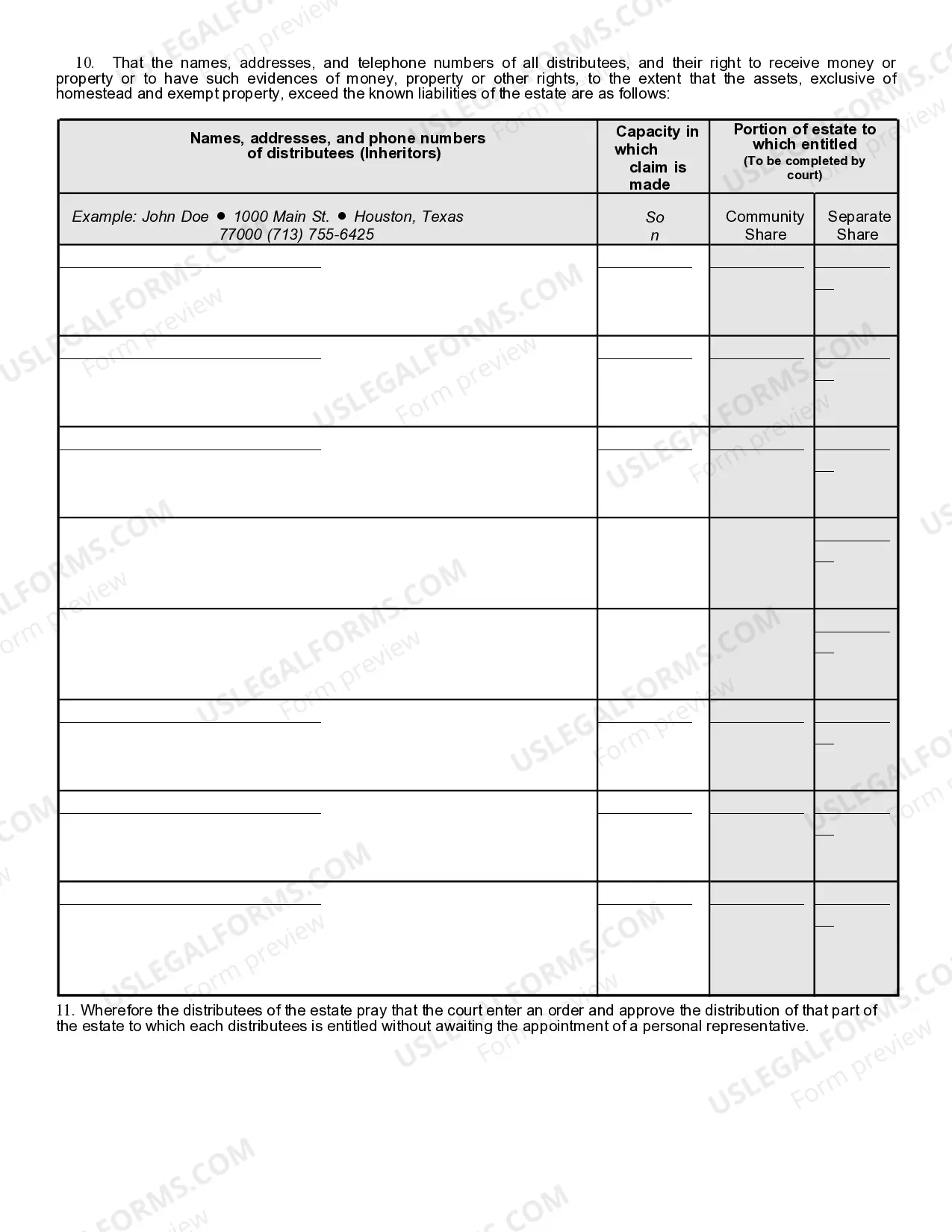

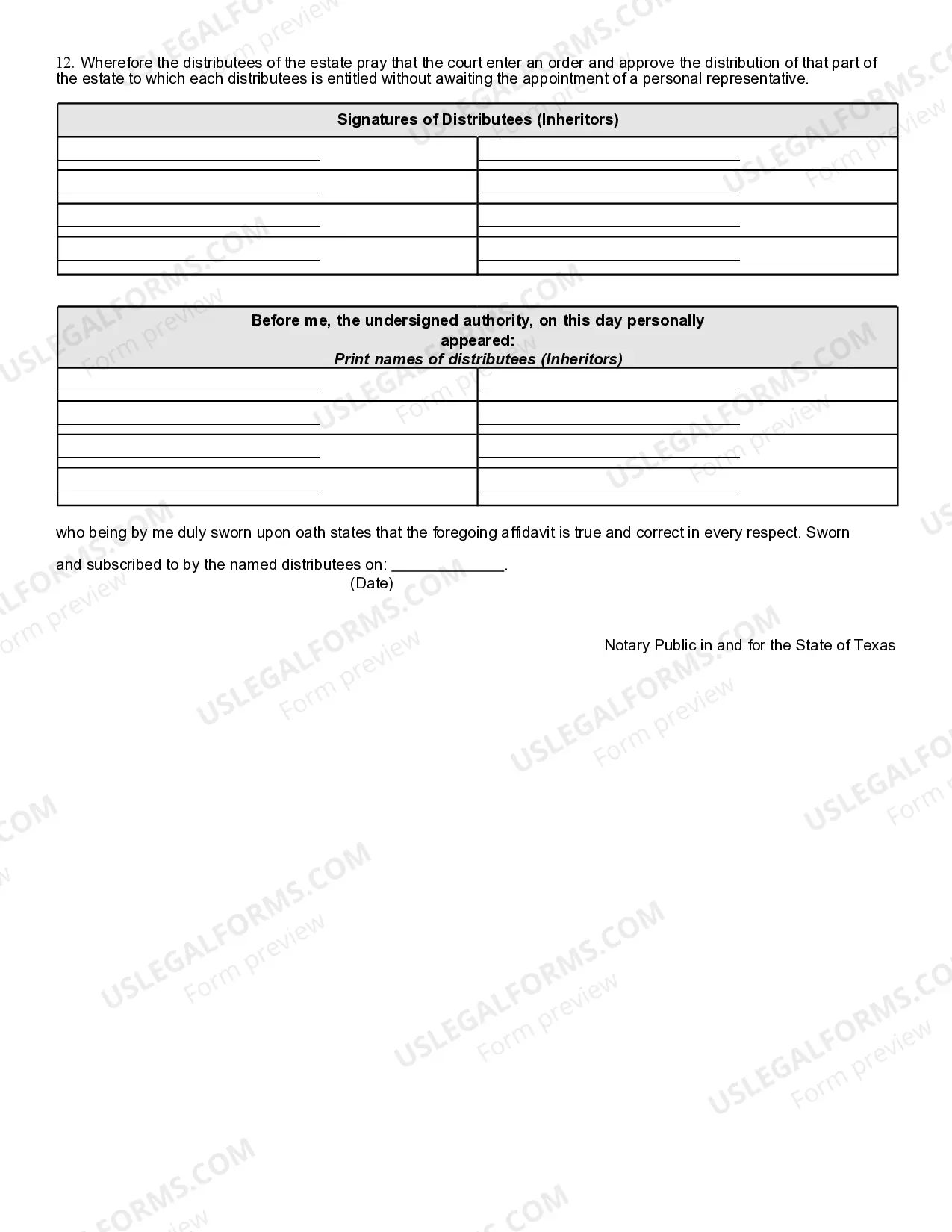

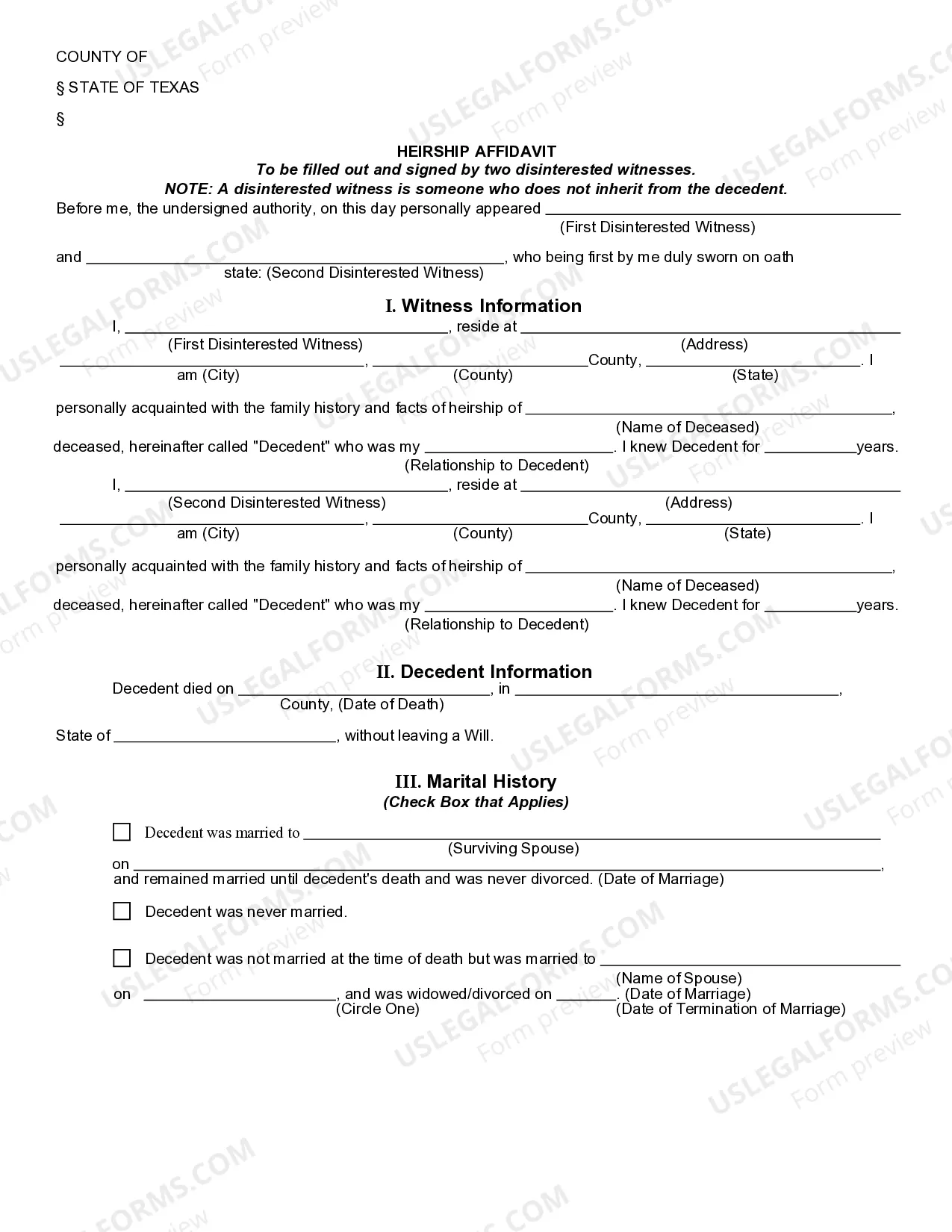

Under Texas statutes, where a probate estate is valued at less than $100,000, an interested party may, thirty (30) days after the death of the decedent, file an affidavit with the clerk of the court having jurisdiction and venue over the estate. After the affidavit has been approved by the court, the affidavit may be used to collect debts owed to the decedent.

Following death, both the homestead and certain personal property of the decedent is exempt from and therefore passes free from most creditor claims. If the decedent is survived by a spouse, minor child, or adult child living in the home, his or her homestead and up to $100,000 in personal property specified under the Texas Property Code Section 42.002(a)1 passes free from claims of general creditors of the estate. In the event the home is sold, the proceeds of the sale also pass free from claims of general creditors.

Free preview