Texas Financial Responsibility Insurance Certificate

Description

How to fill out Texas Financial Responsibility Insurance Certificate?

Get access to high quality Texas Financial Responsibility Insurance Certificate samples online with US Legal Forms. Avoid hours of lost time looking the internet and lost money on documents that aren’t updated. US Legal Forms offers you a solution to just that. Find above 85,000 state-specific authorized and tax forms that you can download and submit in clicks in the Forms library.

To find the example, log in to your account and click on Download button. The file will be stored in two places: on your device and in the My Forms folder.

For people who don’t have a subscription yet, have a look at our how-guide listed below to make getting started easier:

- See if the Texas Financial Responsibility Insurance Certificate you’re considering is appropriate for your state.

- See the form making use of the Preview function and browse its description.

- Visit the subscription page by clicking Buy Now.

- Select the subscription plan to keep on to sign up.

- Pay out by credit card or PayPal to complete making an account.

- Choose a favored file format to download the file (.pdf or .docx).

You can now open the Texas Financial Responsibility Insurance Certificate example and fill it out online or print it and get it done yourself. Take into account giving the document to your legal counsel to be certain everything is completed correctly. If you make a error, print out and fill sample once again (once you’ve created an account every document you download is reusable). Make your US Legal Forms account now and access more templates.

Form popularity

FAQ

An SR-22 is a certificate of financial responsibility required for some drivers by their state or court order. An SR-22 is not an actual "type" of insurance, but a form filed with your state. This form serves as proof your auto insurance policy meets the minimum liability coverage required by state law.

After you meet the terms of the SR-22 insurance, you can have it removed. This is quite simple: Call the insurance company and let the agent know that you don't need the SR-22 coverage. Then, it will be dropped.

SR-22 insurance in Texas costs an average of $826 per year, an increase of 6% compared to standard car insurance rates. In addition to an increased premium, it costs between $15 and $25 to file an SR-22 form in Texas, depending on the insurance company.

Yes, you are still required to file and maintain an SR-22. If you do not own a vehicle you may obtain a Texas non-owners SR-22 Insurance policy. For more information, please visit our webpage on Reinstating a Driver License.

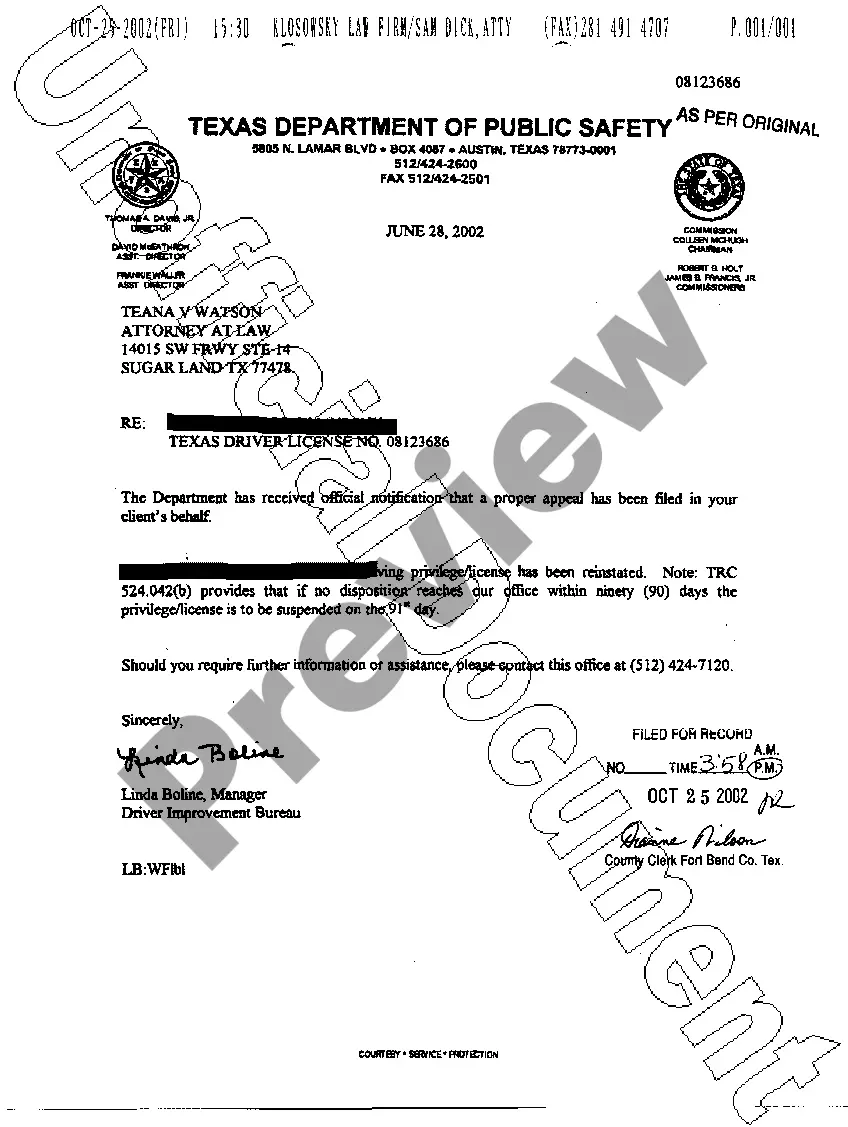

If your driving privilege has been suspended due to a car crash, you have received a second or subsequent conviction for No Motor Vehicle Liability Insurance or a civil judgment has been filed against you, you are required to file a SR-22 with the Department.

To obtain an SR-22, you would contact your car insurance company to inform them of your need for an SR-22 certificate of financial responsibility. They will usually charge you a small service fee of between $25 to $50 and electronically send the SR22 to the California DMV.

To find out if you still need an SR-22, contact your local DMV office and ask if your SR-22 form has been filed for the required period of time. If it has, you can then contact your car insurance company and request that they remove your SR-22 filing with the state.

To find out if you still need an SR-22, contact your local DMV office and ask if your SR-22 form has been filed for the required period of time. If it has, you can then contact your car insurance company and request that they remove your SR-22 filing with the state.

A Financial Responsibility Insurance Certificate (SR-22) is required by the Texas Transportation Code Chapter 601 to verify that you are maintaining motor vehicle liability insurance. A SR-22 can be issued by most insurance providers and certifies that you have the minimum liability insurance as required by law.