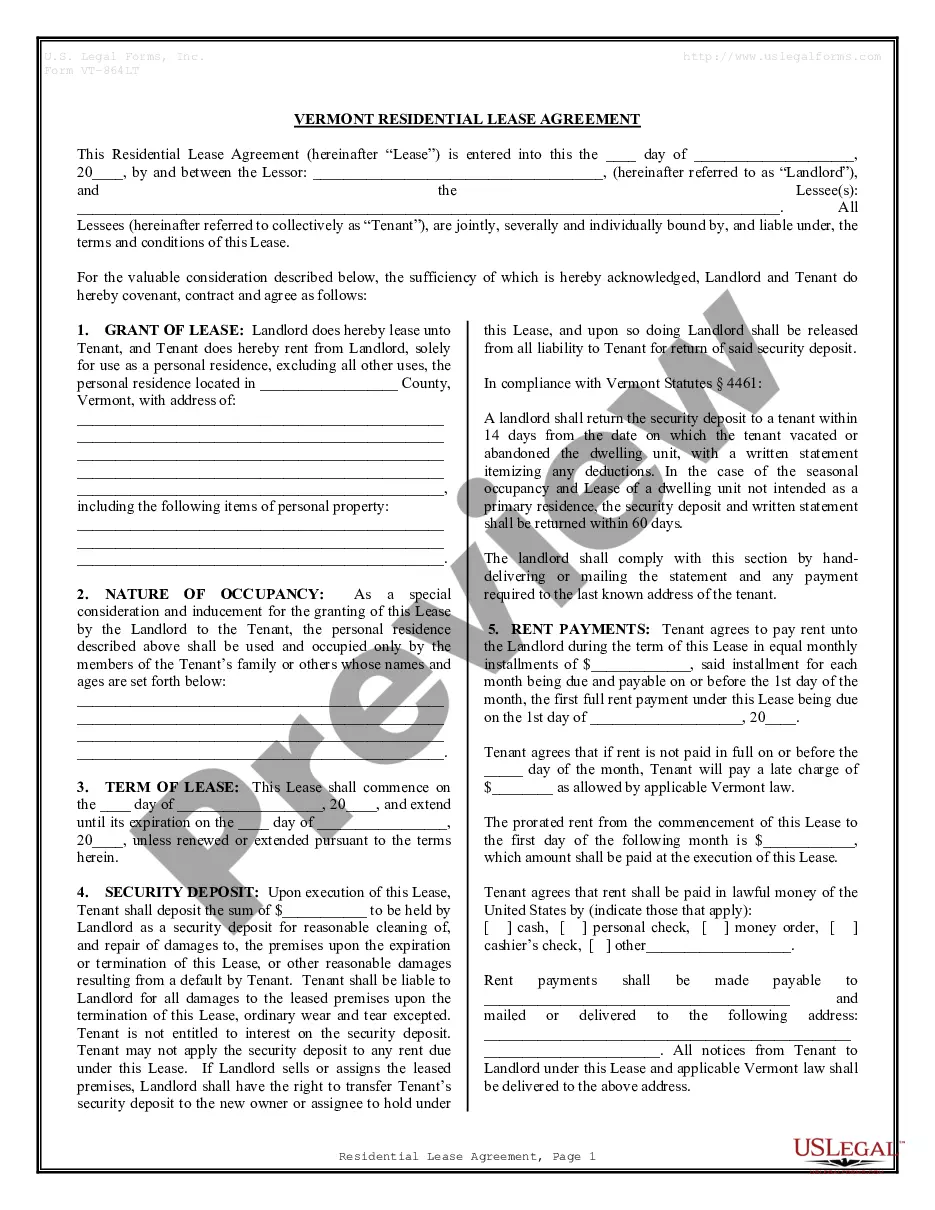

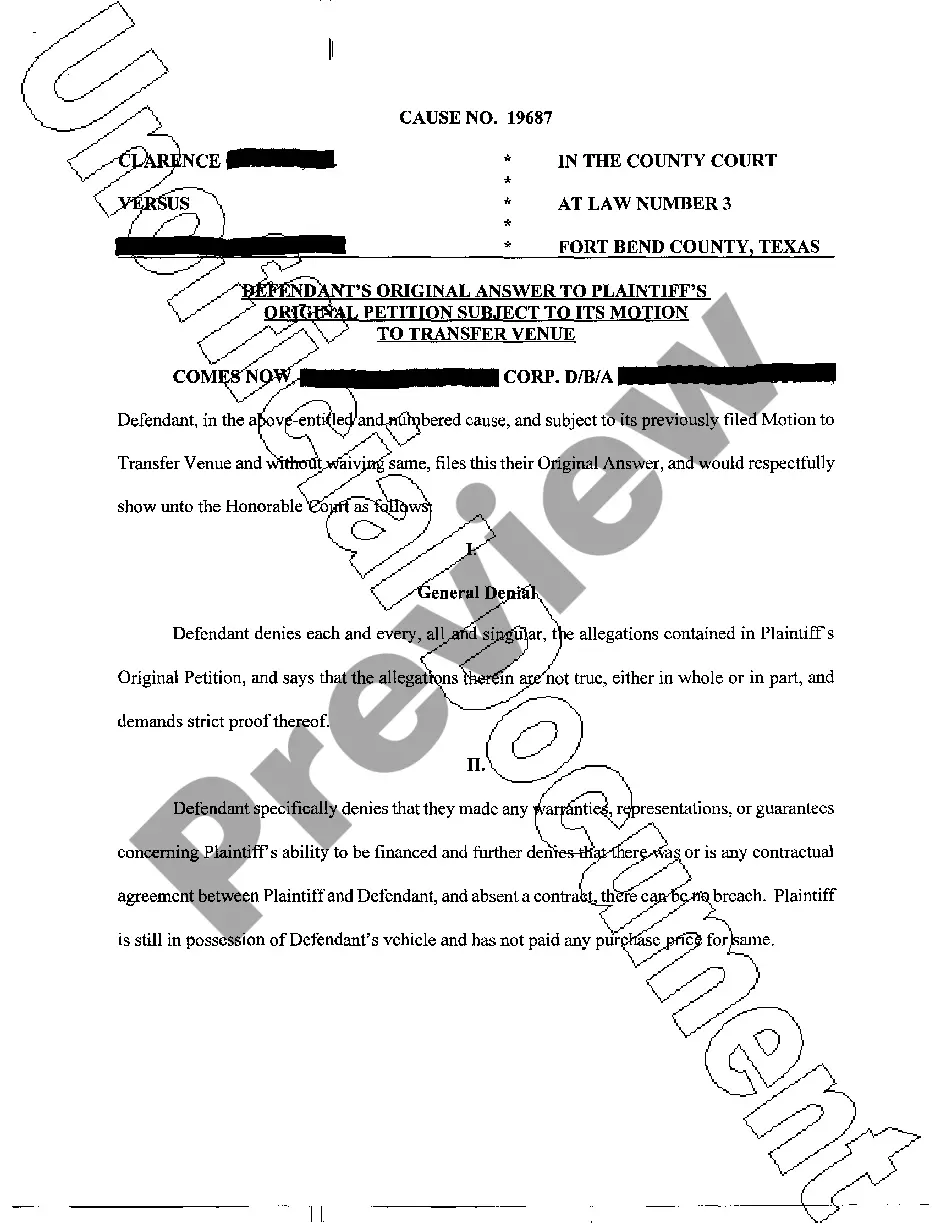

Texas Plaintiffs Original Petition

Description

How to fill out Texas Plaintiffs Original Petition?

Access to quality Texas Plaintiffs Original Petition forms online with US Legal Forms. Avoid days of lost time browsing the internet and lost money on forms that aren’t updated. US Legal Forms provides you with a solution to just that. Get above 85,000 state-specific authorized and tax templates that you can save and fill out in clicks within the Forms library.

To find the example, log in to your account and click Download. The document is going to be saved in two places: on your device and in the My Forms folder.

For those who don’t have a subscription yet, take a look at our how-guide listed below to make getting started simpler:

- See if the Texas Plaintiffs Original Petition you’re considering is suitable for your state.

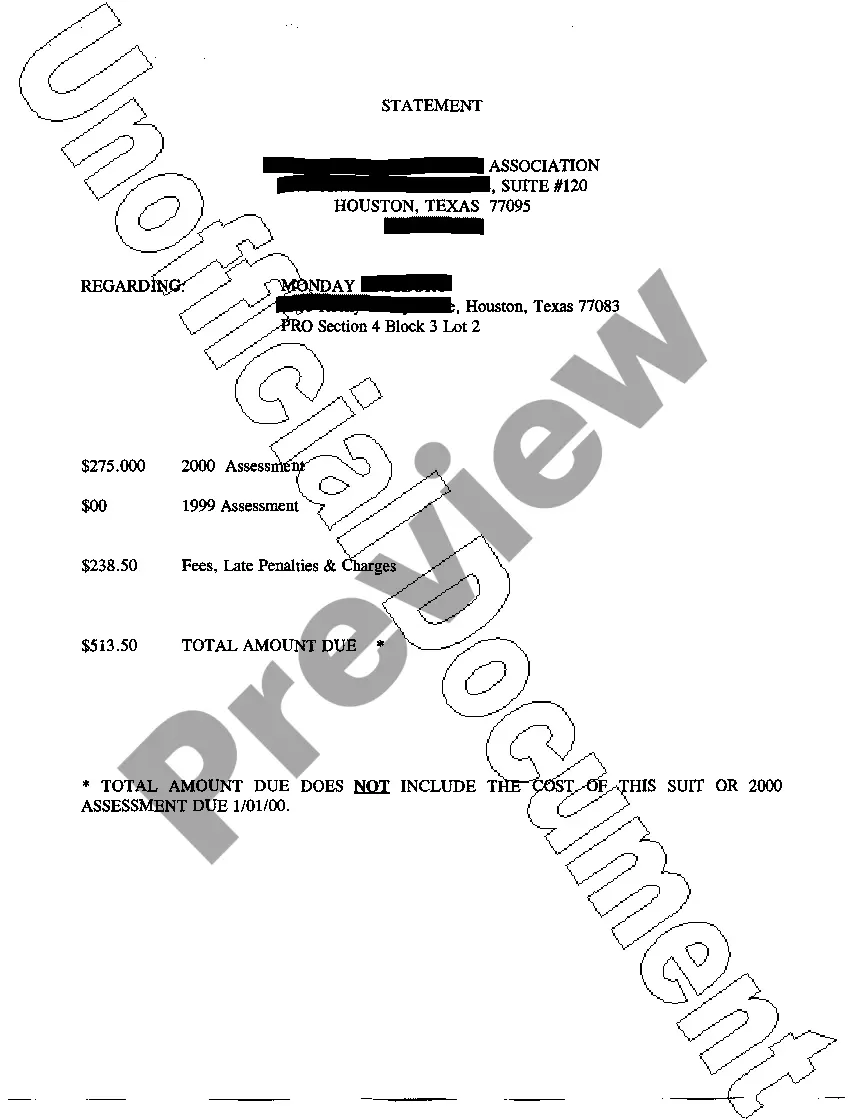

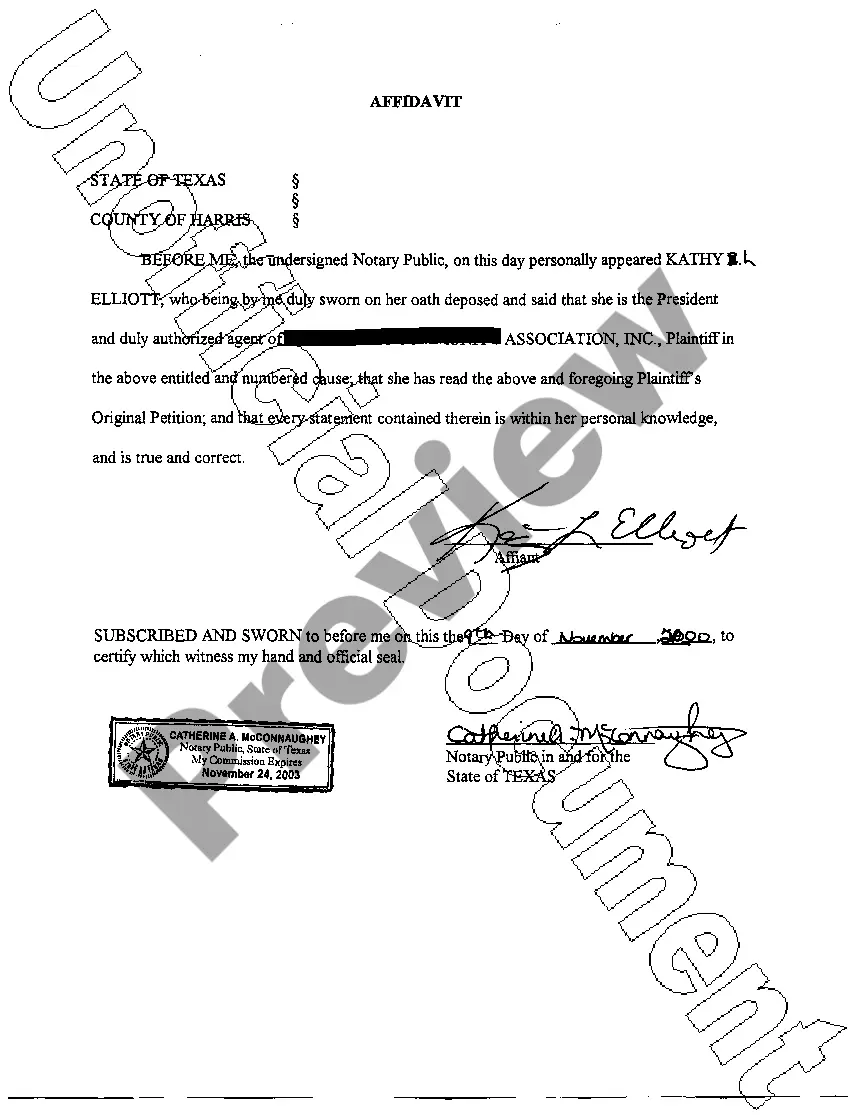

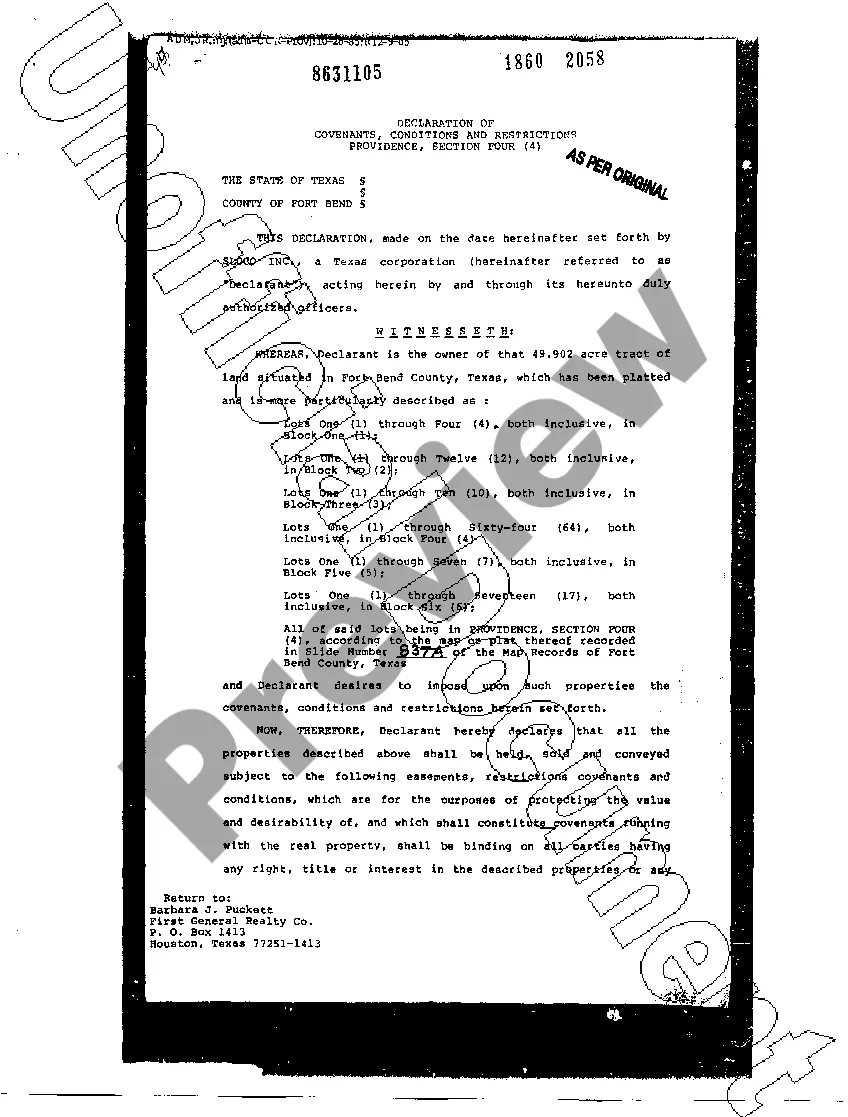

- See the form using the Preview function and browse its description.

- Visit the subscription page by simply clicking Buy Now.

- Choose the subscription plan to keep on to register.

- Pay out by card or PayPal to finish making an account.

- Select a preferred format to save the file (.pdf or .docx).

Now you can open the Texas Plaintiffs Original Petition template and fill it out online or print it out and get it done by hand. Take into account mailing the papers to your legal counsel to ensure things are filled in appropriately. If you make a error, print and complete sample again (once you’ve created an account all documents you download is reusable). Make your US Legal Forms account now and get access to more samples.

Form popularity

FAQ

The PA foreclosure process can take anywhere from several months to over a year, depending on the specific circumstances and any legal challenge to the foreclosure filing. From the first missed payment, it takes 120 days before the bank can file a foreclosure.

The first legal action is the first public action required in the jurisdiction where the property is located to commence the foreclosure process. The first legal action may include: For judicial foreclosures, a complaint, petition, order to docket or notice of hearing.

Borrowers may not avoid foreclosure on their property, for example, simply on the basis of a lost promissory note. The lender has a right to "re-establish" the note legally as long as it has not sold or transferred the note to another party.

When you take out a mortgage, or any other kind of loan, the law requires you to sign a document that signifies your agreement to repay the money. The promissory note represents a binding legal document, enforceable in a court of law.If the note is lost, then the owner of the loan might have a problem.

However, in California, the lender is not required to produce a Promissory Note to conduct a non-judicial foreclosure (also known as a Trustee's Sale).The Promissory Note is the debt instrument, just like an IOU. The person holding the original is the one the borrower has to pay.

A promissory note is a contract, a binding agreement that someone will pay your business a sum of money. However under some circumstances if the note has been altered, it wasn't correctly written, or if you don't have the right to claim the debt then, the contract becomes null and void.

Eviction After the Foreclosure SaleOnce your legal right to stay in the home ends, if you don't vacate the property, the new owner (again, often the lender) will start eviction proceedings to remove you from the property.Other times it might have to file a separate eviction action with the court.

Proving Wrongful Foreclosure If you wish to sue the bank for wrongful foreclosure, you must prove the following: The lender owed you, the borrower, a legal duty. The lender breached that duty. The breach of duty caused your injury or loss (damages)

In most states, lenders are required to provide a homeowner with sufficient notice of default. The lender must also provide notice of the property owner's right to cure the default before the lender can initiate a foreclosure proceeding. Written proof of money owed under the mortgage.