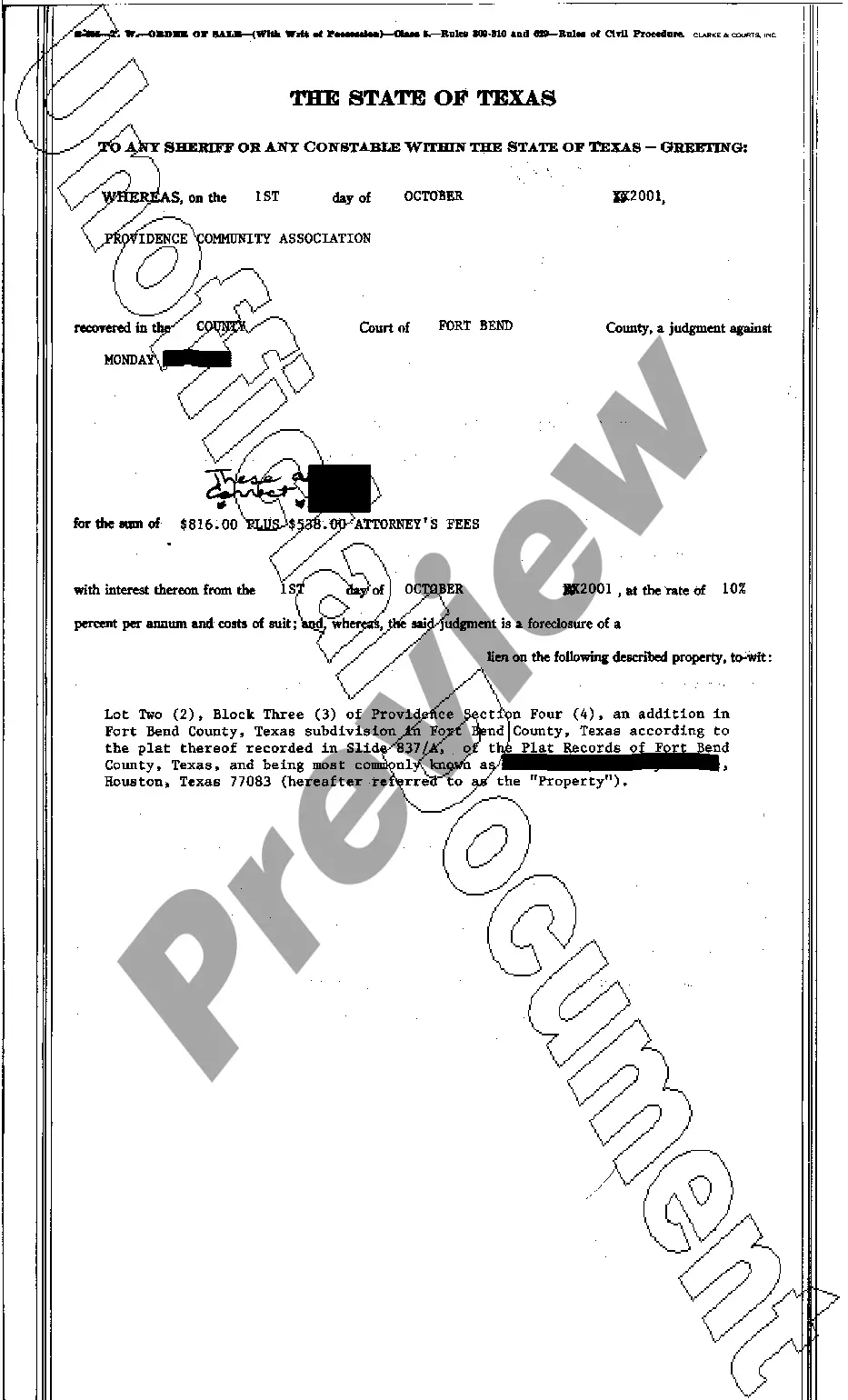

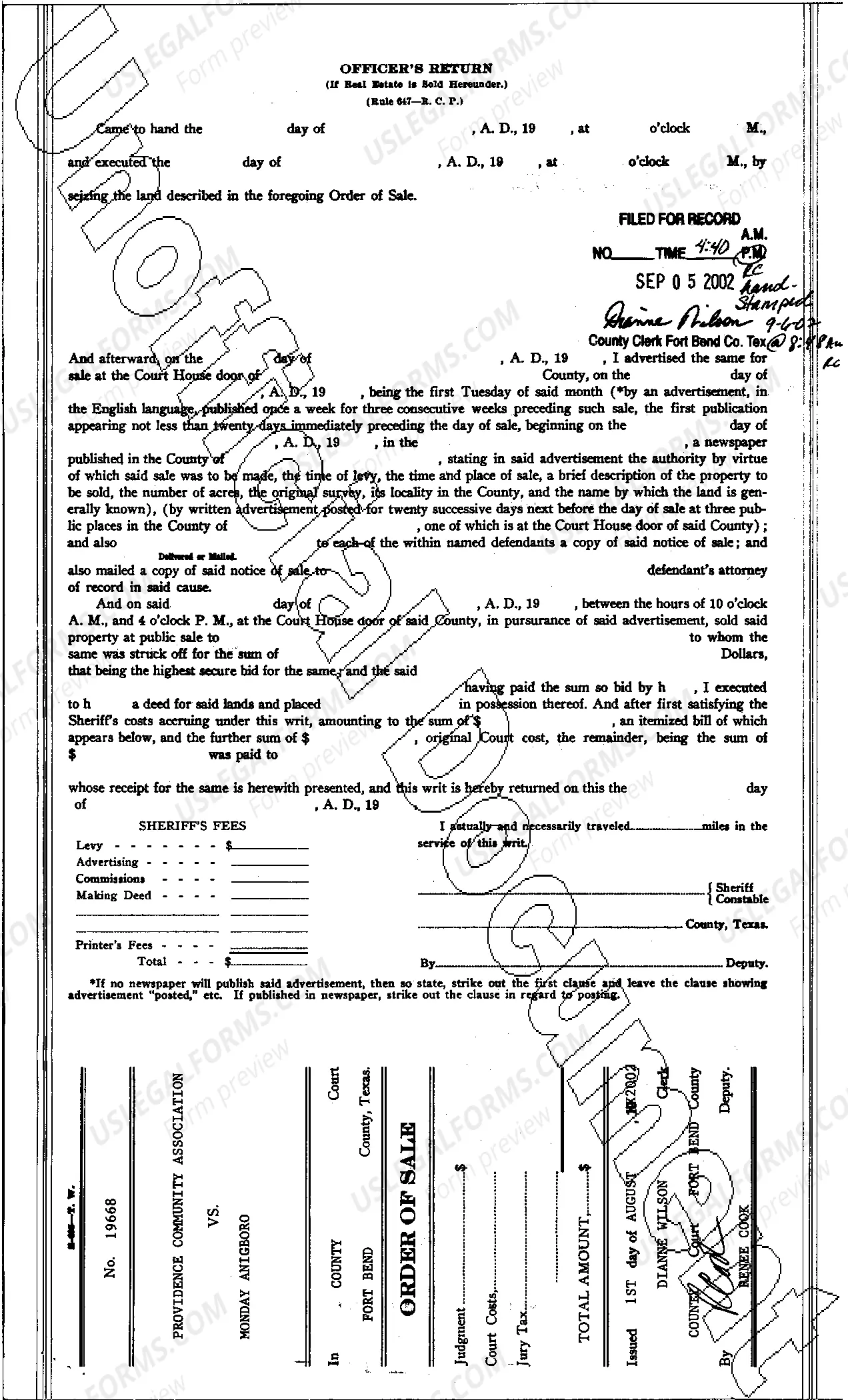

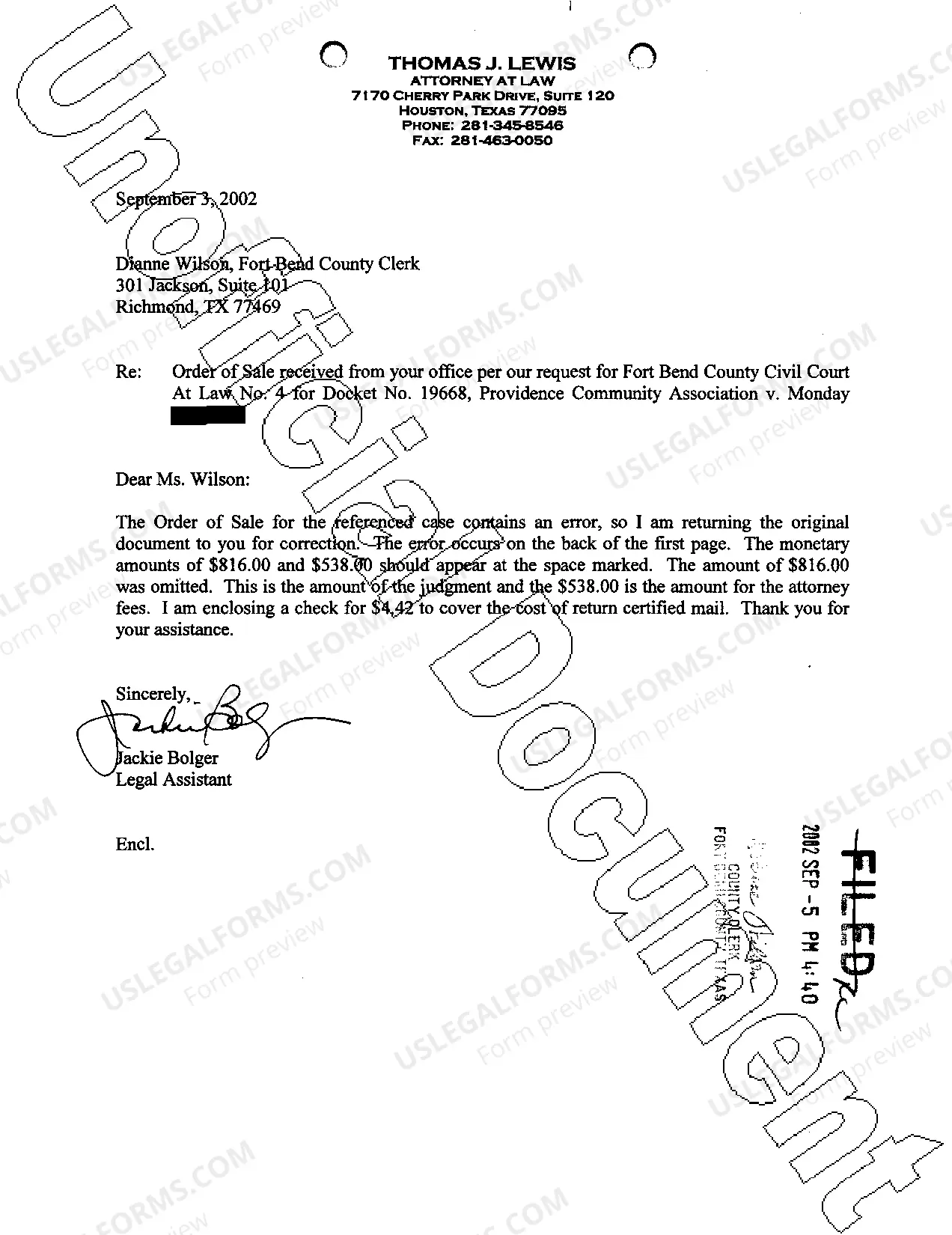

Texas Order of Sale

Description

How to fill out Texas Order Of Sale?

Access to high quality Texas Order of Sale templates online with US Legal Forms. Steer clear of days of lost time seeking the internet and lost money on documents that aren’t updated. US Legal Forms provides you with a solution to just that. Get around 85,000 state-specific authorized and tax samples you can download and submit in clicks within the Forms library.

To receive the sample, log in to your account and then click Download. The file is going to be saved in two places: on your device and in the My Forms folder.

For people who don’t have a subscription yet, check out our how-guide below to make getting started easier:

- Find out if the Texas Order of Sale you’re looking at is appropriate for your state.

- View the form using the Preview option and read its description.

- Check out the subscription page by clicking on Buy Now button.

- Select the subscription plan to go on to sign up.

- Pay out by card or PayPal to complete making an account.

- Choose a preferred format to download the document (.pdf or .docx).

You can now open up the Texas Order of Sale template and fill it out online or print it out and do it by hand. Think about sending the file to your legal counsel to ensure everything is filled out correctly. If you make a mistake, print and fill application once again (once you’ve created an account all documents you download is reusable). Create your US Legal Forms account now and get access to a lot more templates.

Form popularity

FAQ

Make sure the Texas Resale Certificate form is completely filled out This includes the buyer's name and what they sell, your store name, and a detailed description of the items bought for resale. You should also have the buyer's address and signature.

To apply for franchise and sales tax exemptions, complete and submit Form AP-204, Texas Application for Exemption Federal and All Others (PDF) to the Comptroller's office.

Sales to Customers in TexasTexas sellers must collect sales tax on taxable items, including shipping and delivery charges, sold online in Texas.The state sales and use tax rate is 6.25 percent and the local sales and use tax cannot be more than 2 percent.

Step 1 Begin by downloading the Texas Sales and Use Tax Resale Certificate Form 01-339. Step 2 Identify the name, address and phone number of the purchaser.

Step 1: The Buyer Inspects the Car. Step 2: Sign the Back of the Title. Step 3: Sign the Buyer's Application for Title. Step 4: Take off your Plates. Step 5: Remove your Registration Window Sticker. Step 6: Accompany the Buyer to the Local Country Tax Office to Finalize the Transaction.

The resale certificate is the seller's evidence as to why sales tax was not collected on that transaction and should be retained in the seller's books and records for four years.