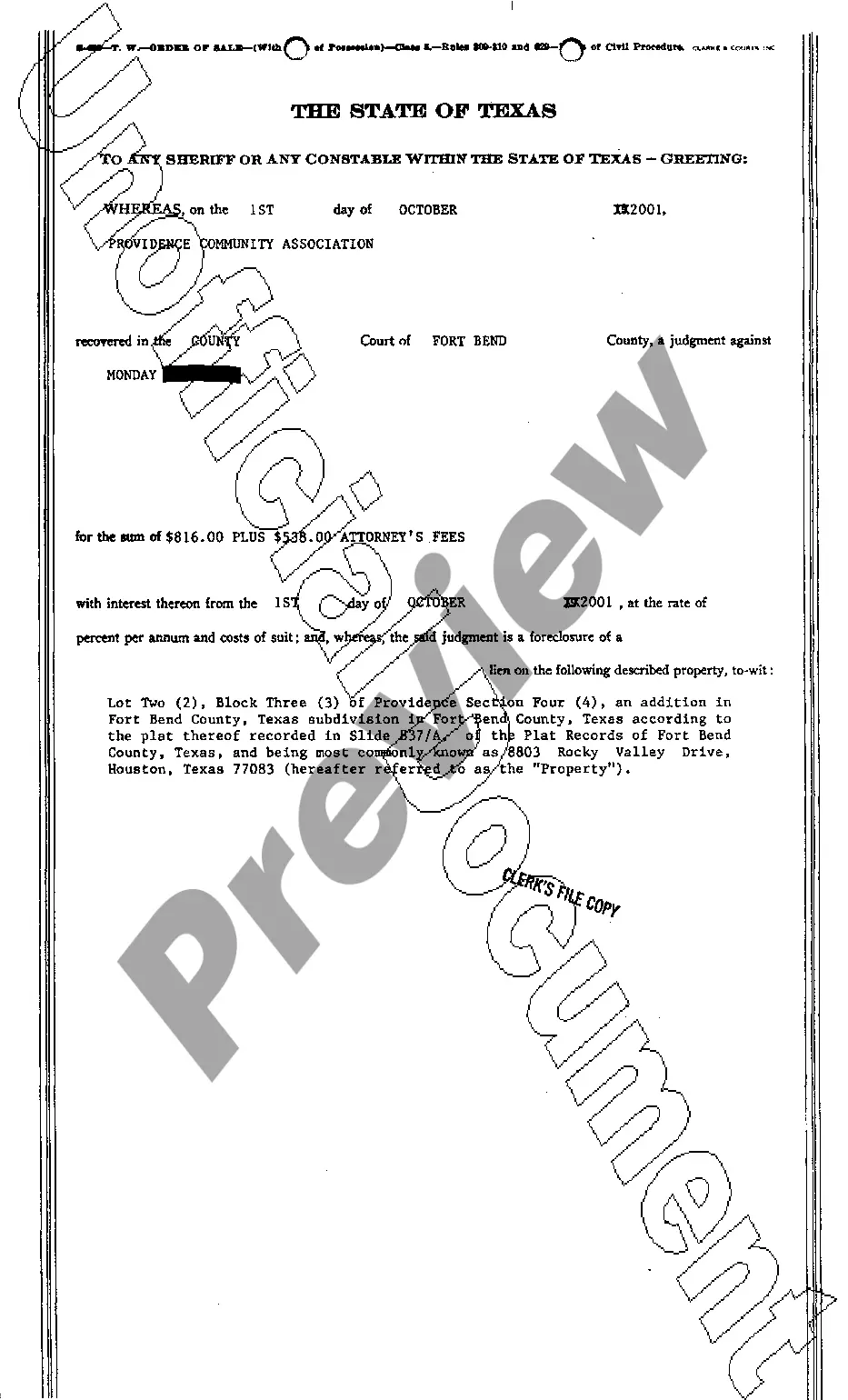

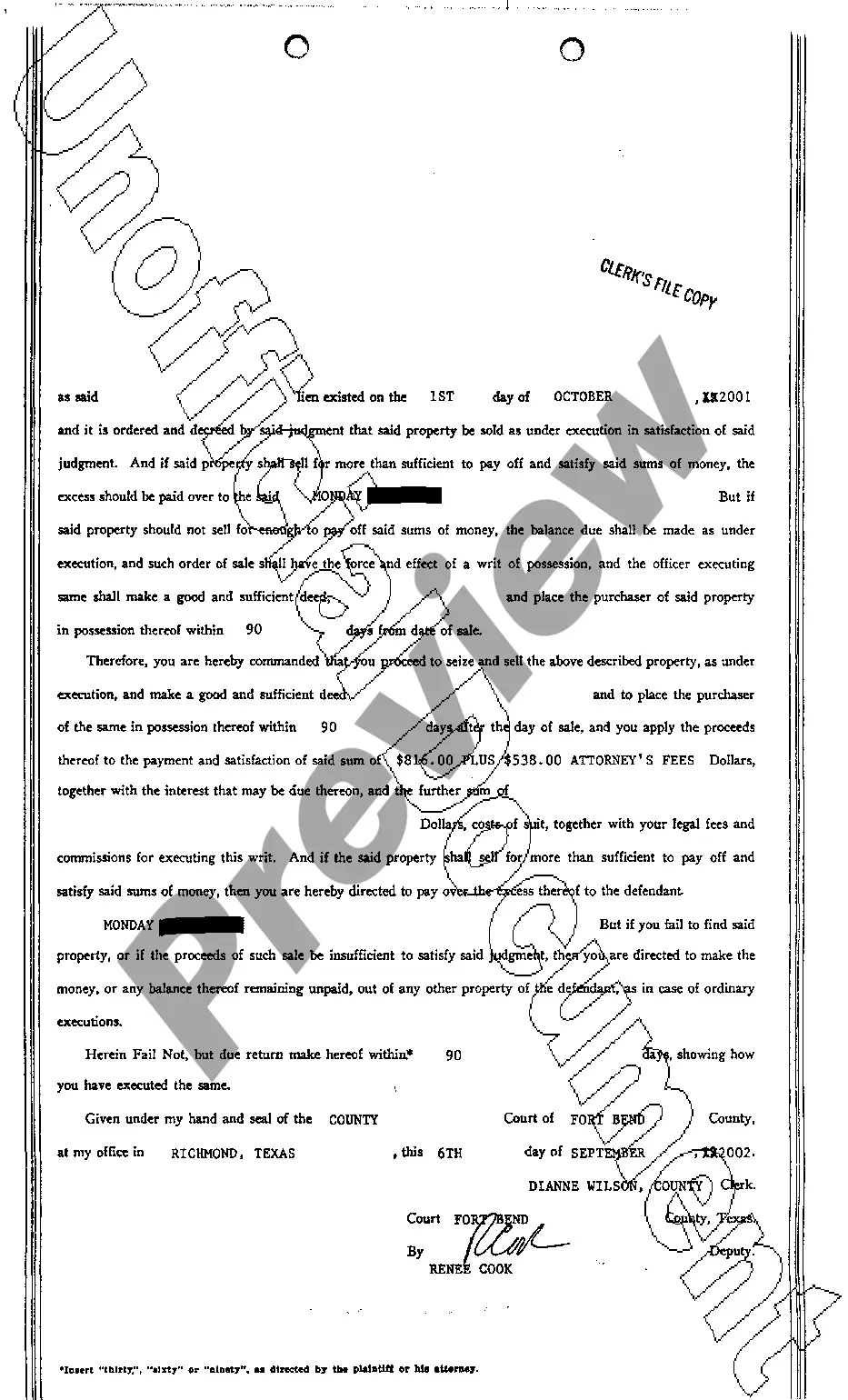

Texas Order of Sale

Description

How to fill out Texas Order Of Sale?

Get access to quality Texas Order of Sale templates online with US Legal Forms. Prevent days of lost time looking the internet and dropped money on documents that aren’t up-to-date. US Legal Forms offers you a solution to exactly that. Find above 85,000 state-specific authorized and tax templates that you can save and complete in clicks within the Forms library.

To find the example, log in to your account and then click Download. The document will be stored in two places: on your device and in the My Forms folder.

For individuals who don’t have a subscription yet, take a look at our how-guide below to make getting started simpler:

- Find out if the Texas Order of Sale you’re looking at is appropriate for your state.

- View the sample using the Preview function and browse its description.

- Go to the subscription page by simply clicking Buy Now.

- Select the subscription plan to go on to sign up.

- Pay by card or PayPal to complete creating an account.

- Select a preferred format to download the document (.pdf or .docx).

You can now open up the Texas Order of Sale template and fill it out online or print it and get it done by hand. Take into account giving the papers to your legal counsel to make sure everything is filled out properly. If you make a mistake, print out and fill application again (once you’ve created an account every document you download is reusable). Create your US Legal Forms account now and get more samples.

Form popularity

FAQ

Make sure the Texas Resale Certificate form is completely filled out This includes the buyer's name and what they sell, your store name, and a detailed description of the items bought for resale. You should also have the buyer's address and signature.

To apply for franchise and sales tax exemptions, complete and submit Form AP-204, Texas Application for Exemption Federal and All Others (PDF) to the Comptroller's office.

Sales to Customers in TexasTexas sellers must collect sales tax on taxable items, including shipping and delivery charges, sold online in Texas.The state sales and use tax rate is 6.25 percent and the local sales and use tax cannot be more than 2 percent.

Step 1 Begin by downloading the Texas Sales and Use Tax Resale Certificate Form 01-339. Step 2 Identify the name, address and phone number of the purchaser.

Step 1: The Buyer Inspects the Car. Step 2: Sign the Back of the Title. Step 3: Sign the Buyer's Application for Title. Step 4: Take off your Plates. Step 5: Remove your Registration Window Sticker. Step 6: Accompany the Buyer to the Local Country Tax Office to Finalize the Transaction.

The resale certificate is the seller's evidence as to why sales tax was not collected on that transaction and should be retained in the seller's books and records for four years.