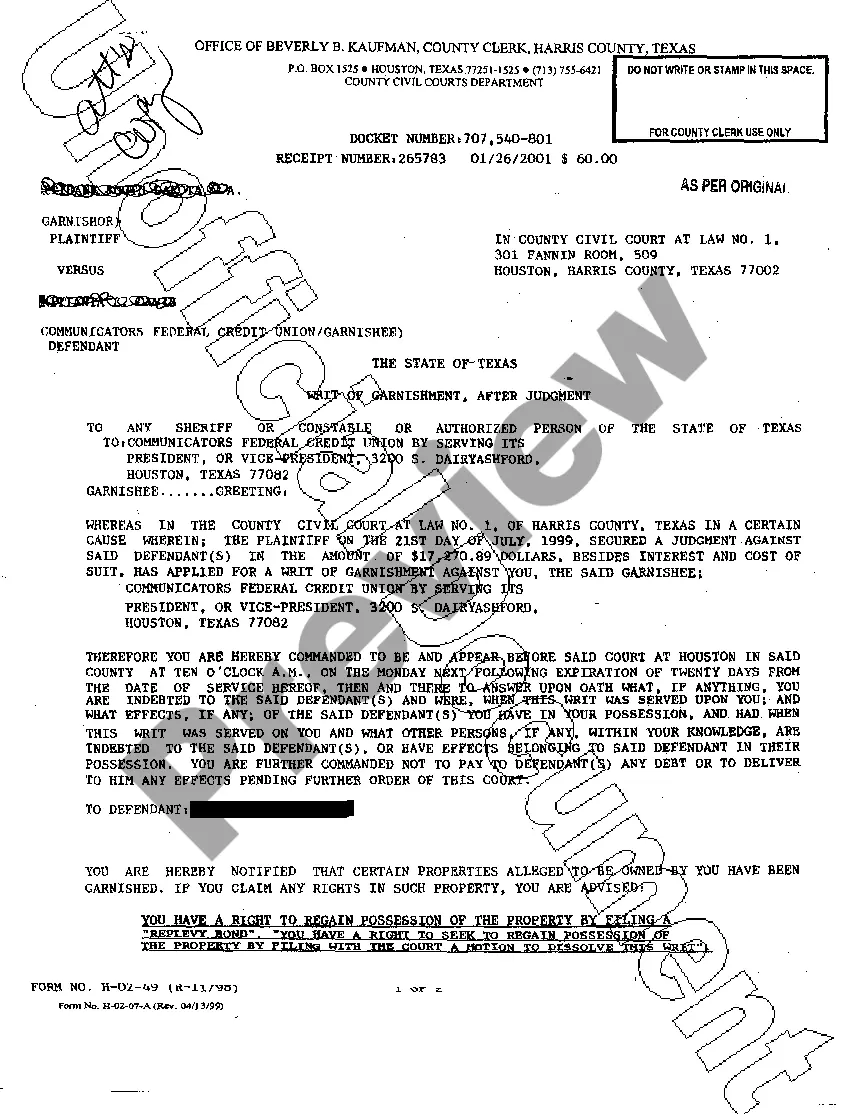

Texas Writ of Garnishment

Description Writ Of Garnishment In Texas

How to fill out Texas Writ Of Garnishment?

Get access to top quality Texas Writ of Garnishment samples online with US Legal Forms. Steer clear of hours of wasted time looking the internet and dropped money on documents that aren’t updated. US Legal Forms provides you with a solution to just that. Find above 85,000 state-specific authorized and tax templates that you could download and fill out in clicks within the Forms library.

To get the sample, log in to your account and then click Download. The document is going to be stored in two places: on the device and in the My Forms folder.

For those who don’t have a subscription yet, check out our how-guide listed below to make getting started simpler:

- Check if the Texas Writ of Garnishment you’re considering is appropriate for your state.

- Look at the form utilizing the Preview function and browse its description.

- Go to the subscription page by simply clicking Buy Now.

- Select the subscription plan to keep on to register.

- Pay by credit card or PayPal to finish making an account.

- Choose a preferred file format to download the document (.pdf or .docx).

You can now open the Texas Writ of Garnishment sample and fill it out online or print it and do it yourself. Think about sending the document to your legal counsel to be certain things are filled in properly. If you make a error, print and complete sample once again (once you’ve created an account all documents you download is reusable). Make your US Legal Forms account now and access a lot more samples.

Form popularity

FAQ

Texas Writ of PossessionAfter the court orders an eviction against your tenant, they have a minimum grace period of at least five days after the judgement to vacate your property.After a Texas writ of possession is delivered, the earliest a constable can actually come back and move the tenant out is 24 hours.

Once you have a judgment against you, creditors can garnish your bank account in Texas. They do this with a Writ of Garnishment. They cannot garnish your wages but once you deposit your paycheck into the bank they can freeze your account with a valid judgment.

Establish a Separate Entity. Sole proprietors that might be at risk for bank account garnishment on their personal debts should consider establishing an LLC to protect their business assets. File for Bankruptcy. Make Payment Arrangements.

Once you have a judgment against you, creditors can garnish your bank account in Texas. They do this with a Writ of Garnishment. They cannot garnish your wages but once you deposit your paycheck into the bank they can freeze your account with a valid judgment.

In Texas, wage garnishment is prohibited by the Texas Constitution except for a few kinds of debt: child support, spousal support, student loans, or unpaid taxes. A debt collector cannot garnish your wages for ordinary debts. However, Texas does allow for a bank account to be frozen.