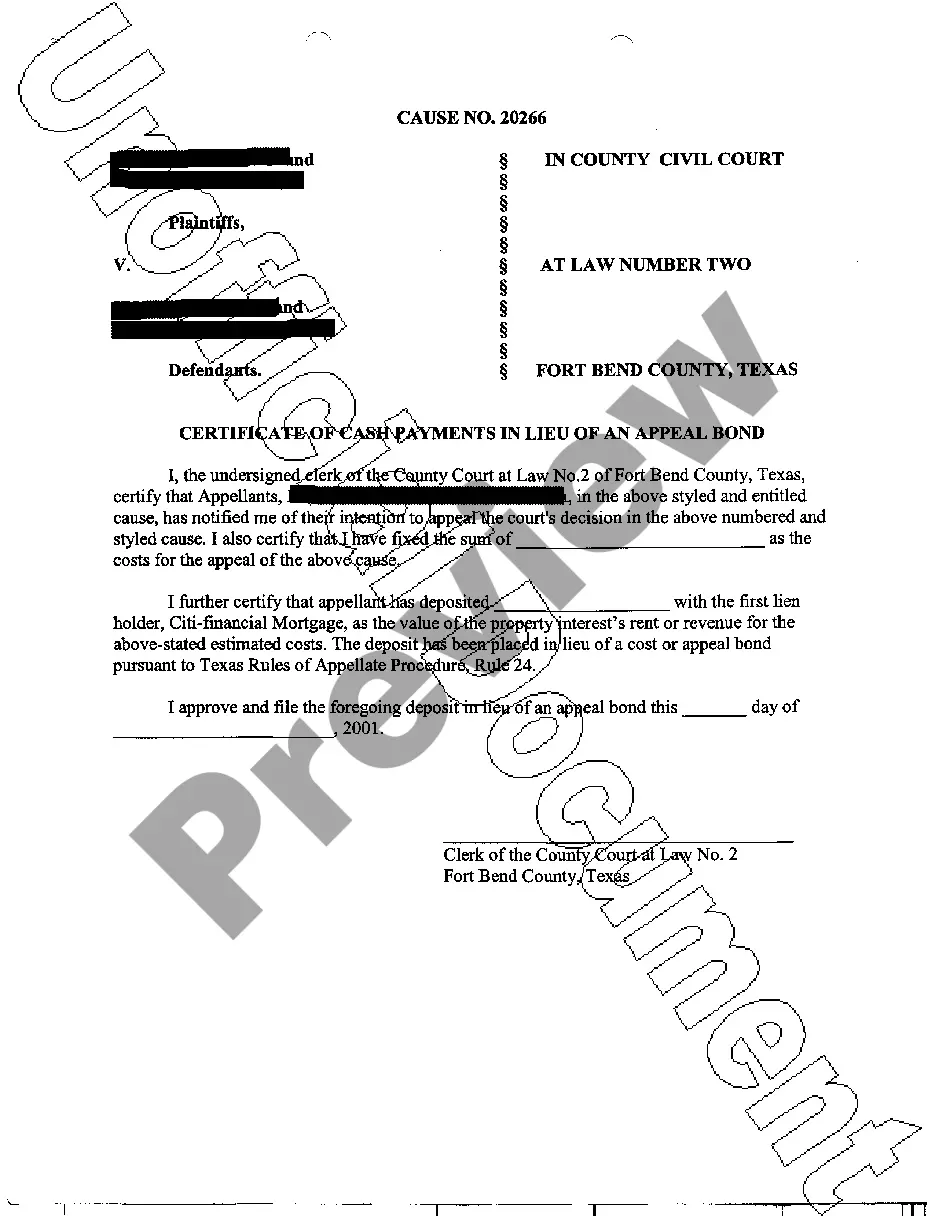

Texas Certificate of Cash Payments in Lieu of Bond

Description

How to fill out Texas Certificate Of Cash Payments In Lieu Of Bond?

Get access to high quality Texas Certificate of Cash Payments in Lieu of Bond templates online with US Legal Forms. Steer clear of days of wasted time searching the internet and lost money on documents that aren’t up-to-date. US Legal Forms gives you a solution to just that. Get above 85,000 state-specific legal and tax forms that you could download and fill out in clicks in the Forms library.

To receive the sample, log in to your account and then click Download. The document will be stored in two places: on your device and in the My Forms folder.

For those who don’t have a subscription yet, look at our how-guide below to make getting started simpler:

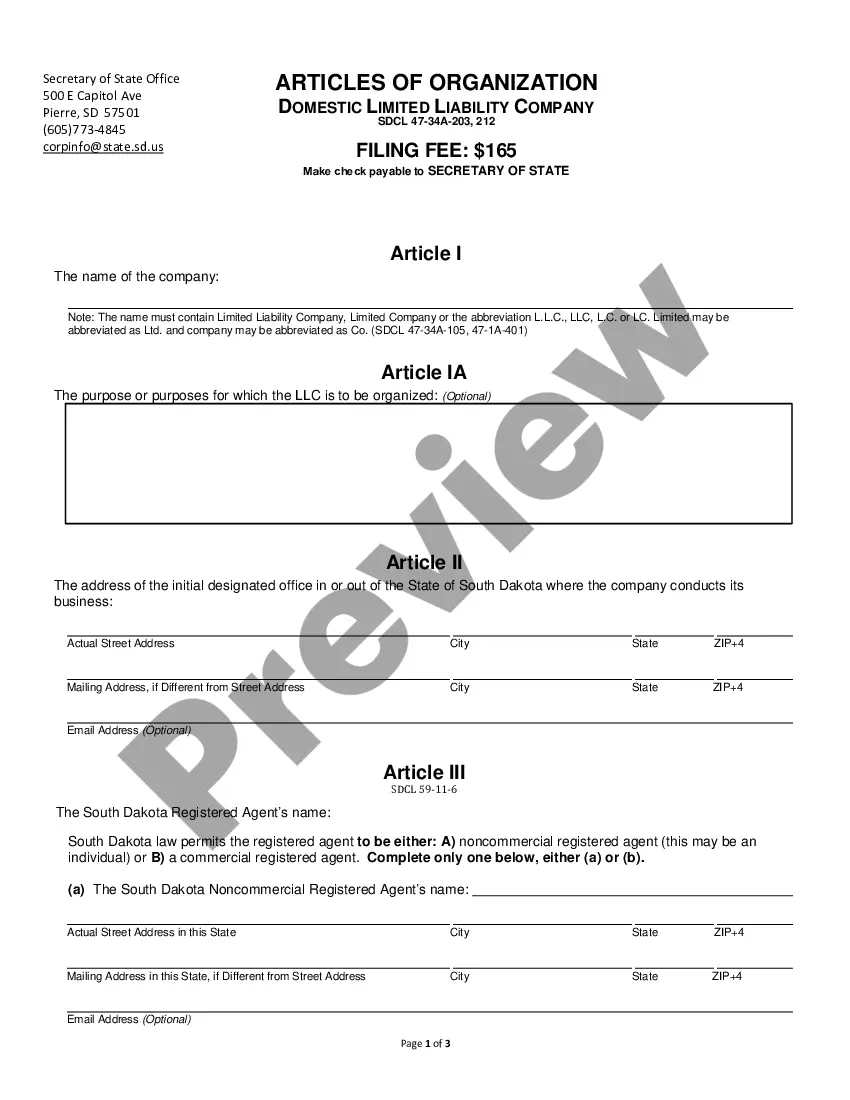

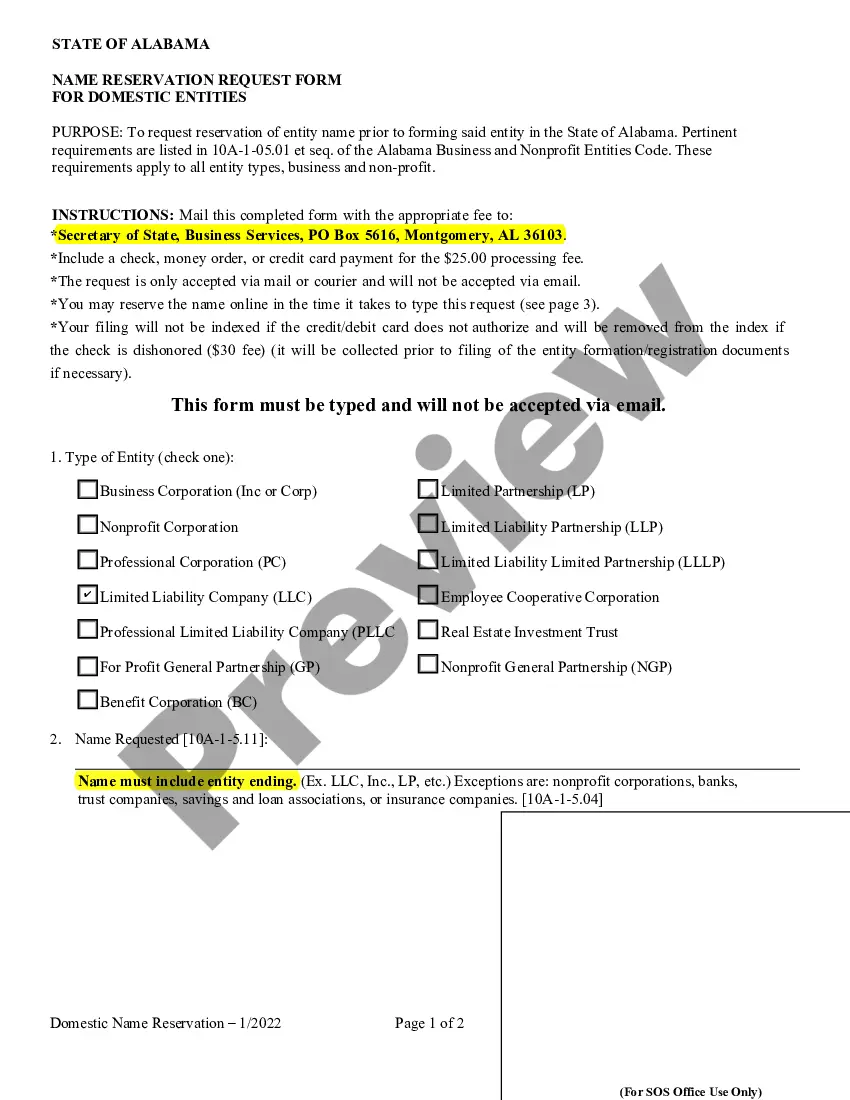

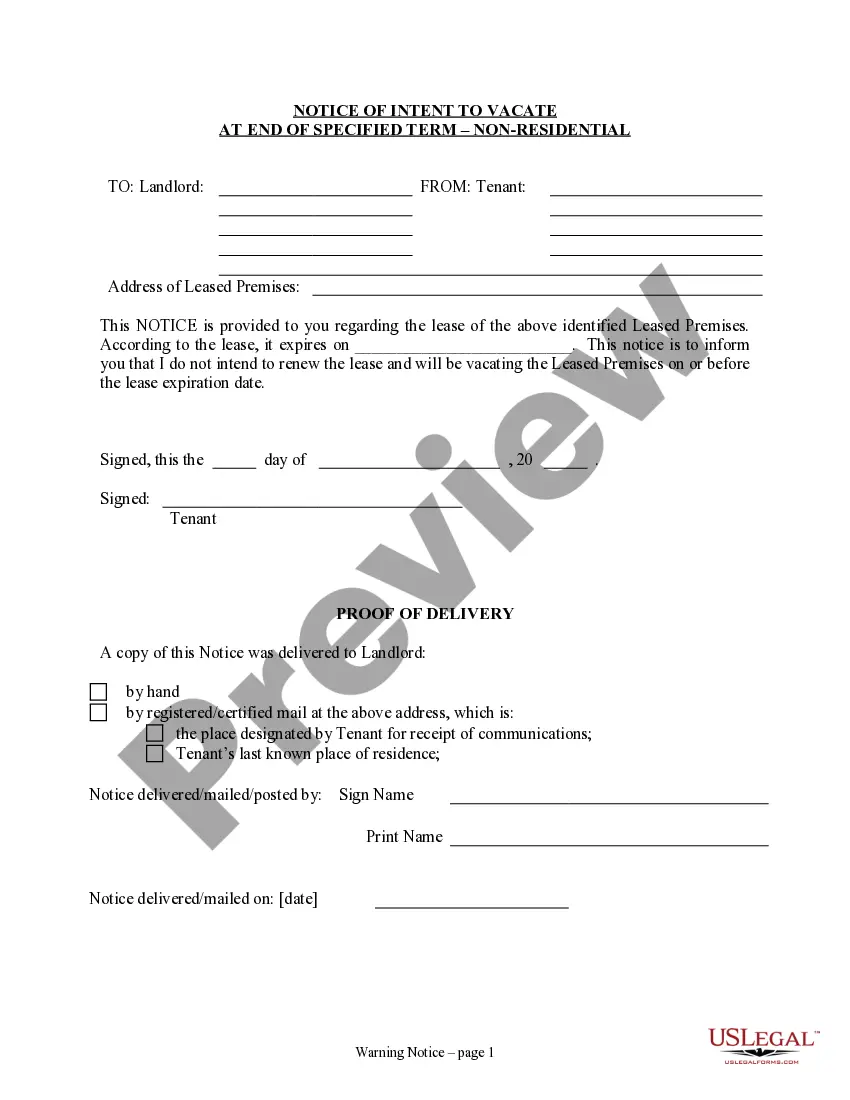

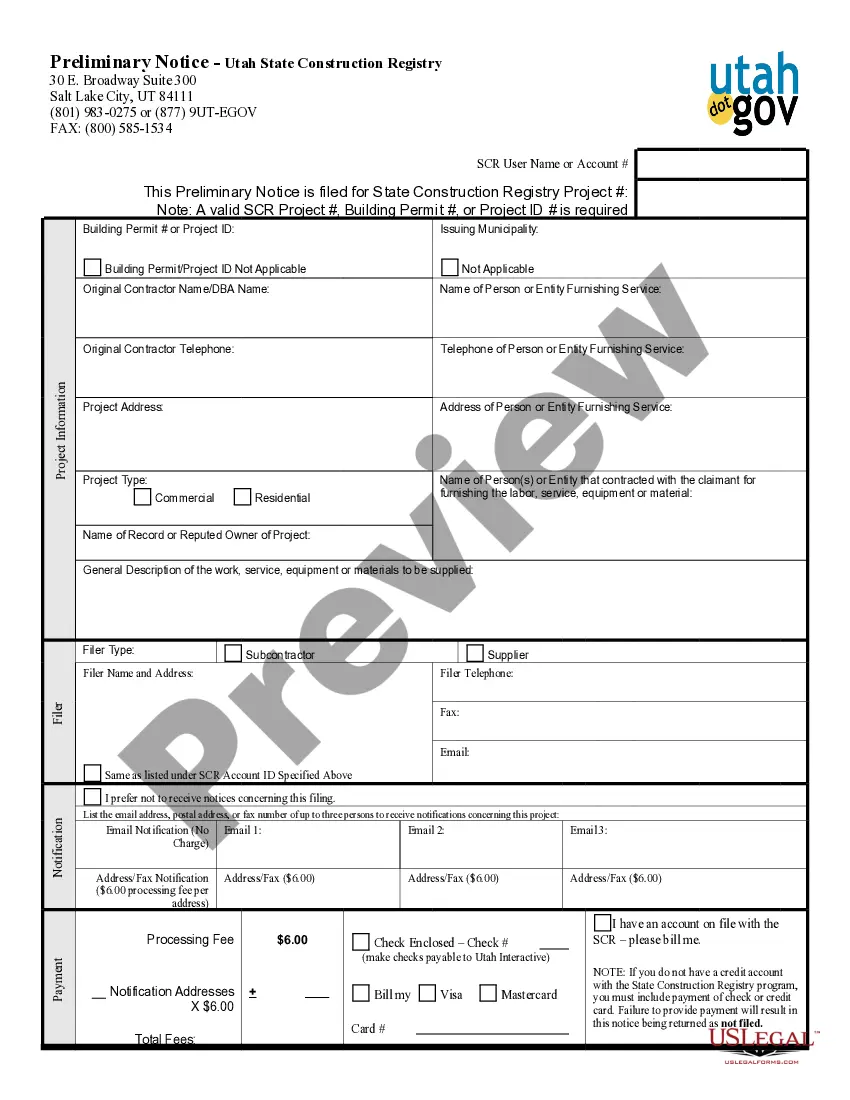

- Check if the Texas Certificate of Cash Payments in Lieu of Bond you’re looking at is suitable for your state.

- View the form making use of the Preview option and browse its description.

- Go to the subscription page by clicking on Buy Now button.

- Choose the subscription plan to continue on to register.

- Pay out by card or PayPal to complete making an account.

- Pick a favored format to save the file (.pdf or .docx).

You can now open up the Texas Certificate of Cash Payments in Lieu of Bond sample and fill it out online or print it out and get it done by hand. Consider mailing the file to your legal counsel to be certain all things are filled out correctly. If you make a mistake, print and fill sample once again (once you’ve registered an account every document you download is reusable). Create your US Legal Forms account now and get a lot more samples.

Form popularity

FAQ

The purpose of the bond is to protect the beneficiaries or creditors of the estate from harm caused by the malfeasance or negligence of the executor or administrator. In California, a probate court bond is issued to administrators, executors, conservators and guardians in probate estates.

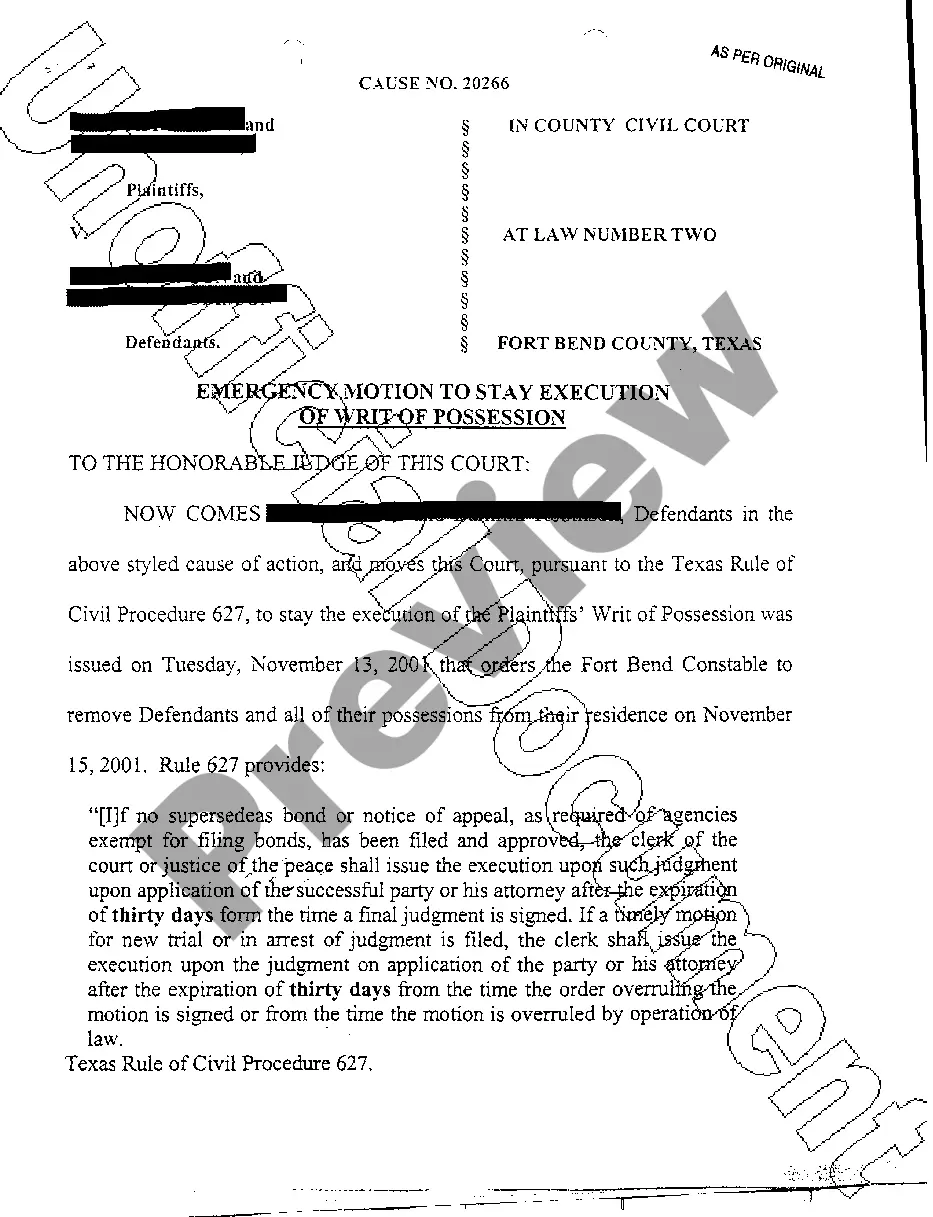

A supersedeas bond in Texas covers the cost of a money judgment and court fees, in order to stay a judgment during an appeal process. Without using a surety bond, a defendant is required to immediately settle the judgment with the plaintiff.

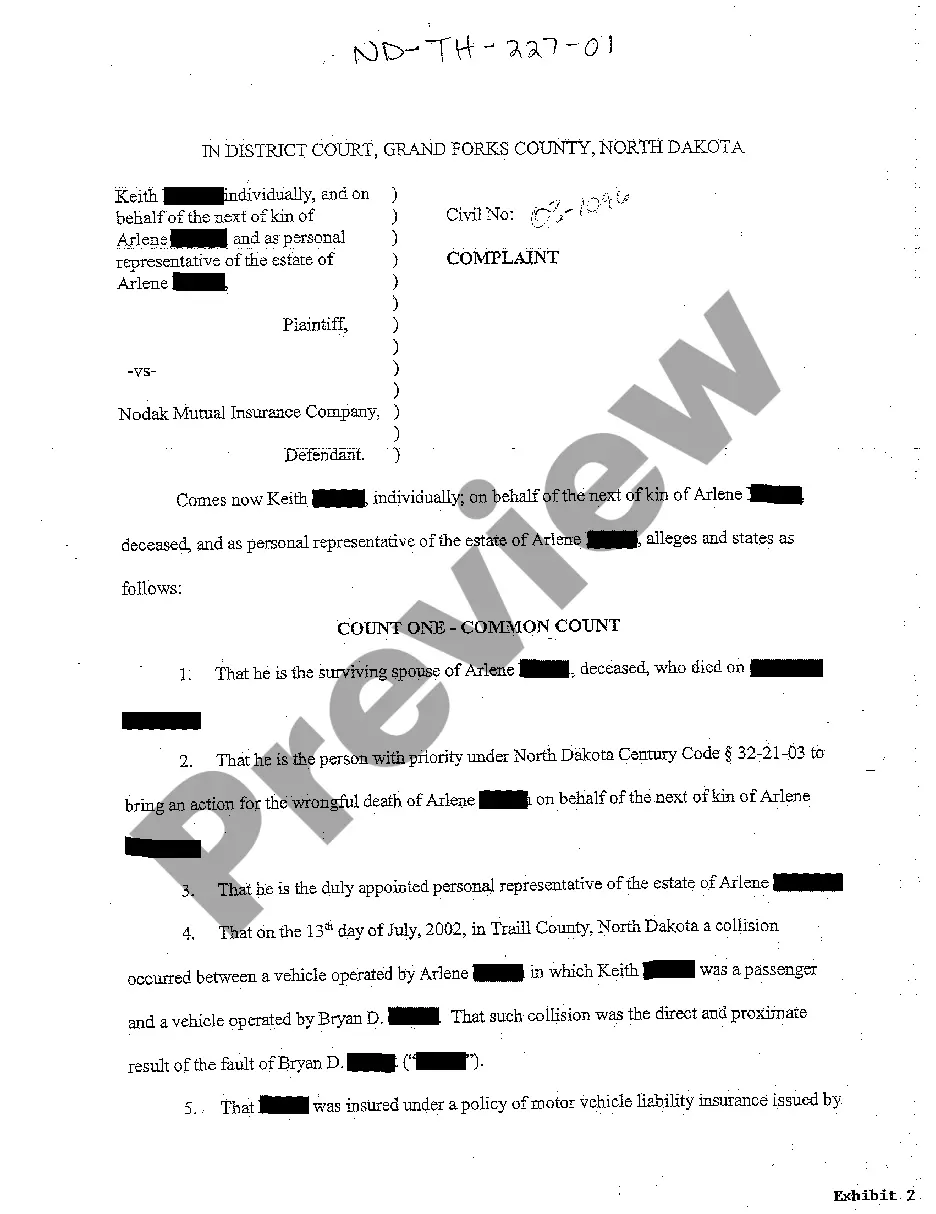

Deposit in lieu of bond. A. In a civil or criminal matter or proceeding when a bond is required of a party, he may, instead of giving the bond, deposit with the court lawful money of the United States in the sum required in the bond, which shall be accepted in lieu of the bond.

An executor bond (also sometimes called an estate bond, a fiduciary bond, or a probate bond) is meant to ensure that the executor doesn't end up defrauding the estate -- for example, by running off with all the assets.

Step 1: Send required notices to protect your bond claim rights. Step 2: Send a Notice of Intent. Step 3: Submit your bond claim. Step 4: Send a Notice of Intent to Proceed Against Bond. Step 5: Enforce your bond claim in court.

Without a Probate Bond, those people are not protected. If a bond is required by law and you choose to not get one, you will not be able to assume your legal duties. The judge of the probate court will generally require a bond unless the will states otherwise.

Estate bonds are also called executor bonds, fiduciary bonds, or probate bonds.An estate bond is a safeguard to ensure that the executor faithfully complies with the written wishes of the deceased. The estate bond acts like an insurance policy.

Examples of these bonds include construction and environmental performance, payment, supply, maintenance, and warranty bonds. Commercial surety helps obtain capacity at the lowest cost for all corporate surety needs.International surety examines the unique surety requirements internationally.

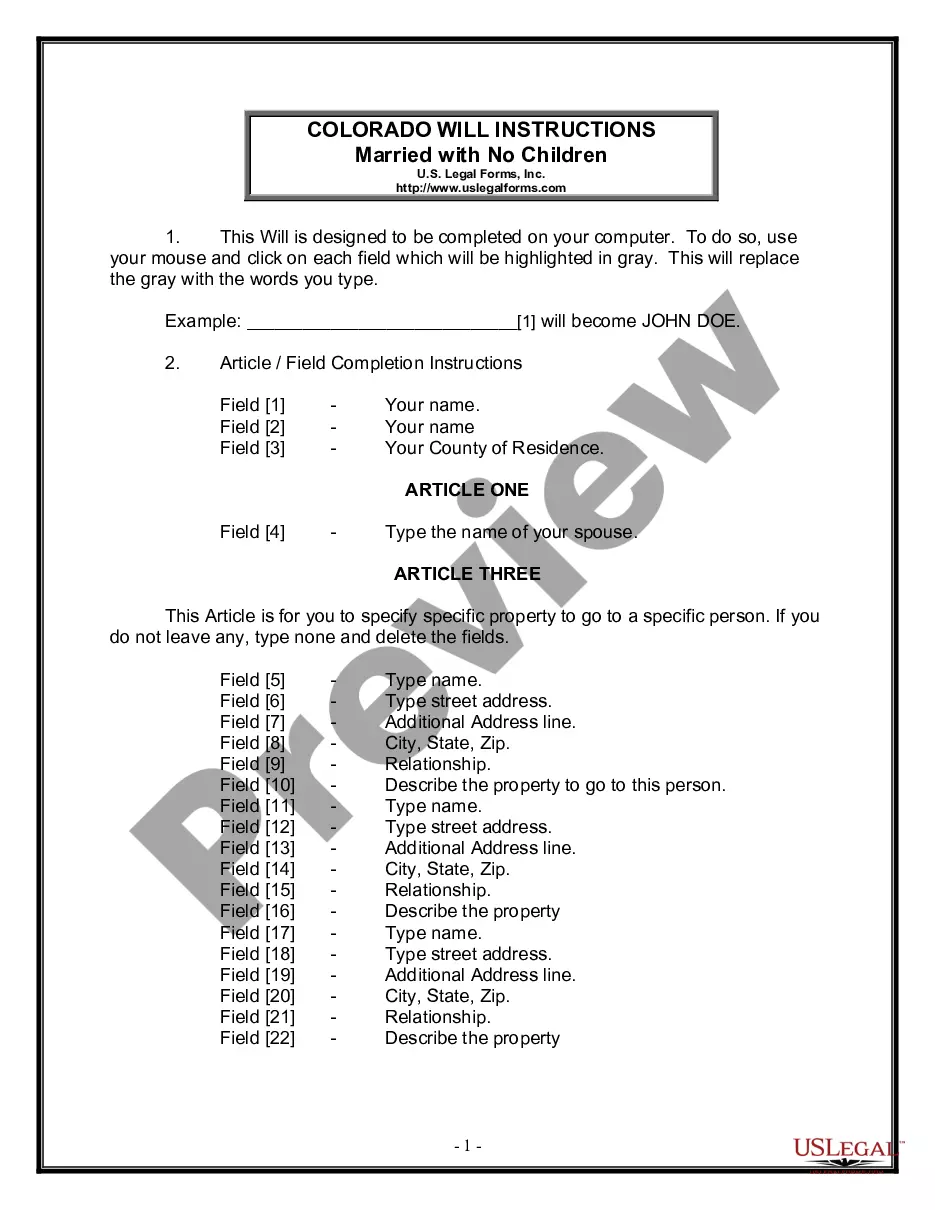

Write the name of the obligor, or project owner, on the line preceded or followed by are held and firmly bonded to. Write the amount of money at issue in the bond on the line designated for the bond amount. Sign the bond in the presence of a notary public and have the bond notarized.