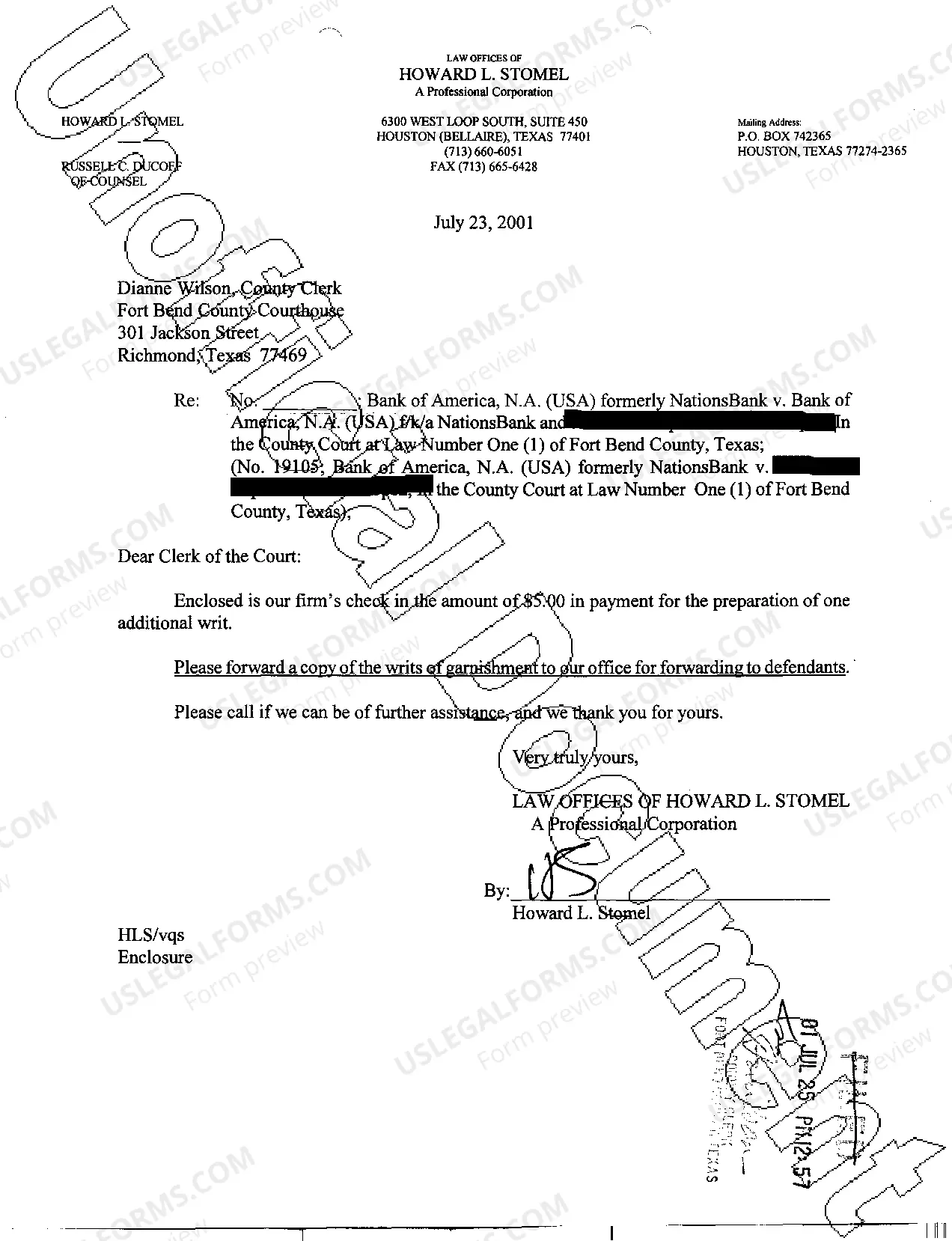

Texas Writ Second to Financial Institution

Description

How to fill out Texas Writ Second To Financial Institution?

Get access to top quality Texas Writ Second to Financial Institution templates online with US Legal Forms. Steer clear of hours of wasted time browsing the internet and lost money on files that aren’t up-to-date. US Legal Forms offers you a solution to exactly that. Get above 85,000 state-specific authorized and tax samples that you can save and fill out in clicks in the Forms library.

To find the sample, log in to your account and click Download. The document is going to be stored in two places: on your device and in the My Forms folder.

For people who don’t have a subscription yet, take a look at our how-guide listed below to make getting started easier:

- Verify that the Texas Writ Second to Financial Institution you’re considering is suitable for your state.

- Look at the sample making use of the Preview option and browse its description.

- Go to the subscription page by clicking on Buy Now button.

- Select the subscription plan to keep on to register.

- Pay out by card or PayPal to finish creating an account.

- Choose a favored file format to save the document (.pdf or .docx).

Now you can open the Texas Writ Second to Financial Institution example and fill it out online or print it out and do it yourself. Think about giving the papers to your legal counsel to be certain all things are filled in properly. If you make a error, print and fill sample once again (once you’ve registered an account every document you download is reusable). Create your US Legal Forms account now and get much more samples.

Form popularity

FAQ

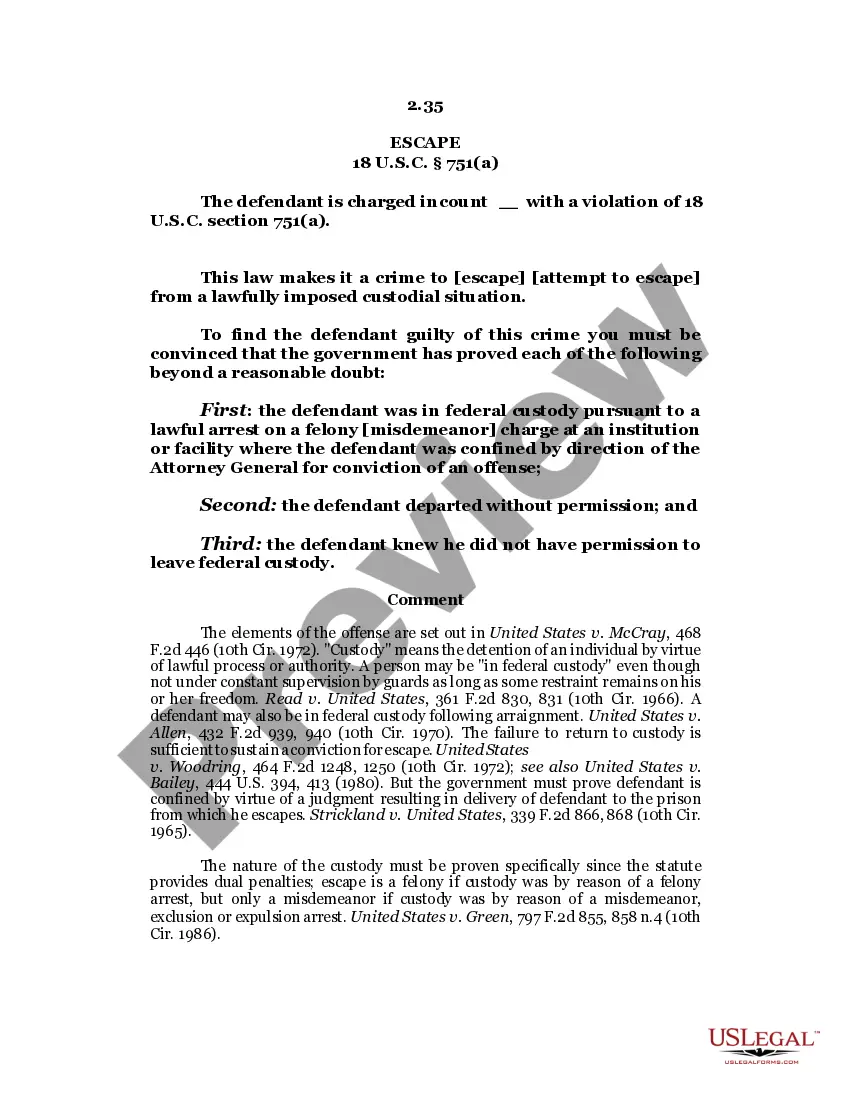

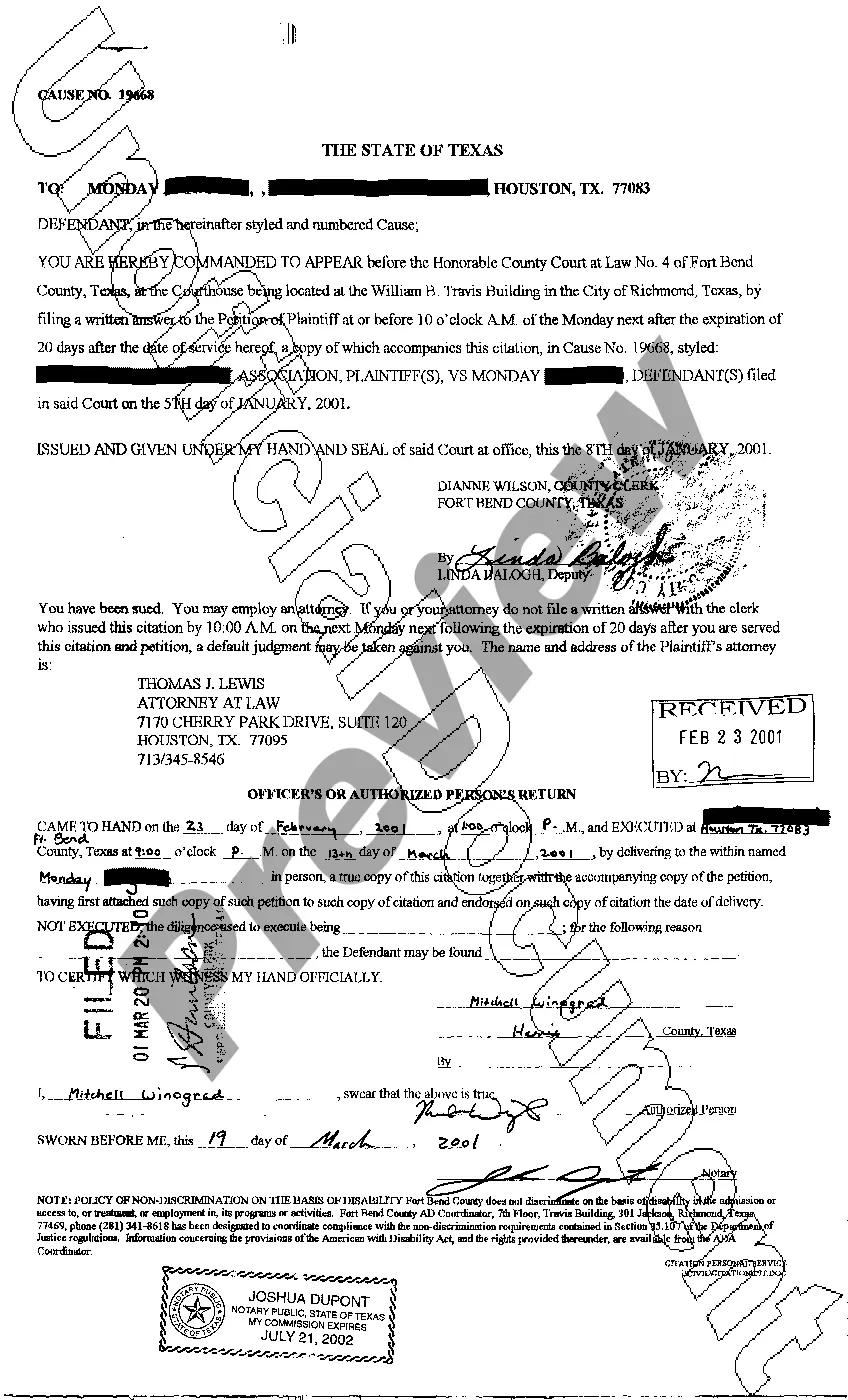

Identify The Funds Or Asset You Want To Collect. Prepare The Writ Of Execution. Prepare The Notice of Execution. Prepare The Writ Of Garnishment. Prepare Instructions To The Sheriff Or Constable. Have Your Papers Served And Watch For A Claim Of Exemption. Track Your Collection And Judgment.

When a court determines that you owe a creditor money and then authorizes the creditor to take money directly from your paycheck or bank accounts, that's called a garnishment.Creditors can use the judgement to garnish your wages, take money from your bank accounts, and put a lien on assets you own, like your house.

Identify The Funds Or Asset You Want To Collect. Prepare The Writ Of Execution. Prepare The Notice of Execution. Prepare The Writ Of Garnishment. Prepare Instructions To The Sheriff Or Constable. Have Your Papers Served And Watch For A Claim Of Exemption. Track Your Collection And Judgment.

In most states, employers answer a writ of garnishment by filling out the paperwork attached to the judgment and returning it to the creditor or the creditor's attorney.

Don't Ignore Debt Collectors. Have Government Assistance Funds Direct Deposited. Don't Transfer Your Social Security Funds to Different Accounts. Know Your State's Exemptions and Use Non-Exempt Funds First.

The Writ of Execution is a proactive approach to post-judgment enforcement. 30 days after obtaining a final judgment, a creditor can request a Writ of Execution from the clerk of the court. The creditor or the creditor's attorney will fill out a Writ of Execution form available at any county courthouse.

The Writ of Execution is a proactive approach to post-judgment enforcement. 30 days after obtaining a final judgment, a creditor can request a Writ of Execution from the clerk of the court. The creditor or the creditor's attorney will fill out a Writ of Execution form available at any county courthouse.

The writ gives the Sheriff the authority to seize property of the judgment debtor and is valid for 180 days after its issuance. You must give the Sheriff signed, written instructions to levy on (seize) and sell, if necessary, specific property belonging to the debtor to satisfy your judgment.