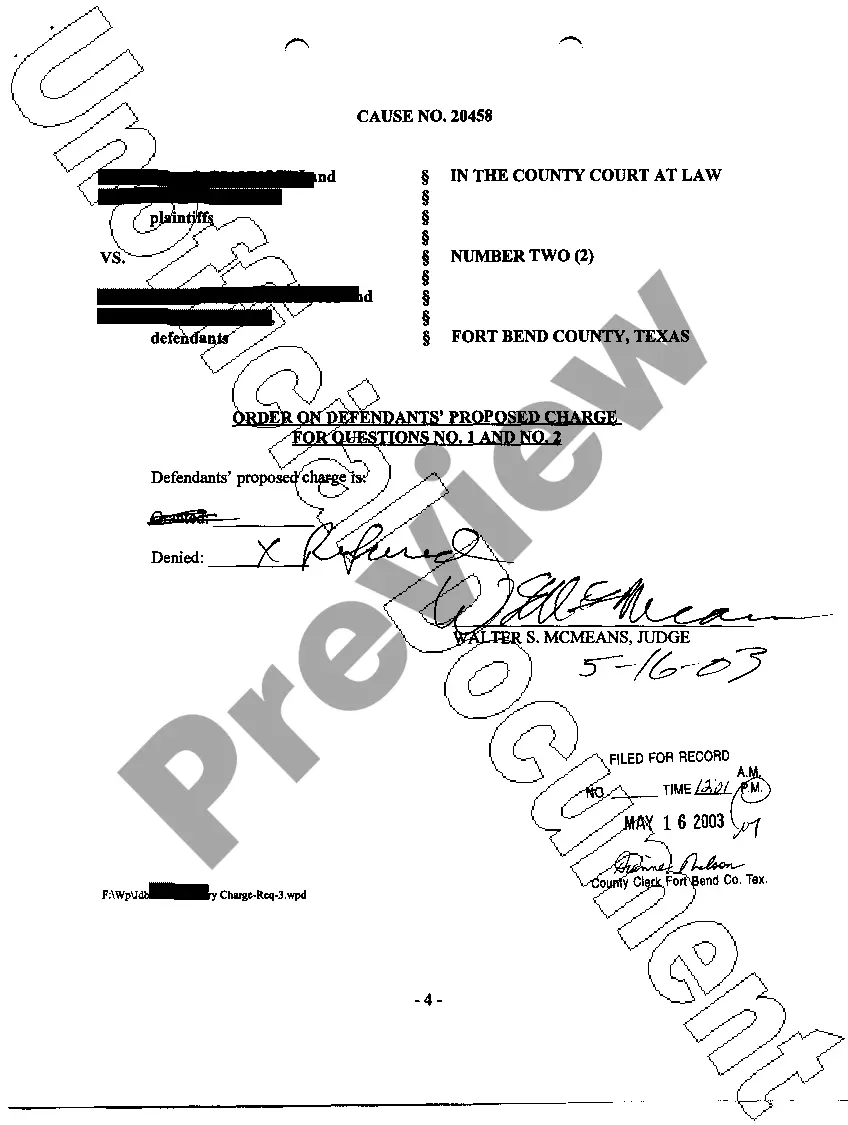

Texas Order on Defendant's Proposed Charge

Description

How to fill out Texas Order On Defendant's Proposed Charge?

Access to quality Texas Order on Defendant's Proposed Charge samples online with US Legal Forms. Steer clear of days of lost time searching the internet and lost money on documents that aren’t up-to-date. US Legal Forms offers you a solution to just that. Find more than 85,000 state-specific authorized and tax samples you can save and fill out in clicks in the Forms library.

To receive the example, log in to your account and click Download. The file is going to be stored in two places: on the device and in the My Forms folder.

For those who don’t have a subscription yet, take a look at our how-guide listed below to make getting started easier:

- Check if the Texas Order on Defendant's Proposed Charge you’re looking at is suitable for your state.

- Look at the form making use of the Preview option and browse its description.

- Check out the subscription page by clicking Buy Now.

- Select the subscription plan to keep on to register.

- Pay by credit card or PayPal to complete creating an account.

- Pick a preferred file format to download the document (.pdf or .docx).

You can now open up the Texas Order on Defendant's Proposed Charge sample and fill it out online or print it and get it done by hand. Take into account sending the file to your legal counsel to ensure all things are completed properly. If you make a error, print and fill application once again (once you’ve registered an account all documents you save is reusable). Make your US Legal Forms account now and access much more templates.

Form popularity

FAQ

The citation must: (1) be styled AThe State of Texas"; (2) be signed by the clerk under seal of court or by the judge; (3) contain the name, location, and address of the court; (4) show the date of filing of the petition; (5) show the date of issuance of the citation; (6) show the file number and names of parties; (7)

Your answer can be a handwritten letter to the court that says you do not agree with the lawsuit. Include your case (cause) number and mailing address and any defenses you may have to the lawsuit; for example, the amount they claim you owe is incorrect, the account isn't yours, or the debt is older than 4 years.

There are two main ways pro se litigants can file documents with the court. The first way is to file a document either in person or by mail. The second way is to file a document electronically if the litigant has access to a computer and the internet.

If the creditor or debt collector wins the lawsuit, they will obtain a judgment against you. That judgment can then be enforced in a variety of ways unless you do not have any money or assets that the creditor could claim. This is commonly called being "judgment proof."

Step 3: File (turn in) your answer form. File (turn in) your completed answer form with the court. To file online, go to E-File Texas and follow the instructions. To file in person, take your answer (and copies) to the district clerk's office in the county where the plaintiff filed the case.

The Federal Rules of Appellate Procedure (officially abbreviated Fed. R. App. P.; colloquially FRAP) are a set of rules, promulgated by the Supreme Court of the United States on recommendation of an advisory committee, to govern procedures in cases in the United States Courts of Appeals.

Responses can be handwritten and submitted to the court, but they need to be specified as to what claims are agreed upon, not agreed upon and unknown. They must also clearly write out the case number, up-to-date mailing address and a defense to each claim in the response.

Debt cases filed in a Texas JP/Justice Court have a deadline of 14 days after the summons is served. If you were served with a summons, but do not file an answer before the deadline, the judge will issue a default judgment against you.Otherwise, you will have a judgment on your record.

Read the summons and make sure you know the date you must answer by. Read the complaint carefully. Write your answer. Sign and date the answer. Make copies for the plaintiff and yourself. Mail a copy to the plaintiff. File your answer with the court by the date on the summons.