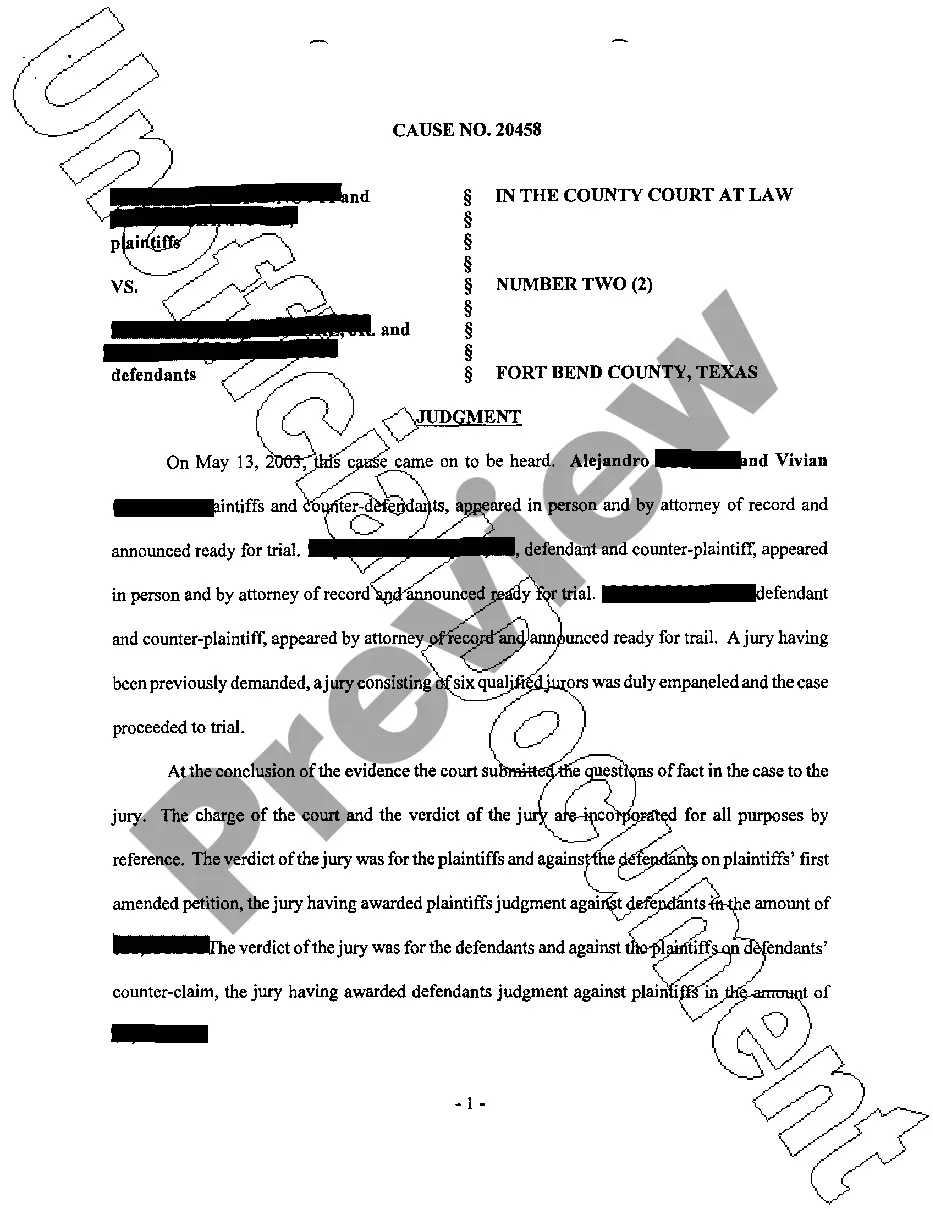

Texas Judgment

Description

How to fill out Texas Judgment?

Get access to quality Texas Judgment templates online with US Legal Forms. Avoid hours of wasted time looking the internet and dropped money on forms that aren’t updated. US Legal Forms offers you a solution to just that. Find around 85,000 state-specific legal and tax samples that you can download and submit in clicks in the Forms library.

To receive the sample, log in to your account and click on Download button. The file will be stored in two places: on your device and in the My Forms folder.

For people who don’t have a subscription yet, have a look at our how-guide below to make getting started simpler:

- Check if the Texas Judgment you’re considering is appropriate for your state.

- See the form utilizing the Preview function and browse its description.

- Check out the subscription page by simply clicking Buy Now.

- Select the subscription plan to continue on to register.

- Pay out by credit card or PayPal to finish creating an account.

- Pick a favored file format to save the document (.pdf or .docx).

Now you can open up the Texas Judgment sample and fill it out online or print it and get it done yourself. Think about giving the document to your legal counsel to make sure things are completed properly. If you make a mistake, print and complete sample again (once you’ve made an account all documents you download is reusable). Create your US Legal Forms account now and access a lot more samples.

Form popularity

FAQ

If you are not able to get in touch with a clerk in your local court, you can try going to the courthouse itself. Be sure to check its hours of operation and parking details online before you go. You should ask to speak to a clerk who can help you search for civil judgment records.

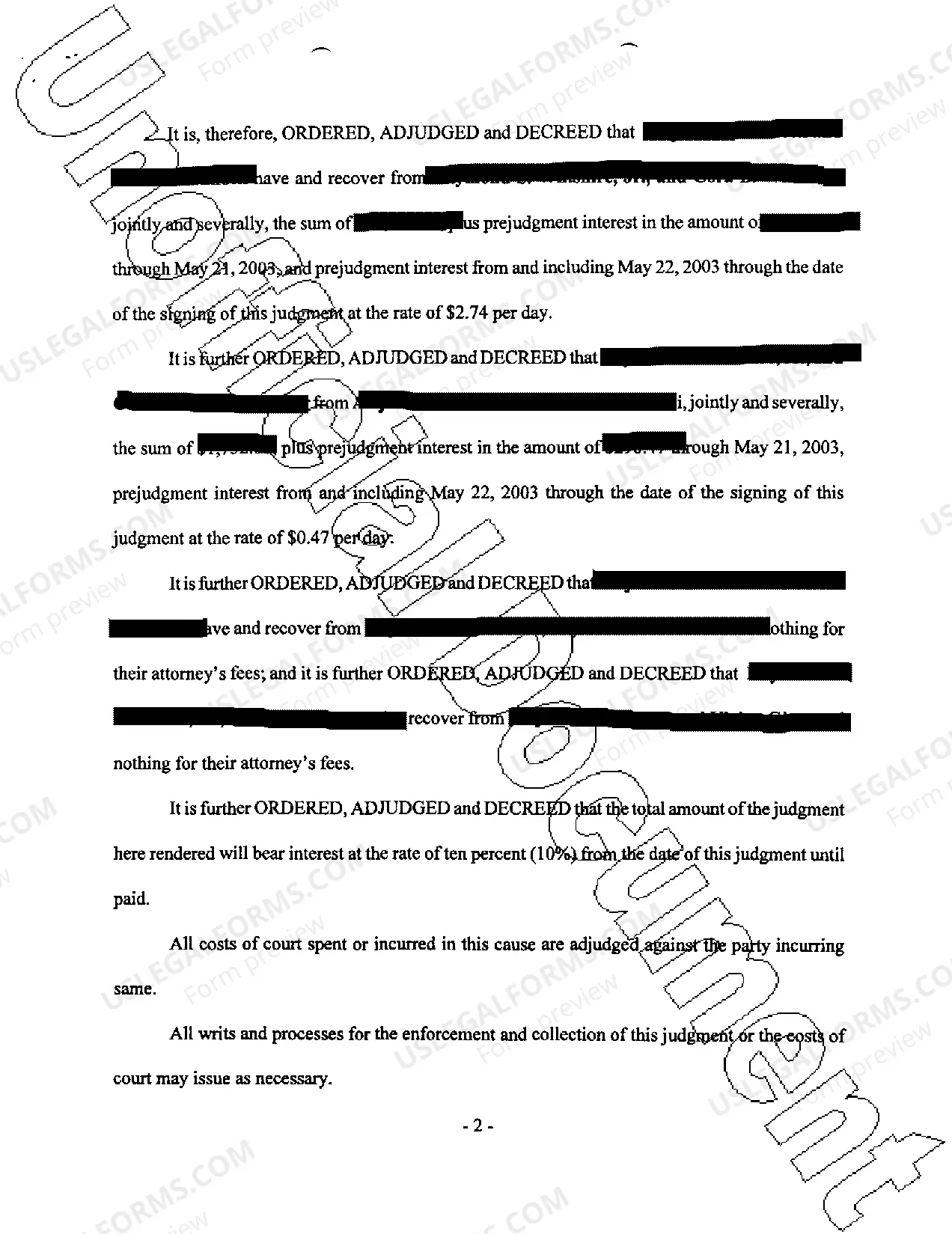

Do Judgments Expire in Texas? Judgments issued in Texas with a non-government creditor are generally valid for ten years but they can be renewed for longer.

When a creditor gets a judgment against a debtor, the creditor has to take steps to get the judgment paid. This is called execution.The things that are taken are sold to pay the judgment. The Texas Property Code sets out the kinds and amounts of property that can and cannot be taken to pay a judgment in Texas.

In Texas, you can attach a property lien to a debtor's real estate to collect a court judgment.A judgment lien gives the creditor the right to be paid a certain amount of money from proceeds from the sale of the debtor's property.