Texas Taxation of Costs is a system used in the state of Texas to collect taxes on certain goods and services. It applies to both individuals and businesses. The taxes are collected by the Texas Comptroller of Public Accounts and are used to fund public services such as education, healthcare, and infrastructure. The types of Texas Taxation of Costs include sales and use taxes, motor vehicle taxes, franchise taxes, hotel taxes, severance taxes, and mixed beverage taxes. Sales and use taxes are imposed on the sale of most retail goods and services, motor vehicle taxes are applied to the sale of new and used cars, franchise taxes are paid by businesses that operate in the state, hotel taxes are imposed on hotel and motel stays, severance taxes are assessed on the extraction of certain natural resources, and mixed beverage taxes are applied to the sale of alcoholic beverages. Texas Taxation of Costs is a critical source of revenue for the state and helps to fund important public services.

Texas Taxation of Costs

Description

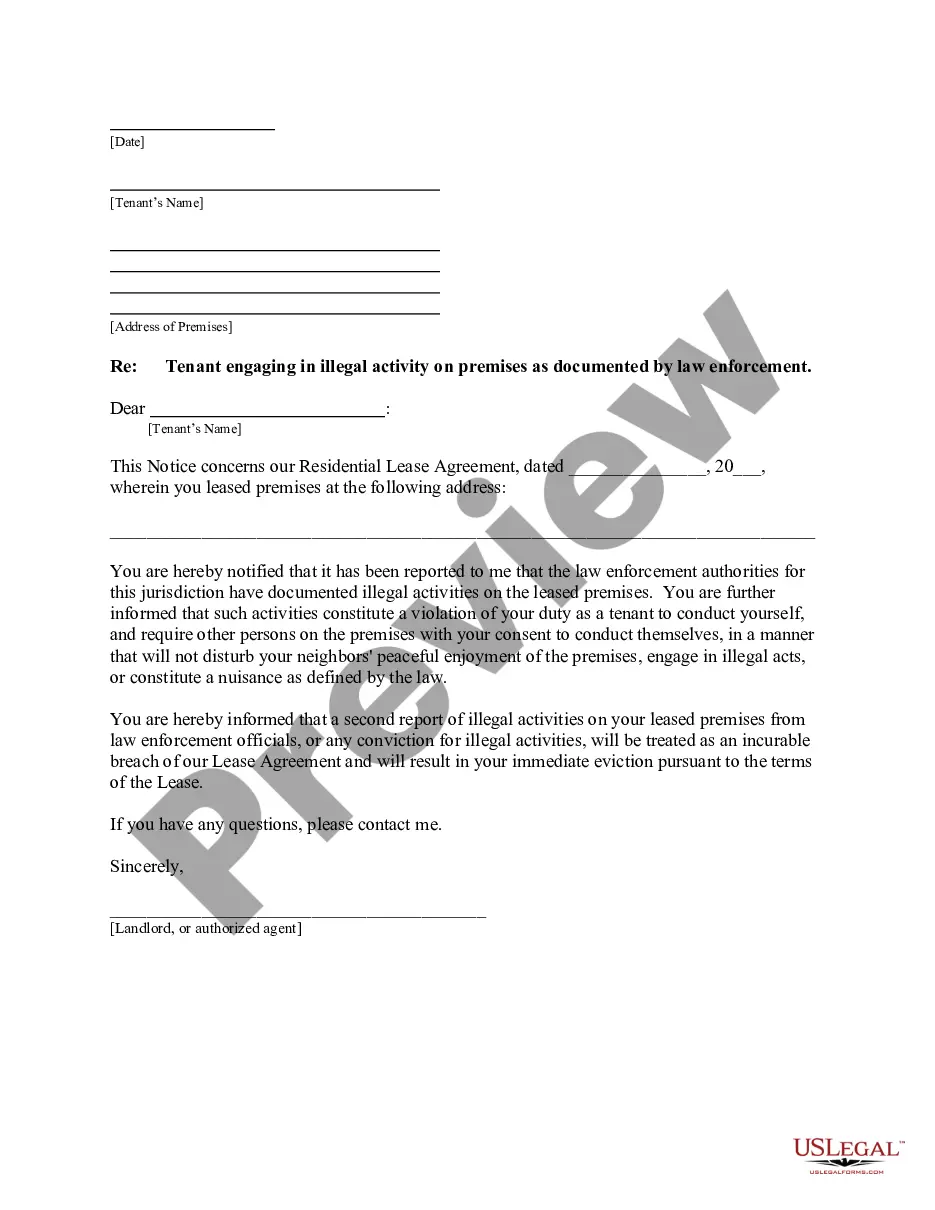

How to fill out Texas Taxation Of Costs?

How much time and resources do you usually spend on composing formal paperwork? There’s a better option to get such forms than hiring legal experts or wasting hours browsing the web for a suitable template. US Legal Forms is the premier online library that offers professionally designed and verified state-specific legal documents for any purpose, like the Texas Taxation of Costs.

To get and complete an appropriate Texas Taxation of Costs template, follow these easy steps:

- Look through the form content to ensure it complies with your state requirements. To do so, read the form description or take advantage of the Preview option.

- In case your legal template doesn’t meet your requirements, locate a different one using the search tab at the top of the page.

- If you are already registered with our service, log in and download the Texas Taxation of Costs. If not, proceed to the next steps.

- Click Buy now once you find the correct blank. Opt for the subscription plan that suits you best to access our library’s full opportunities.

- Sign up for an account and pay for your subscription. You can make a transaction with your credit card or through PayPal - our service is totally safe for that.

- Download your Texas Taxation of Costs on your device and fill it out on a printed-out hard copy or electronically.

Another advantage of our service is that you can access previously purchased documents that you safely keep in your profile in the My Forms tab. Pick them up at any moment and re-complete your paperwork as frequently as you need.

Save time and effort preparing official paperwork with US Legal Forms, one of the most trustworthy web services. Join us now!

Form popularity

FAQ

Taxable Services Amusement Services.Cable Television Services and Bundled Cable Services.Credit Reporting Services.Data Processing Services.Debt Collection Services.Information Services.Insurance Services.Internet Access Services.

The bill of costs (1) lists the ?costs on appeal,? such as the costs which were incurred for the appellate record and the court of appeals filing fees and (2) notes whether those costs have been paid and, if so, by whom.

Under certain circumstances, information technology and associated services may be subject to Texas sales and use tax. The specifics depend on how the Texas Tax Code and Texas Comptroller's rules characterize a particular technology and/or service. Here's a quick explainer. However, contract programming is not taxable.

Labor to repair, remodel, or restore residential real property is not taxable. Residential real property means family dwellings, including apartment complexes, nursing homes, condominiums, and retirement homes.

Labor to repair, remodel, or restore residential real property is not taxable. Residential real property means family dwellings, including apartment complexes, nursing homes, condominiums, and retirement homes. It does not include hotels or residential properties rented for periods of less than 30 days.

Other tax-exempt items in Texas CategoryExemption StatusFood and MealsMedical ServicesEXEMPTMedicinesEXEMPTNewspapers and Magazines19 more rows

Taxable Services Amusement Services.Cable Television Services and Bundled Cable Services.Credit Reporting Services.Data Processing Services.Debt Collection Services.Information Services.Insurance Services.Internet Access Services.

This includes purchases from Texas or out-of-state sellers, or items taken out of inventory for use, items given away, and items purchased for an exempt use but actually used in a taxable manner. Taxable purchases do not include inventory items being held exclusively for resale.