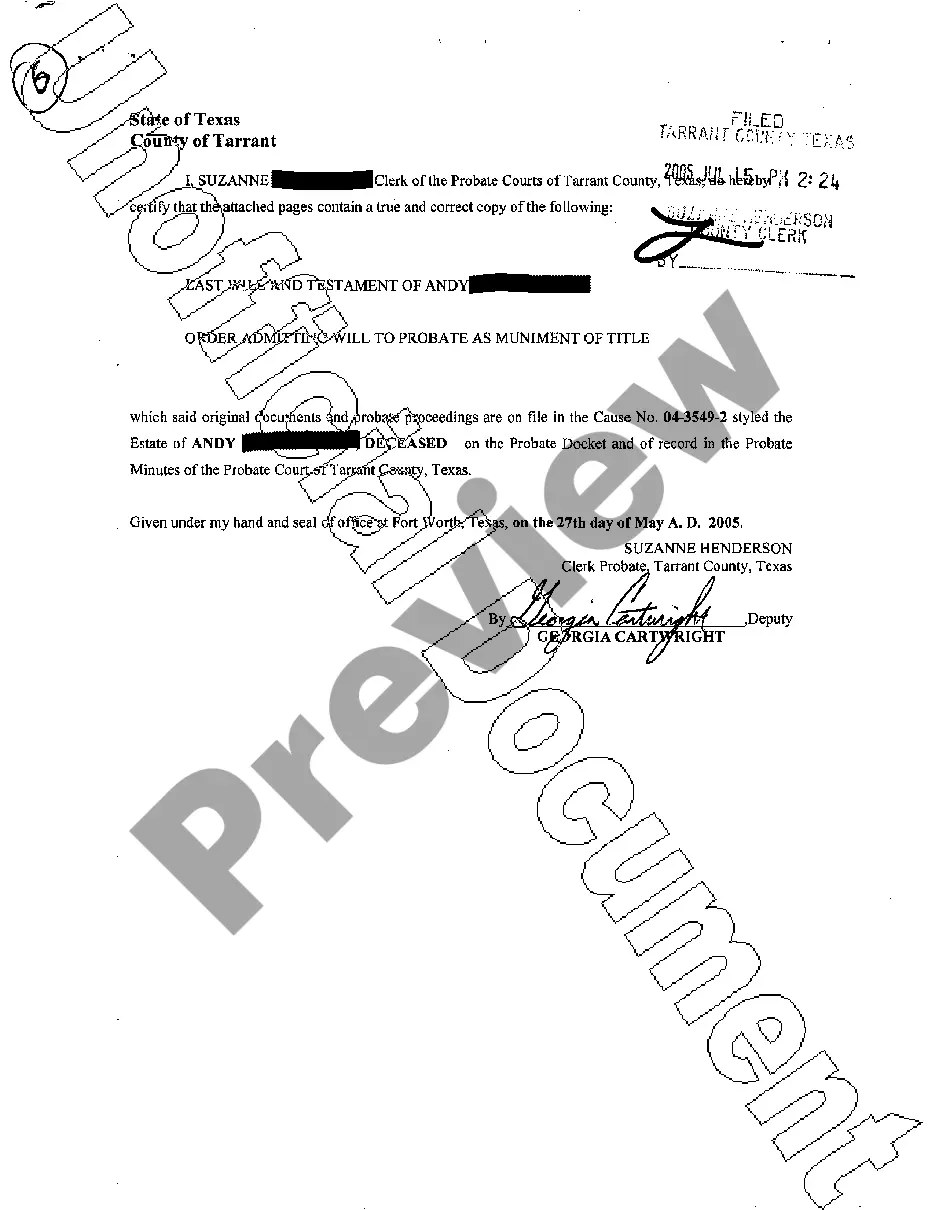

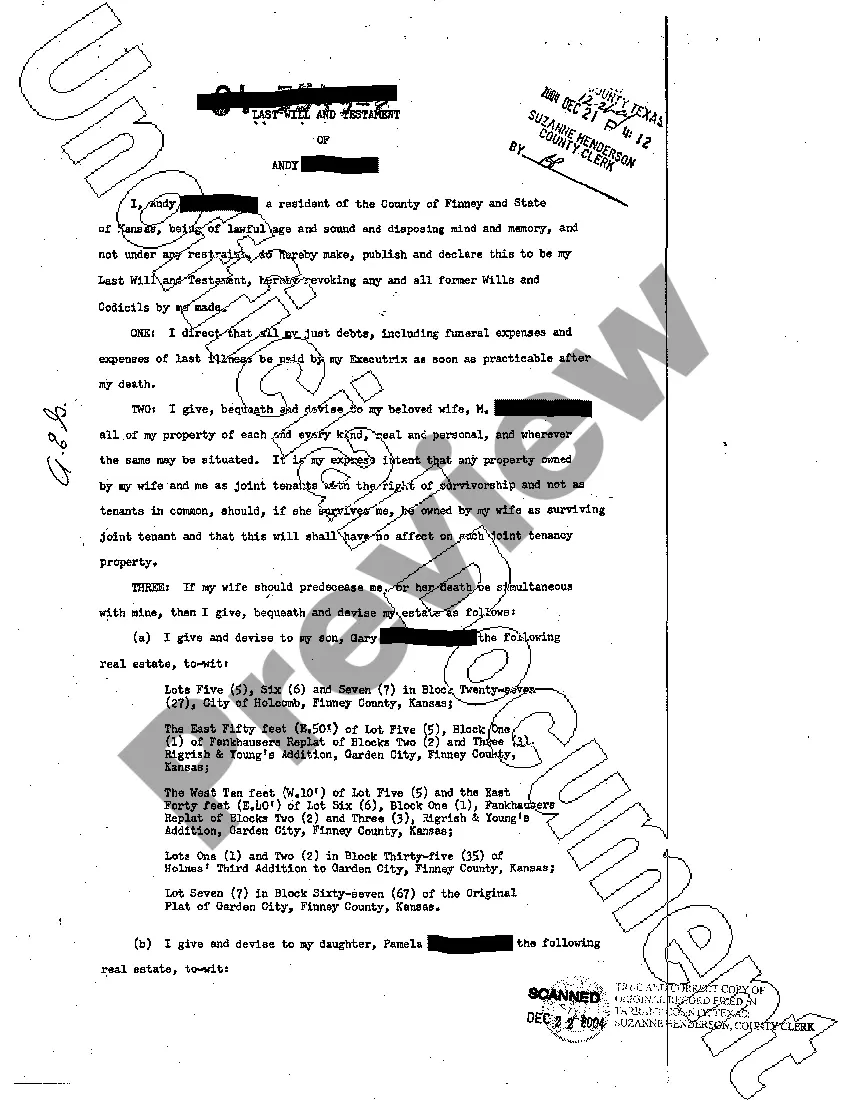

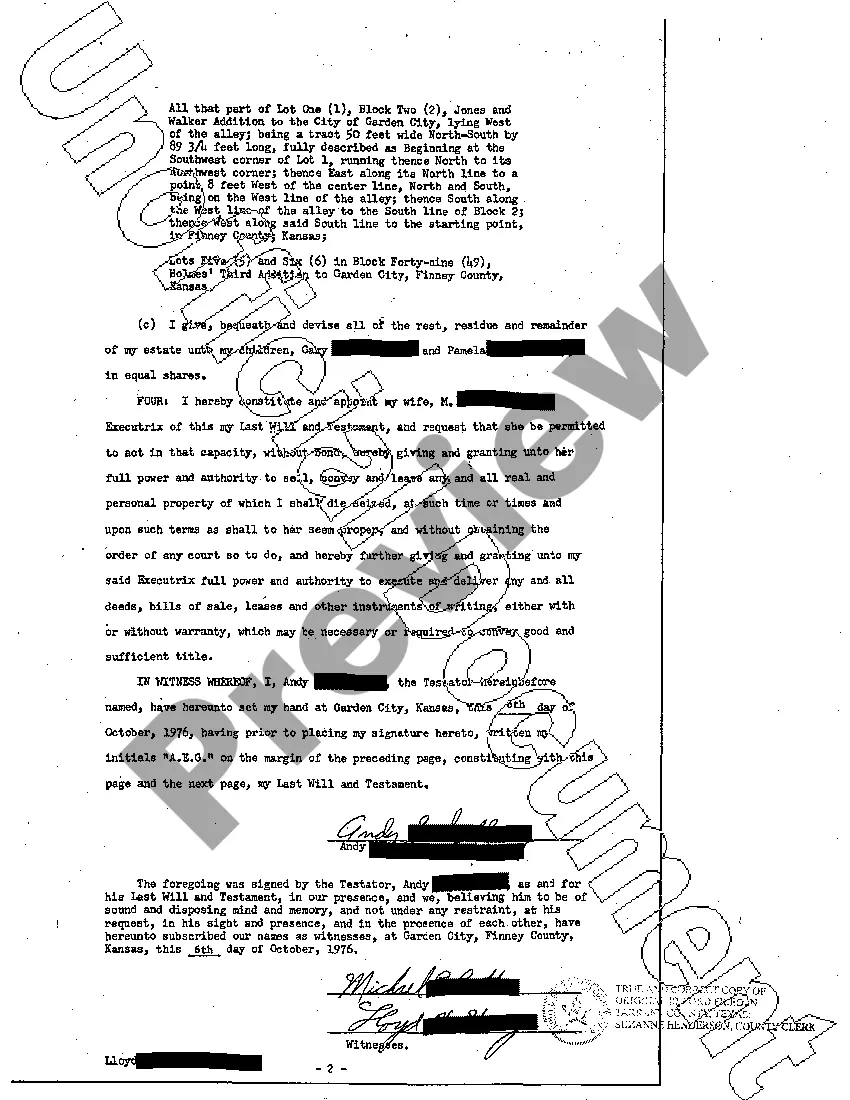

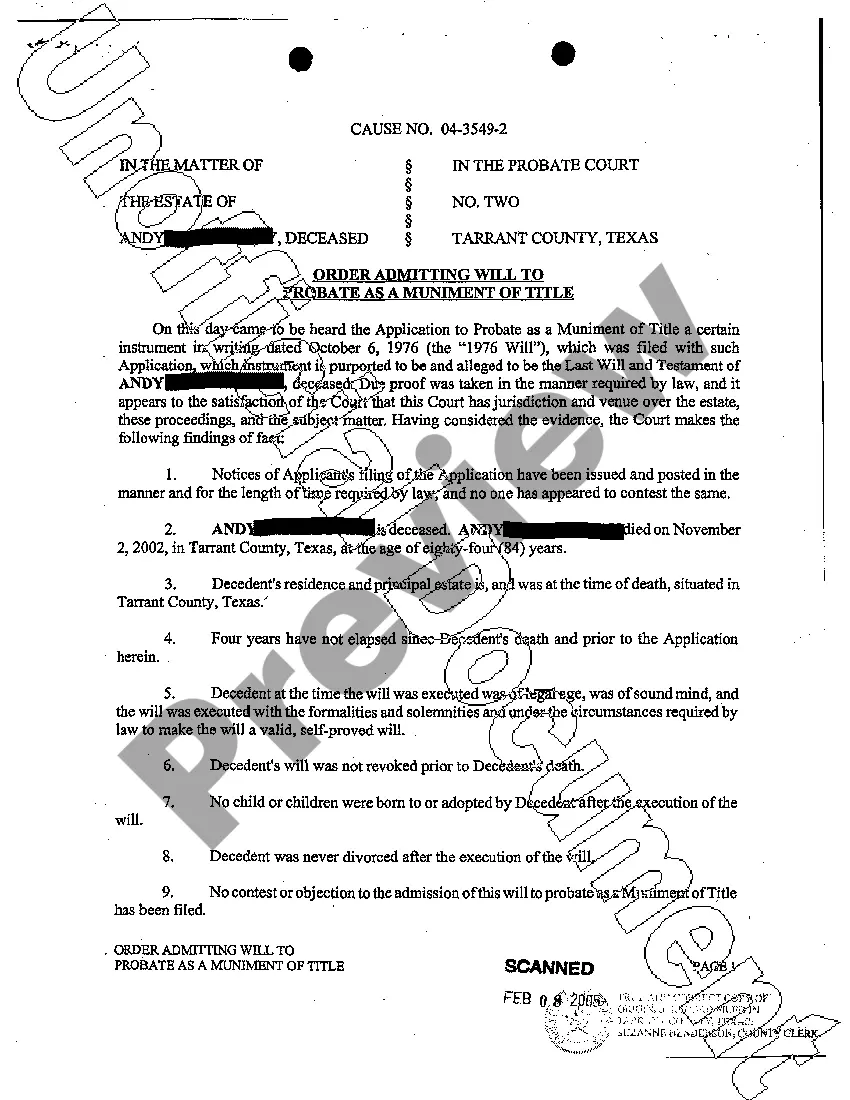

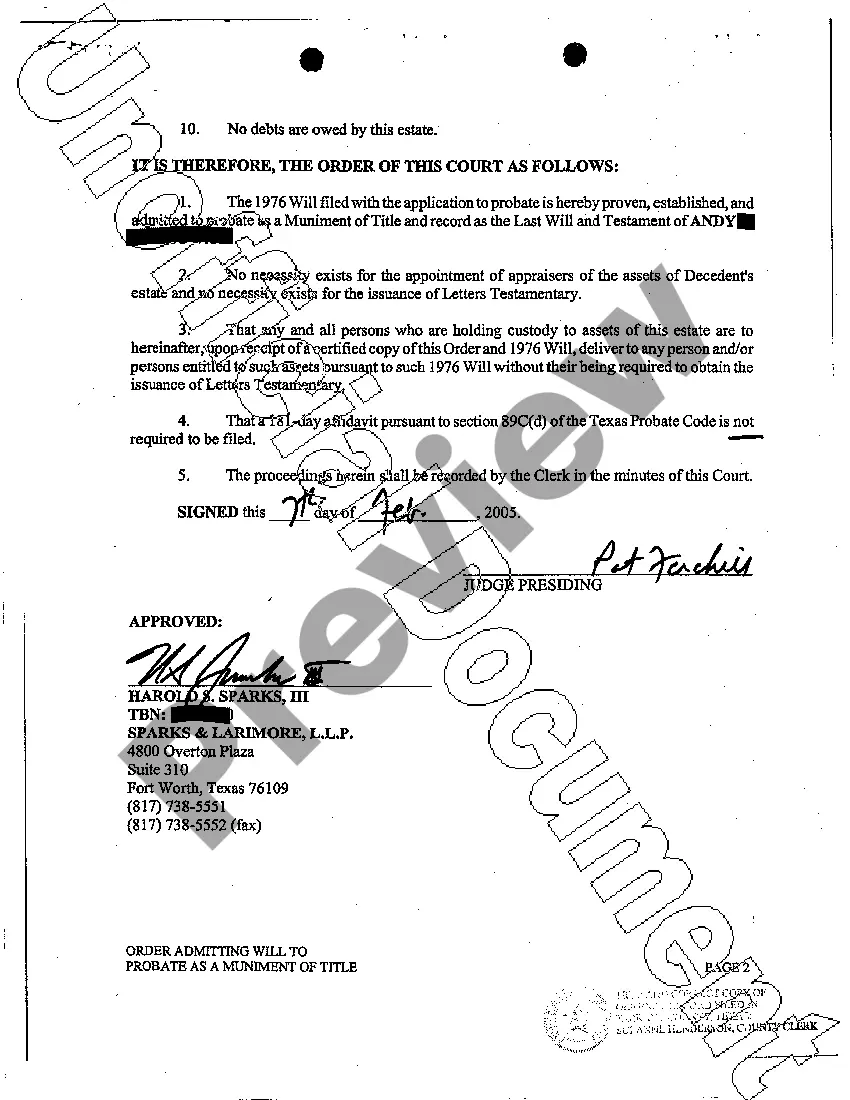

Texas Order Admitting Will to Probate and Last Will and Testament

Description

How to fill out Texas Order Admitting Will To Probate And Last Will And Testament?

Access to top quality Texas Order Admitting Will to Probate and Last Will and Testament templates online with US Legal Forms. Steer clear of days of misused time searching the internet and lost money on forms that aren’t updated. US Legal Forms gives you a solution to just that. Get above 85,000 state-specific authorized and tax templates that you can download and fill out in clicks in the Forms library.

To receive the sample, log in to your account and click on Download button. The file will be stored in two places: on your device and in the My Forms folder.

For individuals who don’t have a subscription yet, have a look at our how-guide listed below to make getting started easier:

- See if the Texas Order Admitting Will to Probate and Last Will and Testament you’re considering is suitable for your state.

- See the form making use of the Preview option and browse its description.

- Check out the subscription page by clicking on Buy Now button.

- Select the subscription plan to go on to register.

- Pay by credit card or PayPal to complete creating an account.

- Select a favored file format to download the document (.pdf or .docx).

Now you can open up the Texas Order Admitting Will to Probate and Last Will and Testament example and fill it out online or print it out and get it done by hand. Take into account giving the file to your legal counsel to be certain all things are completed properly. If you make a mistake, print out and fill application again (once you’ve created an account all documents you download is reusable). Create your US Legal Forms account now and get access to more samples.

Form popularity

FAQ

There is no requirement that a will or property go through probate, but if the decedent owned property that is not arranged specifically to avoid probate, there is no way for the beneficiaries to obtain legal ownership without it.

1) Petition the court to be the estate representative. 2) Notify heirs and creditors. 3) Change legal ownership of assets. 4) Pay Funeral Expenses, Taxes, Debts and Transfer assets to heirs.

Meet the Legal Requirements for Will Creation in Texas. The underlying lost will must itself be valid under Texas law. Show Why Original Will Can't Be Produced. Explain to the probate court why you can't bring the original Will to court. Establish the Contents of the Will.

Probate is required to transfer property out of a deceased individual's name and into the name of a living beneficiary when the asset is not set up to transfer directly by operation of law.

Texas has a probate process similar to many other states, but before we go any further, let's ask an important question: Do you even need to probate the estate? Not all assets go through probate. Assets that automatically transfer to another person without a court order will avoid probate.

If you are named in someone's will as an executor, you may have to apply for probate. This is a legal document which gives you the authority to share out the estate of the person who has died according to the instructions in the will. You do not always need probate to be able to deal with the estate.

Step 1: Filing. Step 2: Posting. Step 3: Will Validation. Step 4: Cataloging Assets. Step 5: Beneficiaries Identified. Step 6 Notifying Creditors. Step 7: Resolving Disputes. Step 8: Distributing Assets.

The court appoints the executor who was named in the will to manage the estate. This involves not only protecting and distributing the decedent's assets, but also taking care of his or her debts and liabilities. Any estate worth less than $75,000 is not required to go through the court.

Probate is required when an estate's assets are solely in the deceased's name. In most cases, if the deceased owned property that had no other names attached, an estate must go through probate in order to transfer the property into the name(s) of any beneficiaries.