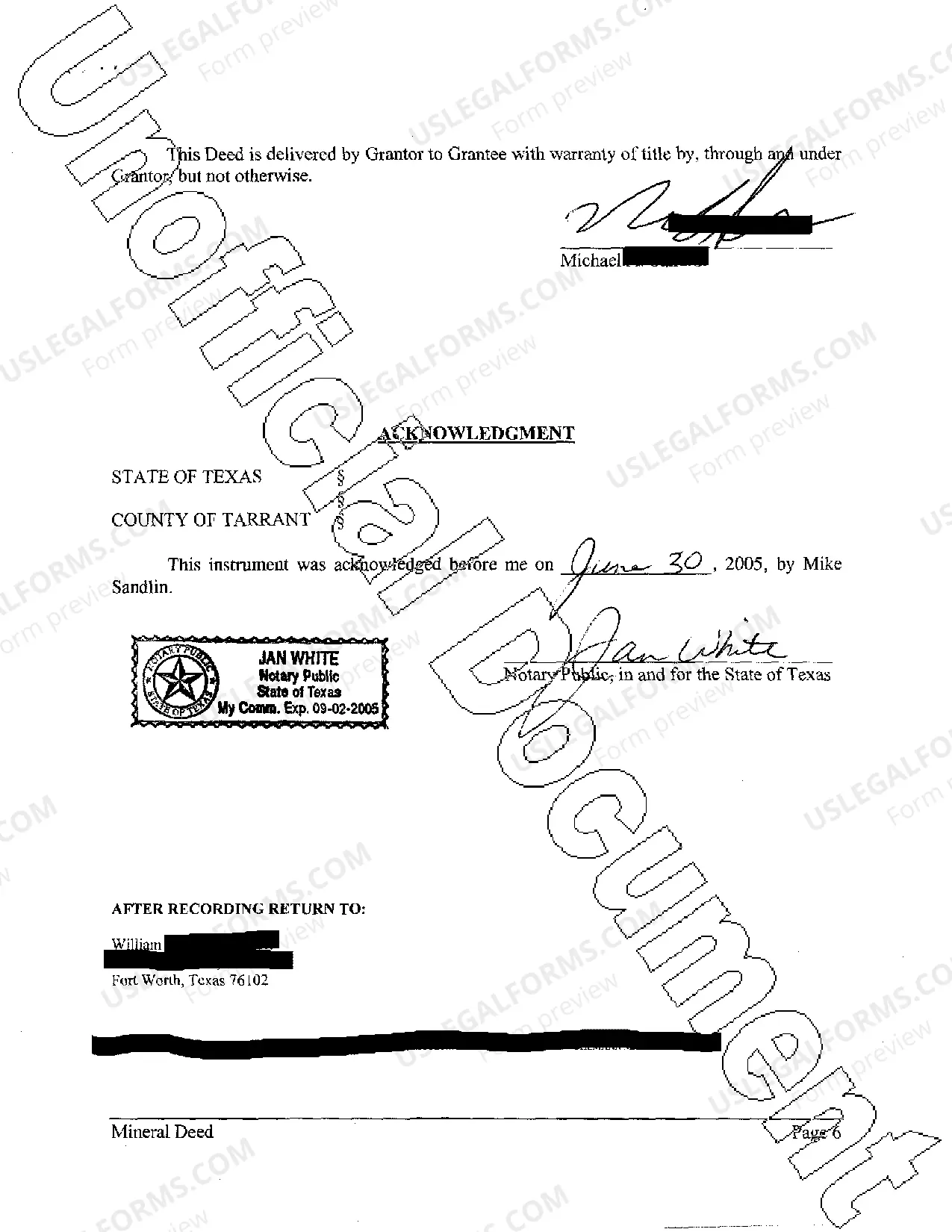

This deed grants, bargains, sells, conveys, and transfers to Grantee an undivided ten percent interest in and to all of Grantor's right, title, and interest in the oil, gas, and other minerals in, on, and under that may be produced from the agreed upon land.

Texas Mineral Deed

Description Mineral Rights Deed Transfer Form Texas

How to fill out Deed Of Conveyance Philippines?

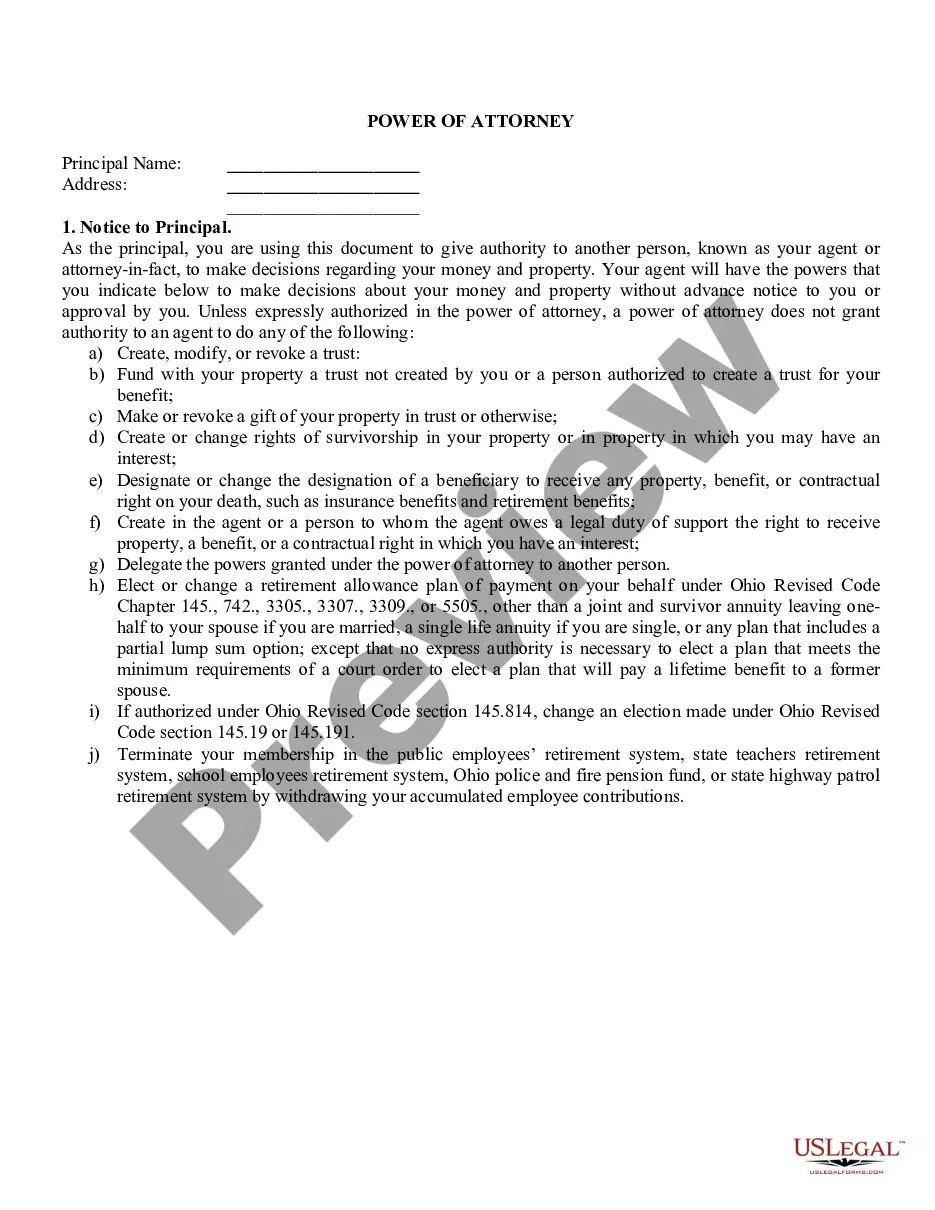

Access to top quality Texas Mineral Deed forms online with US Legal Forms. Steer clear of days of lost time seeking the internet and dropped money on documents that aren’t updated. US Legal Forms offers you a solution to exactly that. Get around 85,000 state-specific legal and tax forms that you could download and submit in clicks within the Forms library.

To get the example, log in to your account and then click Download. The file will be saved in two places: on the device and in the My Forms folder.

For people who don’t have a subscription yet, check out our how-guide below to make getting started easier:

- See if the Texas Mineral Deed you’re considering is suitable for your state.

- View the sample using the Preview function and read its description.

- Go to the subscription page by simply clicking Buy Now.

- Select the subscription plan to continue on to sign up.

- Pay out by credit card or PayPal to complete making an account.

- Choose a preferred file format to download the document (.pdf or .docx).

You can now open up the Texas Mineral Deed sample and fill it out online or print it and get it done yourself. Take into account giving the papers to your legal counsel to make certain all things are filled in properly. If you make a mistake, print out and complete sample again (once you’ve created an account every document you save is reusable). Make your US Legal Forms account now and access much more forms.

Texas Mineral Deed Form Form popularity

Mineral Deed Transfer Form Other Form Names

Deed For Mineral Rights FAQ

Mineral rights in Texas are the rights to mineral deposits that exist under the surface of a parcel of property. This right normally belongs to the owner of the surface estate; however, in Texas those rights can be transferred through sale or lease to a second party.

A Mineral Deed typically applies to rights under the land itself. It provides the buyer with the option to extract those minerals, but the deed does not contain title to the surface land or any of the buildings attached to the property. The Mineral Deed does contain certain rights.

The General Mineral Deed in Texas transfers ALL oil, gas, and mineral rights from the grantor to the grantee.It also transfers any and all rights to receive royalties, overriding royalties, net profits interests or other payments out of or with respect to those oil, gas and other minerals.

A deed that names the seller/donor and the purchaser/donee. It states and describes the rights being sold or given. Filing of the notarized conveyance in the county government office which is generally the county clerk's office.

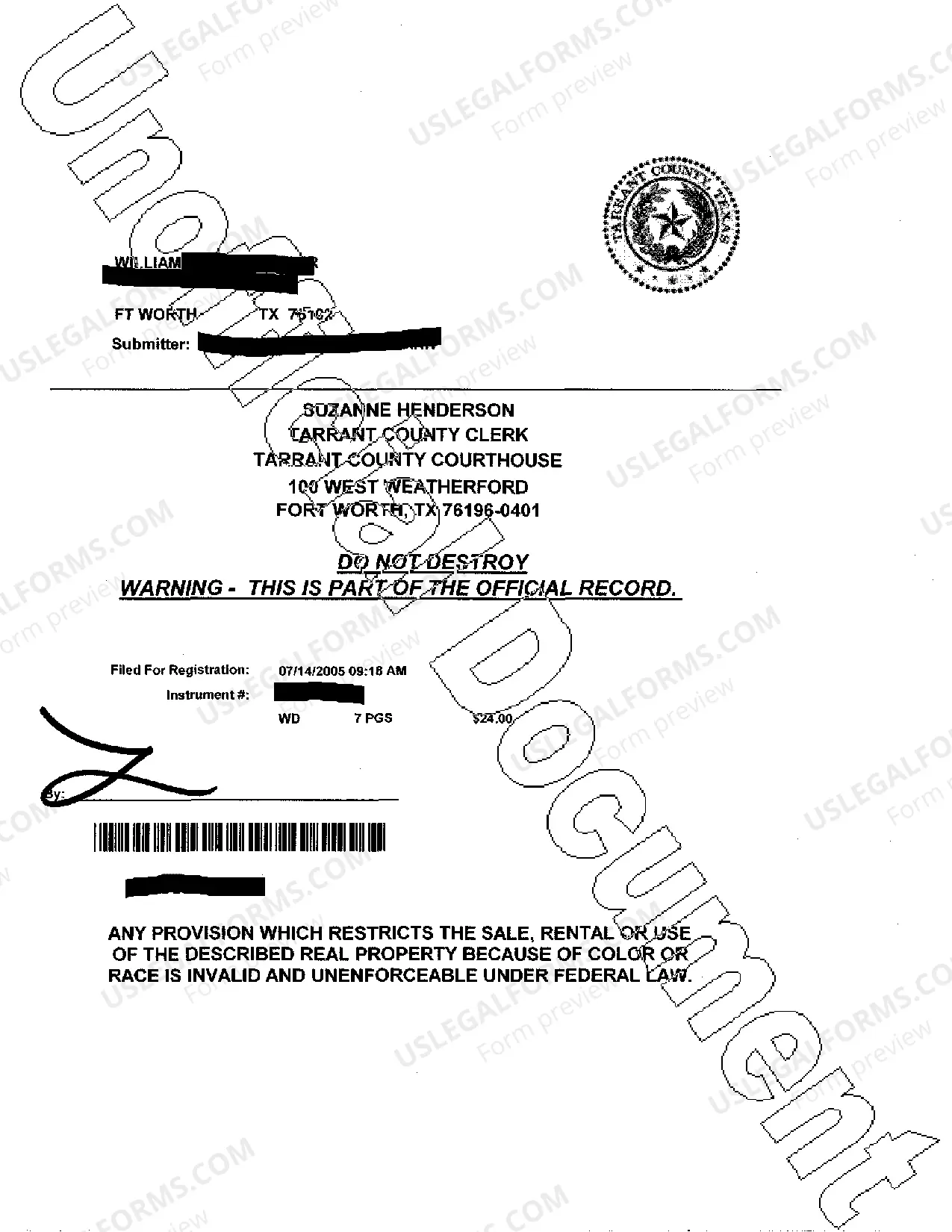

If you're interested in who owns your Texas Mineral Rights located below your property, the best place to start is your local County Clerk's Officenot only is this a free resource; they typically have some of the most up-to-date information you can find.

An owner can separate the mineral rights from his or her land by: Conveying (selling or otherwise transferring) the land but retaining the mineral rights. (This is accomplished by including a statement in the deed conveying the land that reserves all rights to the minerals to the seller.)

If you want to sell the mineral rights to another person, you can transfer them by deed. You will need to create a mineral deed and have it recorded. You should check with the county Recorder of Deeds in the county where the land is located and ask if a printed mineral deed form is available to use.

Under Texas law, ownership of land includes ownership of minerals under the surface of the land.Mineral rights are a form of real property, and they are governed by the same principles of marital property law as other real estate.

Texans do not have to pay state income taxes on mineral rights.In Texas, this includes a gas tax (7.5% tax on the market value of gas) and condensate production tax (4.6% tax on the market value of condensate). It also includes a regulatory fee of . 000667% per thousand cubic feet of gas produced.