Texas Notice to Purchasers

Description

How to fill out Texas Notice To Purchasers?

Access to top quality Texas Notice to Purchasers samples online with US Legal Forms. Avoid days of misused time looking the internet and lost money on documents that aren’t updated. US Legal Forms gives you a solution to exactly that. Find more than 85,000 state-specific authorized and tax forms you can save and fill out in clicks in the Forms library.

To find the sample, log in to your account and click on Download button. The file is going to be saved in two places: on the device and in the My Forms folder.

For individuals who don’t have a subscription yet, take a look at our how-guide listed below to make getting started easier:

- See if the Texas Notice to Purchasers you’re considering is appropriate for your state.

- View the sample making use of the Preview option and browse its description.

- Visit the subscription page by simply clicking Buy Now.

- Select the subscription plan to go on to sign up.

- Pay out by card or PayPal to finish creating an account.

- Pick a preferred format to download the document (.pdf or .docx).

You can now open the Texas Notice to Purchasers example and fill it out online or print it out and do it by hand. Think about giving the file to your legal counsel to be certain all things are filled in appropriately. If you make a error, print and fill sample once again (once you’ve made an account every document you save is reusable). Make your US Legal Forms account now and get access to a lot more forms.

Form popularity

FAQ

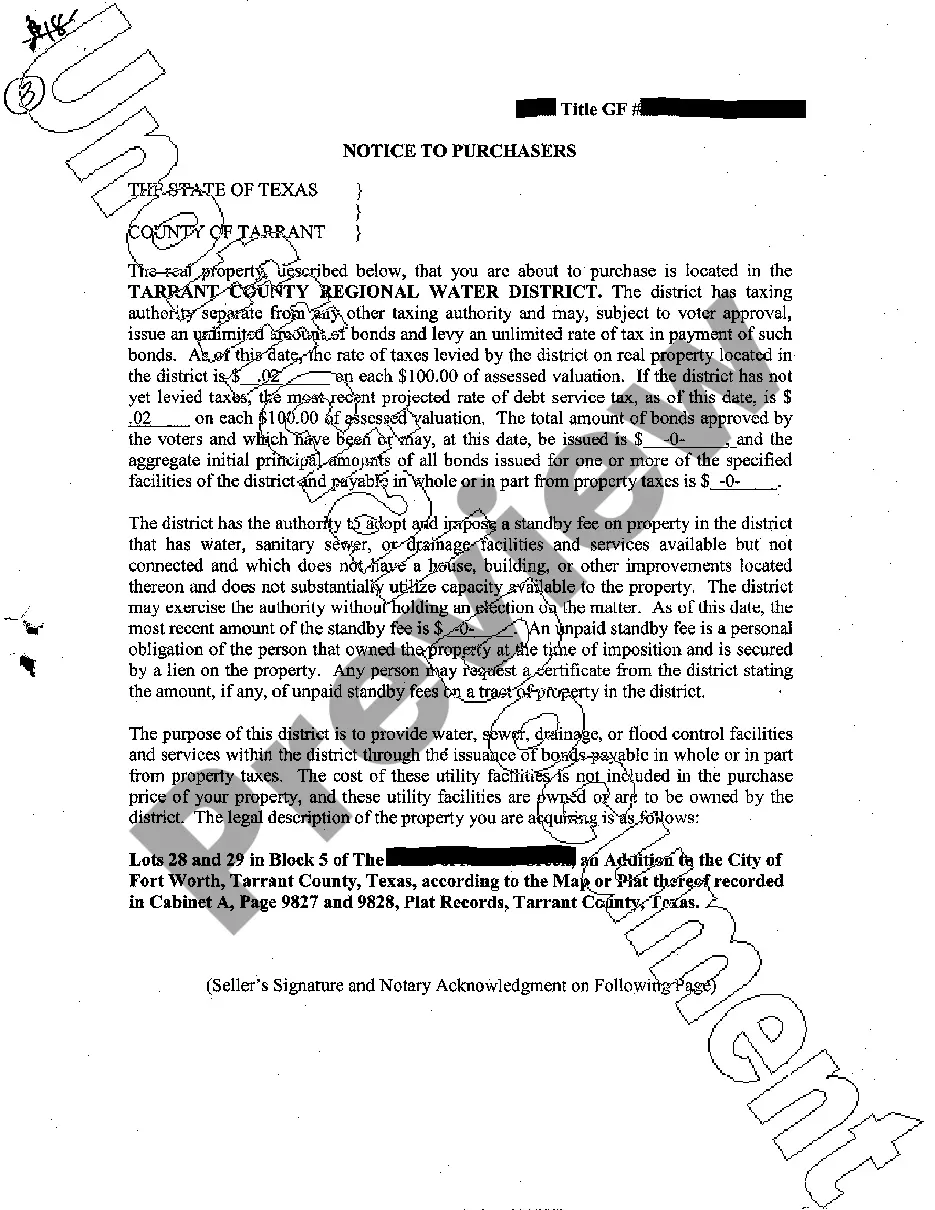

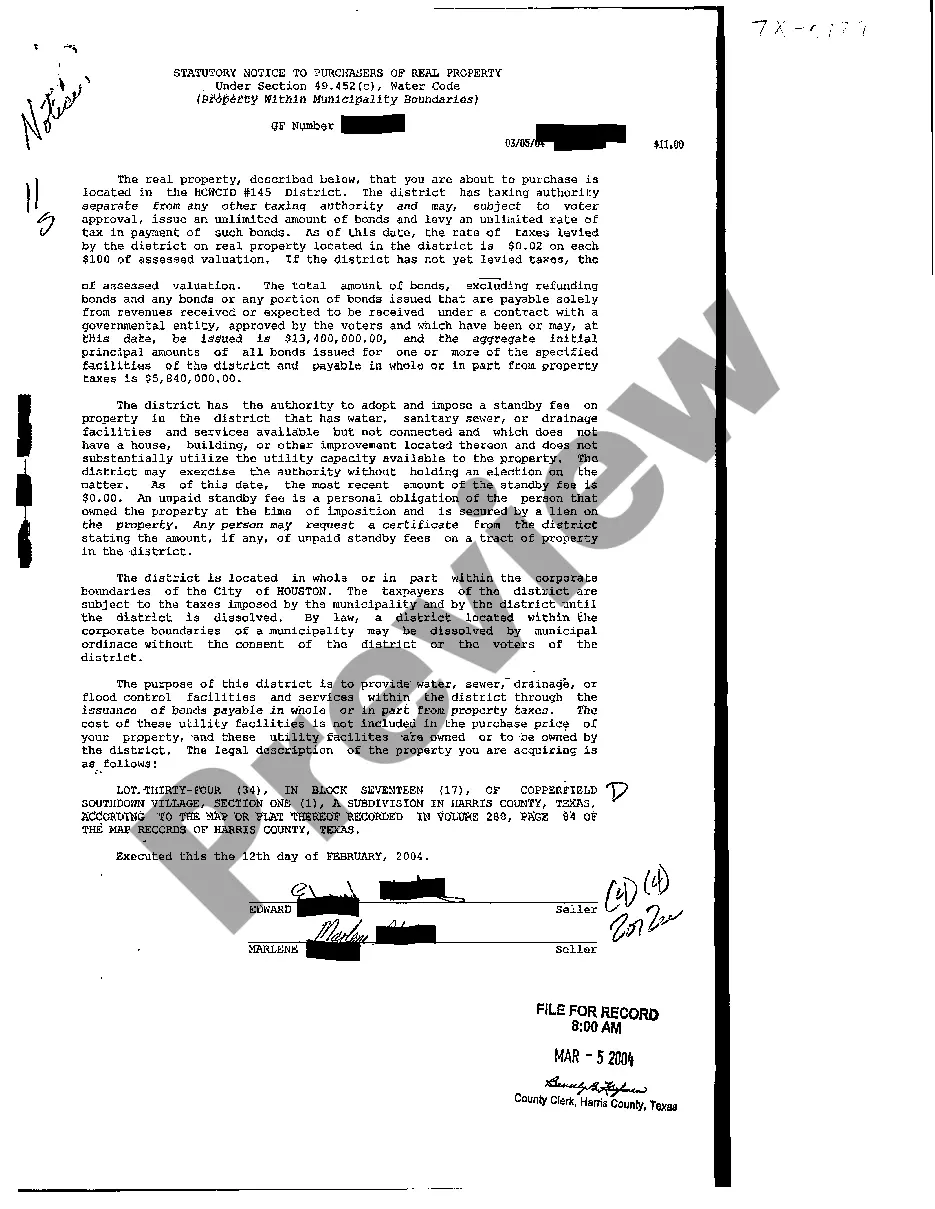

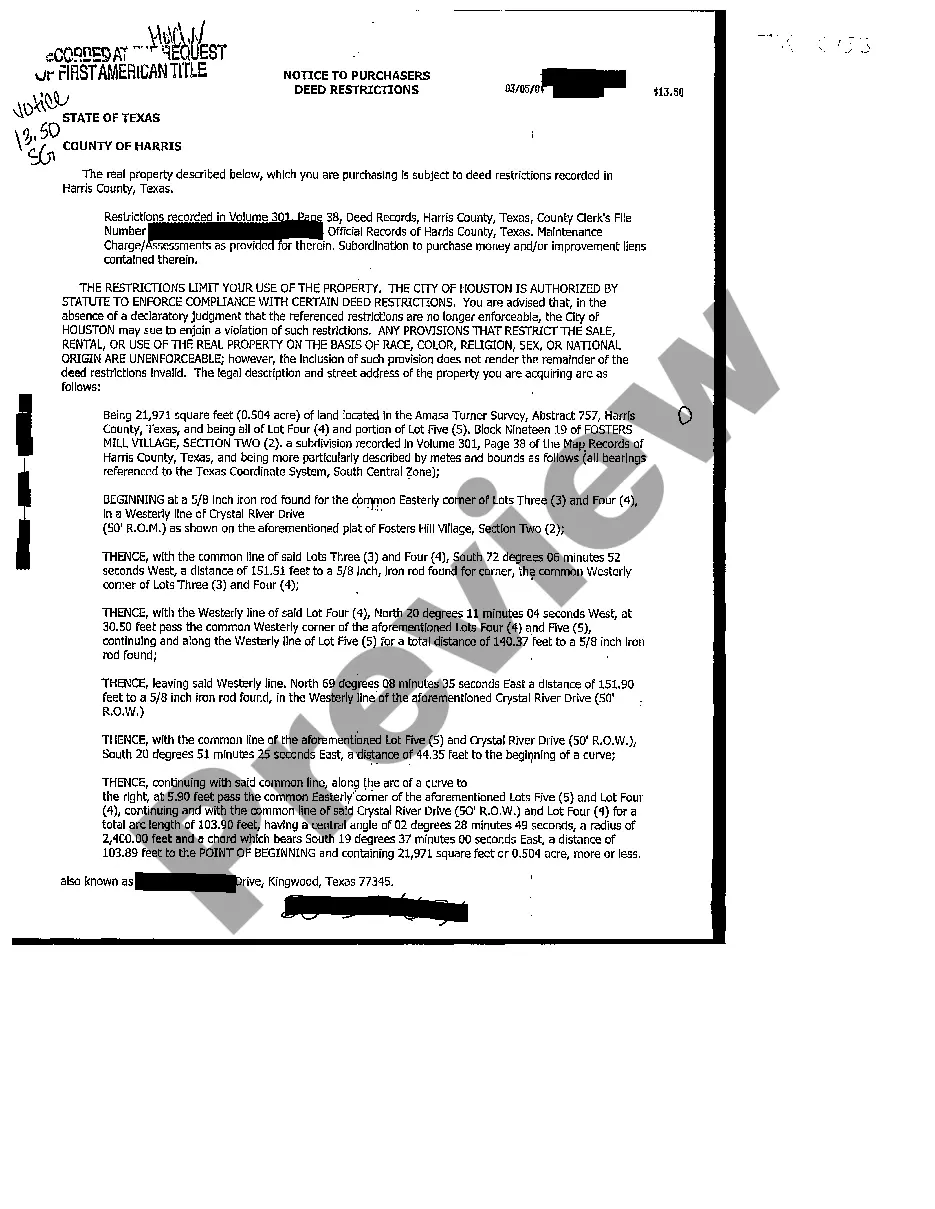

This notice acknowledges that the buyer has been advised by a license holder to have the abstract covering the property examined by an attorney or to obtain a title insurance policy. It also gives information regarding statutory notices that are required if the property is in a Utility District.

The seller is required by the Texas Water Code to provide notice to a buyer that the property is located within a MUD prior to the buyer entering into a sales contract. The notice must provide information regarding the tax rate, bonded indebtedness, and fees, if any, of the MUD.

True; The Farm and Ranch Contract allows for info regarding Exception Documents and Surface Leases.New Home Contracts, the Unimproved Property Contract, and the Farm and Ranch Contract.

A MUD is a taxing entity for a development outside of city limits. A MUD is governed by a board of directors elected by homeowners.The majority of the MUD tax rate is typically for infrastructure debtpaying for everything that links up the development to city or county services, from roads to water, officials said.

Seller agrees to give Purchaser prompt notice of any fire or other casualty occurring at or to the Property between the date of this Agreement and the Closing Date, or of any actual or threatened condemnation of all or any part of the Land of which Seller has knowledge.

TREC's forms are public record, so they are available to anyone. However, the forms are primarily intended for use by real estate license holders, who are generally required to use these forms.

The three main components of property tax structure in Spring Texas are the county tax, school district tax, and the MUD (Municipal Utility District) tax. MUDs are political entities that provide the water, sewage, and drainage services for a community.The MUD tax can range from $0.00 to $1.40.

If the buyer is walking away for a valid reason under the contract, then they are entitled to their earnest money. During the option period, the buyer has the unrestricted right to withdraw for any reason whatsoever.

The TREC contract allows the buyer to submit objections to the survey or the title commitment which the seller shall cure so long as the seller does not have to incur any expense in doing so.