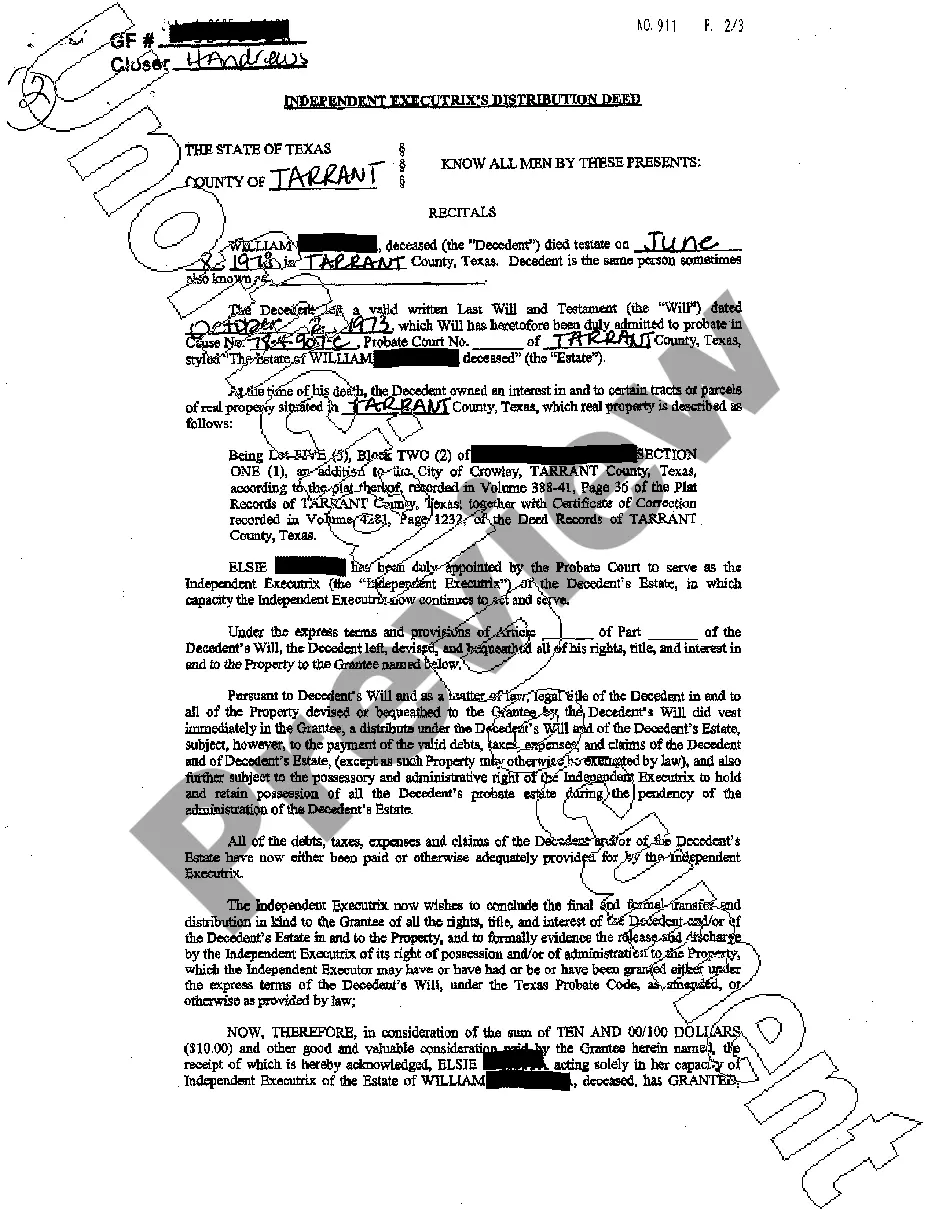

Texas Independent Executrix's Distribution Deed

Description Executrix Deed

How to fill out Texas Independent Executrix's Distribution Deed?

Get access to top quality Texas Independent Executrix's Distribution Deed samples online with US Legal Forms. Prevent hours of wasted time browsing the internet and dropped money on files that aren’t up-to-date. US Legal Forms gives you a solution to exactly that. Get above 85,000 state-specific legal and tax forms that you could save and complete in clicks in the Forms library.

To receive the example, log in to your account and then click Download. The document will be stored in two places: on the device and in the My Forms folder.

For those who don’t have a subscription yet, take a look at our how-guide listed below to make getting started simpler:

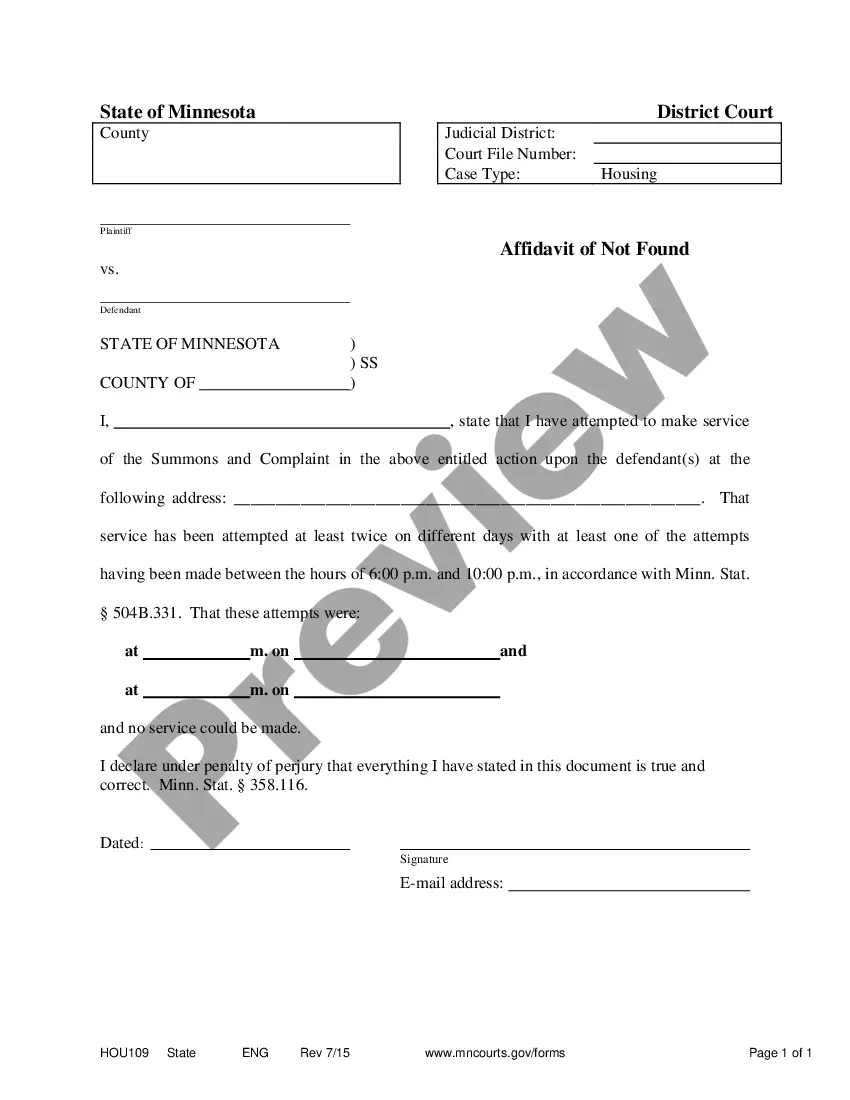

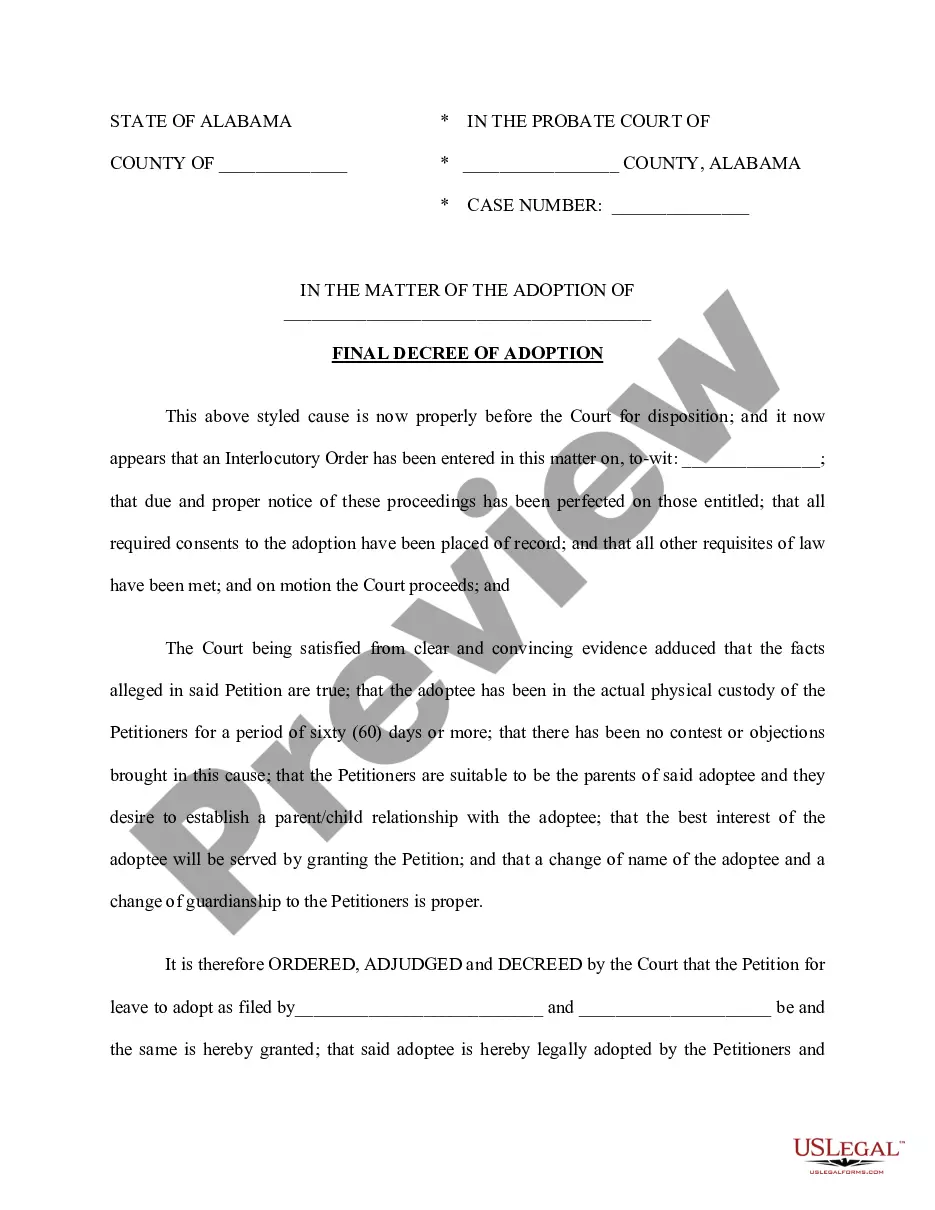

- Find out if the Texas Independent Executrix's Distribution Deed you’re considering is appropriate for your state.

- Look at the sample utilizing the Preview option and read its description.

- Visit the subscription page by clicking Buy Now.

- Select the subscription plan to keep on to sign up.

- Pay out by card or PayPal to complete creating an account.

- Pick a preferred file format to download the file (.pdf or .docx).

You can now open the Texas Independent Executrix's Distribution Deed template and fill it out online or print it out and do it yourself. Consider mailing the file to your legal counsel to be certain all things are filled out appropriately. If you make a mistake, print out and fill application again (once you’ve created an account every document you download is reusable). Create your US Legal Forms account now and get access to more samples.

Form popularity

FAQ

If there's enough money in the estate account, an interim payment can be made to beneficiaries, with executors holding back some money to cover potential costs. These payments should be recorded by asking the beneficiaries to sign a written receipt.

A Will can provide that each Independent Co- Executor may act alone without the consent of the other Indpendent Co-Executor.

Depending on the circumstances, the executor might transfer the title to heirs as directed in the decedent's will or sell the property outright.In any case, the executor must issue a deed for the transfer. Note that executor's deeds do NOT typically include a general warranty on the title.

When the executor has paid off the debts, filed the taxes and sold any property needed to pay bills, he can submit a final estate accounting to the probate court. Once the probate court approves the accounting, he can distribute assets to you and other beneficiaries according to the terms of the will.

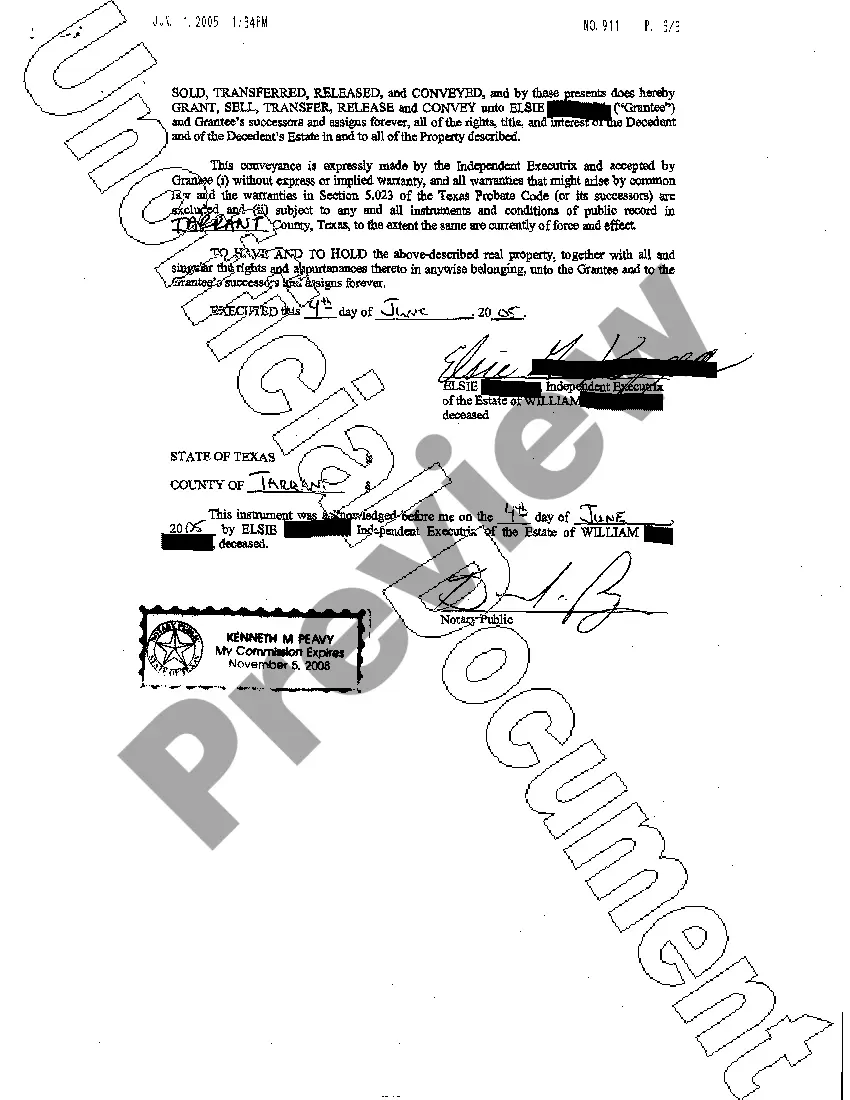

In most states, an executor's deed must be signed by a witness and notarized. An executor's deed should be recorded in the real estate records of the county in which the property being conveyed is located.

Q: How Long Does an Executor Have to Distribute Assets From a Will? A: Dear Waiting: In most states, a will must be executed within three years of a person's death.

If an Executor breaches this duty, then they can be held personally financially liable for their mistakes, and the financial claim that is made against them can be substantial. In an extreme example of this, one Personal Representative failed to settle the Inheritance Tax bill before distributing the Estate.

When you and someone else are named as co-executors in a Will, that essentially means that you must execute the Will together. You must both apply to Probate the Will together. You must both sign checks and title transfers together. Basically, neither of you may act independently of the other.

Those requirements are: That the estate assets are distributed at least 6 months after the deceased's date of death; That the executor has published a 30 day notice of his/her intent to distribute the estate; and. That the time specified in the notice has expired.