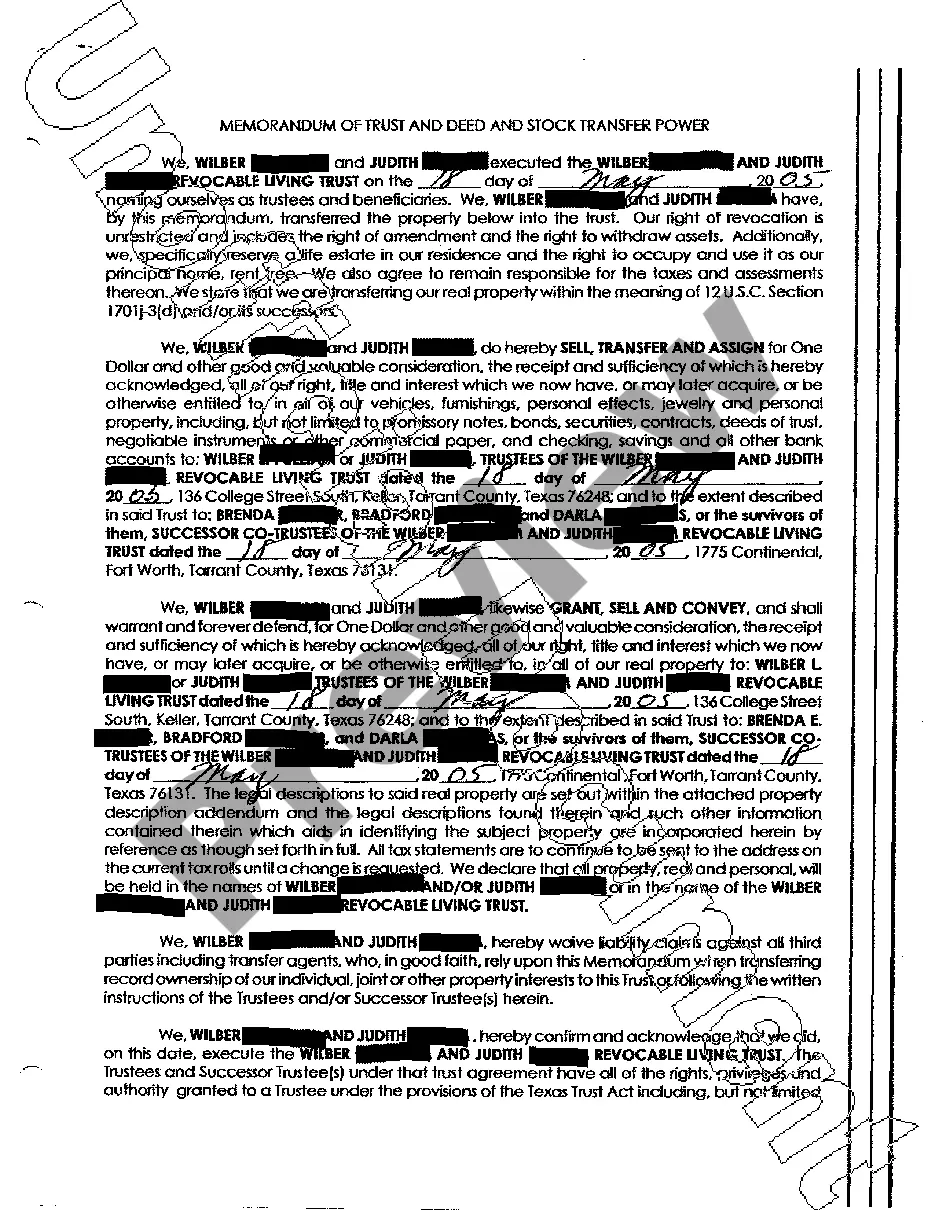

Texas Memorandum of Trust and Deed and Stock Transfer Power

Description

How to fill out Texas Memorandum Of Trust And Deed And Stock Transfer Power?

Access to high quality Texas Memorandum of Trust and Deed and Stock Transfer Power forms online with US Legal Forms. Avoid hours of lost time searching the internet and dropped money on documents that aren’t up-to-date. US Legal Forms provides you with a solution to just that. Find more than 85,000 state-specific authorized and tax templates you can save and submit in clicks in the Forms library.

To find the example, log in to your account and click on Download button. The document is going to be stored in two places: on your device and in the My Forms folder.

For individuals who don’t have a subscription yet, have a look at our how-guide below to make getting started easier:

- Find out if the Texas Memorandum of Trust and Deed and Stock Transfer Power you’re looking at is suitable for your state.

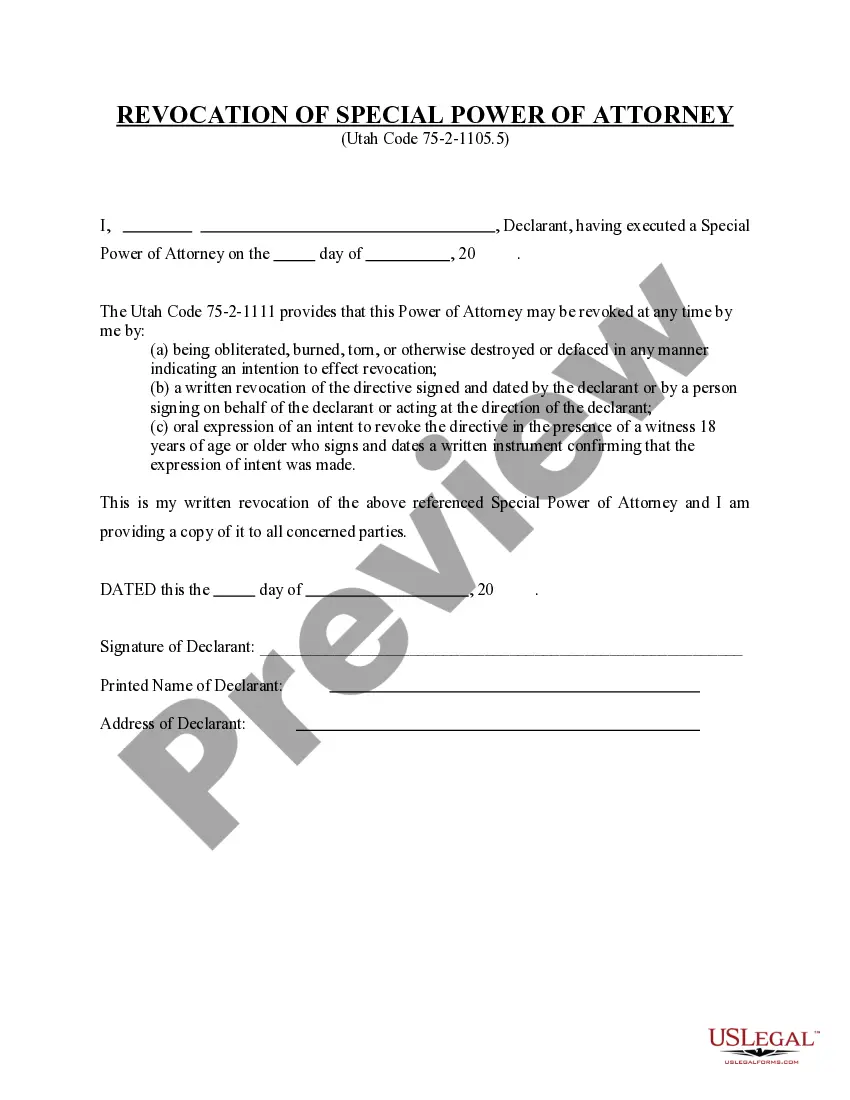

- Look at the sample using the Preview option and read its description.

- Go to the subscription page by simply clicking Buy Now.

- Choose the subscription plan to keep on to sign up.

- Pay out by card or PayPal to complete creating an account.

- Pick a favored format to save the file (.pdf or .docx).

You can now open the Texas Memorandum of Trust and Deed and Stock Transfer Power sample and fill it out online or print it and do it by hand. Consider mailing the file to your legal counsel to make sure everything is completed properly. If you make a mistake, print and complete sample once again (once you’ve created an account every document you download is reusable). Make your US Legal Forms account now and get more samples.

Form popularity

FAQ

Moving Stocks or Bonds to the Trust To put stocks or bonds that you hold into a trust, you typically use a document called a securities assignment (sometimes called a "stock power"). This document asks the securities' transfer agent for permission to transfer the securities to your trust.

Placing an investment account with a named beneficiary in a trust does not negate the original beneficiary designation.This can cause confusion among the trust beneficiaries as to why the investment accounts are not included in with the trust assets. An unhappy beneficiary could take the matter to the probate court.

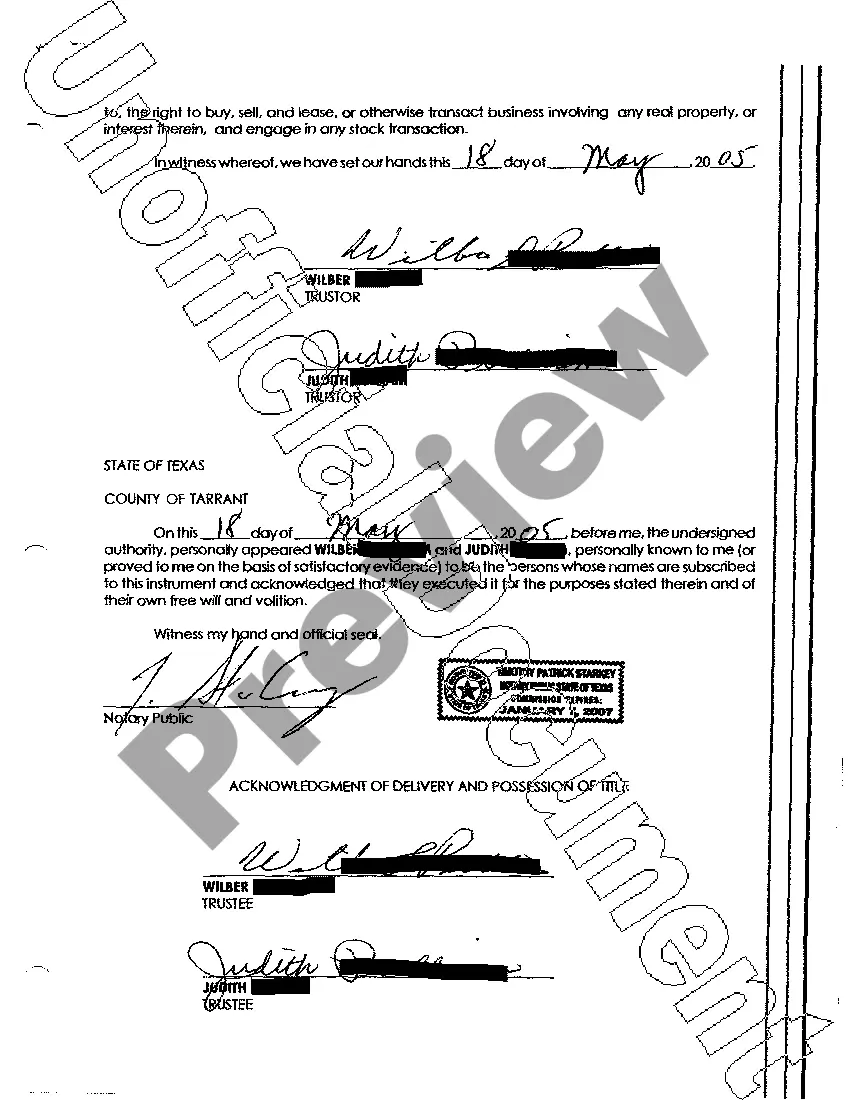

Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries who will get the trust property. Create the trust document. Sign the document in front of a notary public.

Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries who will get the trust property. Create the trust document. Sign the document in front of a notary public.

Qualified retirement accounts 401ks, IRAs, 403(b)s, qualified annuities. Health saving accounts (HSAs) Medical saving accounts (MSAs) Uniform Transfers to Minors (UTMAs) Uniform Gifts to Minors (UGMAs) Life insurance. Motor vehicles.

Assets Held in the Trustee's Name Kahane Revocable Living Trust or the Nessler Family Trust. In particular, look for a list of assets at the end of the document. It will likely be labeled Schedule A or something similar, and should list the items the person who set up the trust intended to hold in the trust.

What Is the Process of Transferring Shares to My Trust? If you want any existing shares you own to be held by your trust instead, you will need to transfer those shares to your trust. You will need to inform the company that you intend to transfer your shares to your trust.

To transfer over an existing account already in individual names, you just put the account number(s) in Section 4. The Certification of Trust form requires signatures to be notarized. Instead of using Fidelity's form, I just attached a copy of the trust certification document prepared and notarized by our lawyer.

Locate the deed that's in trust. Use the proper deed. Check with your title insurance company and lender. Prepare a new deed. Sign in the presence of a notary. Record the deed in the county clerk's office.