Texas Real Estate Lien Note

Description Lien On Property

How to fill out Lien Note?

Access to quality Texas Real Estate Lien Note samples online with US Legal Forms. Avoid days of lost time searching the internet and lost money on documents that aren’t up-to-date. US Legal Forms provides you with a solution to just that. Find around 85,000 state-specific authorized and tax samples that you can download and complete in clicks within the Forms library.

To get the sample, log in to your account and click Download. The file is going to be stored in two places: on the device and in the My Forms folder.

For those who don’t have a subscription yet, check out our how-guide listed below to make getting started simpler:

- Verify that the Texas Real Estate Lien Note you’re considering is appropriate for your state.

- See the sample making use of the Preview function and browse its description.

- Check out the subscription page by clicking Buy Now.

- Choose the subscription plan to continue on to sign up.

- Pay by credit card or PayPal to complete creating an account.

- Pick a preferred file format to download the document (.pdf or .docx).

You can now open the Texas Real Estate Lien Note example and fill it out online or print it out and do it by hand. Take into account giving the document to your legal counsel to be certain everything is completed correctly. If you make a error, print and complete application again (once you’ve made an account every document you save is reusable). Create your US Legal Forms account now and get access to a lot more samples.

Lien Example Form popularity

Real Property Examples Other Form Names

Property Lien Example FAQ

Texas has a homestead exemption, which means creditors can still place liens on a debtor's primary real estate, but they cannot seize the property. However, having a lien on your homestead still clouds the title.

Fill out the appropriate mechanics lien form. (Lien form for Original Contractors Lien form for Subcontractors & Suppliers) Deliver your lien form to the county recorder office. Serve your lien on the property owner.

A lien is a legal right or claim against a property by a creditor. Liens are commonly placed against property, such as homes and cars, so creditors, such as banks and credit unions, can collect what is owed to them. Liens can also be removed, giving the owner full and clear title to the property.

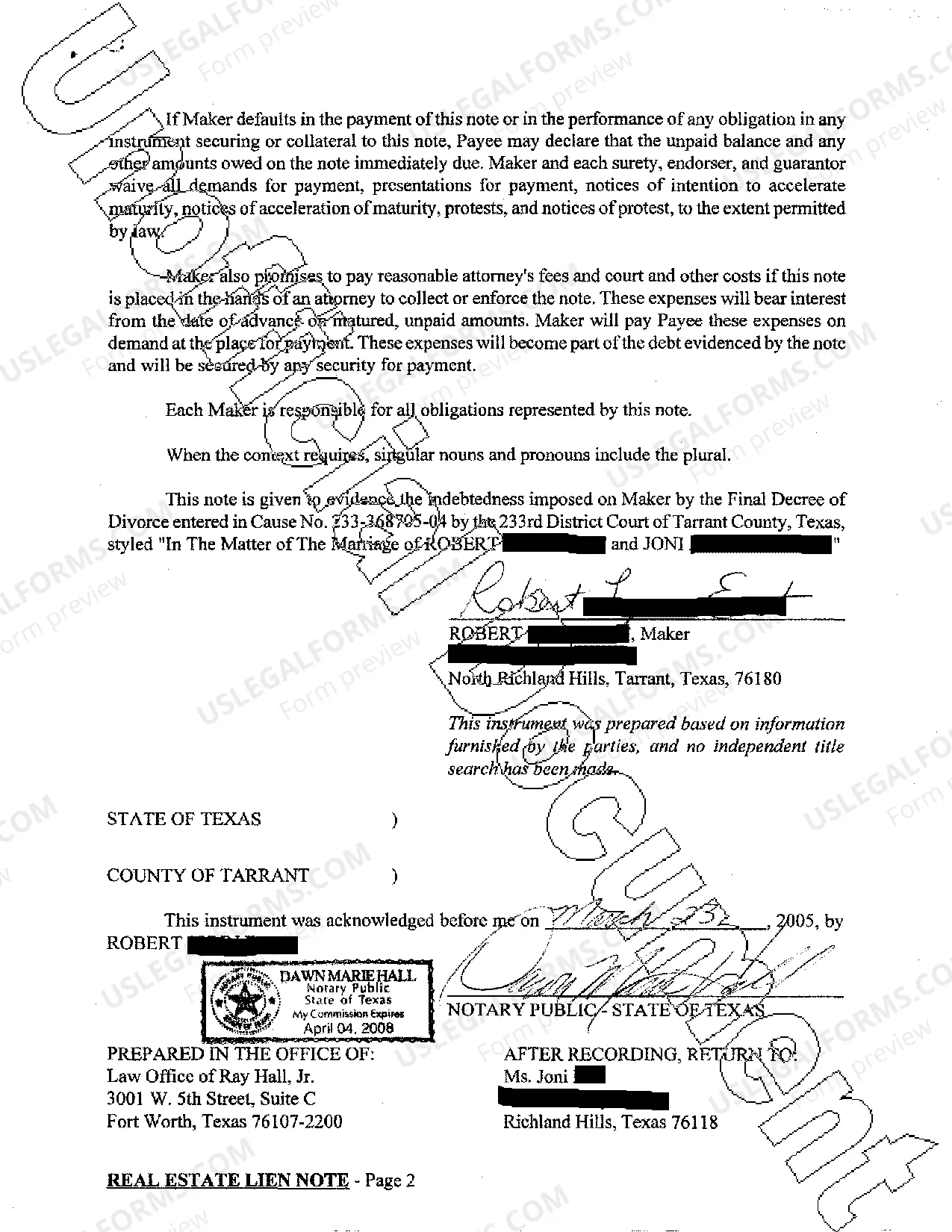

In the United States, a mortgage note (also known as a real estate lien note, borrower's note) is a promissory note secured by a specified mortgage loan. Mortgage notes are a written promise to repay a specified sum of money plus interest at a specified rate and length of time to fulfill the promise.

A judgment lien lasts for ten years. According to Section 52.001 of the Texas Property Code, a judgment lien cannot attach to any real property that is exempt from seizure or forced sale under Chapter 41 of the Texas Property Code.