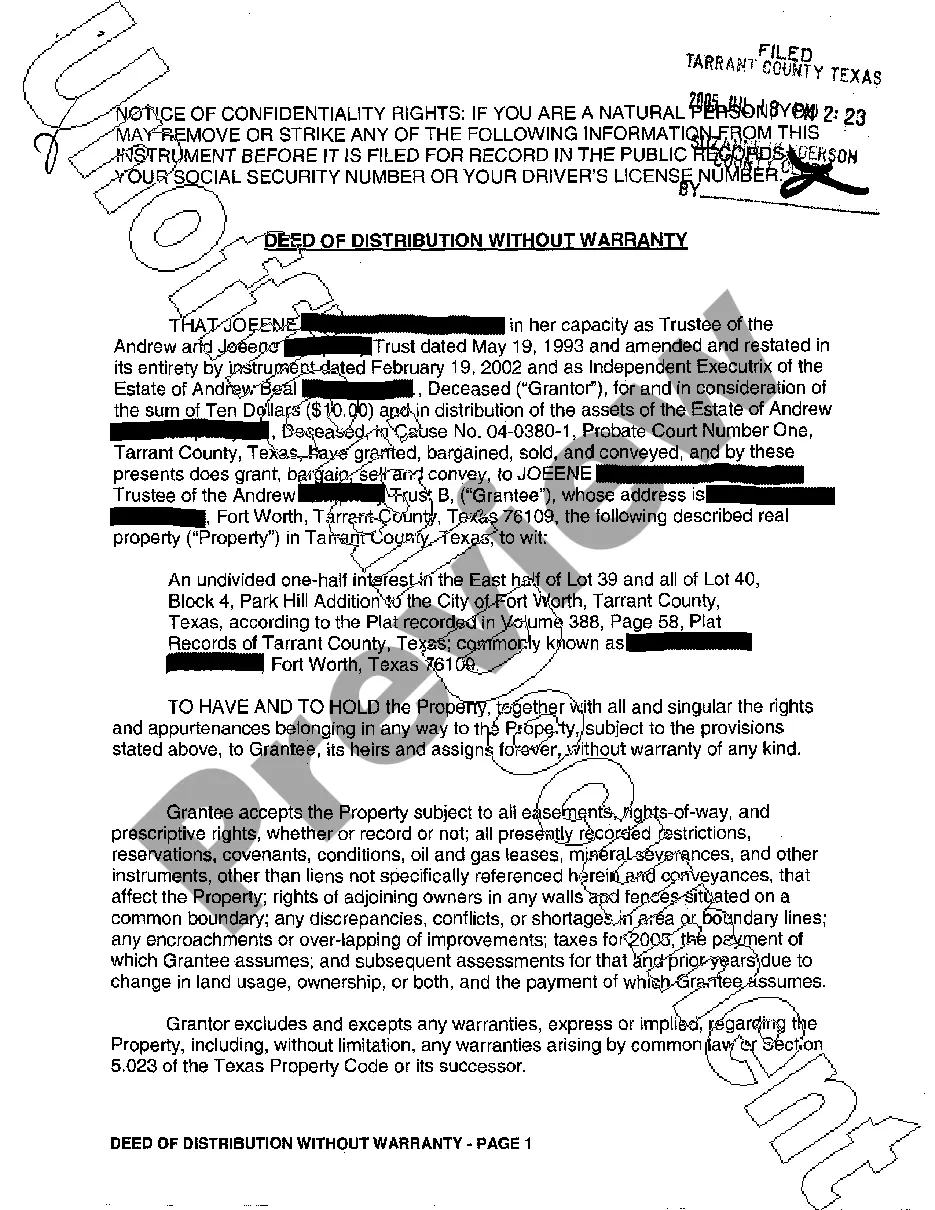

Texas Deed of Distribution Without a Warranty

Description Deed Without Warranty Texas Pdf

How to fill out Warranty Deeds In Texas?

Get access to top quality Texas Deed of Distribution Without a Warranty samples online with US Legal Forms. Prevent days of wasted time looking the internet and dropped money on forms that aren’t up-to-date. US Legal Forms offers you a solution to just that. Find above 85,000 state-specific legal and tax templates you can save and complete in clicks within the Forms library.

To find the sample, log in to your account and click on Download button. The file is going to be saved in two places: on your device and in the My Forms folder.

For those who don’t have a subscription yet, check out our how-guide below to make getting started simpler:

- Verify that the Texas Deed of Distribution Without a Warranty you’re considering is suitable for your state.

- View the sample utilizing the Preview option and browse its description.

- Go to the subscription page by clicking on Buy Now button.

- Select the subscription plan to continue on to register.

- Pay by card or PayPal to complete making an account.

- Pick a favored format to save the file (.pdf or .docx).

Now you can open the Texas Deed of Distribution Without a Warranty example and fill it out online or print it out and get it done yourself. Consider sending the file to your legal counsel to be certain everything is filled in correctly. If you make a error, print out and fill sample once again (once you’ve created an account every document you save is reusable). Make your US Legal Forms account now and access a lot more templates.

Texas Deed Without Warranty Form popularity

What Is A Warranty Deed In Texas Other Form Names

Sample Warranty Deed Texas FAQ

A warranty deed, also known as a general warranty deed, is a legal real estate document between the seller (grantor) and the buyer (grantee). The deed protects the buyer by pledging that the seller holds clear title to the property and there are no encumbrances, outstanding liens, or mortgages against it.

A Deed Without Warranty is a document that transfers title without any warranties, express or implied, as to any subjects. This type of instrument is the lowest form of deed in Texas.

A warranty deed guarantees that: The grantor is the rightful owner of the property and has the legal right to transfer the title.The title would withstand third-party claims to ownership of the property. The grantor will do anything to ensure the grantee's title to the property.

In a Non-Warranty Deed, the seller gives no warranties.In a Non-Warranty or Quitclaim Deed, the seller merely is giving the buyer whatever rights, if any, that the seller has in the property and the seller makes no warranties of any nature about the seller's rights in the property.

The deed and any related agreements should be filed in the land records of the county where the property is located. The county clerk will require a recording fee. Recording fees can vary, but usually range from $11.00 to $30.00 for the first page and $4.00 for each additional page.

A distribution deed is a way to legally transfer real property when the party who is supposed to receive the property cannot be determined from the decedent's will.In other words, the party obtaining the distribution deed will assume control and ownership of the property.

A warranty deed contains a guarantee that the grantor has legal title and rights to the real estate. A quitclaim deed offers little to no protection to the grantee.Warranty deeds ensure that the grantor has the right to sell the property, and guarantees that there are no liens or encumbrances against the land.

There are four major deeds in Texas: general warranty deeds, special warranty deeds, no warranty deeds, and quitclaims.

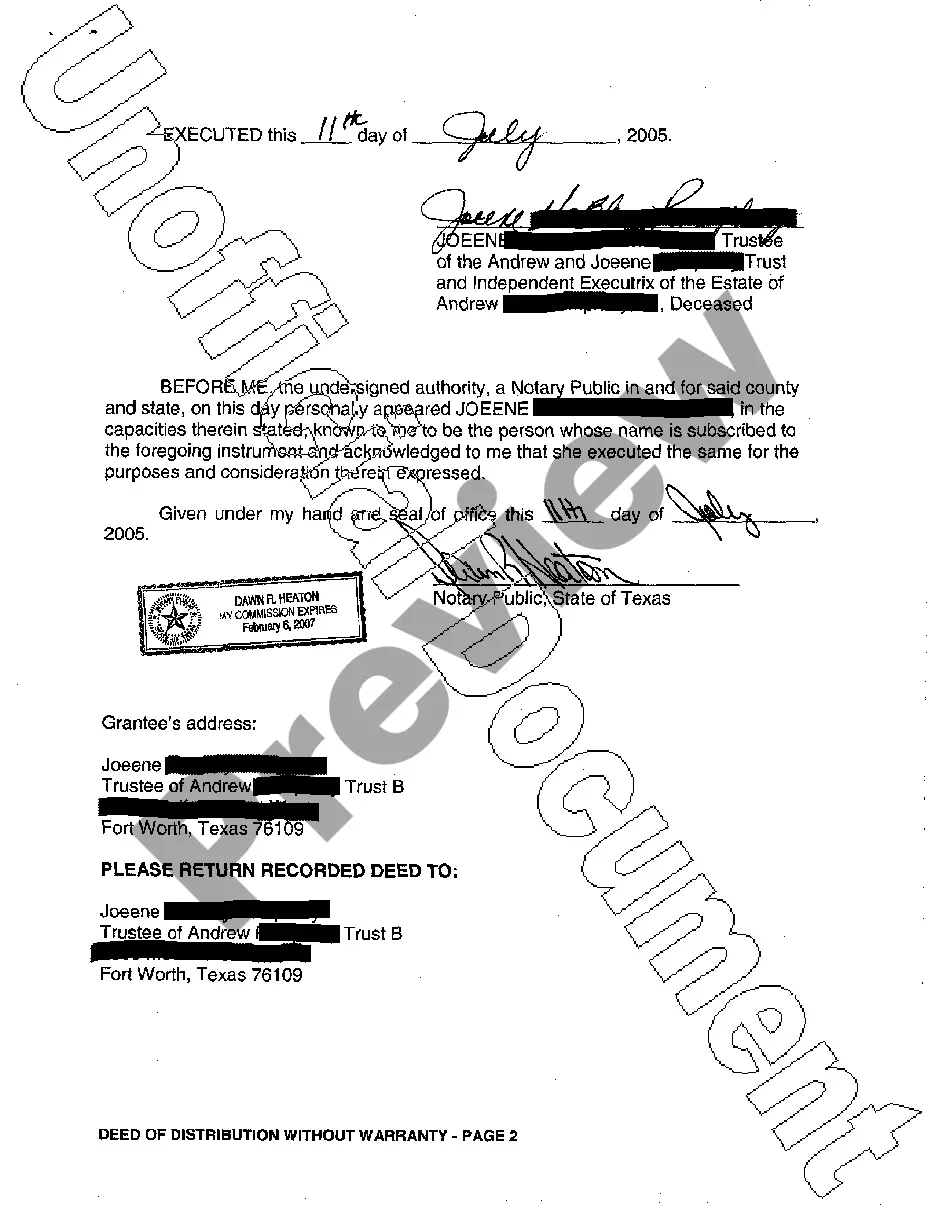

Find the most recent deed to the property. It is best to begin with a copy of the most recent deed to the property (the deed that transferred the property to the current grantor). Create a new deed. Sign and notarize the deed. File the documents in the county land records.