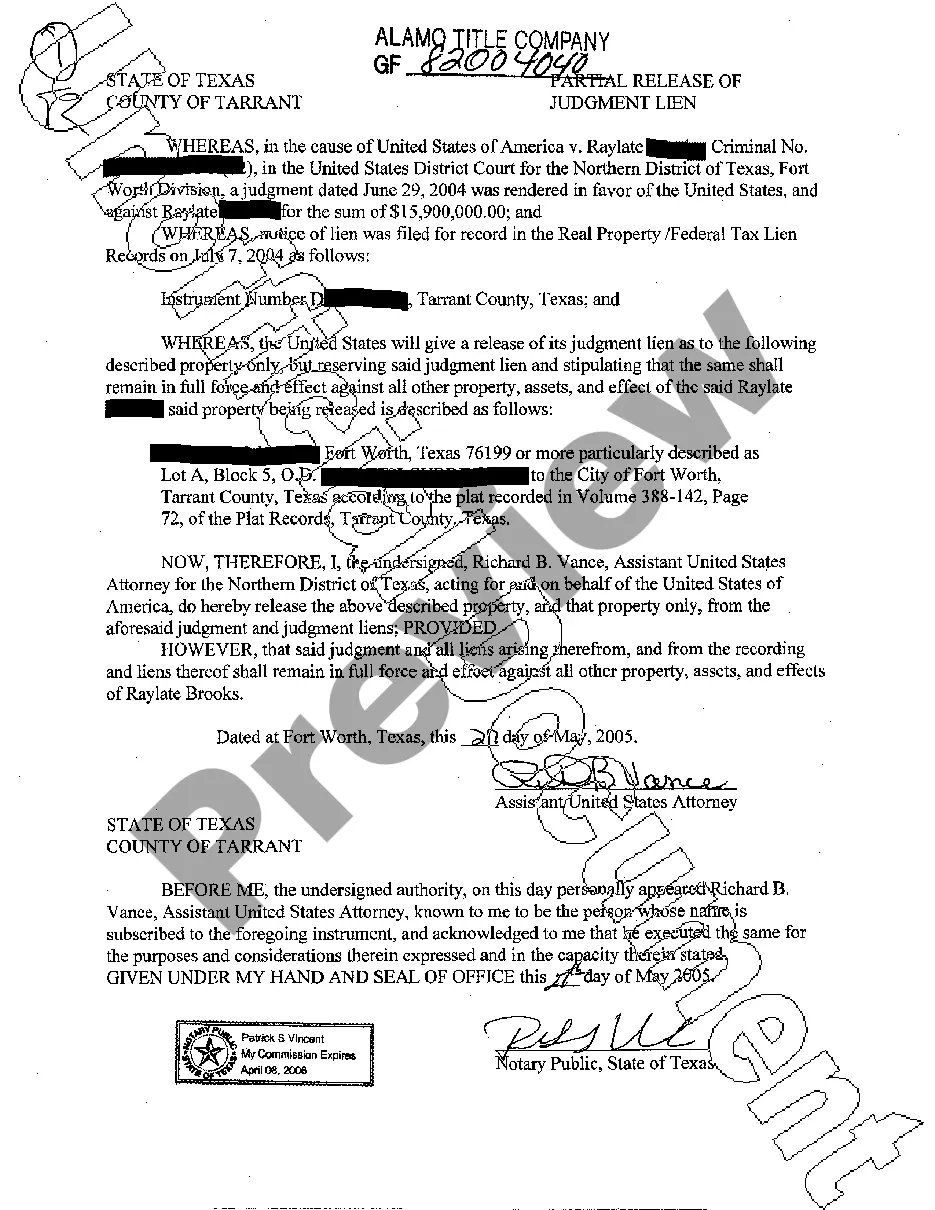

Texas Partial Release of Judgment Lien

Description Release Of Lien Texas Property Form

How to fill out Judgement Release?

Access to high quality Texas Partial Release of Judgment Lien templates online with US Legal Forms. Avoid days of misused time browsing the internet and dropped money on files that aren’t up-to-date. US Legal Forms offers you a solution to just that. Find above 85,000 state-specific authorized and tax samples that you can download and submit in clicks in the Forms library.

To find the example, log in to your account and click on Download button. The document is going to be stored in two places: on your device and in the My Forms folder.

For individuals who don’t have a subscription yet, take a look at our how-guide listed below to make getting started simpler:

- Find out if the Texas Partial Release of Judgment Lien you’re looking at is suitable for your state.

- View the sample making use of the Preview function and browse its description.

- Check out the subscription page by simply clicking Buy Now.

- Choose the subscription plan to continue on to sign up.

- Pay out by card or PayPal to finish making an account.

- Choose a preferred file format to save the file (.pdf or .docx).

Now you can open up the Texas Partial Release of Judgment Lien template and fill it out online or print it and do it yourself. Take into account sending the papers to your legal counsel to ensure everything is filled in properly. If you make a mistake, print and complete application once again (once you’ve created an account all documents you save is reusable). Create your US Legal Forms account now and get more templates.

Property Lien Form Texas Form popularity

Texas Abstract Of Judgment Other Form Names

Texas Release Of Lien Form Pdf FAQ

If the judgment creditor does not immediately file an Acknowledgement of Satisfaction of Judgment (EJ-100) when the judgment is satisfied, the judgment debtor may make a formal written demand for the creditor to do so. The judgment creditor has 15 days after receiving the debtor's request to serve the acknowledgement.

Add or Remove a Lien on a Vehicle To add or remove a lien on your vehicle title, visit your local county tax office. The title fee is $28 or $33, depending on your county, and must be paid at time of application. Please contact your local county tax office for the exact cost.

There are a few ways you can satisfy or avoid a lien altogether. The firstand most obviousoption is to repay the debt. If you pay off your obligation, the creditor will remove the lien. This is done by filing a release through the same place the lien was recordedthe county or state.

The subcontractor would file a lien waiver before a lien is filed. By doing so, the subcontractor is giving up his or her right to a lien against the property. In comparison, a lien release (also known as release of lien, cancellation of lien, or a lien cancellation) would come into play after the filing of a lien.

Write your name and return address in the top three lines of the letter. Insert the complete date (month, day, year). Enter the recipient's name, title, company name and address on the next five lines. Greet the reader by writing "Dear (recipient's name):" Skip two lines. State the subject in a subject line.

A Lien Release (also considered a Lien Cancellation or Release of Lien) is a legally binding document that is sent by the current lien holder, the individual who has leased the property or provided payment to secure the property, that informs any debt in relation to that property has been fulfilled and they relinquish

There are two options. You can obtain a full release of the abstract of judgment from the creditor or you can file your own partial release of the abstract of judgment as it relates to your homestead.

Satisfy the terms of the loan by paying the balance of the loan back to the lender, including any interest incurred. If you don't receive the lien release, submit a request to your lender for proof that the loan has been satisfied.

Lenders in Texas customarily use a release of lien when the loan secured by a deed of trust has been paid in full or otherwise satisfied.The release of lien is recorded in the county where the real property collateral is located.