Texas Land Trust Agreement

Description

What is a Land Trust Agreement?

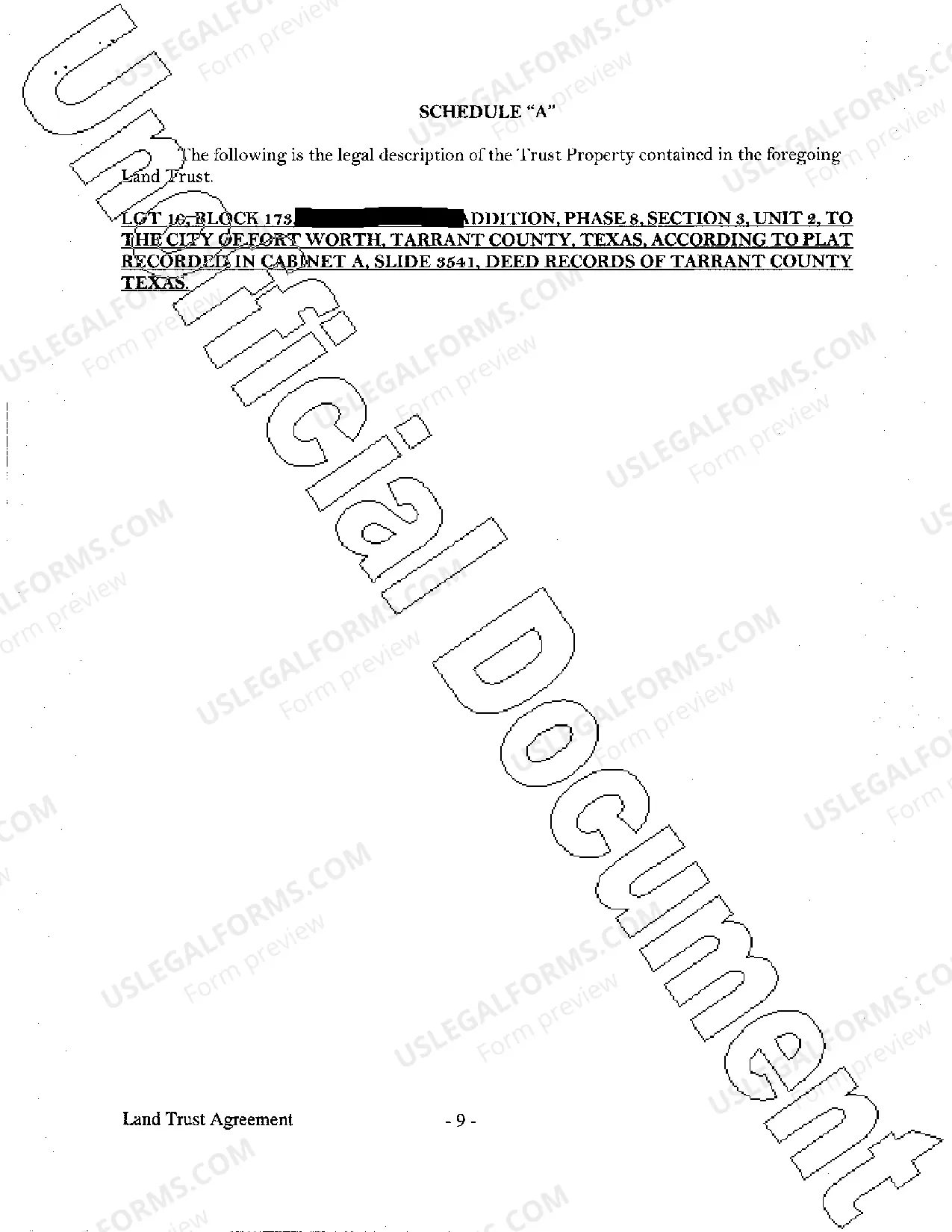

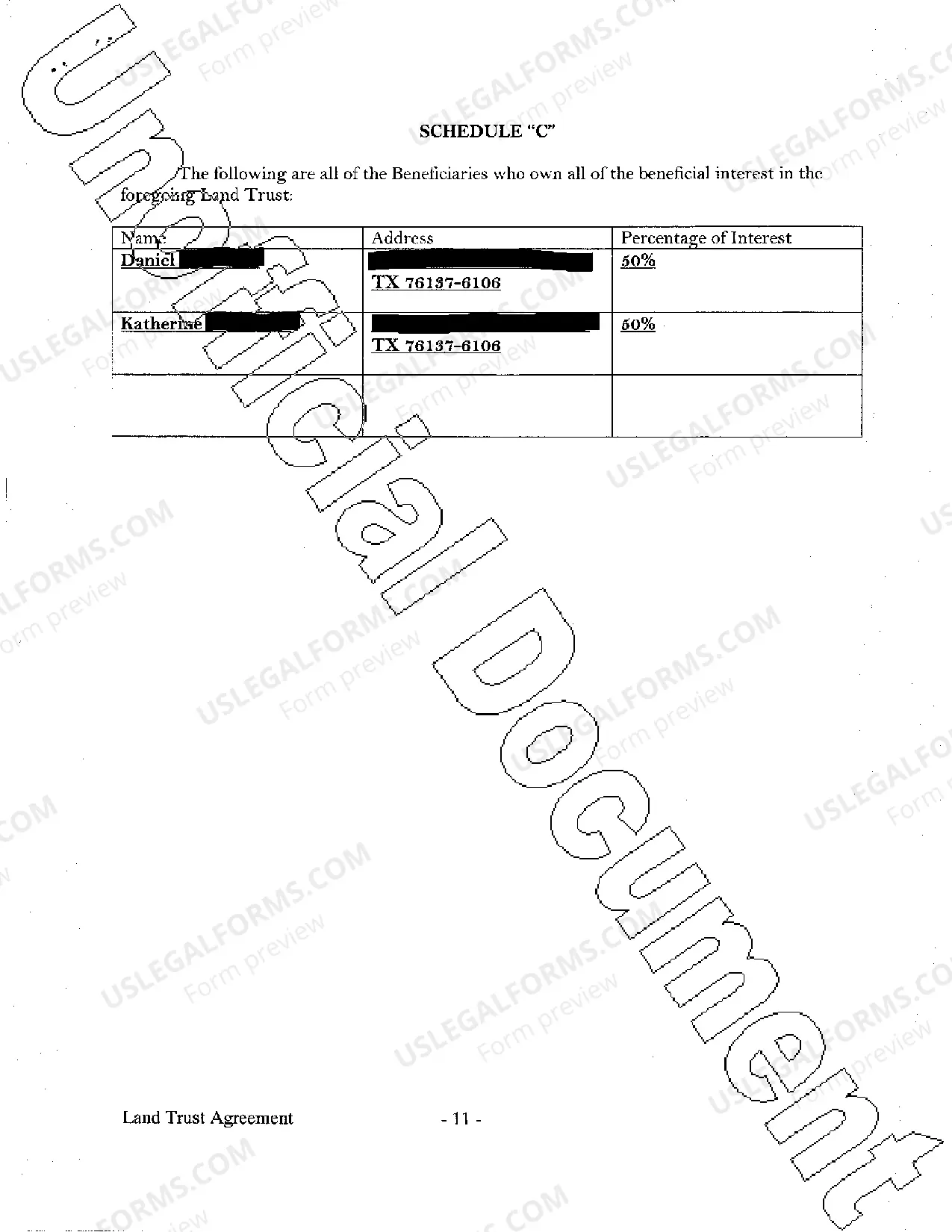

A land trust agreement is a legal document that assigns the management of real estate property to a trustee. This arrangement allows property owners in the United States to maintain privacy over ownership details while still benefiting from the property. The trustee holds title to the property, manages, or sells it as per the agreements stated within the trust.

Key Concepts & Definitions

- Real Estate Planning: The process of making advance arrangements for the management of one's real estate, which includes land trusts.

- Successor Trustee Responsibilities: Refers to duties taken on by a trustee after the original trustee can no longer manage the trust property, typically due to resignation or death.

- Beneficiary Rights: Legal rights entitled to the beneficiary of a trust, including the right to information and to benefit from the trust assets.

- Trust Property Management: The management and administration of property held in a trust.

Step-by-Step Guide on Setting Up a Land Trust Agreement

- Consult with Estate Planning Lawyers to discuss goals and legality.

- Choose a suitable Trustee and Successor Trustee.

- Define the beneficiary rights and trustee responsibilities clearly in the agreement.

- Use a trust agreement template to draft the agreement or create a custom agreement with legal assistance.

- Review and modify the agreement with a focus on intellectual property rights and trust property management.

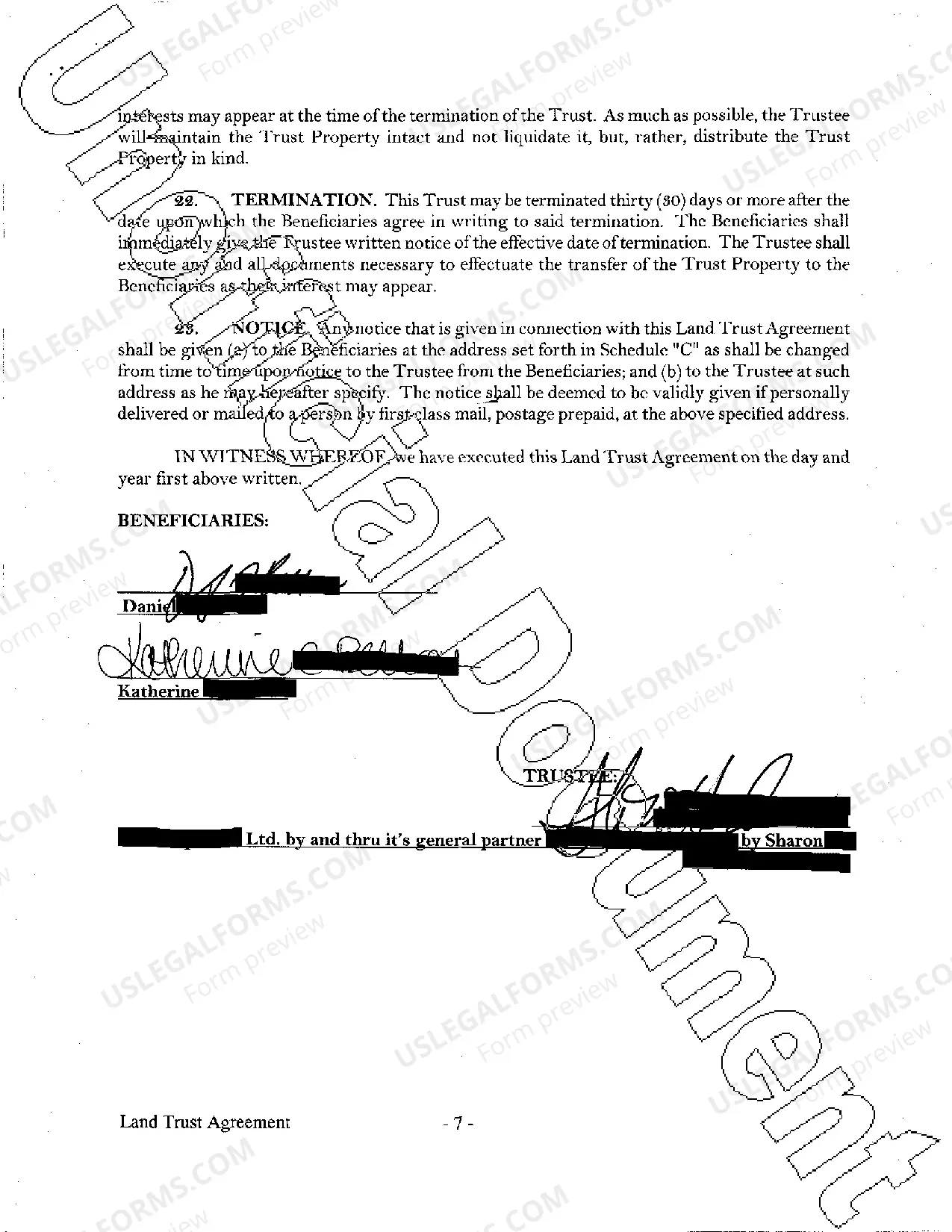

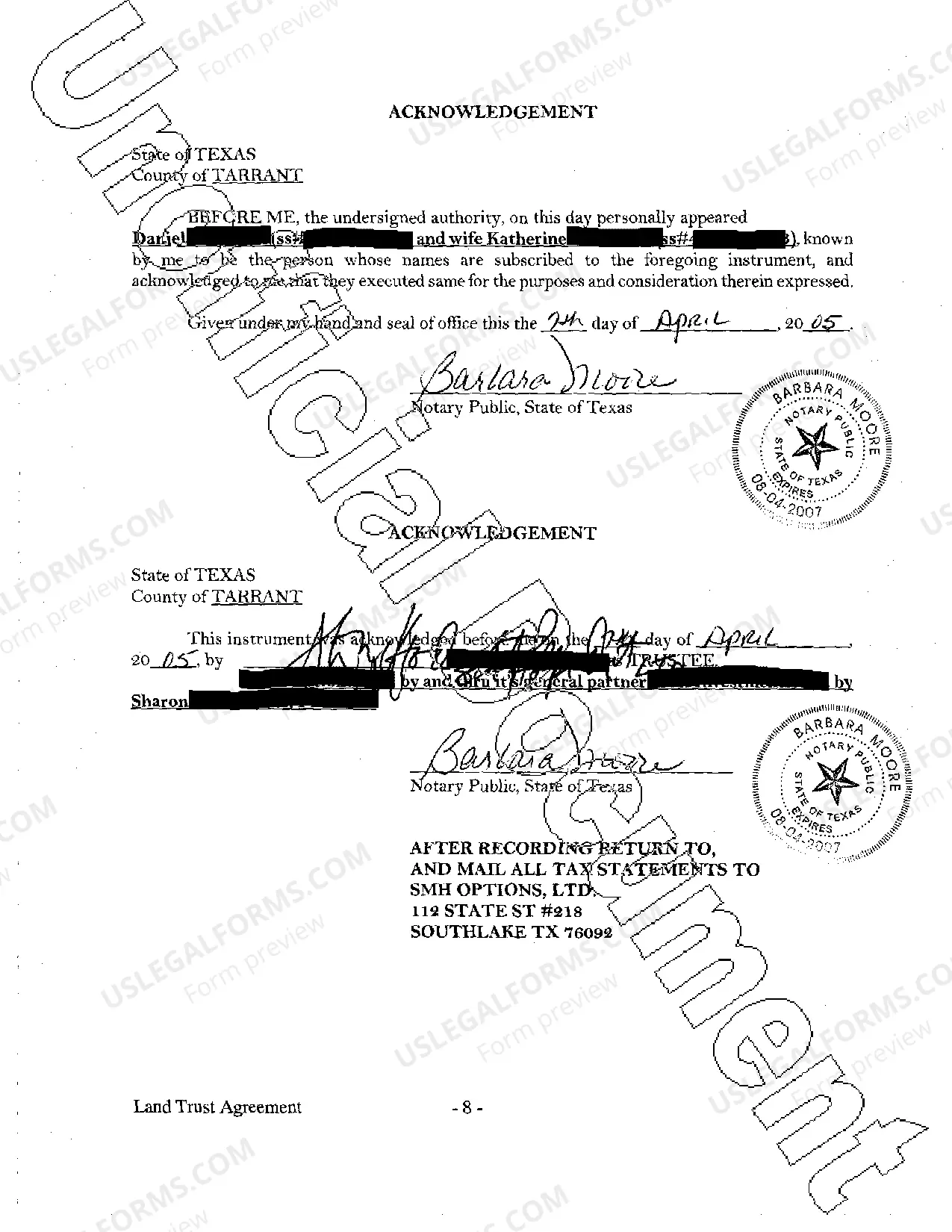

- Sign the agreement in the presence of a notary and register it if required by state law.

Risk Analysis of Land Trust Agreements

- Privacy Risks: While a land trust offers privacy, information might still be disclosed through legal proceedings or specific state regulations.

- Management Risks: Poor management by the trustee can lead to decreased property value or legal challenges.

- Legal Compliance: Failure to comply with state-specific laws can invalidate the trust agreement, leading to potential legal disputes.

Best Practices in Drafting Land Trust Contracts

- Ensure clarity and specificity in the documentation to avoid ambiguities that could lead to disputes.

- Select a reliable and experienced trustee to manage the trust property effectively.

- Regularly review and update the trust to reflect changes in the law or in the circumstances of the beneficiary or trustee.

Common Mistakes & How to Avoid Them

- Lack of Specificity: Avoid vague terms in the land trust agreement. Be as specific as possible regarding rights, responsibilities, and procedures.

- Ignoring State Laws: Each state has different regulations governing trust agreements. Consult estate planning lawyers to ensure compliance.

- Neglecting Regular Reviews: Circumstances and laws change. Periodically review your trust agreement to reflect these changes.

Real-World Applications of Land Trust Agreements

Land trust agreements are commonly used by real estate investors in the United States to manage multiple properties efficiently, to protect assets from public scrutiny, and to streamline succession planning.

FAQ

- Where can I download trust agreement templates? Templates can be found through online legal resources or by consulting with estate planning lawyers.

- How can I ensure my intellectual property rights are protected in a land trust? Include specific clauses regarding intellectual property within your land trust agreement and consult your lawyer.

- Can a beneficiary be a trustee? Yes, a beneficiary can also be the trustee, depending on the terms laid out in the trust agreement.

How to fill out Texas Land Trust Agreement?

Get access to quality Texas Land Trust Agreement forms online with US Legal Forms. Prevent days of lost time seeking the internet and lost money on files that aren’t updated. US Legal Forms offers you a solution to exactly that. Get around 85,000 state-specific authorized and tax samples that you could download and submit in clicks in the Forms library.

To find the sample, log in to your account and click Download. The file is going to be saved in two places: on the device and in the My Forms folder.

For people who don’t have a subscription yet, look at our how-guide below to make getting started simpler:

- Find out if the Texas Land Trust Agreement you’re looking at is appropriate for your state.

- See the form using the Preview option and read its description.

- Check out the subscription page by simply clicking Buy Now.

- Choose the subscription plan to keep on to sign up.

- Pay by card or PayPal to finish creating an account.

- Pick a preferred format to download the file (.pdf or .docx).

You can now open the Texas Land Trust Agreement template and fill it out online or print it out and get it done yourself. Take into account sending the document to your legal counsel to be certain all things are filled out properly. If you make a mistake, print out and fill sample again (once you’ve created an account all documents you download is reusable). Make your US Legal Forms account now and access far more samples.

Form popularity

FAQ

Reduces Your Tax Burden. Allows You to Remain Anonymous. Protects You from Liability. Prevents the Due-on-Sale Clause. Keeps the Sale Price a Secret. Prevents Property Liens and Judgments. Helps Minimize the Difficulty of Probate. Makes It Easy to Transfer Property.

The trustee is the legal owner of the property in trust, as fiduciary for the beneficiary or beneficiaries who is/are the equitable owner(s) of the trust property. Trustees thus have a fiduciary duty to manage the trust to the benefit of the equitable owners.

A land trust is a real property title-holding vehicle, a trust agreement under which the beneficiary directs the trustee in all matters affecting title to the trust property. The beneficiary also holds the trustee free from liability.The ownership of the property simply assigns the beneficial interest under the trust.

Land trusts can provide asset protection benefits by providing you with privacy of ownership for real property. Each piece of real estate can be placed into a separate land trust. If a lawsuit is associated with one piece of real estate, other properties titled to different trusts are not automatically encumbered.

Land trusts are organizations that take legal ownership, stewardship, or partial control over property at the behest of the landowner. Title-holding land trusts, also known as Illinois land trusts, protect landowner anonymity and keep property out of probate.

Trust law in Texas falls under the Property Code while the law of business entities (LLCs and corporations) falls under the Business Organizations Code. Trusts can hold property, of course, but there is no liability barrier against lawsuits as with registered entities formed under the BOC.

Land Trusts as Pass Through Entities This is because a revocable land trust is seen as a pass through entity by the IRS. Any income on the land trusts is treated as personal income and thus reported only on a personal tax return. As a pass through entity, a land trust doesn't lead to the grantor being taxed twice.

Land Trust. Land trusts can provide asset protection benefits by providing you with privacy of ownership for real property. Each piece of real estate can be placed into a separate land trust.They are not asset protection trusts but they can help keep prying eyes from knowing what you own.