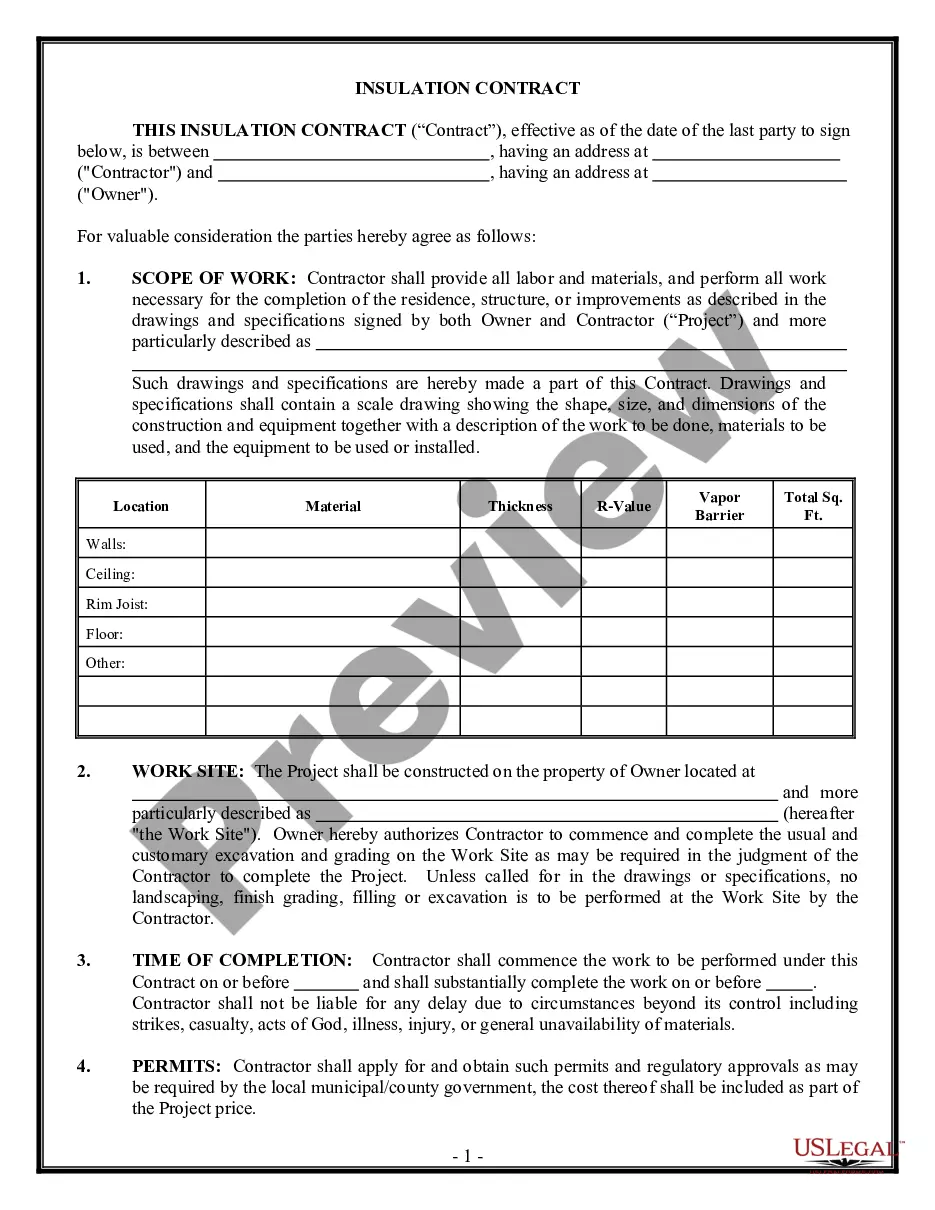

Texas Home Equity Affidavit and Agreement

Description Texas Home Equity Security Instrument

How to fill out Texas Home Equity Affidavit And Agreement?

Get access to quality Texas Home Equity Affidavit and Agreement samples online with US Legal Forms. Avoid hours of wasted time looking the internet and dropped money on files that aren’t updated. US Legal Forms offers you a solution to exactly that. Find more than 85,000 state-specific authorized and tax samples that you can download and complete in clicks in the Forms library.

To find the sample, log in to your account and then click Download. The document will be saved in two places: on the device and in the My Forms folder.

For individuals who don’t have a subscription yet, check out our how-guide below to make getting started simpler:

- Find out if the Texas Home Equity Affidavit and Agreement you’re looking at is appropriate for your state.

- View the form using the Preview function and read its description.

- Visit the subscription page by clicking on Buy Now button.

- Choose the subscription plan to go on to sign up.

- Pay out by card or PayPal to complete creating an account.

- Pick a favored file format to download the file (.pdf or .docx).

Now you can open up the Texas Home Equity Affidavit and Agreement sample and fill it out online or print it out and do it by hand. Think about giving the file to your legal counsel to ensure things are filled in appropriately. If you make a error, print and fill application once again (once you’ve registered an account every document you download is reusable). Make your US Legal Forms account now and get access to a lot more forms.

Form popularity

FAQ

There are two parties to a mortgage. You are the mortgagor or borrower, and the lender is the mortgagee. A mortgage document creates a lien on the property, which serves as a lender's security for the debt.

Overview. A Texas Section 50(a)(6) loan is a loan originated in accordance with and secured by a lien permitted under the provisions of Article XVI, Section 50(a)(6), of the Texas Constitution, which allow a borrower to take equity out of a homestead property under certain conditions.

A mortgage is a legal instrument which is used to create a security interest in real property held by a lender as a security for a debt, usually a loan of money.

If originated in compliance with the requirements of Article XVI, Section 50(f)(2) of the Texas Constitution, a 50(f)(2) refinance converts a 50(a)(6) home equity lien into a valid 50(a)(4) refinance lien.the rate/term refinance without it being considered a Texas home equity loan.

The most important of these is the Satisfaction of Mortgage, sometimes referred to as a letter of satisfaction, which the lender sends to the borrower to indicate the home loan is paid in full.

A security instrument is a legal document giving the bank a security interest in the property. It can be a mortgage, giving the lender a lien on the property, or a deed of trust, whereby a trustee holds the deed for the lender until you finish paying off the loan.