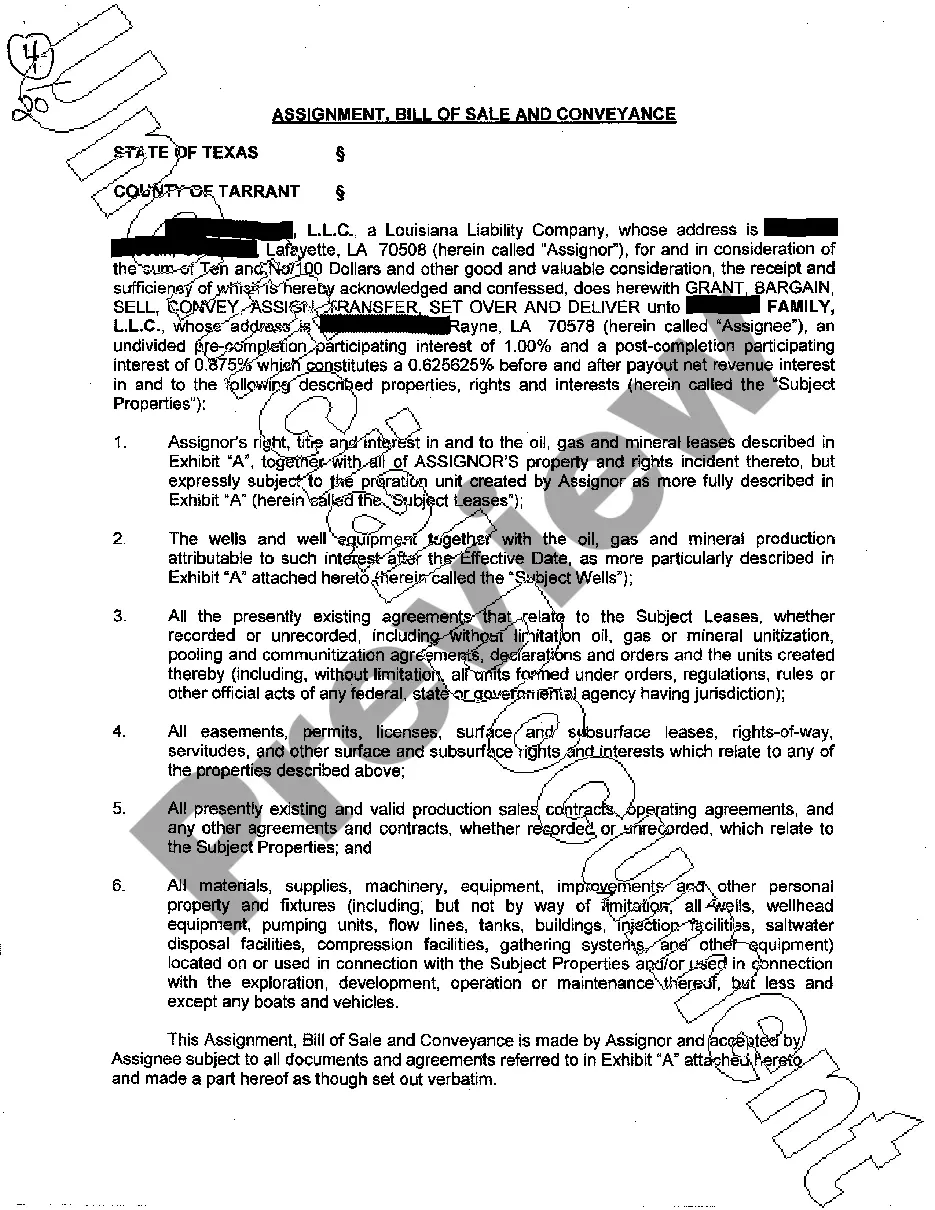

This form is used when Assignor (for adequate consideration), pursuant to the terms and conditions of the Purchase and Sale Agreement, sells, assigns, transfers, conveys, and delivers to Assignee all of Assignor's rights, title, and interests in and to the within described property and interests (collectively, the “Assets”)

Texas Assignment, Bill of Sale and Conveyance

Description

How to fill out Texas Assignment, Bill Of Sale And Conveyance?

Get access to quality Texas Assignment, Bill of Sale and Conveyance samples online with US Legal Forms. Avoid hours of wasted time searching the internet and lost money on files that aren’t updated. US Legal Forms gives you a solution to exactly that. Find above 85,000 state-specific legal and tax samples that you could download and fill out in clicks in the Forms library.

To find the example, log in to your account and then click Download. The file is going to be saved in two places: on the device and in the My Forms folder.

For those who don’t have a subscription yet, take a look at our how-guide below to make getting started easier:

- Find out if the Texas Assignment, Bill of Sale and Conveyance you’re considering is appropriate for your state.

- View the sample using the Preview function and browse its description.

- Check out the subscription page by clicking Buy Now.

- Choose the subscription plan to go on to sign up.

- Pay out by credit card or PayPal to complete making an account.

- Choose a preferred format to save the file (.pdf or .docx).

Now you can open up the Texas Assignment, Bill of Sale and Conveyance example and fill it out online or print it out and get it done yourself. Think about mailing the file to your legal counsel to ensure everything is completed appropriately. If you make a error, print and fill application again (once you’ve created an account all documents you save is reusable). Create your US Legal Forms account now and access a lot more forms.

Form popularity

FAQ

Texas title, signed and dated by the seller(s) and buyer(s). VTR-130U (Application for Texas title), signed and dated by the seller(s) and buyer(s). Proof of insurance in the buyer's name. Acceptable form of ID. Proof of inspection. Fees.

The state does not require the document be notarized, but it does suggest that both parties jointly visit the county tax office when the seller is signing over title to the vehicle.

The date of the sale. The sale price. The full name and address of both the buyer and the seller. A general description of the vehicle, including its make, model, and condition. The vehicle identification and license plate numbers of the car.

Directly under the statement Assignment of title by registered owner, write in the date the car was sold. On the next line, write in the name or names of the buyers and their address. On the next line, write in the odometer reading. Where it says Signature(s) of buyer, the buyer or buyers must sign the title.

This serves as a legal contract from the seller to the buyer documenting the transaction so a Bill of Sale Form is needed if the buyer of a vehicle wants documentation of the sale and/or the seller wishes a receipt of the sale.

A royalty deed gives its holder the right to receive a percentage of the profits from the sale of the minerals, if and when they are actually produced. This kind of legal document does not convey all of the mineral rights to the holder, only the right to receive royalties.

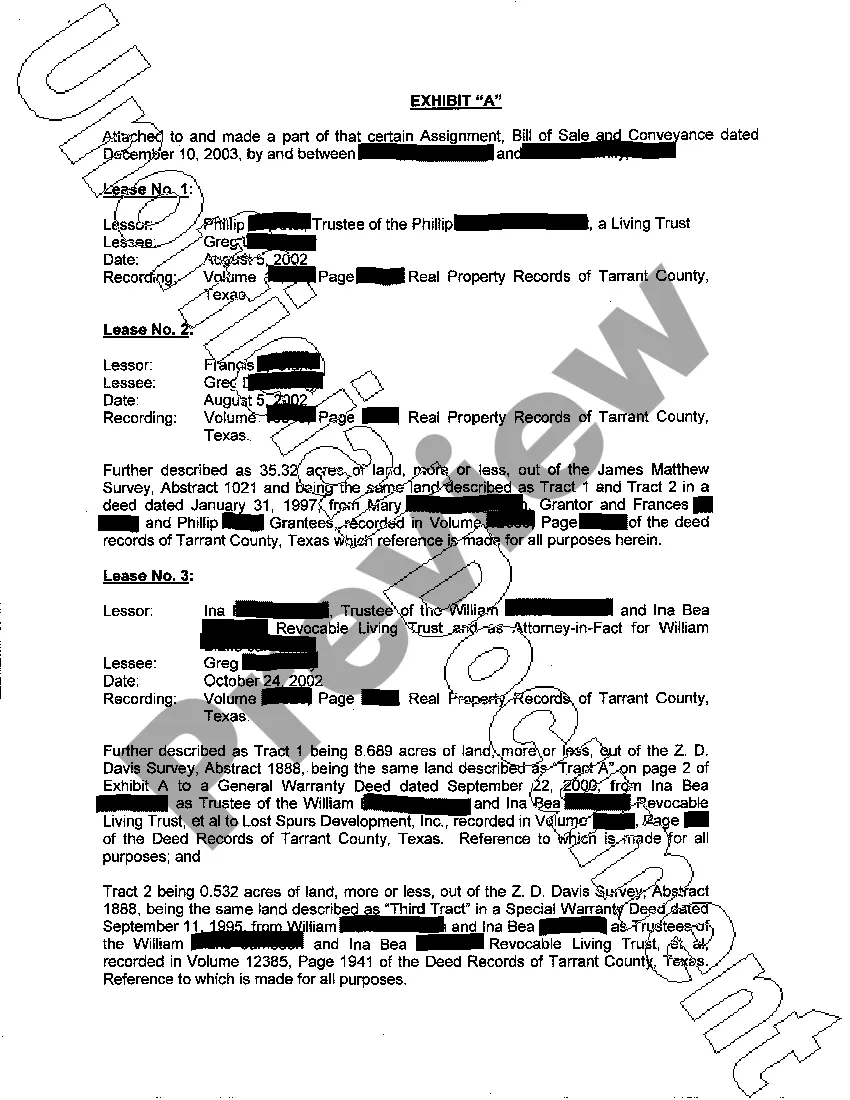

Like land, mineral rights are conveyed through a deed transferring ownership to the buyer. While the property deed will reference the mineral rights transfer at the time of the separation of land and mineral rights, subsequent sales of the land will not.

A mineral owner's rights typically include the right to use the surface of the land to access and mine the minerals owned. This might mean the mineral owner has the right to drill an oil or natural gas well, or excavate a mine on your property.

Not owning the mineral rights to a parcel of land doesn't mean your property is worthless. If someone else owns the mineral rights and they sell those rights to an individual or corporation, you can still make a profit as the surface rights owner.