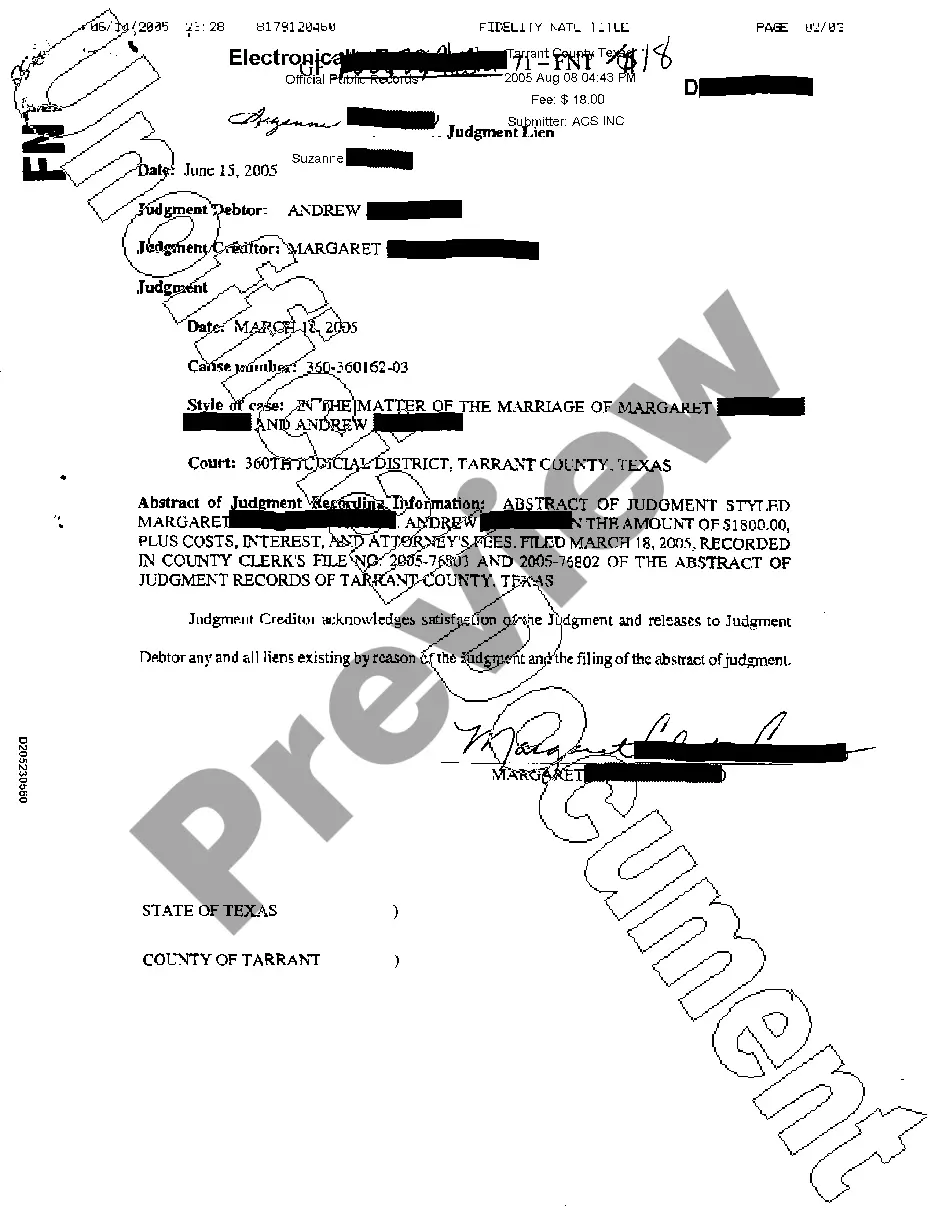

Texas Satisfaction and Release of Judgment Lien in a Divorce

Description

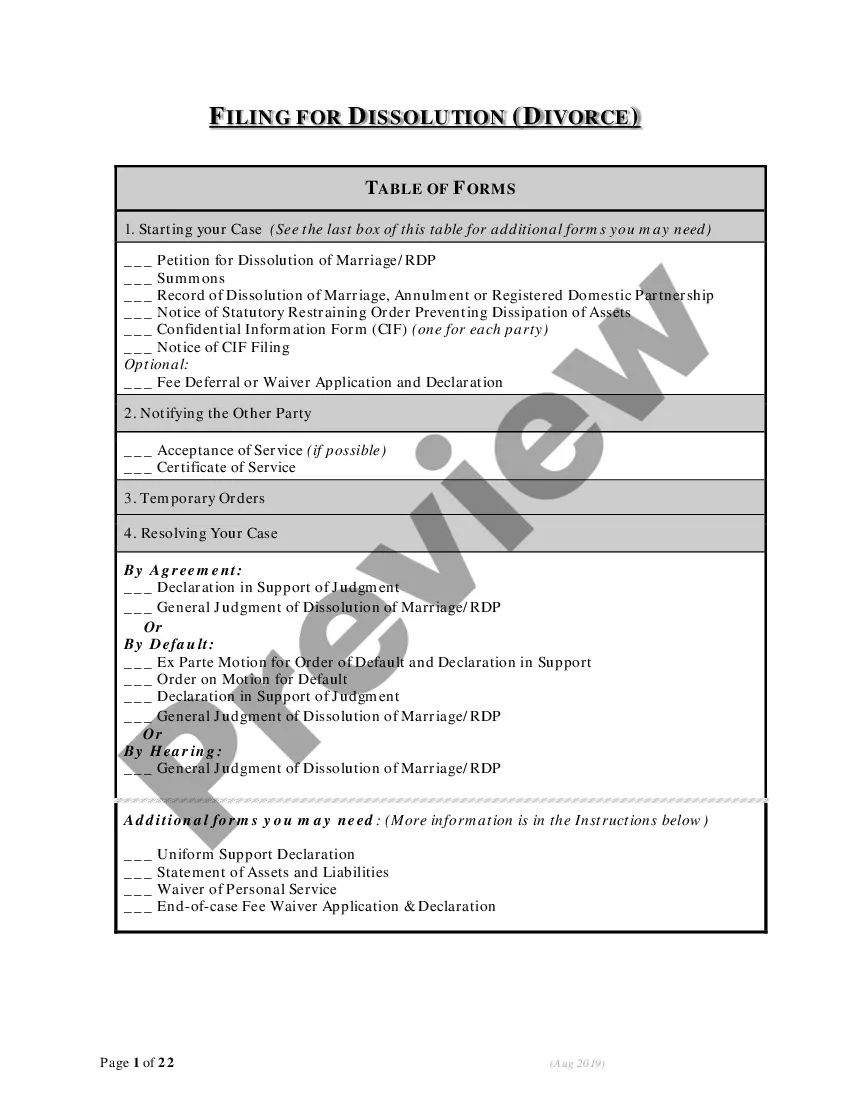

How to fill out Texas Satisfaction And Release Of Judgment Lien In A Divorce?

Get access to high quality Texas Satisfaction and Release of Judgment Lien in a Divorce samples online with US Legal Forms. Prevent hours of wasted time seeking the internet and lost money on documents that aren’t up-to-date. US Legal Forms provides you with a solution to exactly that. Find over 85,000 state-specific authorized and tax templates that you could save and submit in clicks within the Forms library.

To receive the example, log in to your account and click on Download button. The file is going to be saved in two places: on the device and in the My Forms folder.

For people who don’t have a subscription yet, look at our how-guide below to make getting started easier:

- Check if the Texas Satisfaction and Release of Judgment Lien in a Divorce you’re looking at is appropriate for your state.

- Look at the form using the Preview option and read its description.

- Visit the subscription page by clicking on Buy Now button.

- Choose the subscription plan to keep on to sign up.

- Pay by credit card or PayPal to complete making an account.

- Pick a favored file format to download the document (.pdf or .docx).

Now you can open up the Texas Satisfaction and Release of Judgment Lien in a Divorce example and fill it out online or print it and do it yourself. Think about mailing the papers to your legal counsel to make sure everything is filled in appropriately. If you make a mistake, print and complete sample once again (once you’ve registered an account every document you save is reusable). Create your US Legal Forms account now and get much more samples.

Form popularity

FAQ

There are a few ways you can satisfy or avoid a lien altogether. The firstand most obviousoption is to repay the debt. If you pay off your obligation, the creditor will remove the lien. This is done by filing a release through the same place the lien was recordedthe county or state.

In order to vacate a judgment in California, You must file a motion with the court asking the judge to vacate or set aside the judgment. Among other things, you must tell the judge why you did not respond to the lawsuit (this can be done by written declaration).

The subcontractor would file a lien waiver before a lien is filed. By doing so, the subcontractor is giving up his or her right to a lien against the property. In comparison, a lien release (also known as release of lien, cancellation of lien, or a lien cancellation) would come into play after the filing of a lien.

If the judgment creditor does not immediately file an Acknowledgement of Satisfaction of Judgment (EJ-100) when the judgment is satisfied, the judgment debtor may make a formal written demand for the creditor to do so. The judgment creditor has 15 days after receiving the debtor's request to serve the acknowledgement.

A Lien Release (also considered a Lien Cancellation or Release of Lien) is a legally binding document that is sent by the current lien holder, the individual who has leased the property or provided payment to secure the property, that informs any debt in relation to that property has been fulfilled and they relinquish

Write your name and return address in the top three lines of the letter. Insert the complete date (month, day, year). Enter the recipient's name, title, company name and address on the next five lines. Greet the reader by writing "Dear (recipient's name):" Skip two lines. State the subject in a subject line.

The defendant should ask for a letter confirming that the entire amount of the judgment has been paid. He or she may do so by sending a demand letter to the plaintiff. The release and satisfaction form is filed with the court clerk and entered into the case record.

Satisfy the terms of the loan by paying the balance of the loan back to the lender, including any interest incurred. If you don't receive the lien release, submit a request to your lender for proof that the loan has been satisfied.

About the release form This form should be filed with the recorder's office in the Texas county where the lien was originally recorded. Texas law requires claimants to file a lien release within 10 days after the lien is satisfied, or upon request from the property owner.