Texas Individual Term and Whole Life Checklist

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

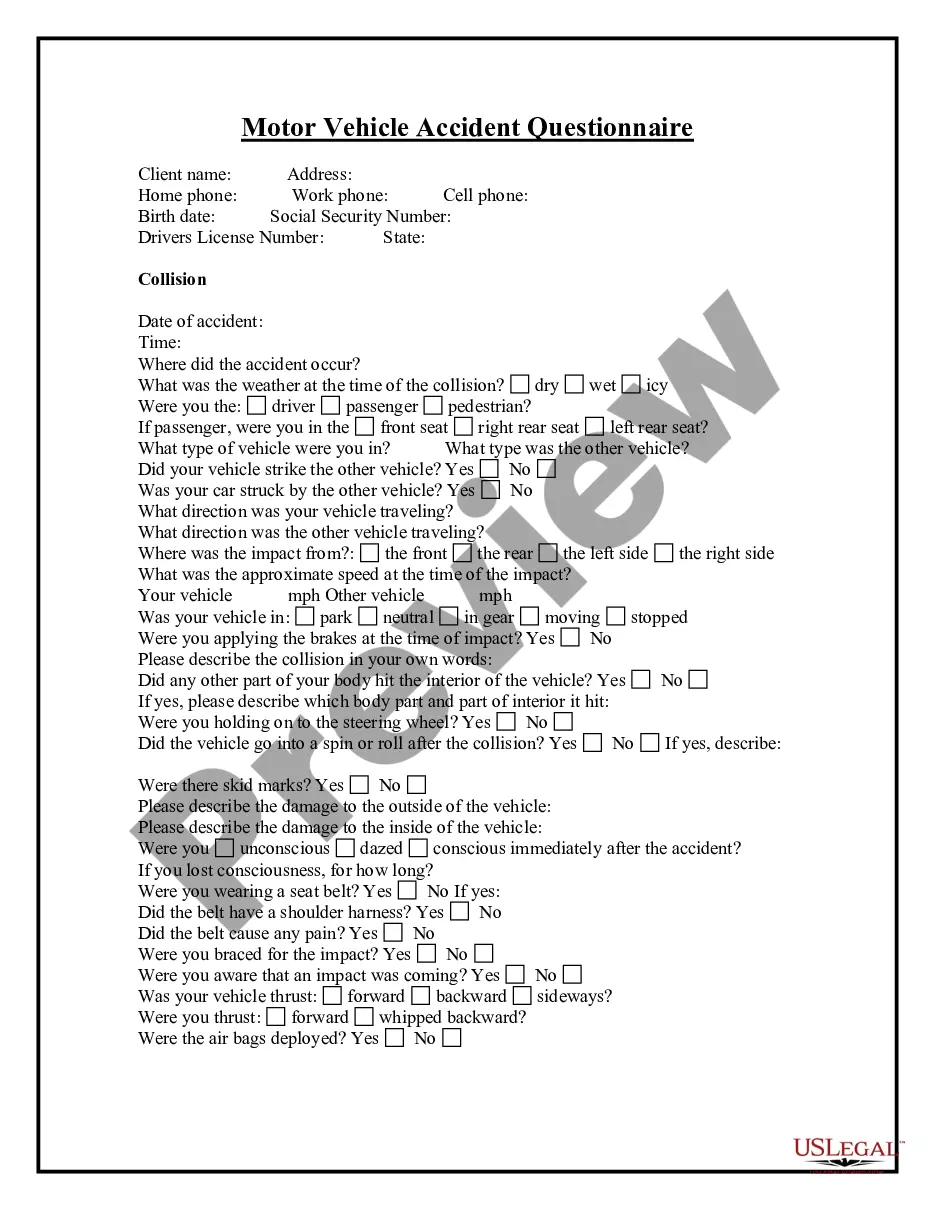

How to fill out Texas Individual Term And Whole Life Checklist?

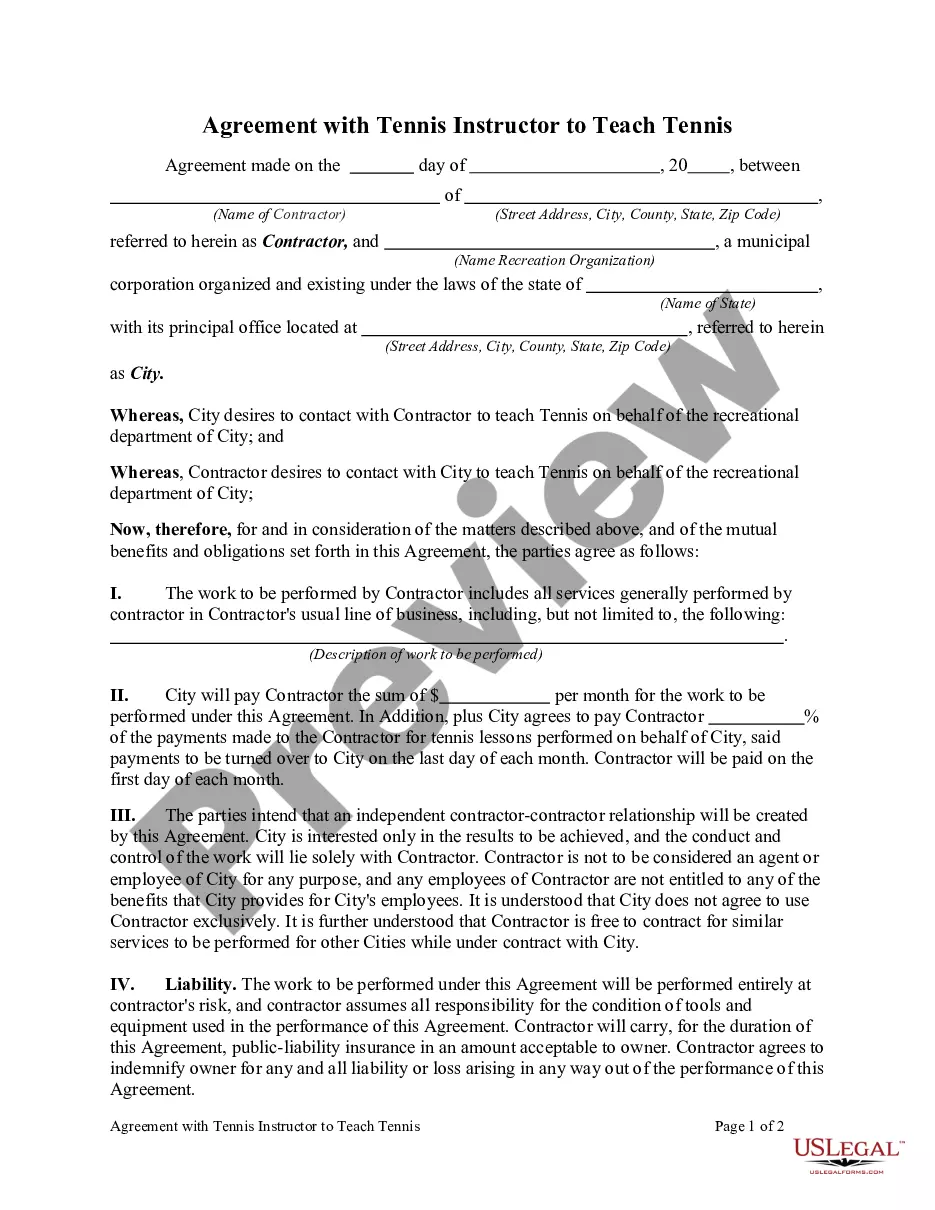

Preparing official paperwork can be a real stress if you don’t have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be certain in the blanks you obtain, as all of them correspond with federal and state regulations and are verified by our specialists. So if you need to fill out Texas Individual Term and Whole Life Checklist, our service is the best place to download it.

Obtaining your Texas Individual Term and Whole Life Checklist from our library is as easy as ABC. Previously authorized users with a valid subscription need only sign in and click the Download button once they locate the correct template. Afterwards, if they need to, users can pick the same blank from the My Forms tab of their profile. However, even if you are new to our service, signing up with a valid subscription will take only a few minutes. Here’s a brief guideline for you:

- Document compliance check. You should carefully examine the content of the form you want and check whether it satisfies your needs and fulfills your state law regulations. Previewing your document and reviewing its general description will help you do just that.

- Alternative search (optional). Should there be any inconsistencies, browse the library using the Search tab on the top of the page until you find an appropriate template, and click Buy Now when you see the one you want.

- Account registration and form purchase. Sign up for an account with US Legal Forms. After account verification, log in and select your preferred subscription plan. Make a payment to continue (PayPal and credit card options are available).

- Template download and further usage. Choose the file format for your Texas Individual Term and Whole Life Checklist and click Download to save it on your device. Print it to fill out your paperwork manually, or use a multi-featured online editor to prepare an electronic version faster and more efficiently.

Haven’t you tried US Legal Forms yet? Subscribe to our service now to obtain any official document quickly and easily any time you need to, and keep your paperwork in order!

Form popularity

FAQ

20-pay life insurance is a limited-pay whole life insurance policy that offers coverage for your lifetime, but you pay off the policy in 20 annual installments. Premiums remain fixed during the payment period. These policies offer cash value and can accumulate quicker than straight life insurance cash values.

Whole life insurance guarantees payment of a death benefit to beneficiaries in exchange for level, regularly-due premium payments. The policy includes a savings portion, called the ?cash value,? alongside the death benefit. In the savings component, interest may accumulate on a tax-deferred basis.

You may no longer need life insurance once you've hit your 60s or 70s. If you're living on a fixed income, cutting the expense could give your budget some breathing room. Make sure to discuss your needs with an insurance agent or a financial advisor before making any major moves.

What if I miss a premium payment? Most policies have a 31-day grace period after your premium's due date. You may pay the premium during the grace period with no interest charged and still have coverage. If you die during this period, your beneficiary gets the death benefit minus the premium owed.

Depending on the insurance policy, the grace period can be as little as 24 hours or as long as 30 days. The amount of time granted in an insurance grace period is indicated in the insurance policy contract. Paying after the due date may attract a financial penalty from the insurance company.

Every policy has different grace period stipulations. Depending on what's in your contract, it can vary anywhere from 24 hours up to 30 days. Many policies will also offer two timeframes for a grace period; a shorter period that doesn't entail a late fee and an extended period that will require you to pay one.

Most policies have a 31-day grace period after your premium's due date. You can make a late payment without being charged interest and still be covered. If you die during the grace period, your beneficiary gets the death benefit minus the past due premium.