Texas Certificate of Conversion Of A Limited Liability Company Converting To A Corporation

Description

How to fill out Texas Certificate Of Conversion Of A Limited Liability Company Converting To A Corporation?

Handling official paperwork requires attention, accuracy, and using properly-drafted blanks. US Legal Forms has been helping people across the country do just that for 25 years, so when you pick your Texas Certificate of Conversion Of A Limited Liability Company Converting To A Corporation template from our library, you can be sure it complies with federal and state laws.

Working with our service is easy and quick. To get the required paperwork, all you’ll need is an account with a valid subscription. Here’s a quick guide for you to get your Texas Certificate of Conversion Of A Limited Liability Company Converting To A Corporation within minutes:

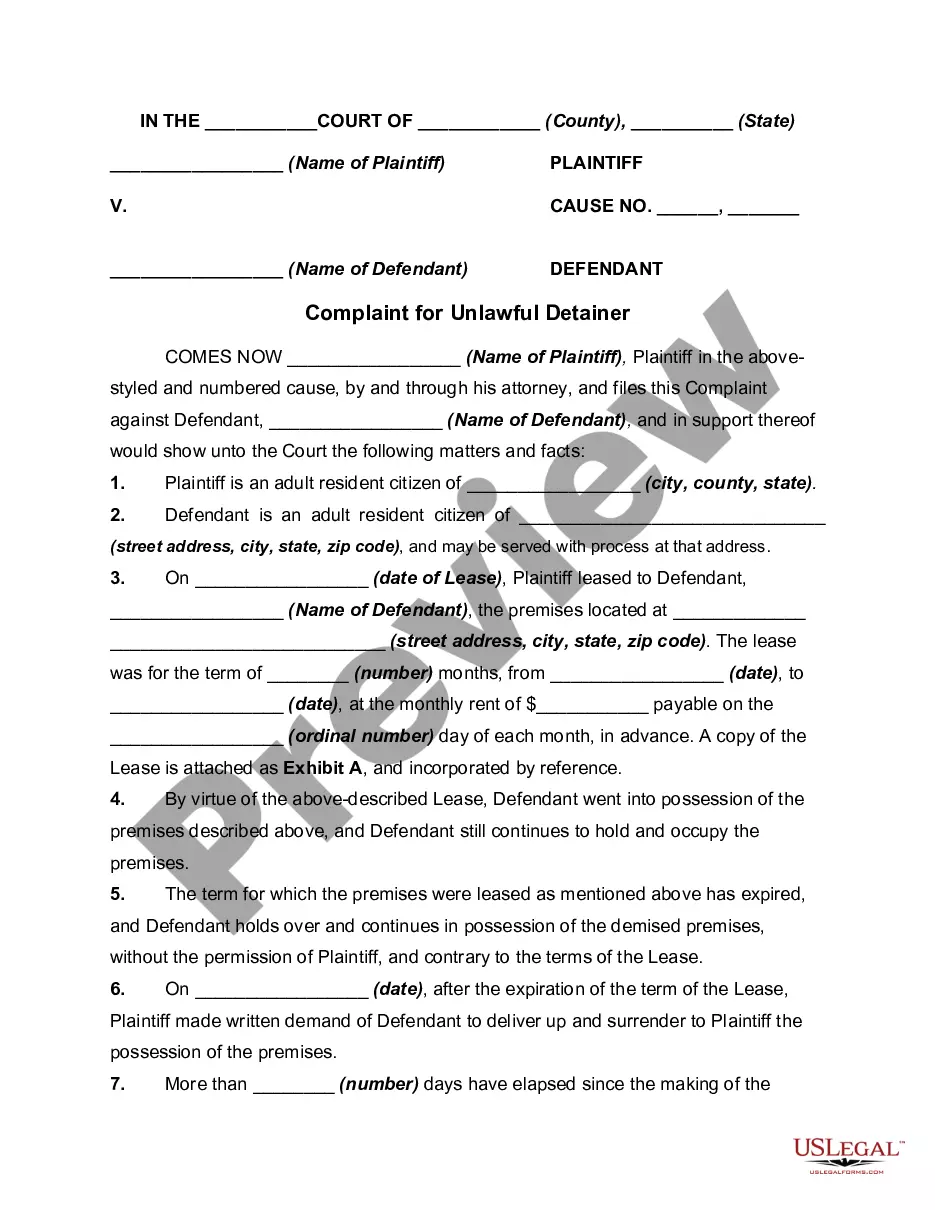

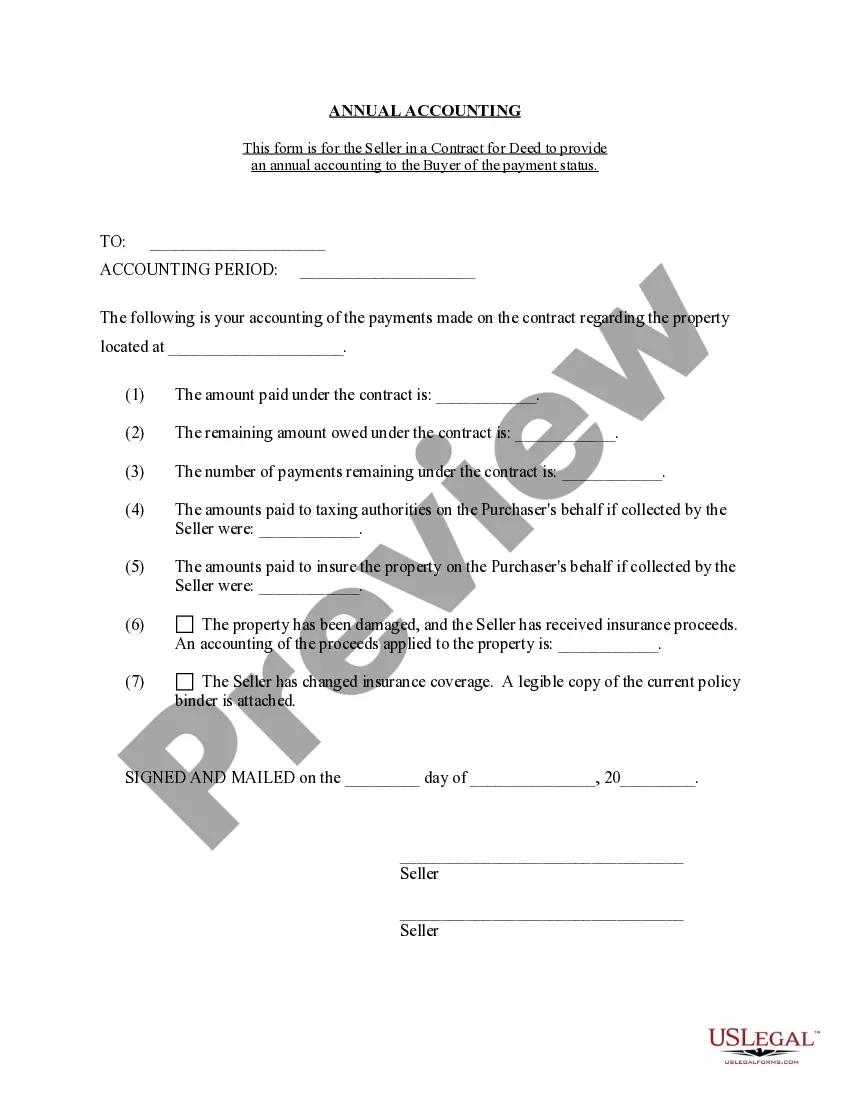

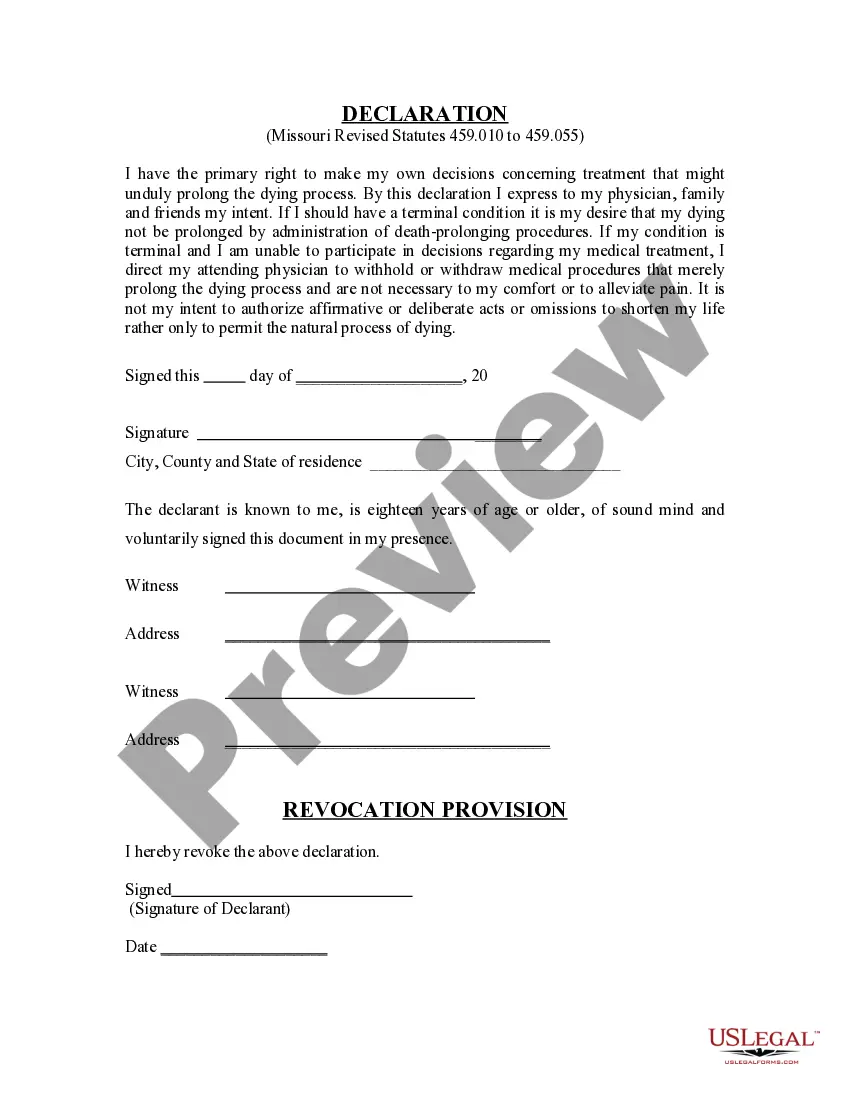

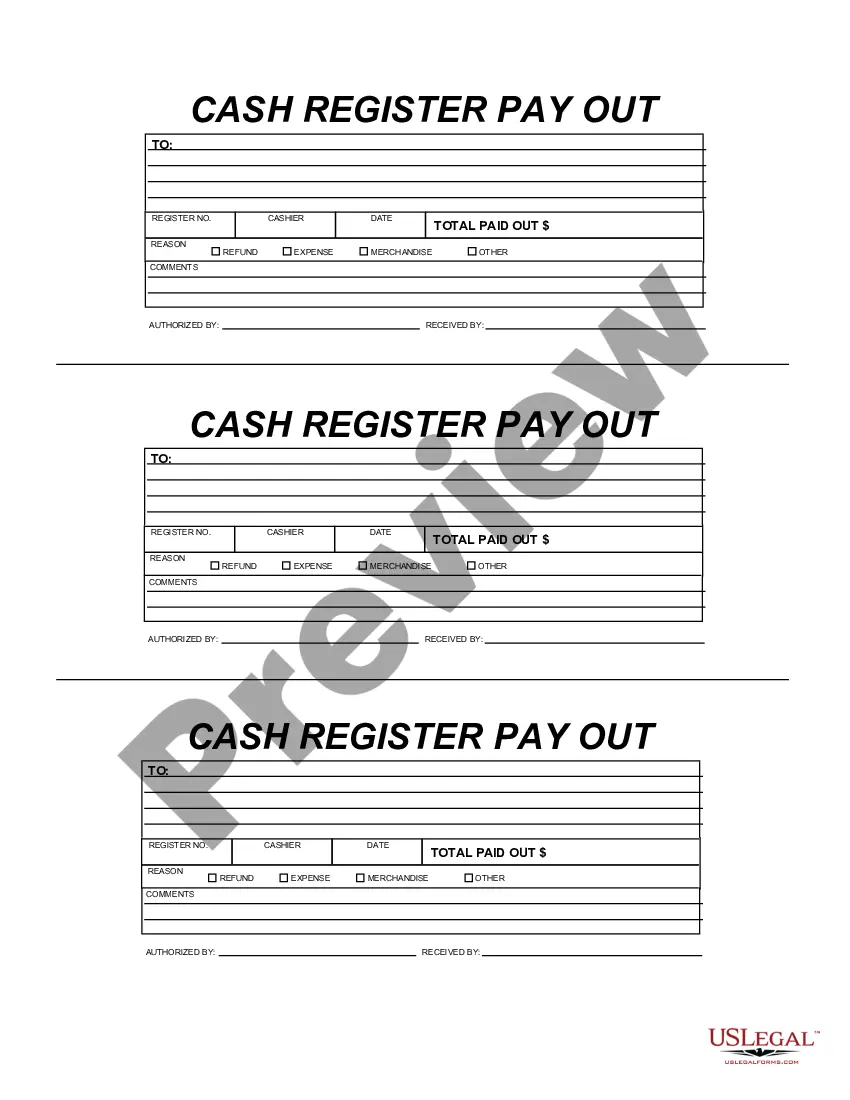

- Make sure to carefully examine the form content and its correspondence with general and legal requirements by previewing it or reading its description.

- Search for an alternative formal template if the previously opened one doesn’t match your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and download the Texas Certificate of Conversion Of A Limited Liability Company Converting To A Corporation in the format you need. If it’s your first experience with our website, click Buy now to continue.

- Create an account, select your subscription plan, and pay with your credit card or PayPal account.

- Decide in what format you want to obtain your form and click Download. Print the blank or upload it to a professional PDF editor to prepare it paper-free.

All documents are created for multi-usage, like the Texas Certificate of Conversion Of A Limited Liability Company Converting To A Corporation you see on this page. If you need them one more time, you can fill them out without re-payment - just open the My Forms tab in your profile and complete your document whenever you need it. Try US Legal Forms and prepare your business and personal paperwork rapidly and in full legal compliance!

Form popularity

FAQ

It is possible to change a limited liability company (LLC) to a corporation, and it's a simple process in many states. But if you only want to become a corporation for its tax advantages, you can also remain an LLC and elect to be to be taxed as an S-Corporation.

It costs $600 to convert a Texas LLC to a Texas corporation ($300 to file the Certificate of Conversion plus $300 for the Certificate of Formation for the corporation).

To convert a Texas LLC to a Texas corporation, you need to: file a certificate of conversion including a certificate of account status with the Secretary of State. file a certificate of formation with the Secretary of State; and. adopt a plan of conversion and file it with the Secretary of State.

It is possible to change a limited liability company (LLC) to a corporation, and it's a simple process in many states. But if you only want to become a corporation for its tax advantages, you can also remain an LLC and elect to be to be taxed as an S-Corporation.

You can convert your Texas LLC to a Texas corporation without dissolving your business. You'll have to come up with a member-agreed upon Plan of Conversion, and file both a Certificate of Conversion of a Limited Liability Company Converting to a Corporation and a Certificate of Formation For-Profit Corporation.

How do I convert my Texas LLC to an S Corp? Converting an LLC to an S Corporation is a two-step process. First, you file Form 8832 with the IRS to have your LLC taxed as a corporation. Then, you file Form 2253 with the IRS to elect S Corporation status.

It's free. If you want to convert your LLC into an S-corp for tax purposes, you'll need to file Form 2553 with the IRS. There are no filing fees.

A limited liability company may convert into a corporation by adopting a plan of conversion in ance with section 10.101 of the Texas Business Organizations Code (BOC) and filing a certificate of conversion with the secretary of state in ance with sections 10.154 and 10.155 of the BOC.