Texas Tax Affidavit Designation Other Property as Homestead Property

Description Designation Of Homestead Texas

How to fill out Texas Affidavit Designation?

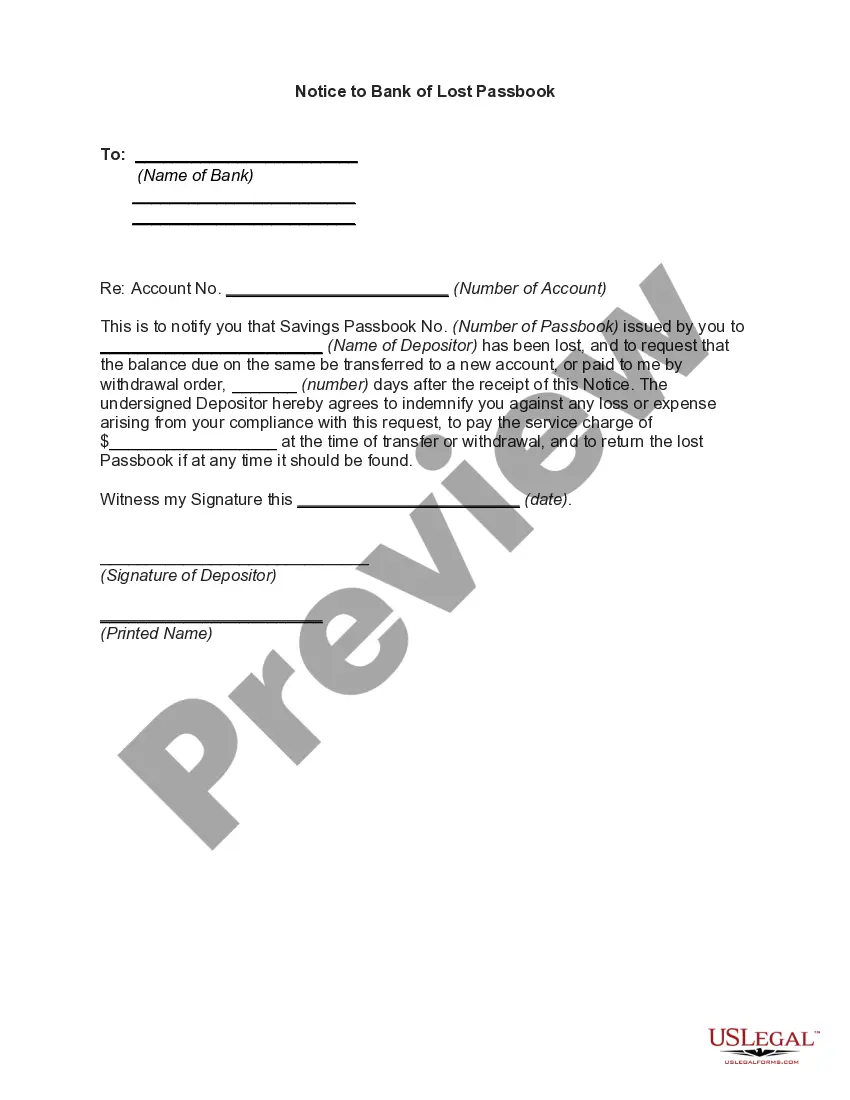

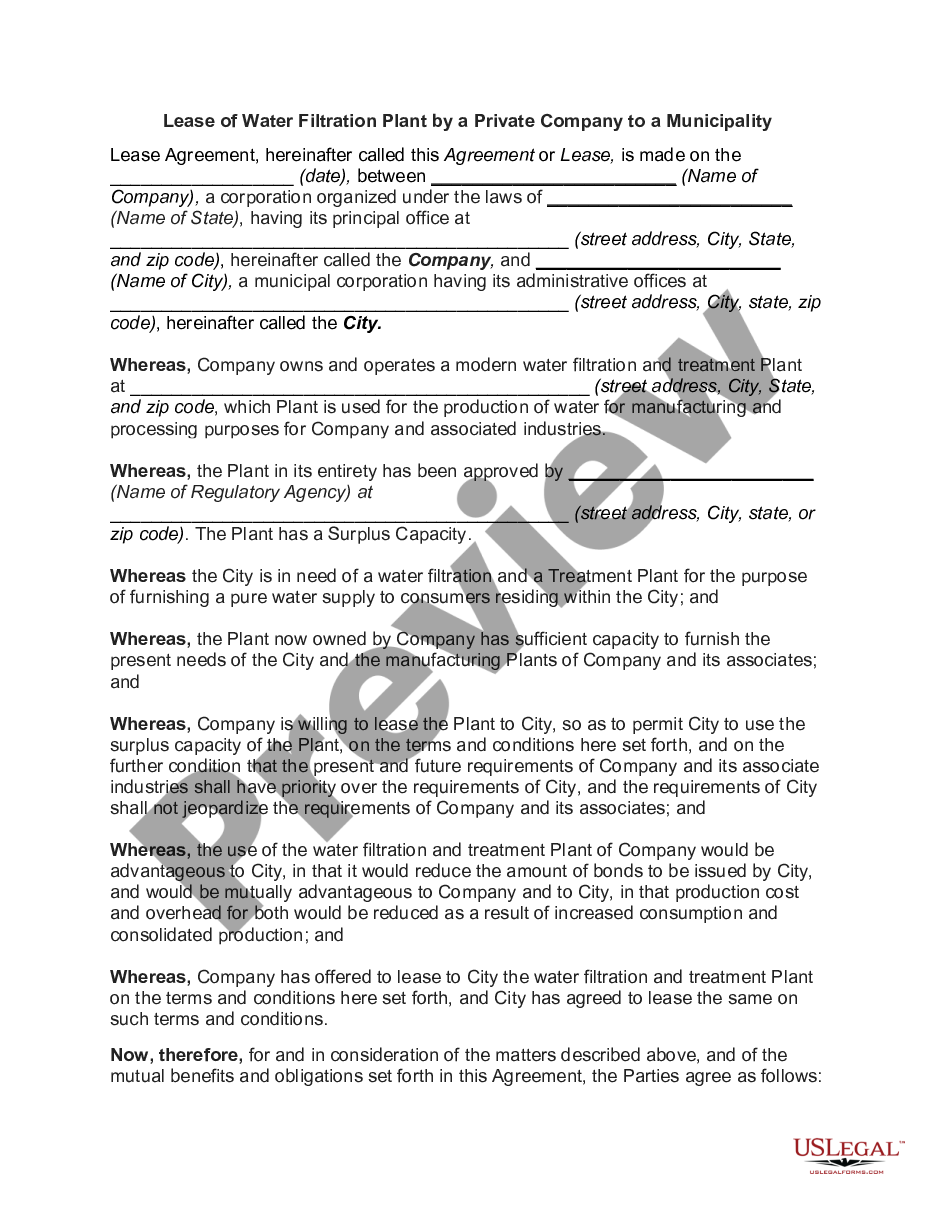

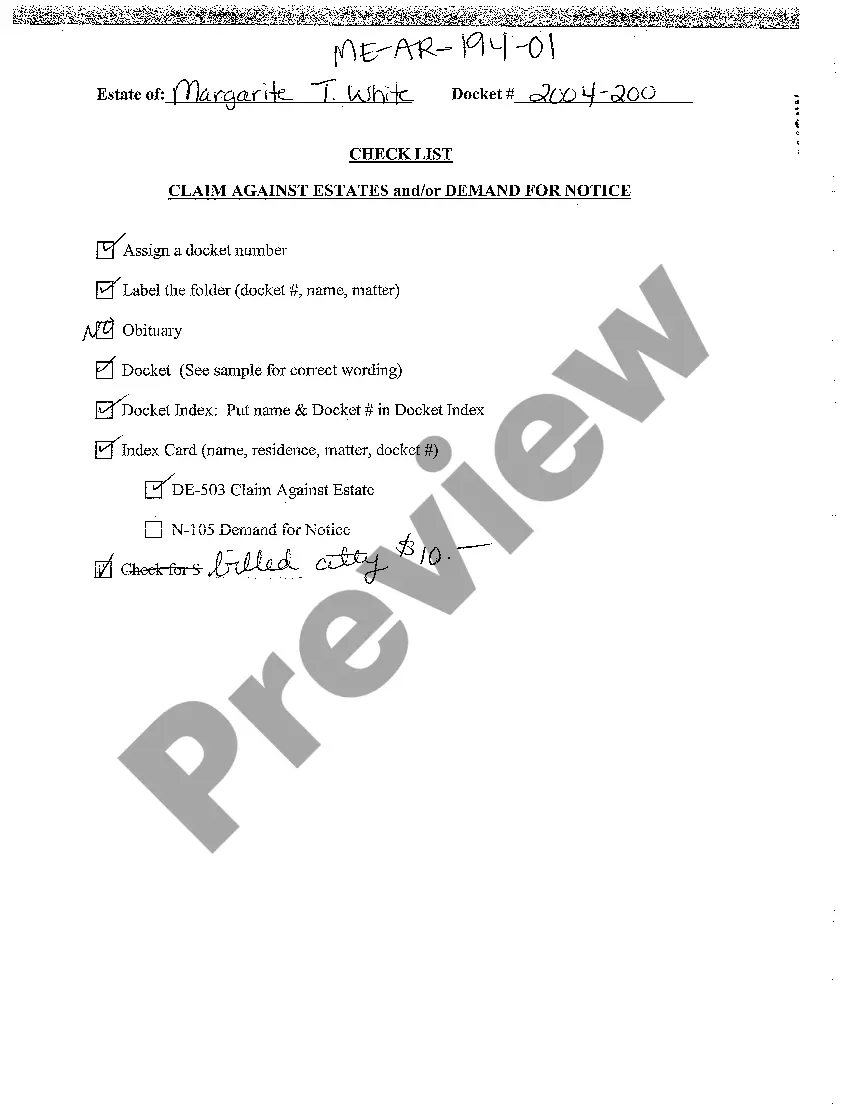

Get access to top quality Texas Tax Affidavit Designation Other Property as Homestead Property samples online with US Legal Forms. Steer clear of hours of misused time looking the internet and dropped money on forms that aren’t up-to-date. US Legal Forms provides you with a solution to just that. Get more than 85,000 state-specific authorized and tax samples you can download and complete in clicks in the Forms library.

To get the example, log in to your account and then click Download. The file is going to be saved in two places: on the device and in the My Forms folder.

For individuals who don’t have a subscription yet, check out our how-guide listed below to make getting started easier:

- Find out if the Texas Tax Affidavit Designation Other Property as Homestead Property you’re looking at is suitable for your state.

- Look at the sample utilizing the Preview function and read its description.

- Visit the subscription page by clicking on Buy Now button.

- Select the subscription plan to continue on to register.

- Pay out by card or PayPal to finish creating an account.

- Select a favored format to save the file (.pdf or .docx).

Now you can open up the Texas Tax Affidavit Designation Other Property as Homestead Property template and fill it out online or print it out and get it done yourself. Consider mailing the document to your legal counsel to be certain things are filled in correctly. If you make a mistake, print out and complete sample once again (once you’ve made an account all documents you download is reusable). Create your US Legal Forms account now and access a lot more templates.

Texas Homestead Designation Form popularity

Homestead Affidavit Texas Other Form Names

Texas Affidavit Homestead FAQ

(US) a house and adjoining land designated by the owner as his fixed residence and exempt under the homestead laws from seizure and forced sale for debts. The place of the house or home place.

To qualify, a home must meet the definition of a residence homestead: The home's owner must be an individual (for example: not a corporation or other business entity) and use the home as his or her principal residence on Jan. 1 of the tax year. An age 65 or older or disabled exemption is effective as of Jan.

The Texas Homestead Exemption The homestead exemption is available only for your principal residence. Vacation or rental properties are not covered under the exemption, nor are properties owned by corporations rather than individuals.

The homestead exemption is an automatic benefit in some states while, in others, homeowners must file a claim with the state in order to receive it. Since a homestead property is considered a person's primary residence, no exemptions can be claimed on other owned property, even residences.

You think your Spring Texas home has a homestead exemption but you are not 100% sure. So how can you easily find out if you have a homestead exemption? At the Harris County Appraisal District website of www.hcad.org you can look up your account and see which if any exemptions have been applied to your account.

To qualify, a home must meet the definition of a residence homestead: The home's owner must be an individual (for example: not a corporation or other business entity) and use the home as his or her principal residence on Jan. 1 of the tax year. An age 65 or older or disabled exemption is effective as of Jan.

Affiant acknowledges the Homestead Property as legally sufficient to qualify as his legal homestead. This Affidavit is made to induce Lender to make a mortgage loan on the Non-Homestead Property, or to grant other financial accommodations, secured by a Deed of Trust on the Non-Homestead Property.

How do I apply for a homestead exemption? To apply for a homestead exemption, you need to submit an application with your county appraisal district. Filing an application is free and only needs to be filed once. The application can be found on your appraisal district website or using Texas Comptroller Form 50-114.

You cannot have more than one homestead at the same time.