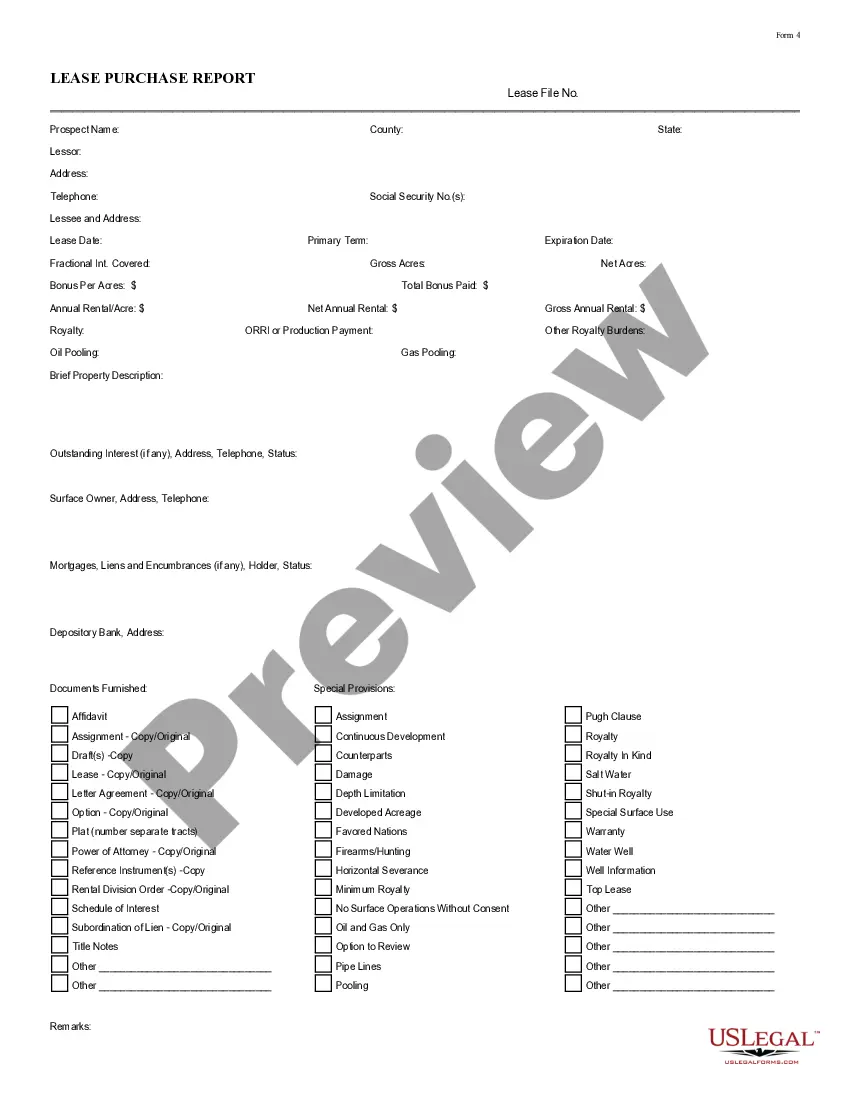

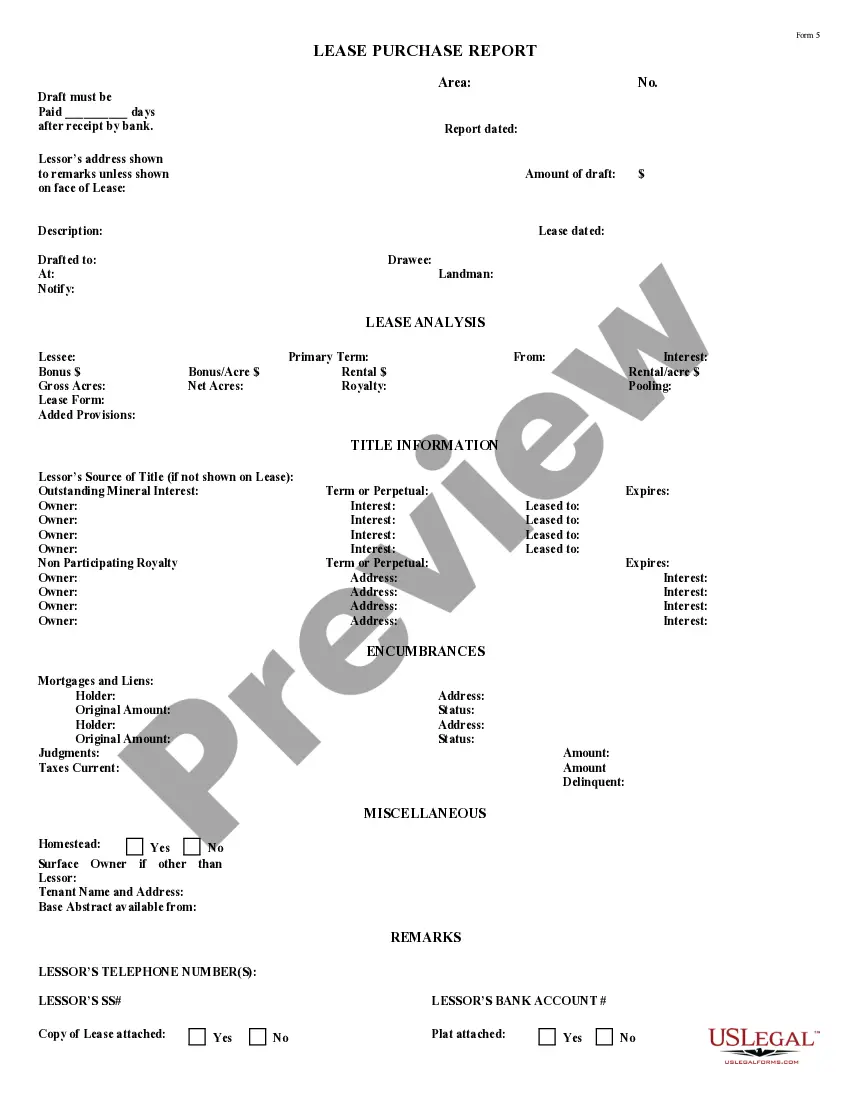

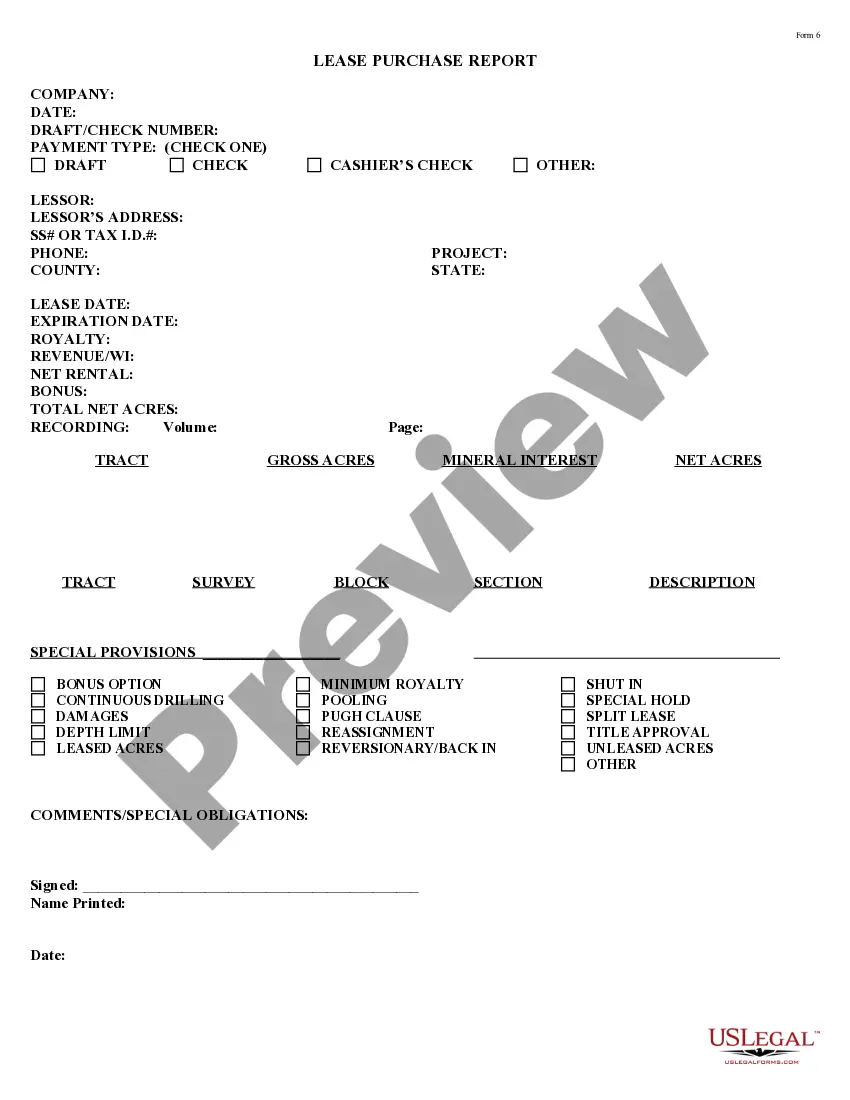

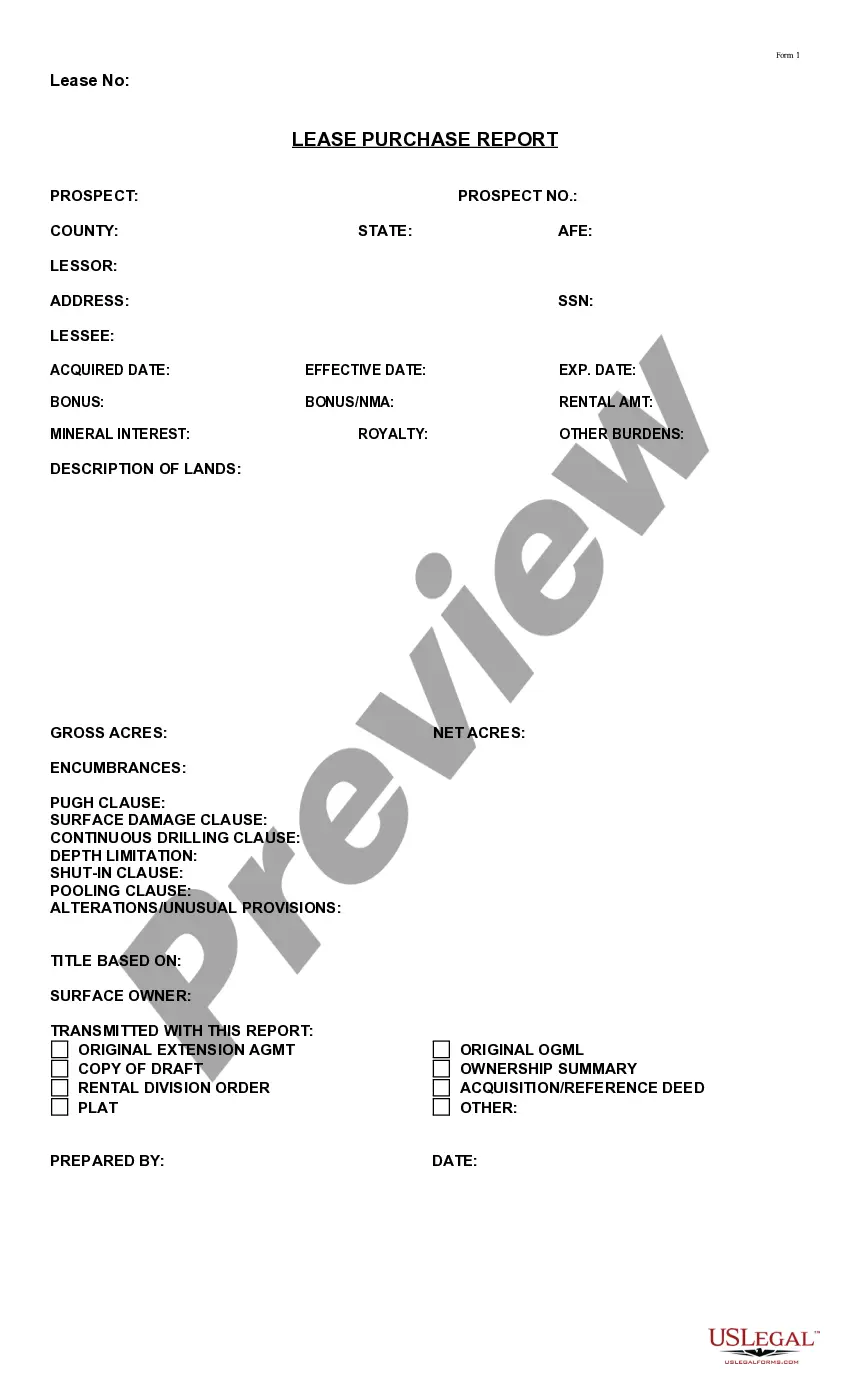

This oil, gas, and minerals document is a report form documenting information of sellers and purchasers that enter into a legally binding obligation to sell and purchase real property at the expiration of or during a lease term. In a lease purchase agreement, a party agrees to purchase a particular piece of real property within a certain timeframe, usually at a price determined beforehand.

Texas Lease Purchase Report Form 1

Description

How to fill out Texas Lease Purchase Report Form 1?

Get access to high quality Texas Lease Purchase Report Form 1 forms online with US Legal Forms. Steer clear of hours of misused time looking the internet and dropped money on files that aren’t up-to-date. US Legal Forms offers you a solution to just that. Get more than 85,000 state-specific legal and tax forms you can download and complete in clicks within the Forms library.

To receive the sample, log in to your account and then click Download. The file will be stored in two places: on the device and in the My Forms folder.

For people who don’t have a subscription yet, look at our how-guide below to make getting started easier:

- Check if the Texas Lease Purchase Report Form 1 you’re considering is suitable for your state.

- View the form making use of the Preview option and browse its description.

- Visit the subscription page by clicking Buy Now.

- Select the subscription plan to continue on to sign up.

- Pay out by card or PayPal to finish creating an account.

- Choose a preferred format to download the document (.pdf or .docx).

Now you can open up the Texas Lease Purchase Report Form 1 template and fill it out online or print it and get it done by hand. Think about sending the document to your legal counsel to ensure things are completed appropriately. If you make a error, print out and fill sample once again (once you’ve made an account every document you download is reusable). Create your US Legal Forms account now and get more templates.

Form popularity

FAQ

"Contracts for Deed" - Contracts for deed, sometimes referred to as "rent to own" financing arrangements, are legal in Texas.Under a contract for deed, the buyer only has an equity interest after they have paid 40% of the loan or more, or have made 48 monthly payments.

Standard lease agreements require monthly rental payments to use a car that is owned by the dealer and, if the agreement includes a purchase option, you may choose to buy the car at the end of the lease period. The lease-to-own agreement requires you to purchase the car or lose your investment.

A rent-to-own agreement is a deal in which you commit to renting a property for a specific period of time, with the option of buying it before the lease runs out.You pay rent throughout the lease, and in some cases, a percentage of the payment is applied to the purchase price.

Make no mistake, one can still do a lease-option in Texas, but many requirements now exist that did not apply before 2005. Property Code Sections 5.069 and 5.070 contain a number of these requirements, which must be met before the executory contract is signed by the purchaser (i.e., before and not at closing).

Rent-to-own contracts can vary, but generally they work like this: The renter agrees to lease the house for a set amount of time, usually one to three years.The contract locks in the purchase price of the home. The renter can purchase the home on or before the lease's expiration date.

A lease-option is a contract in which a landlord and tenant agree that, at the end of a specified period, the renter can buy the property. The tenant pays an up-front option fee and an additional amount each month that goes toward the eventual down payment.

Lease-option contracts give you the right to buy the home when the lease expires, while lease-purchase contracts require you to buy it. You pay rent throughout the lease, and in some cases, a percentage of the payment is applied to the purchase price.

Lease-option contracts give you the right to buy the home when the lease expires, while lease-purchase contracts require you to buy it. You pay rent throughout the lease, and in some cases, a percentage of the payment is applied to the purchase price.

The difference between a lease option and lease purchase agreement is that the lease option only obligates the seller to sell. A lease purchase agreement commits both parties to the sale barring breach of contract or the buyer's inability to secure a mortgage.