This lease rider form may be used when none of the provisions contained in the division order shall diminish, alter, or affect the rights, titles, or interests vested in Lessor by the terms of this Lease. No division order which Lessor may be requested to sign shall contain terms other than those terms and provisions expressly allowed by any applicable statute of the state in which the lands subject to this Lease are located.

Texas Division Orders

Description Texas Division Order Statute

How to fill out Texas Division Orders?

Access to high quality Texas Division Orders templates online with US Legal Forms. Avoid days of wasted time searching the internet and lost money on forms that aren’t updated. US Legal Forms offers you a solution to just that. Get over 85,000 state-specific legal and tax templates that you could save and complete in clicks in the Forms library.

To find the sample, log in to your account and click on Download button. The file will be saved in two places: on the device and in the My Forms folder.

For individuals who don’t have a subscription yet, check out our how-guide below to make getting started simpler:

- Find out if the Texas Division Orders you’re considering is appropriate for your state.

- View the form making use of the Preview function and browse its description.

- Go to the subscription page by simply clicking Buy Now.

- Select the subscription plan to go on to register.

- Pay out by card or PayPal to finish making an account.

- Select a favored format to save the document (.pdf or .docx).

Now you can open the Texas Division Orders example and fill it out online or print it and do it by hand. Take into account giving the papers to your legal counsel to be certain things are filled in appropriately. If you make a error, print out and fill application again (once you’ve made an account every document you save is reusable). Make your US Legal Forms account now and get access to a lot more templates.

Division Order Form popularity

Texas Divisions Other Form Names

FAQ

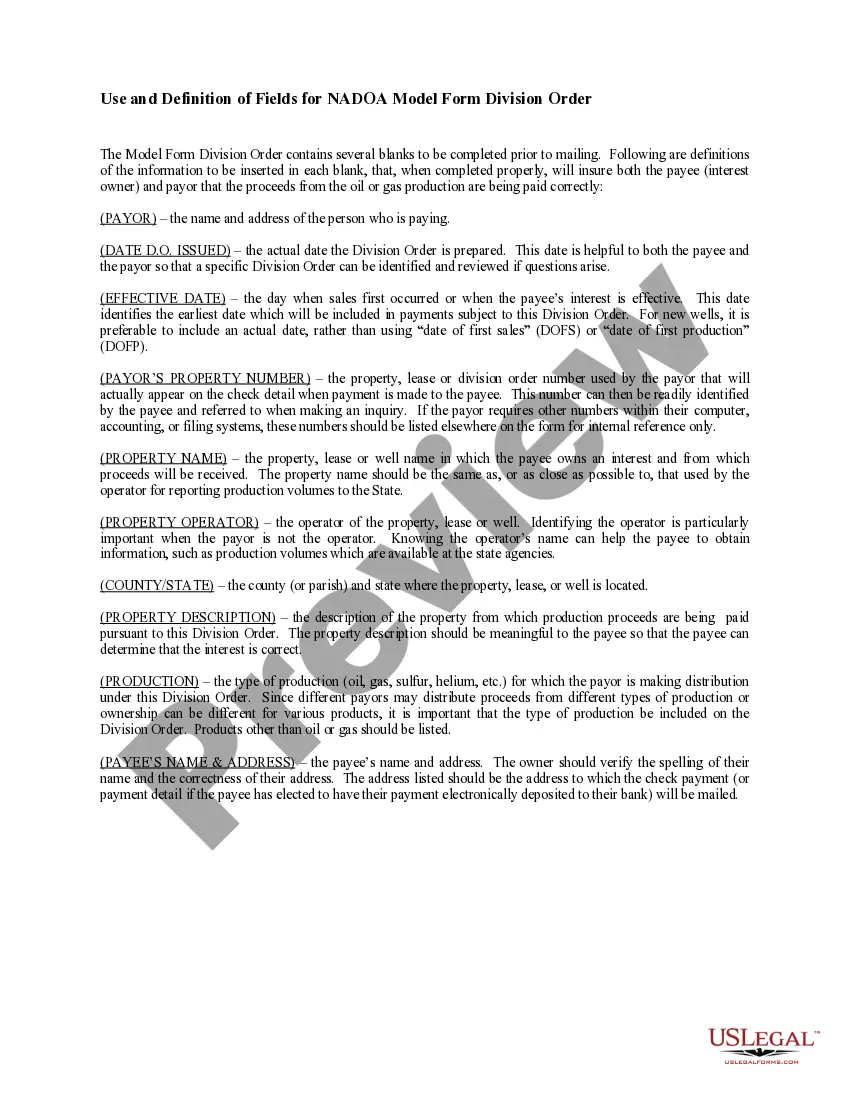

The percentage each lease tract contributes to the overall PA (or Communitized Area) is referred to as the Tract Participation Factor (TPF). percentage of unit revenue was multiplied by the Royalty (or ORRI) burden, to determine the royalty burden for each tract.

Royalty Interest an ownership in production that bears no cost in production. Royalty interest owners receive their share of production revenue before the working interest owners. Working Interest an ownership in a well that bears 100% of the cost of production.

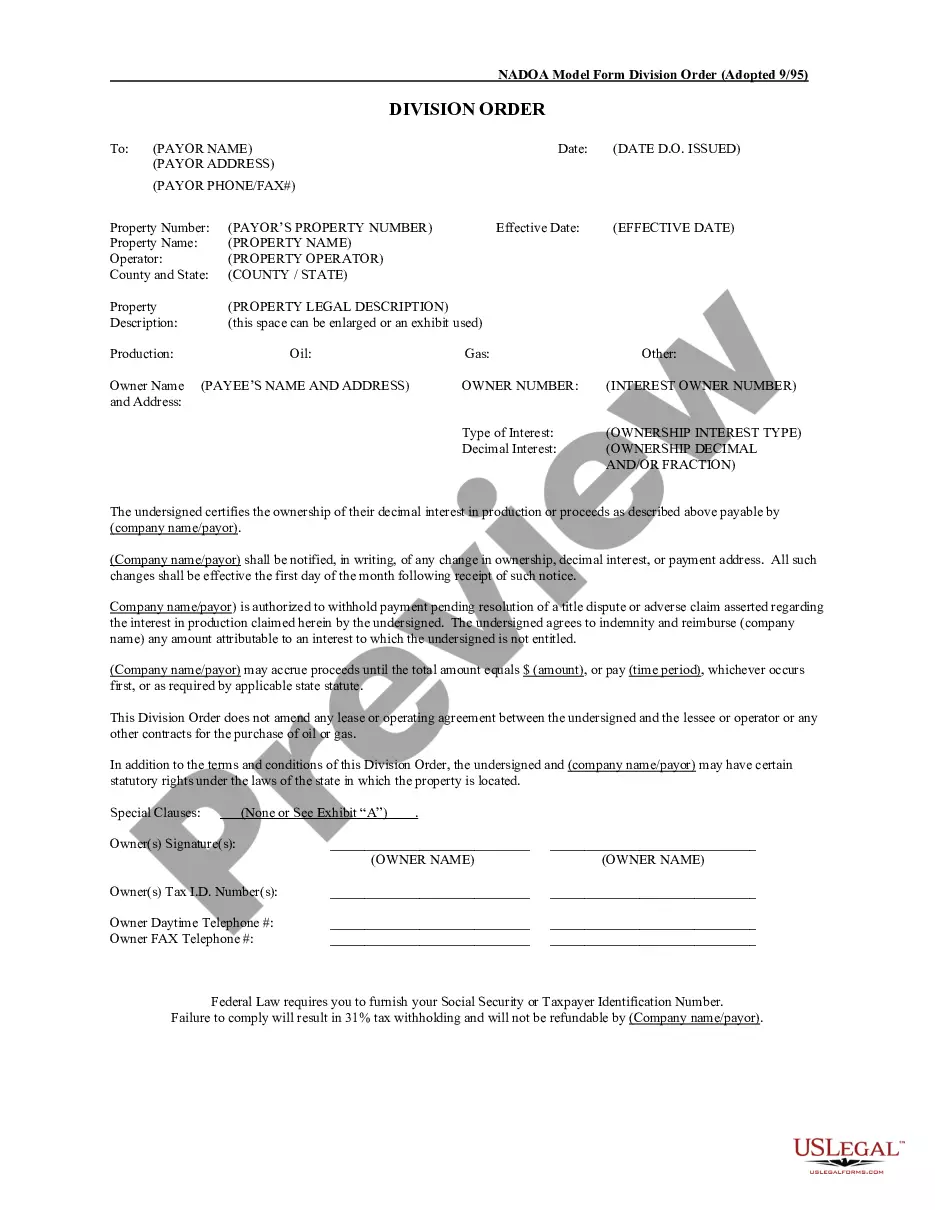

A division order is a record of your interest in a specific well. It contains your decimal interest, interest type, well number and well name. Division orders are issued to all that own an interest in a specific well after that well has achieved first sales of either oil or gas.

Net revenue is the amount that is shared among the property owners. To determine net revenue interest, multiply the royalty interest by the owner's shared interest. For example, if you have a 5/16 royalty, your net royalty interest would be 25% multiplied by 5/16, which equals 7.8125% calculated to four decimal places.

Your decimal interest is calculated based on your royalty interest in the tract or unit on which the well is drilled.Or, you might own a non-participating royalty equal to 1/16 of the royalty reserved in any lease of the lands in the unit (a fraction of the royalty).

A Division Order (DO's), also known as a Division of Interest (DOI), is the instrument which details the proportional ownership of produced minerals, including oil, liquids, natural gas, etc., in a well or unitized area of production.

Use this formula to calculate your decimal share of royalties from the producing well: (Mineral Interest Share) times (Royalty Rate) = (Royalty Share Decimal). Example 1: (1/3 x 100% mineral interest) times (1/8 Royalty Rate) = 1/3 x 1/8 = 1/24 = 0.04166667 RI.

A Division Order is an instrument which sets forth the proportional ownership in produced hydrocarbons, including crude oil, natural gas, and NGL's. Sometimes the Division Order is referred to as a division of interest. More often than not, a single well or lease will have multiple owners.

Royalty interest in the oil and gas industry refers to ownership of a portion of a resource or the revenue it produces. A company or person that owns a royalty interest does not bear any operational costs needed to produce the resource, yet they still own a portion of the resource or revenue it produces.