Texas El Declaration de Divulgacion Del Us ode Information de Credito (Texas Credit Disclosure Statement) is a form issued by the Texas Department of Banking in the state of Texas. It is a legal document that outlines the rights and responsibilities of consumers and lenders regarding the collection, use, and sharing of credit information. This document explains the type of information that lenders can collect from consumers, the purpose of collecting the information, how it can be used, and how it can be shared with other parties. It also outlines a consumer’s right to dispute any inaccurate information collected, as well as the right to obtain a free copy of their credit report. There are two types of Texas El Declaration de Divulgacion Del Us ode Information de Credito: the individual credit disclosure statement and the joint credit disclosure statement. The individual credit disclosure statement is for one consumer, while the joint credit disclosure statement is for two or more consumers applying for a joint loan. In both cases, the document outlines the same rights and responsibilities regarding the collection, use, and sharing of credit information.

Texas El Declaracion de Divulgacion del Uso de Informacion de Credito

Description

How to fill out Texas El Declaracion De Divulgacion Del Uso De Informacion De Credito?

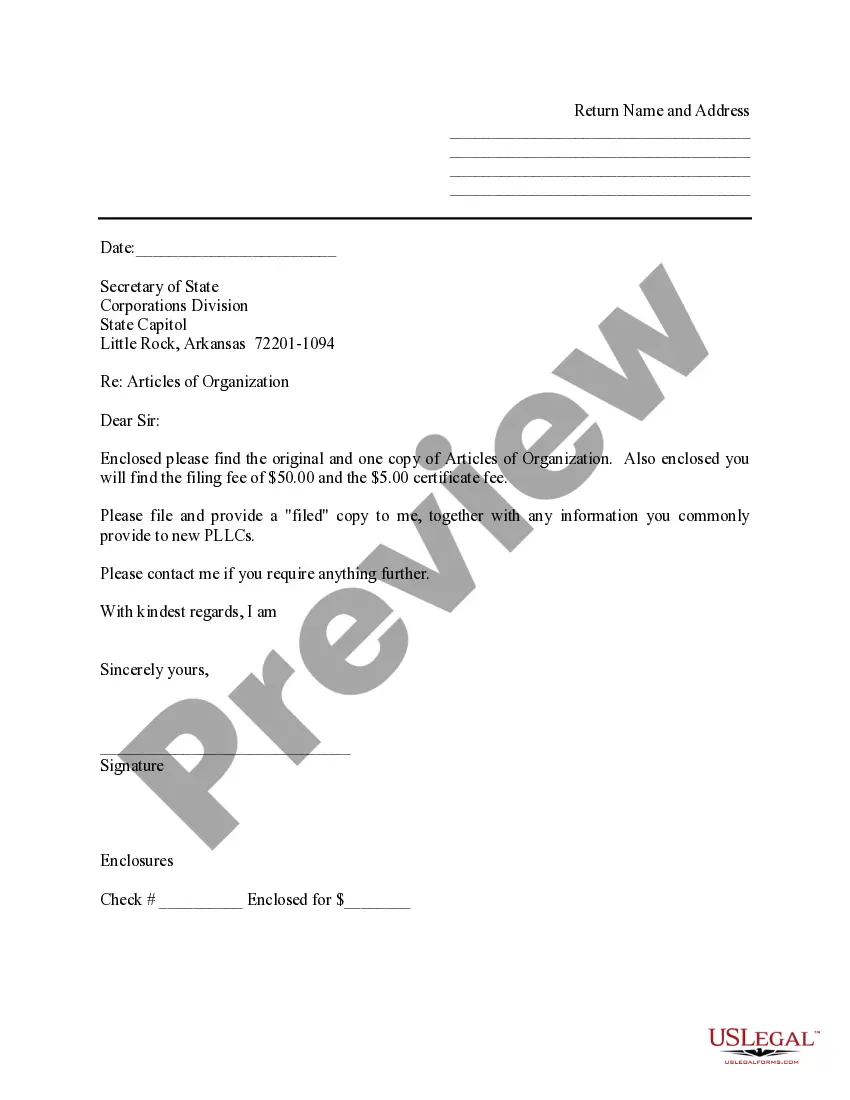

Preparing legal paperwork can be a real burden if you don’t have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be certain in the blanks you obtain, as all of them correspond with federal and state laws and are examined by our experts. So if you need to prepare Texas El Declaracion de Divulgacion del Uso de Informacion de Credito, our service is the best place to download it.

Obtaining your Texas El Declaracion de Divulgacion del Uso de Informacion de Credito from our catalog is as simple as ABC. Previously registered users with a valid subscription need only sign in and click the Download button after they find the proper template. Afterwards, if they need to, users can pick the same blank from the My Forms tab of their profile. However, even if you are new to our service, signing up with a valid subscription will take only a few moments. Here’s a brief guideline for you:

- Document compliance check. You should attentively review the content of the form you want and check whether it satisfies your needs and meets your state law requirements. Previewing your document and reviewing its general description will help you do just that.

- Alternative search (optional). If you find any inconsistencies, browse the library through the Search tab on the top of the page until you find an appropriate template, and click Buy Now once you see the one you want.

- Account registration and form purchase. Register for an account with US Legal Forms. After account verification, log in and select your most suitable subscription plan. Make a payment to continue (PayPal and credit card options are available).

- Template download and further usage. Choose the file format for your Texas El Declaracion de Divulgacion del Uso de Informacion de Credito and click Download to save it on your device. Print it to complete your paperwork manually, or take advantage of a multi-featured online editor to prepare an electronic copy faster and more efficiently.

Haven’t you tried US Legal Forms yet? Subscribe to our service now to get any formal document quickly and easily every time you need to, and keep your paperwork in order!

Form popularity

FAQ

An insurer generally has the duty to defend or pay the legal expenses of an insured who is subject to a legal action for the covered risk. Duties of an Insurer - Explained - The Business Professor, LLC thebusinessprofessor.com ? insurance-risk-law ? d... thebusinessprofessor.com ? insurance-risk-law ? d...

2) Agencia: el asegurador representa al afiliado y hace compras en volumen o interviene en la prestacion de servicios para reducir precios de bienes y servicios requeridos para recuperar la salud.

Puedes presentar tu queja ante la Comision Nacional de Seguros y Fianzas (CNSF), derivada por conductas que puedan conllevar infracciones administrativas a la regulacion de la actividad de ajustador de seguros, para que la autoridad inicie un tramite y resuelva lo procedente, conforme a las disposiciones aplicables.

Conclusion. Segun la ley de Texas, un ajustador de seguros no tiene que decirle cuales son los limites de la poliza de sus asegurados . Puede hacer una demanda de Stowers para obligarlos a pagar y probar los limites, pero esto depende de que acepte su oferta de liquidacion.

Un asegurador generalmente tiene el deber de defender o pagar los gastos legales de un asegurado que esta sujeto a una accion legal por el riesgo cubierto .

Conclusion. Under Texas law, an insurance adjuster does not have to tell you what their insured's policy limits are. You can do a Stowers demand to force them to pay and prove the limits, but this is contingent upon you accepting their settlement offer. How To Find Out the Other Driver's Insurance Policy Limits in Texas simmonsandfletcher.com ? blog ? how-to-fi... simmonsandfletcher.com ? blog ? how-to-fi...

La principal obligacion del tomador de un seguro consiste en pagar la prima de dicho seguro, ademas, cuando se hace presente un siniestro (una enfermedad en un seguro de salud), esta obligado a informar sobre la misma a efectos de que las consecuencias sean lo menos graves posible.