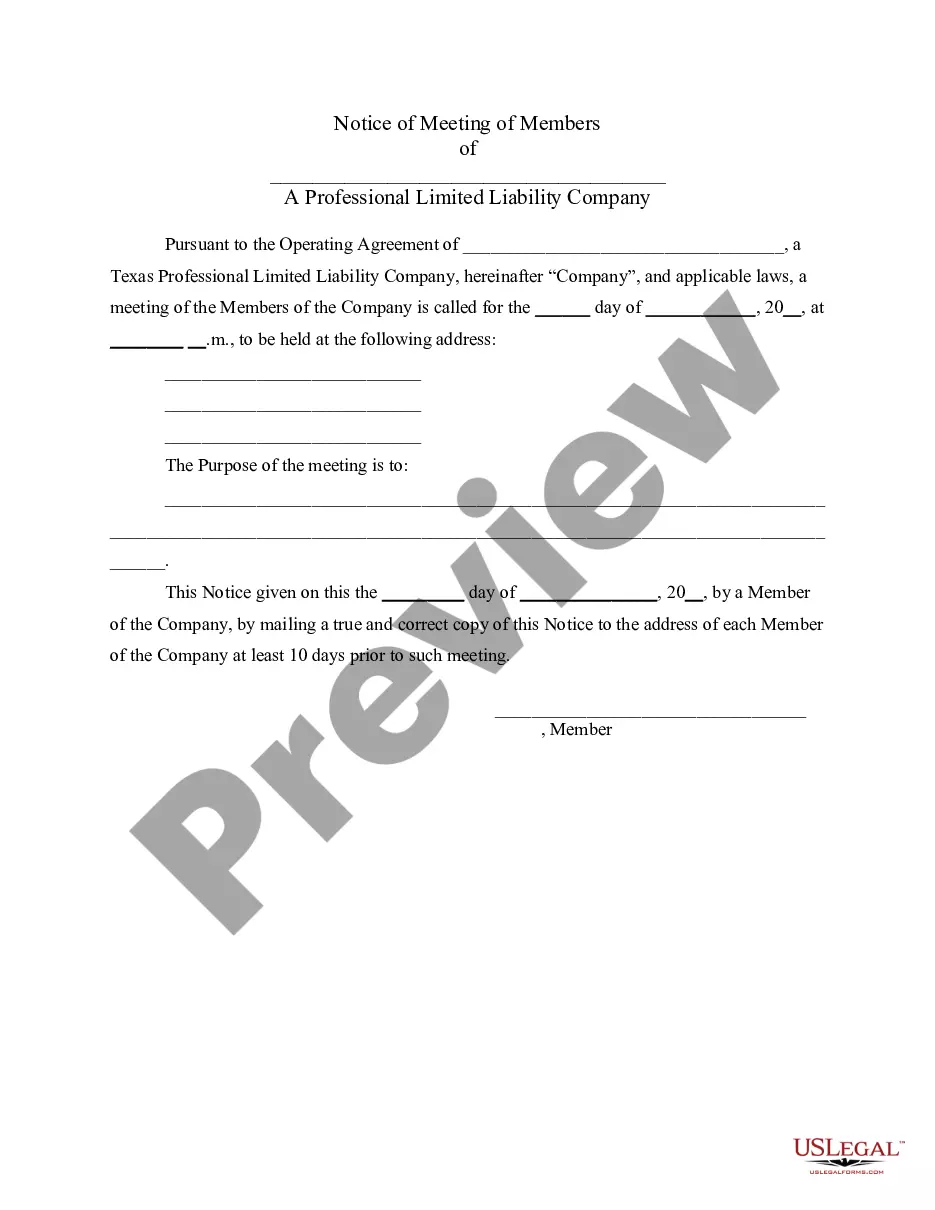

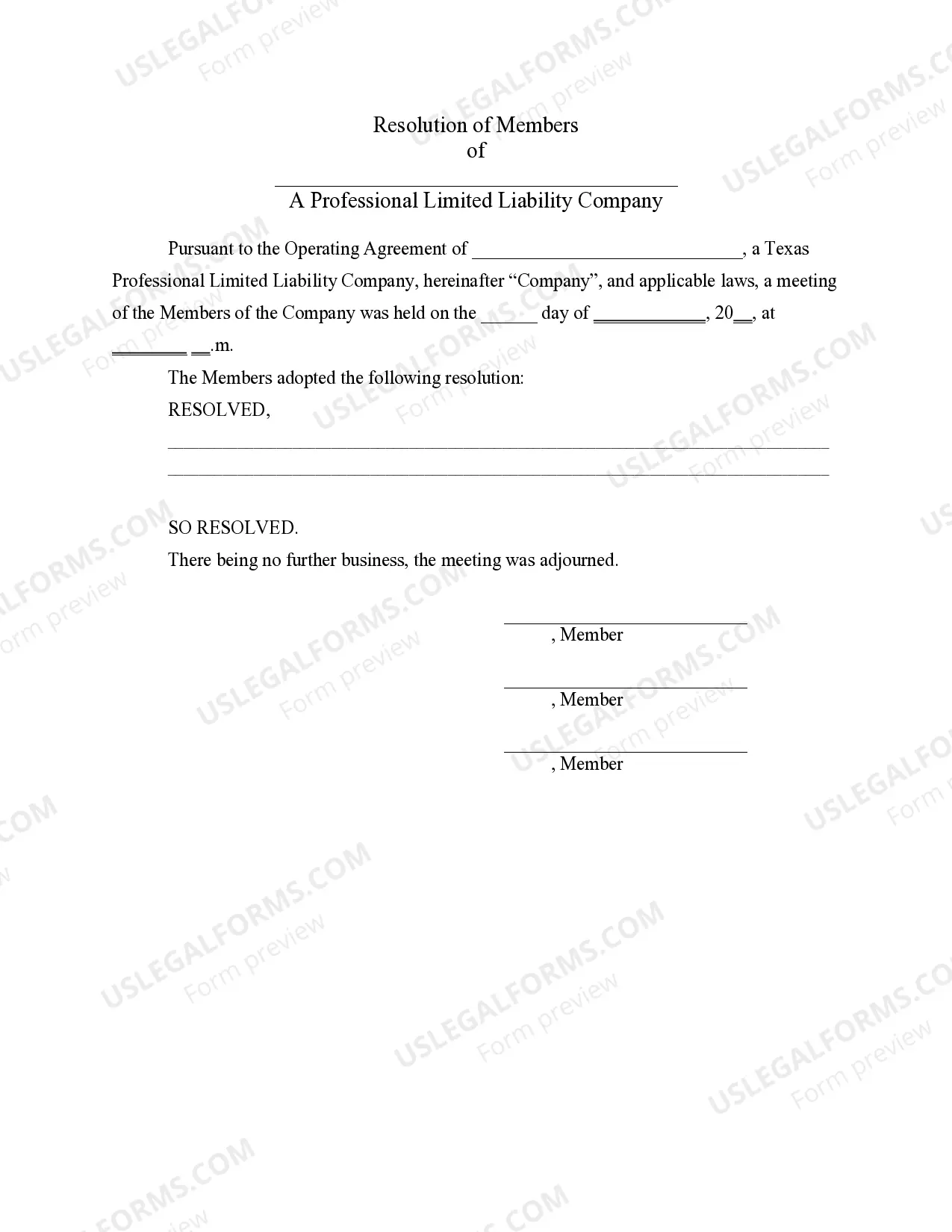

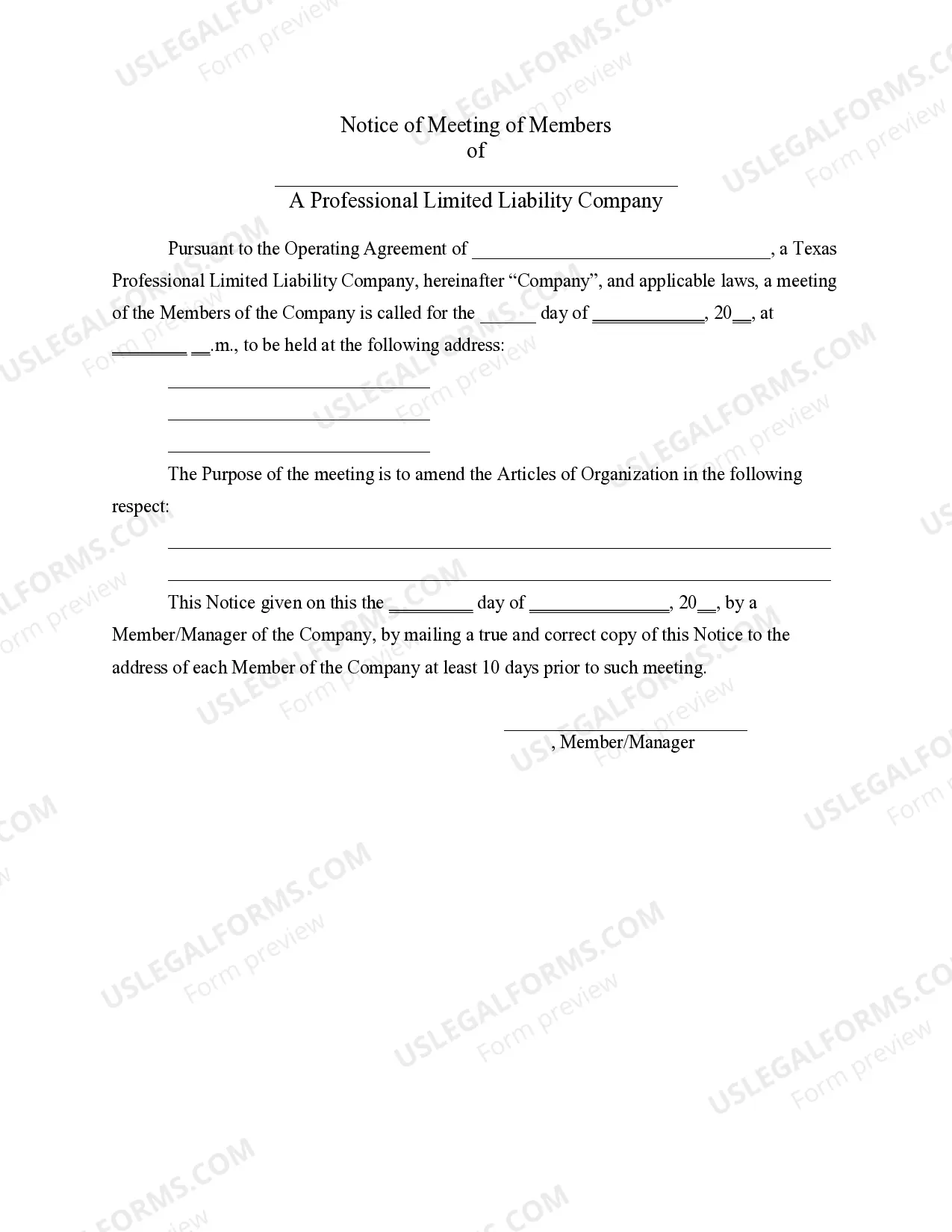

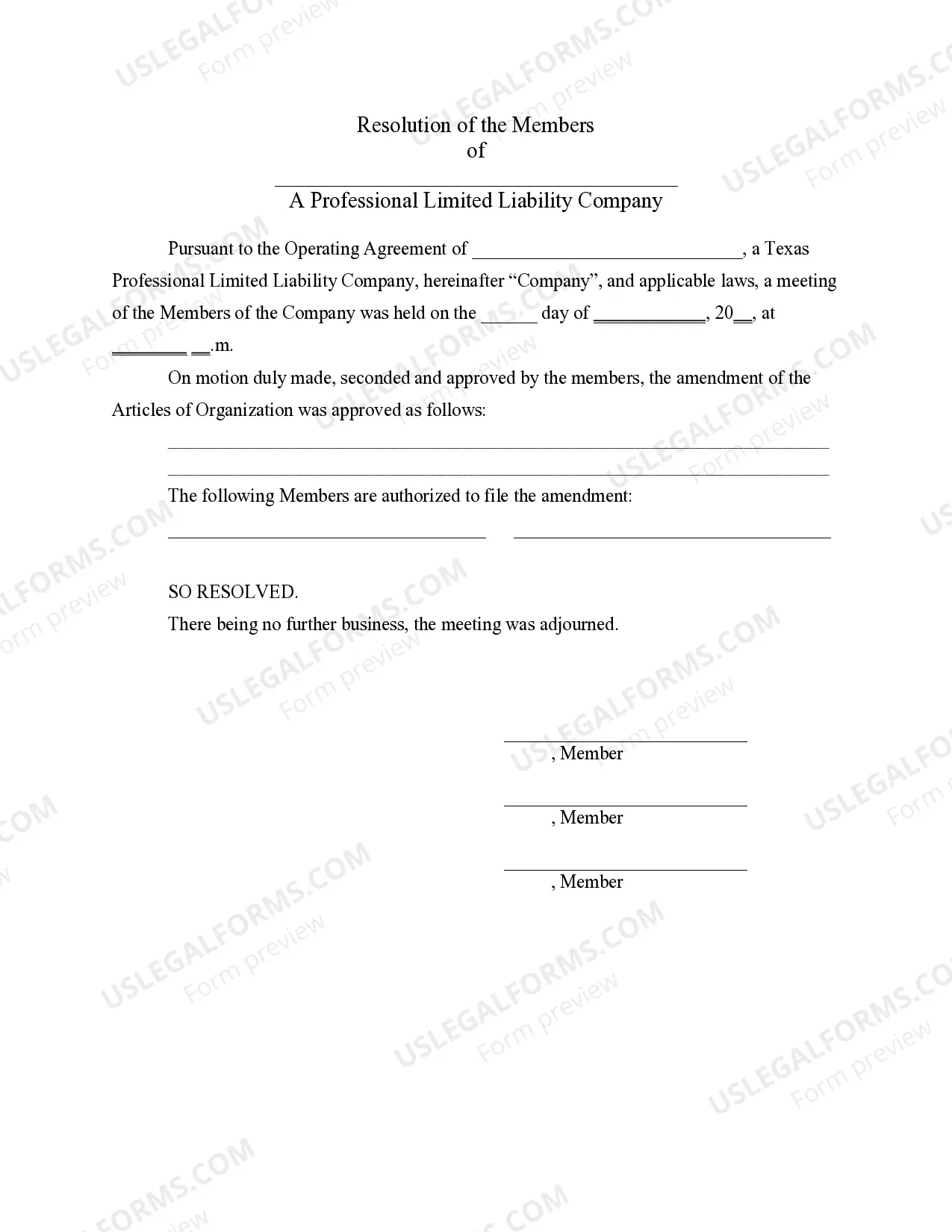

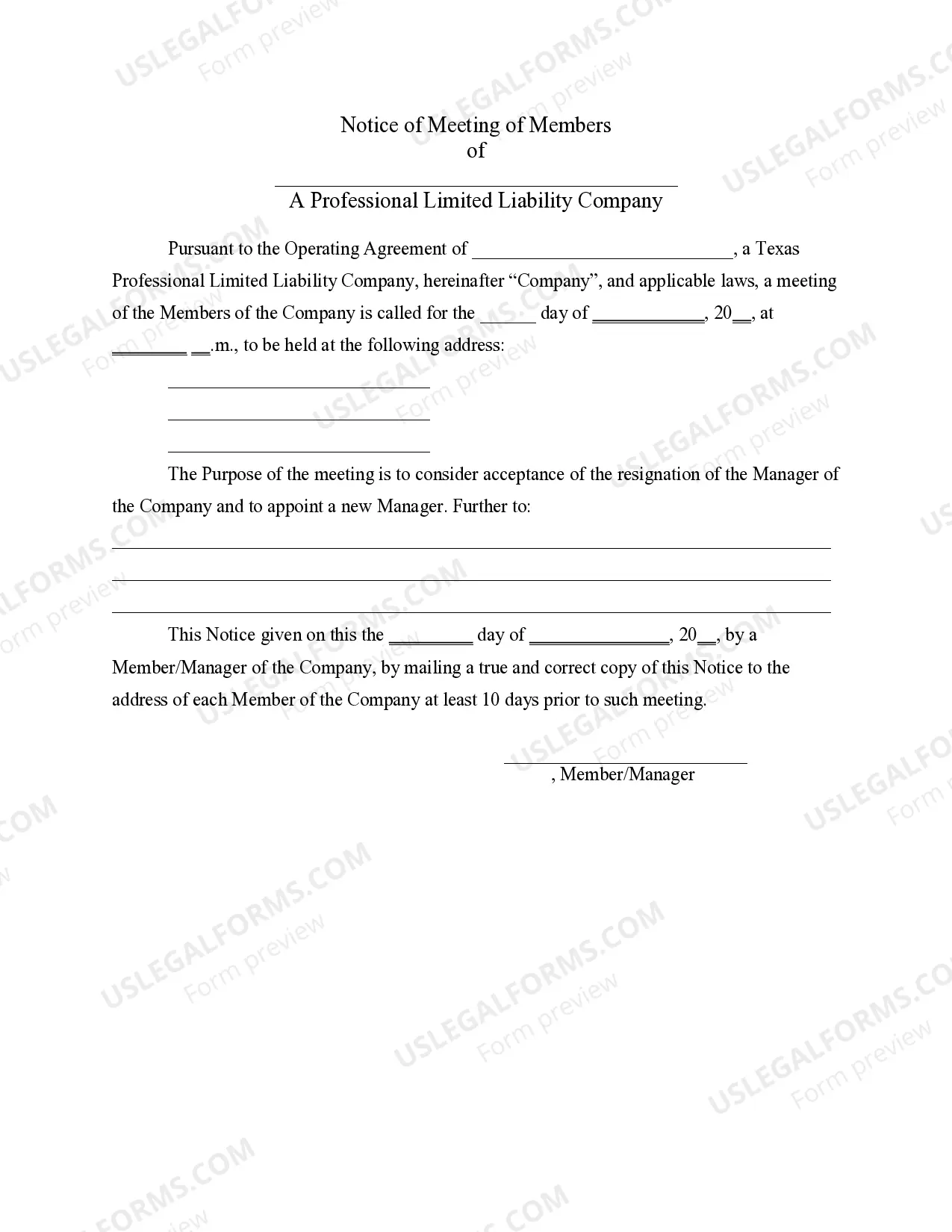

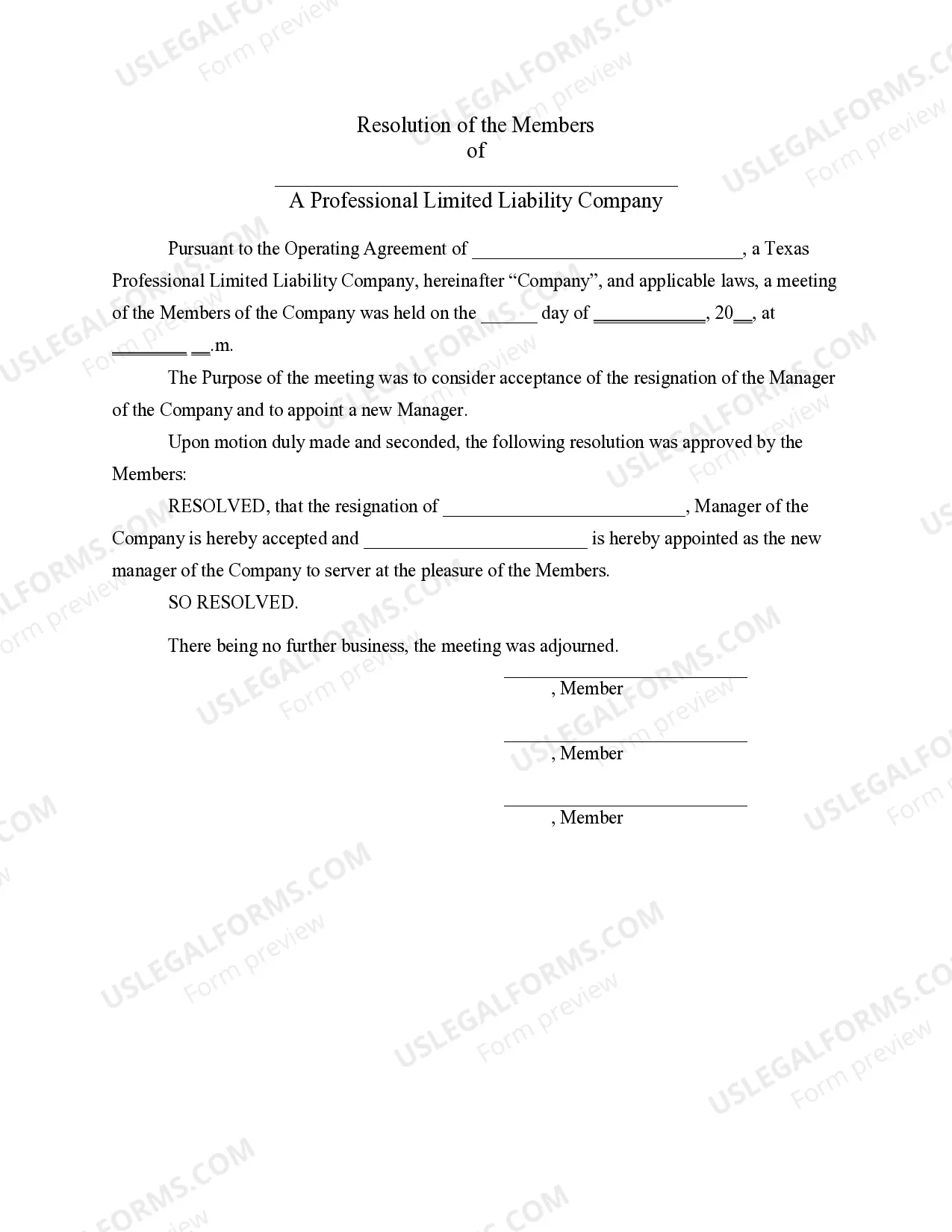

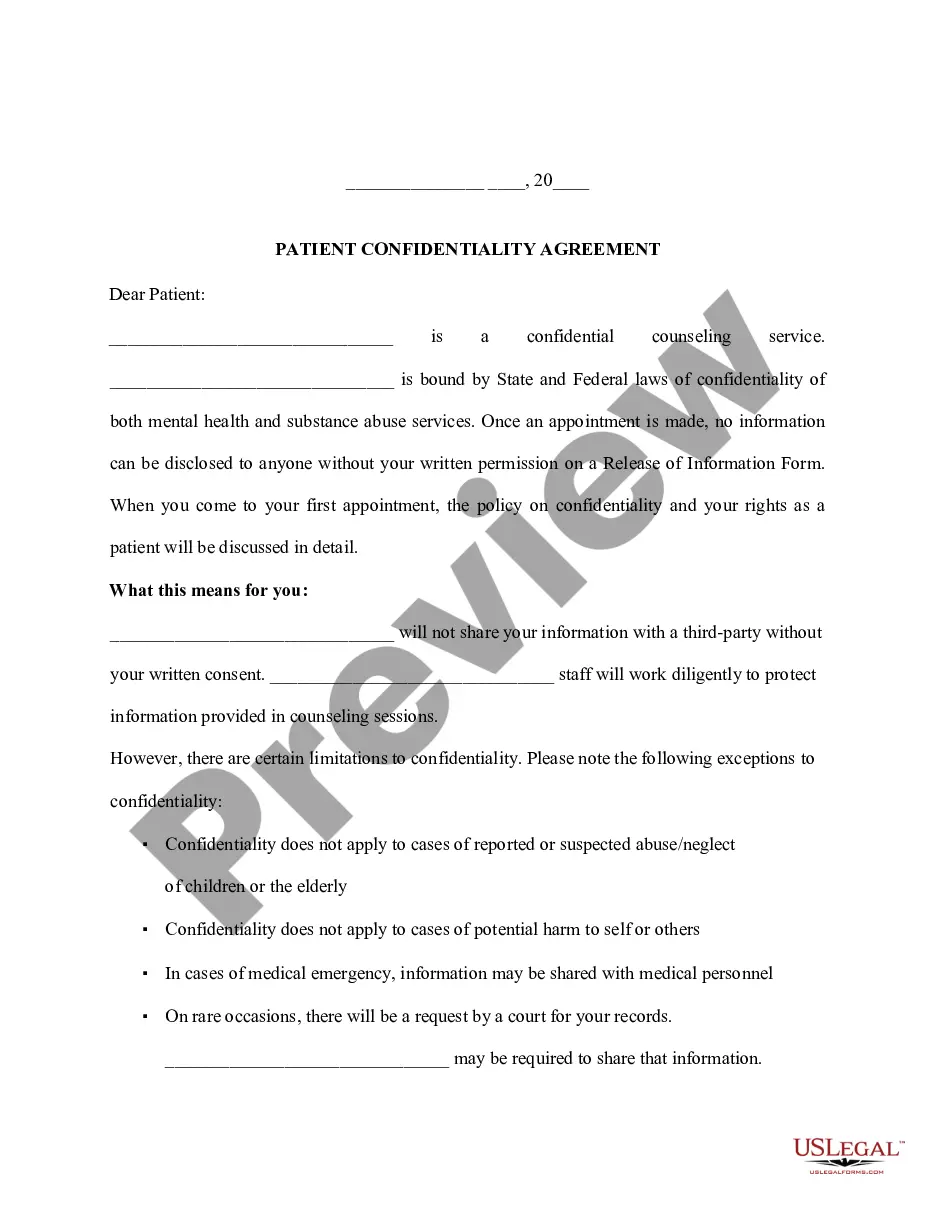

Sample Notices and Resolutions for use in the business transactions of a PLLC.

Texas PLLC Notices and Resolutions

Description

How to fill out Texas PLLC Notices And Resolutions?

Access to top quality Texas PLLC Notices and Resolutions forms online with US Legal Forms. Steer clear of hours of wasted time looking the internet and dropped money on documents that aren’t up-to-date. US Legal Forms provides you with a solution to just that. Get above 85,000 state-specific legal and tax templates that you can save and fill out in clicks within the Forms library.

To get the sample, log in to your account and click on Download button. The document will be saved in two places: on the device and in the My Forms folder.

For individuals who don’t have a subscription yet, have a look at our how-guide below to make getting started simpler:

- Find out if the Texas PLLC Notices and Resolutions you’re considering is suitable for your state.

- View the sample using the Preview function and browse its description.

- Visit the subscription page by clicking Buy Now.

- Choose the subscription plan to continue on to register.

- Pay out by card or PayPal to complete creating an account.

- Choose a preferred file format to download the document (.pdf or .docx).

You can now open the Texas PLLC Notices and Resolutions sample and fill it out online or print it and get it done yourself. Think about mailing the document to your legal counsel to make certain everything is filled out appropriately. If you make a mistake, print out and fill sample once again (once you’ve created an account all documents you download is reusable). Make your US Legal Forms account now and access more templates.

Form popularity

FAQ

Annual Report Unlike most states, Texas does not require LLCs to file annual reports with the Secretary of State. However, LLCs must file annual franchise tax reports (see below).

A limited liability company's articles of organization generally allow its members to designate the duration of the company. Articles can state a date upon which an LLC expires. If no expiration date is stated, the LLC continues perpetually.

It takes 1 - 3 business days (from start to finish) to form a Texas LLC. The LLC formation process starts when a Certificate of Formation is filed with the Texas Secretary of State. The Secretary approves online filings in 1 - 3 business days (5 - 7 business days for fax filings).

Have the state license for each professional who will be a member of the company. check with the state licensing board for your profession to see if its prior approval is required, (and, if so, obtain the necessary documentation showing that approval), and.

In other words, the responsibility for paying federal income taxes passes through the LLC itself and falls on the individual LLC members. By default, LLCs themselves do not pay federal income taxes, only their members do. Texas, however, imposes a state franchise tax on most LLCs.

If you've incorporated as a business As an LLC, LLP, S-Corp or C-Corp, you must file an annual report, normally with your state's Secretary of State. This applies no matter how big or small your business is. Typically, sole proprietors and partnerships do not have to file an annual report.

To file a certificate of amendment if the entity seeks only to change its registered agent or its Page 4 Form 424 4 registered office. A filing entity may file a statement of change of registered agent/registered office pursuant to section 5.202 of the BOC.

How much does it cost to form an LLC in Texas? The Texas Secretary of State charges a $300 filing fee, plus an additional state-mandated 2.7% convenience fee to file an LLC Certificate of Formation.

A limited liability company is its own legal entity. Like a corporation or partnership, it receives a tax identification number. Instead of the owner having to do business, complete financial transactions and file paperwork in his or her own name, they can accomplish all those tasks under the LLC.