Texas Notice of Potential Entitlement to Workers' Compensation Death Benefits

Description

How to fill out Texas Notice Of Potential Entitlement To Workers' Compensation Death Benefits?

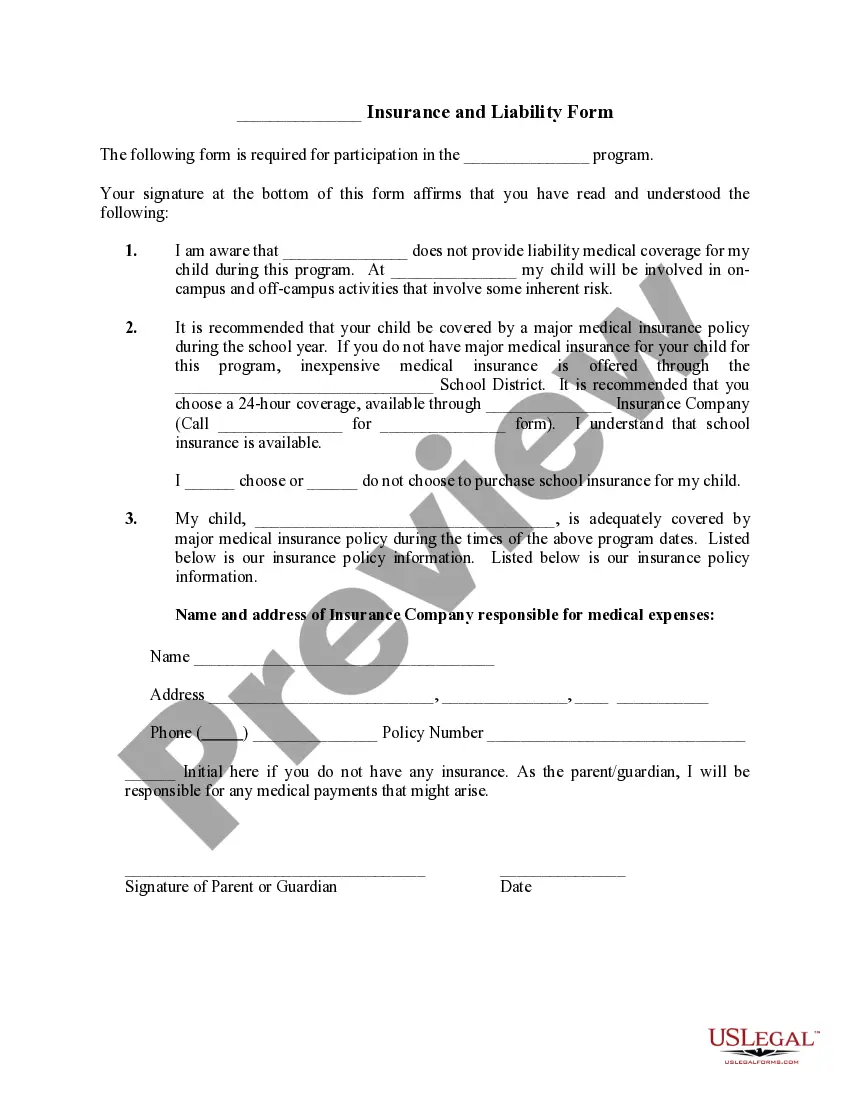

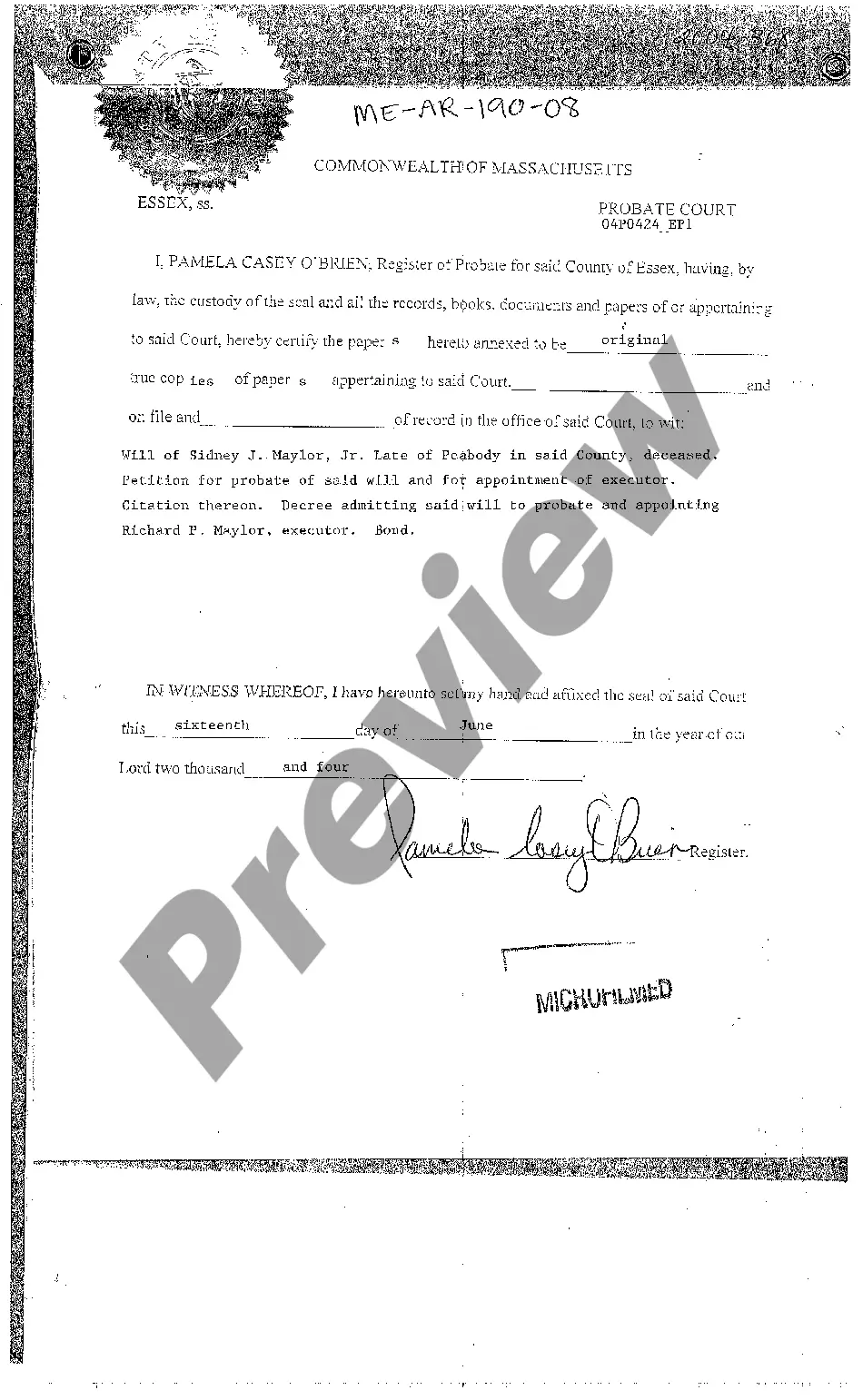

Preparing legal paperwork can be a real stress if you don’t have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be confident in the blanks you obtain, as all of them correspond with federal and state laws and are checked by our specialists. So if you need to fill out Texas Notice of Potential Entitlement to Workers' Compensation Death Benefits, our service is the perfect place to download it.

Obtaining your Texas Notice of Potential Entitlement to Workers' Compensation Death Benefits from our catalog is as easy as ABC. Previously authorized users with a valid subscription need only sign in and click the Download button after they find the proper template. Afterwards, if they need to, users can pick the same blank from the My Forms tab of their profile. However, even if you are new to our service, registering with a valid subscription will take only a few moments. Here’s a brief guideline for you:

- Document compliance check. You should carefully examine the content of the form you want and make sure whether it satisfies your needs and meets your state law regulations. Previewing your document and reviewing its general description will help you do just that.

- Alternative search (optional). If there are any inconsistencies, browse the library using the Search tab above until you find an appropriate template, and click Buy Now when you see the one you want.

- Account registration and form purchase. Sign up for an account with US Legal Forms. After account verification, log in and choose your most suitable subscription plan. Make a payment to proceed (PayPal and credit card options are available).

- Template download and further usage. Choose the file format for your Texas Notice of Potential Entitlement to Workers' Compensation Death Benefits and click Download to save it on your device. Print it to complete your papers manually, or take advantage of a multi-featured online editor to prepare an electronic version faster and more effectively.

Haven’t you tried US Legal Forms yet? Sign up for our service now to obtain any official document quickly and easily every time you need to, and keep your paperwork in order!

Form popularity

FAQ

Survivors Benefit Amount Surviving spouse, full retirement age or older ? 100% of the deceased worker's benefit amount. Surviving spouse, age 60 ? through full retirement age ? 71½ to 99% of the deceased worker's basic amount. Surviving spouse with a disability aged 50 through 59 ? 71½%.

Death Benefits are paid at a rate of 75 percent of the deceased employee's average weekly wage. These benefits are subject to statutory weekly maximums, currently $895 per week, but are not subject to statutory minimums. Similar to Lifetime Income Benefits, Death Benefits are not taxable.

Regardless of when, how, or why your employer stops payments, workers comp cannot stop paying without notice. Your employer or their insurer cannot stop paying you workers' compensation benefits without telling you.

What Is The Ninety Day Rule? The ninety day rule comes from Division of Workers' Compensation Rule 130.12. It states that the first valid impairment rating given to an injured worker becomes FINAL if it is not disputed within ninety days of delivery of written notice through verifiable means.

While most other states allow lump sum settlements, Texas does not. The only benefits that may be paid in a lump sum are impairment income benefits. If you have been back to work for at least three months and earn at least 80% of your average weekly wage, you can commute your impairment income benefits.

Death benefits are 75% of the deceased employee's average weekly wage. There are maximum and minimum benefit limits. Benefits may also be available for burial expenses. They are paid to the person who paid for the burial expenses.

Your spouse, children, and parents could be eligible for benefits based on your earnings. You may receive survivors benefits when a family member dies. You and your family could be eligible for benefits based on the earnings of a worker who died. The deceased person must have worked long enough to qualify for benefits.

There is a monthly payment paid by the State of Texas to the eligible surviving spouse and minor child until the child reaches the age of 18: ? $400 each month; if there is one surviving child. $600 each month; if there are two surviving children.