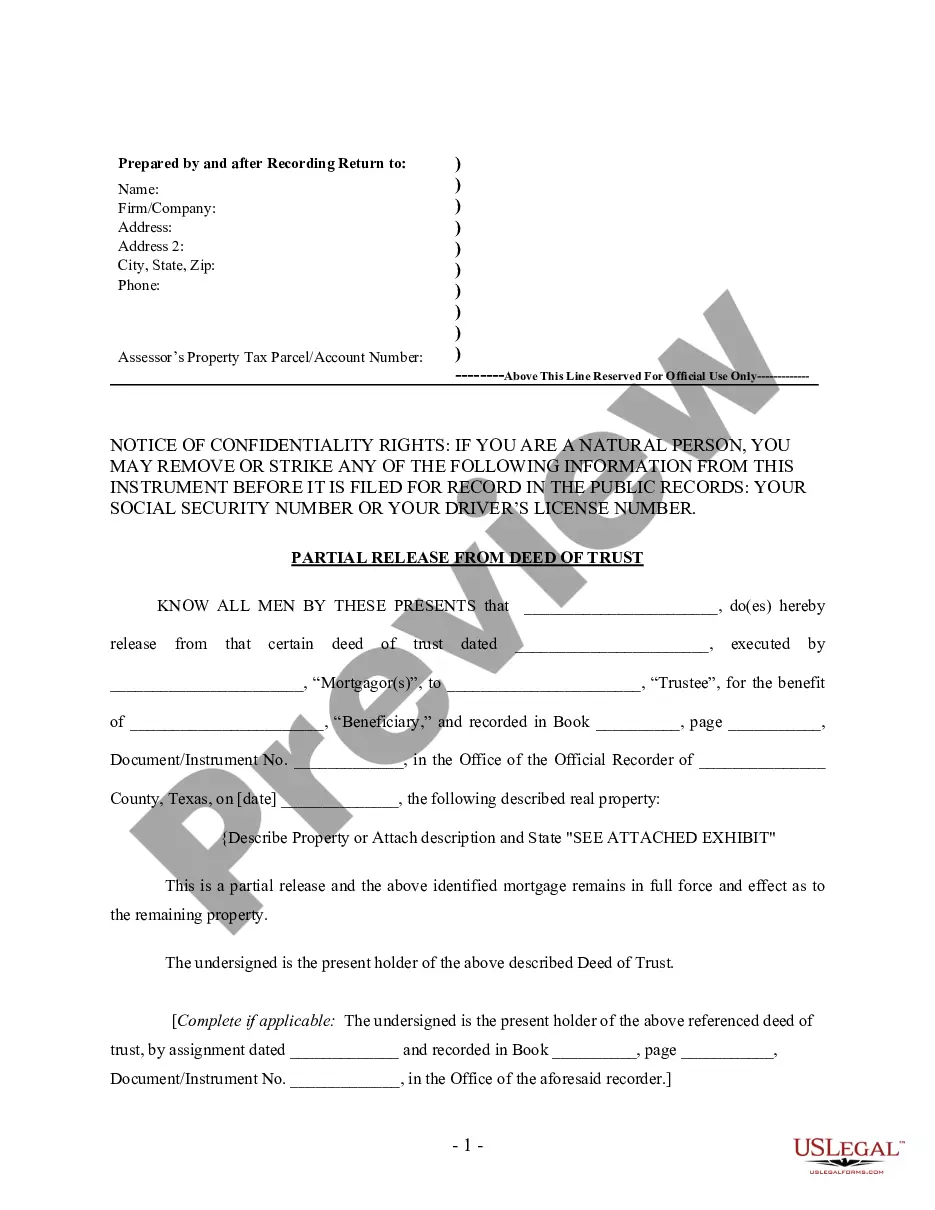

This form is for a holder of a deed of trust or mortgage (see title) to release a portion of the real property described as security. It asserts that the identified and referenced deed of trust or mortgage remains in full force or effect as to the remaining property.

Texas Partial Release of Property From Deed of Trust for Individual

Description Property Deed Trust

How to fill out Deed Release Form?

Access to quality Texas Partial Release of Property From Deed of Trust for Individual forms online with US Legal Forms. Avoid days of lost time searching the internet and lost money on documents that aren’t updated. US Legal Forms gives you a solution to just that. Get around 85,000 state-specific authorized and tax templates that you can download and complete in clicks in the Forms library.

To find the sample, log in to your account and then click Download. The file is going to be stored in two places: on the device and in the My Forms folder.

For people who don’t have a subscription yet, look at our how-guide listed below to make getting started simpler:

- Verify that the Texas Partial Release of Property From Deed of Trust for Individual you’re looking at is appropriate for your state.

- Look at the form using the Preview option and read its description.

- Check out the subscription page by simply clicking Buy Now.

- Choose the subscription plan to go on to register.

- Pay by credit card or PayPal to complete making an account.

- Choose a preferred format to save the document (.pdf or .docx).

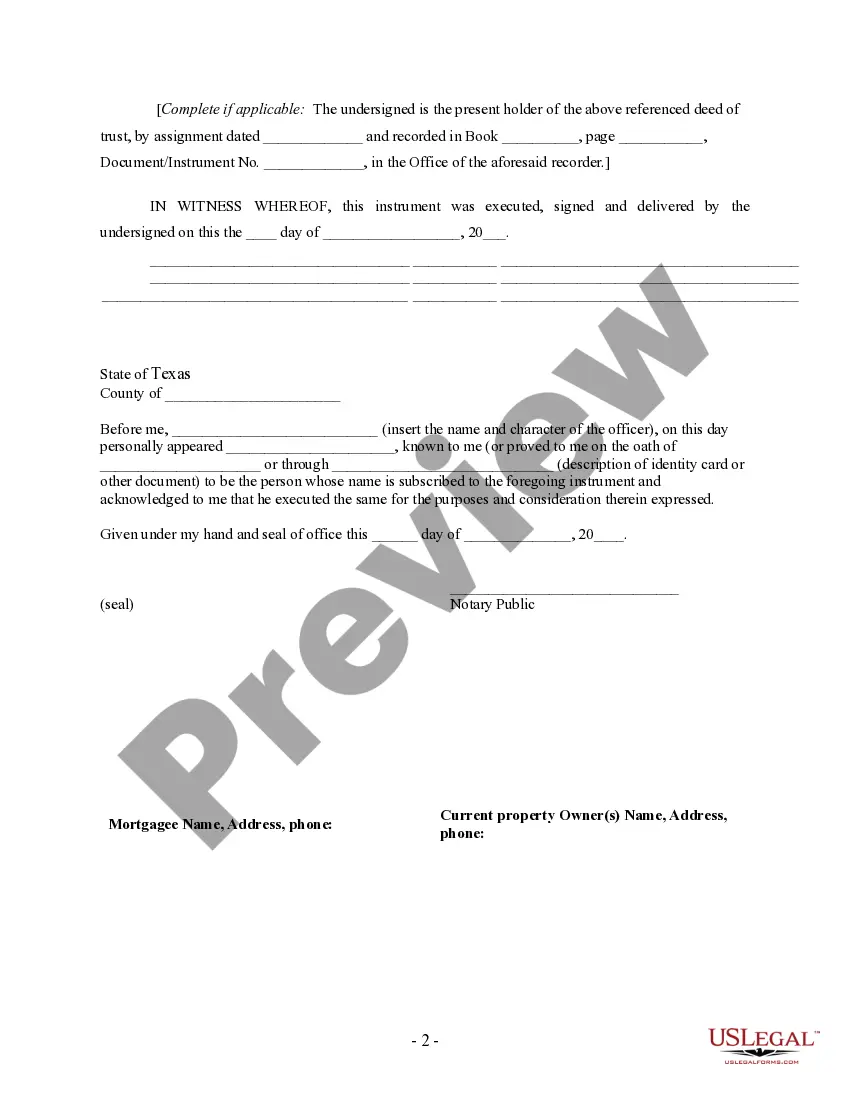

You can now open the Texas Partial Release of Property From Deed of Trust for Individual sample and fill it out online or print it and get it done by hand. Consider mailing the document to your legal counsel to ensure everything is filled out properly. If you make a mistake, print out and complete application again (once you’ve made an account every document you download is reusable). Make your US Legal Forms account now and get much more forms.

Deed Of Trust Form popularity

Release Deed Trust Other Form Names

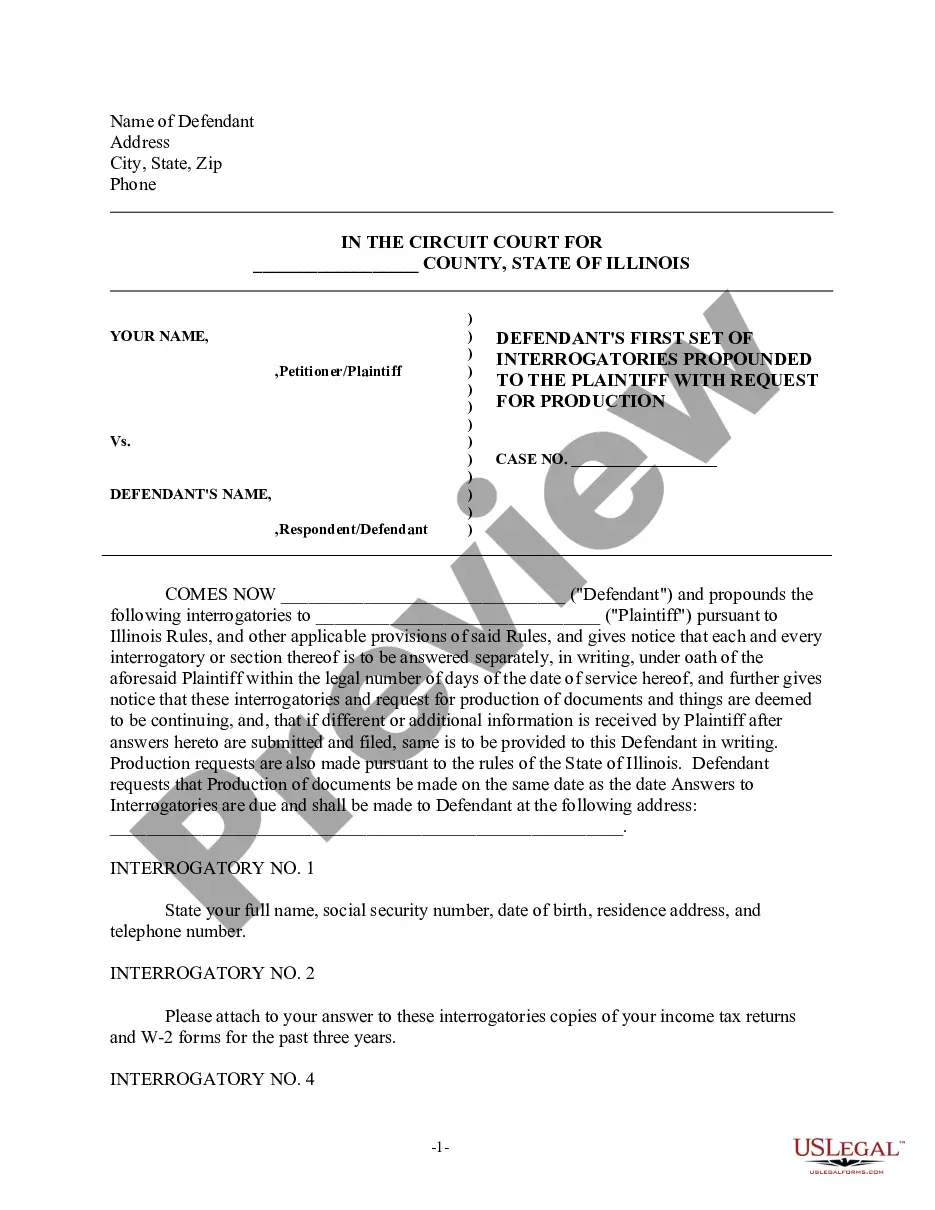

Texas Deed Individual FAQ

In the context of a California mortgage transaction, a trust deed also transfer ownership. Only this time, the title is being placed in the hands of a third-party trustee, who holds the property on behalf of the lender and the homeowner-borrower until the mortgage is paid.

In Texas, a deed must be in writing and signed by the person transferring the land, otherwise known as the grantor. The person the grantor is transferring the land to is known as the grantee. No particular words must be used in order to constitute a legally effective transfer, but whatever words are used must show

Find the most recent deed to the property. It is best to begin with a copy of the most recent deed to the property (the deed that transferred the property to the current grantor). Create a new deed. Sign and notarize the deed. File the documents in the county land records.

An acknowledgment technically is not required for a deed to be valid; however, in most states, a deed without an acknowledgment cannot be recorded in the official public records. It is usually not necessary to record a deed for the transfer of title to be valid.

Find the most recent deed to the property. It is best to begin with a copy of the most recent deed to the property (the deed that transferred the property to the current grantor). Create a new deed. Sign and notarize the deed. File the documents in the county land records.

About the release form This form should be filed with the recorder's office in the Texas county where the lien was originally recorded. Texas law requires claimants to file a lien release within 10 days after the lien is satisfied, or upon request from the property owner.

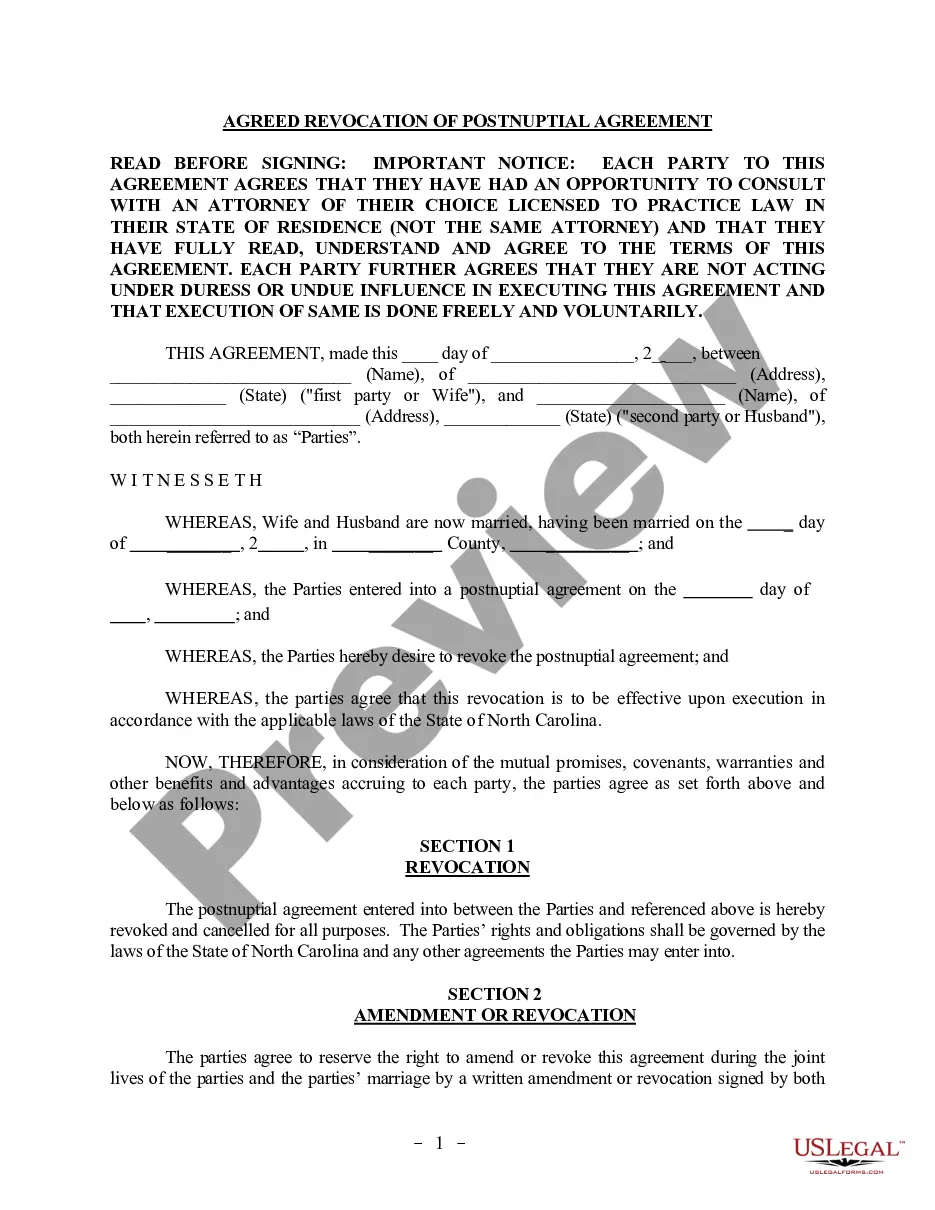

Now, people can convey clear title to their property by completing a transfer on death deed form, signing it in front of a notary, and filing it in the deed records office in the county where the property is located before they die at a cost of less than fifty dollars.

Witnessedwritten, two witnesses; holographic-handwritten or typed, signed by testator; approved-on a pre-printed form approved by the state; nuncupative-written by a witness from testator's oral statement; generally not valid for real estate transfer.

Pay off your debt. Fill out a release-of-lien form and have the lien holder sign it. Run out the statute of limitations. Get a court order. Make a claim with your title insurance company. Learn more: