This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

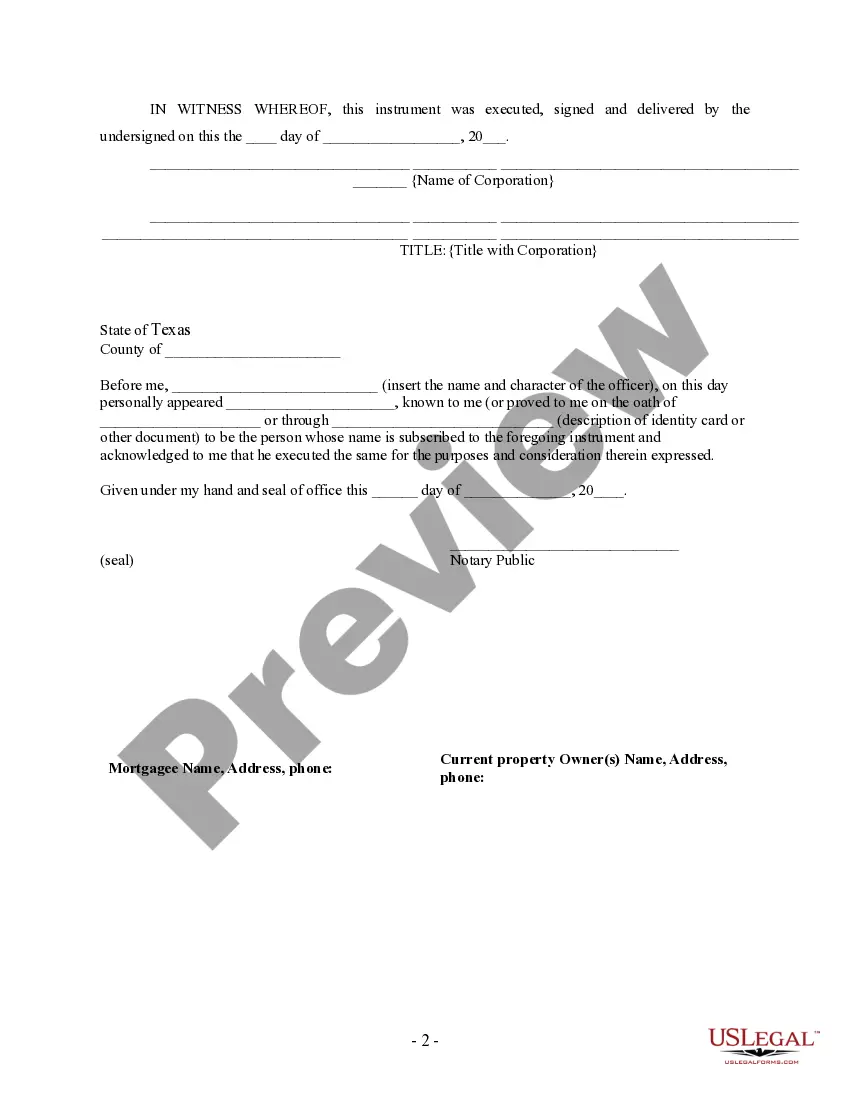

Texas Partial Release of Property From Deed of Trust for Corporation

Description Property Deed Trust

How to fill out Release Property Deed?

Get access to top quality Texas Partial Release of Property From Deed of Trust for Corporation templates online with US Legal Forms. Avoid days of lost time looking the internet and dropped money on files that aren’t up-to-date. US Legal Forms offers you a solution to just that. Find more than 85,000 state-specific authorized and tax samples that you can download and complete in clicks within the Forms library.

To find the sample, log in to your account and click on Download button. The document is going to be saved in two places: on your device and in the My Forms folder.

For individuals who don’t have a subscription yet, take a look at our how-guide listed below to make getting started simpler:

- Find out if the Texas Partial Release of Property From Deed of Trust for Corporation you’re looking at is appropriate for your state.

- See the sample using the Preview function and browse its description.

- Visit the subscription page by clicking Buy Now.

- Select the subscription plan to keep on to register.

- Pay by card or PayPal to complete making an account.

- Choose a preferred file format to download the file (.pdf or .docx).

You can now open the Texas Partial Release of Property From Deed of Trust for Corporation sample and fill it out online or print it out and get it done yourself. Think about giving the file to your legal counsel to ensure things are filled in correctly. If you make a error, print and fill sample again (once you’ve made an account all documents you download is reusable). Create your US Legal Forms account now and access a lot more forms.

Texas Deed Form Fillable Form popularity

Property Trust Form Other Form Names

Tx Deed Form FAQ

Yes, you can challenge the release deed/ relinquishment deed after the death of the person. but to challenge it you need to have solid grounds and proof stating that the deed was made fraudulently. if you dont have any proof then their is no point challenging it as the case may not sustain merit in the court.

In the context of a California mortgage transaction, a trust deed also transfer ownership. Only this time, the title is being placed in the hands of a third-party trustee, who holds the property on behalf of the lender and the homeowner-borrower until the mortgage is paid.

A deed of release literally releases the parties to a deal from previous obligations, such as payments under the term of a mortgage because the loan has been paid off. The lender holds the title to real property until the mortgage's terms have been satisfied when a deed of release is commonly entered into.

Parties need a deed of release to bring a dispute or agreement to an end.Alternatively, if you are an employer, you may want a departing employee to sign a deed of release to agree that they won't make any employment claims against you once they have gone.

A deed of release or release deed is a legal document that removes the claim of a person from an immovable property and transfers his/her share to the co-owner. The release deed procedure is executed in the sub-registrars office and both the parties are required to be present for signing it.

In order to clear the Deed of Trust from the title to the property, a Deed of Reconveyance must be recorded with the Country Recorder or Recorder of Deeds. If the Trustee/Beneficiary fails to record a satisfaction within the set time limits, the Trustee/Beneficiary may be responsible for damages as set out by statute.

A deed of trust involves three parties: a lender, a borrower, and a trustee. The lender gives the borrower money. In exchange, the borrower gives the lender one or more promissory notes. As security for the promissory notes, the borrower transfers a real property interest to a third-party trustee.

The person who owns the property usually signs a promissory note and a deed of trust. The deed of trust does not have to be recorded to be valid.

A deed conveys ownership; a deed of trust secures a loan.