Texas Schedule D: Creditors Who Hold Claims Secured By Property (non-individuals)

Description

How to fill out Texas Schedule D: Creditors Who Hold Claims Secured By Property (non-individuals)?

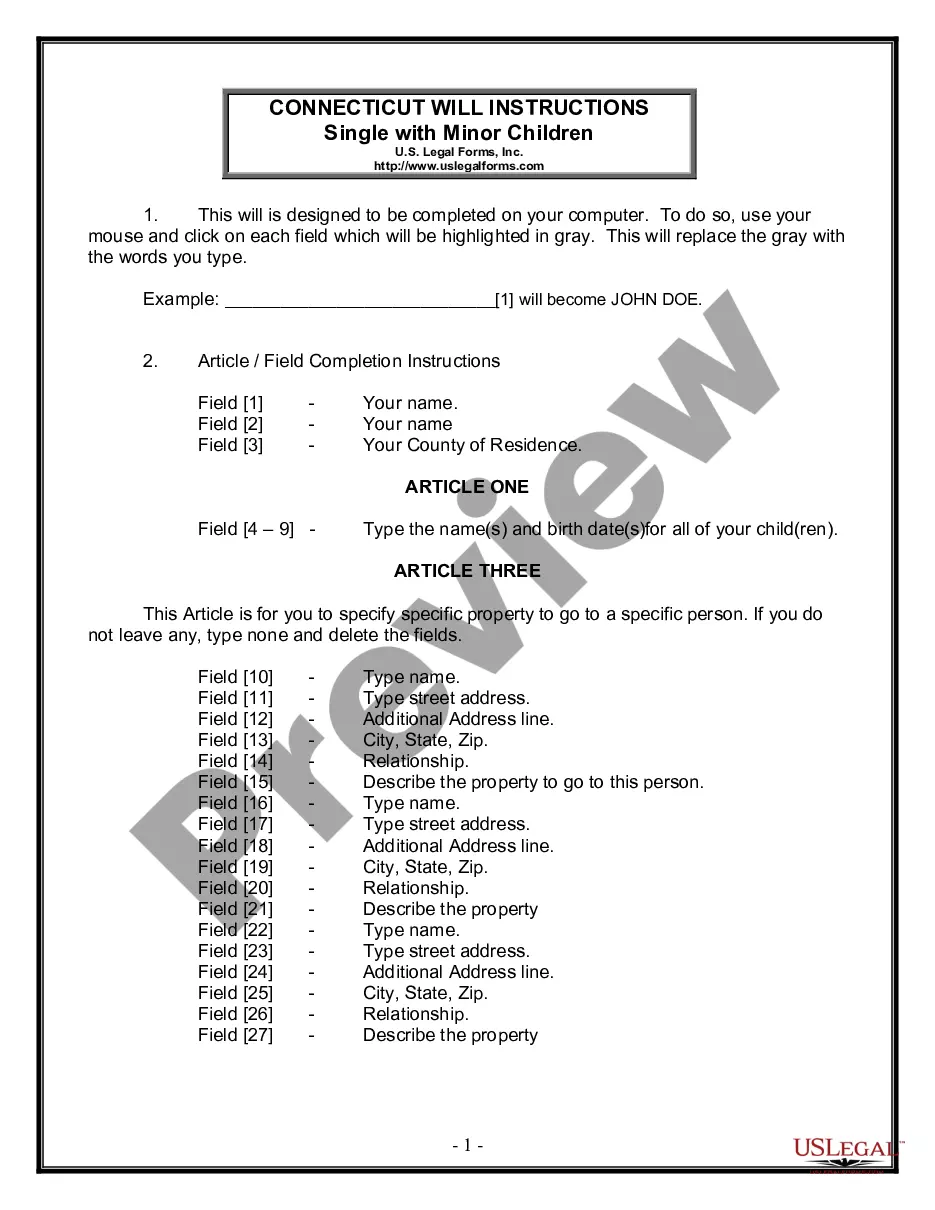

Preparing official paperwork can be a real stress if you don’t have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be certain in the blanks you obtain, as all of them correspond with federal and state laws and are verified by our specialists. So if you need to prepare Texas Schedule D: Creditors Who Hold Claims Secured By Property (non-individuals), our service is the perfect place to download it.

Getting your Texas Schedule D: Creditors Who Hold Claims Secured By Property (non-individuals) from our library is as simple as ABC. Previously authorized users with a valid subscription need only log in and click the Download button once they find the correct template. Afterwards, if they need to, users can get the same document from the My Forms tab of their profile. However, even if you are unfamiliar with our service, registering with a valid subscription will take only a few moments. Here’s a brief guide for you:

- Document compliance verification. You should attentively review the content of the form you want and make sure whether it suits your needs and fulfills your state law regulations. Previewing your document and reviewing its general description will help you do just that.

- Alternative search (optional). Should there be any inconsistencies, browse the library using the Search tab above until you find an appropriate blank, and click Buy Now when you see the one you want.

- Account creation and form purchase. Register for an account with US Legal Forms. After account verification, log in and choose your most suitable subscription plan. Make a payment to proceed (PayPal and credit card options are available).

- Template download and further usage. Select the file format for your Texas Schedule D: Creditors Who Hold Claims Secured By Property (non-individuals) and click Download to save it on your device. Print it to fill out your papers manually, or take advantage of a multi-featured online editor to prepare an electronic copy faster and more efficiently.

Haven’t you tried US Legal Forms yet? Subscribe to our service today to obtain any official document quickly and easily any time you need to, and keep your paperwork in order!

Form popularity

FAQ

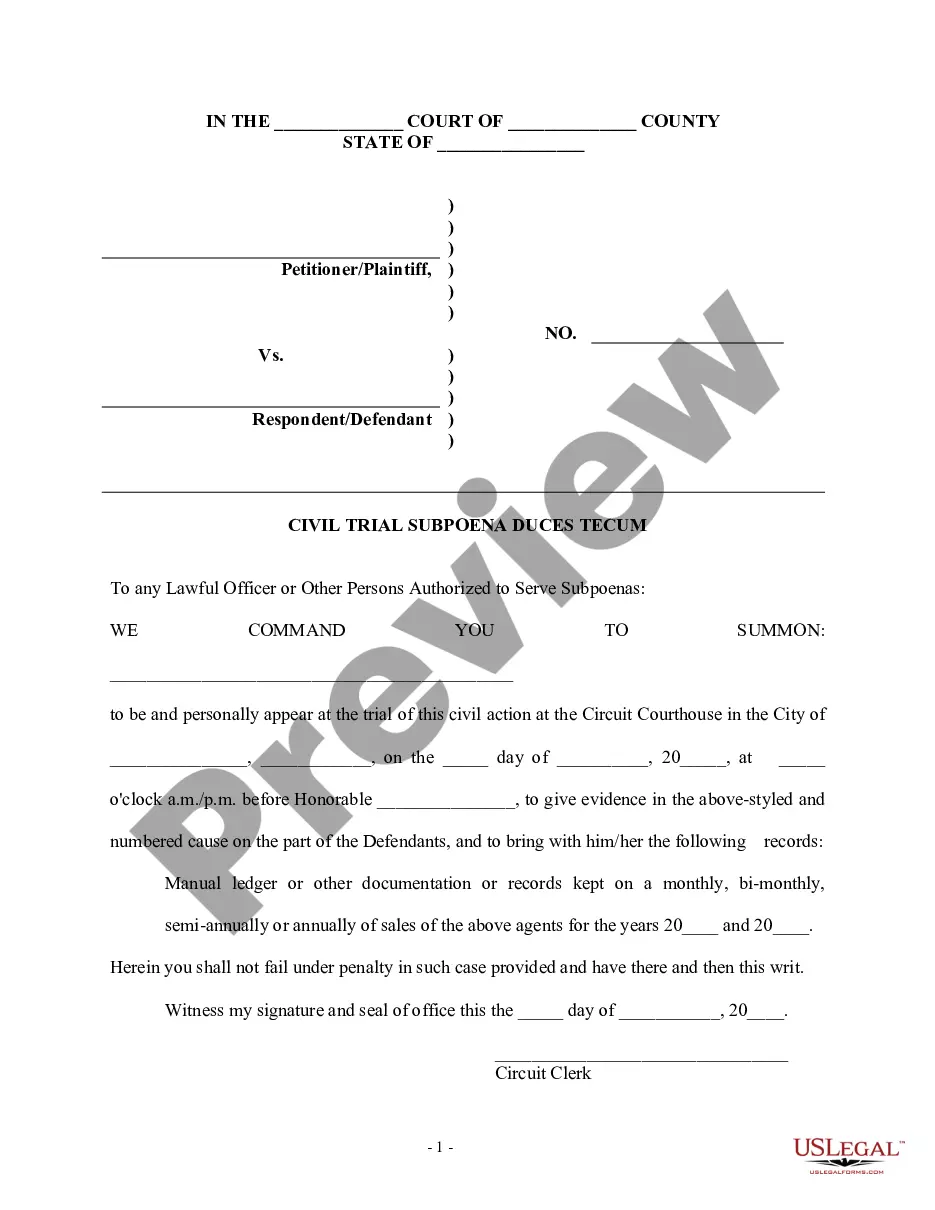

Secured Creditors are creditors that hold a lien on its debtor's property, whether that property is real property or personal property. The lien gives the secured creditor an interest in its debtor's property that provides for the property to be sold to satisfy the debt in cases of default.

A lender must check the "secured claim" box if the borrower agreed to guarantee the debt with property, called "collateral." In other words, the borrower put up an asset that the creditor could sell if the borrower defaulted on (broke the terms of) the contract.

Unsecured claims still take priority over other debts that the person may owe, but they aren't secured with collateral. These claims usually have priority for public policy reasons, where the public would otherwise be harmed by unpaid debts.

A priority claim is debt that is entitled to special treatment in the bankruptcy process and will get paid ahead of non-priority claims. These might include bank lenders, employees, the government if any taxes are due, suppliers, and investors who have unsecured bonds.

A secured debt is a debt that is secured by property. If you don't repay the debt ing to your contract?for example, you fail to make your monthly payment?the creditor has the right to take back the secured property, such as your home or car. In contrast, your unsecured creditors don't have the same rights.

A claim held by a creditor who has a perfected lien or a right of set-off against the debtor's property. A claim is secured to the extent of the creditor's interest in the debtor's property or to the extent of the amount subject to set-off.

Secured creditors can be various entities, although they are typically financial institutions. A secured creditor may be the holder of a real estate mortgage, a bank with a lien on all assets, a receivables lender, an equipment lender, or the holder of a statutory lien, among other types of entities.

Priority unsecured creditors are parties that the bankruptcy law favors over other unsecured creditors, even though they do not have a security interest in the debtor's property. Examples of priority unsecured claims include: Alimony or child support payments, The costs of the trustee in handling the bankruptcy, and.